You Don't Have to Be a Genius to Win at Investing

Julian Schwinger changed everything we know about light and matter...

His theory predicted exactly how they interact on the subatomic level. His work incorporated both Einstein's theory of relativity and actual experimental results.

His theory of quantum electrodynamics won the Nobel Prize. Without it, some of today's most incredible achievements would be unimaginable... nanotechnology, quantum computing, and even the basic transistor that brought about the desktop computer.

But Julian Schwinger is a forgotten man...

Schwinger's theories followed in the style of Schwinger himself. He dressed conservatively, was extremely organized, and spoke formally and with purpose at all times.

His framework was diligently mathematical, incorporating pages of formulas, proofs, and complex calculations. It took an organized mind like Schwinger's just to start to get a handle on it.

Almost no one uses his stuff today.

Schwinger split his Nobel Prize with two other guys... If you know about either of these men, chances are that the name you recognize (if vaguely) is Richard Feynman.

They didn't work together. Rather, they happened to solve the same problem at the same time, presenting their ideas at the same conference in 1948.

Feynman and Schwinger couldn't be any different...

Feynman wore short sleeves, played the bongos, and cracked safes containing top-secret documents for fun during his work on the Manhattan Project.

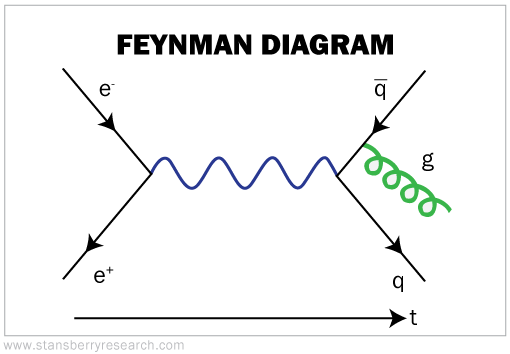

He, too, created equations that described light and matter. But rather than pages of difficult formulas and computations, Feynman's work was easily visualized. You could internalize it and gain an understanding of what was happening at a subatomic level.

You could even draw it with a few lines. This became known as the "Feynman diagram" and became the workhorse of quantum physics. It gives physicists a way to visualize a problem quickly. Here's a picture of one...

A 'Feynman Diagram' for Options

You can apply the concept behind the Feynman diagram to how we think about selling options in my Retirement Trader newsletter...

Options often seem like a foreign concept for many folks who are just starting to trade them. Just like quantum physics, it seems like a strange world with lots of interacting parts. But an internalized understanding of options is invaluable.

You could memorize the Black-Scholes equation for options pricing (which also earned its developer a Nobel Prize)...

Or you could become a whiz with an option calculator... But those efforts aren't necessary to understand how to earn money in the options market.

Whenever Feynman tackled a problem, he always narrowed it down to "first principles" – the unquestioned simple facts – and then built everything from there.

When we think of option prices, we have one first principle to understand. It is this:

The more likely an option is to pay out, the higher its price will be.

Say that out loud slowly. (Seriously, we'll wait...)

Think about someone who buys a call option expecting a stock to rise. If the option buyer knew that a particular option had zero chance of turning into a winner, then the price would be zero. If the trader could be absolutely certain it would turn a profit, its price would be high.

It's true that there are more complicated factors – strike price, volatility, time – that insert themselves into that measure of the likelihood of an option paying out. But the first principle is the most basic part of options selling you should understand.

If selling options already sounds too scary, I get it. Even though it's one of my favorite ways to collect extra income each month, too many folks aren't willing to give options a try. They've heard horror stories of inexperienced investors throwing entire portfolios away on risky strategies.

That's why, when I began Retirement Trader, I did so with people like my mom in mind.

You see, when my mom was in her early 70s, she'd been divorced from my father for 20 years and her own mother had recently passed. It would often bother me to know my mom was alone for most of the day.

She also inherited an investing portfolio from her mom. So to help her find something to do – and to make sure her mind stayed sharp – I started to teach her my strategies.

I always preach to keep learning, even later in life... I took nearly everything from my time at Goldman Sachs and on Wall Street and brought it to my mom's house.

I gave her the full crash course in investing. I taught her about zero-coupon bonds, interest rates, yields, different kinds of stocks, you name it. It was great bonding for us. And my mom genuinely took an interest in it.

She took her inheritance and turned it into a diversified portfolio of bonds, cash, dividend-paying stocks.

As our investing lessons kept progressing, I introduced her to my options-selling strategy – one I've personally used for years. And she gravitated toward it. Not only did it help keep her mind active, she was generating additional wealth during her retirement years.

I'm fortunate that I've been able to share the knowledge behind this powerful investment tool with thousands of subscribers all over the world, from various backgrounds.

Take, for example, the story of my longtime subscriber, Steve...

He's a regular guy who, like so many others, spent a few years feeling anxious about his financial future... especially as he got closer to retirement age.

He doesn't have a fancy financial degree... and he's not some Wall Street insider. He was just willing to take the time to learn my powerful stock market income strategy that completely changed his outlook and his finances.

So far, he has used this income strategy to collect nearly $118,000. And he and his wife are enjoying retirement on their terms.

That's the kind of life I want for all of my readers.

If you want to hear more of Steve's story – and how you can apply what he has learned to your own portfolio – click here.

What We're Reading...

- Something different: Americans are obsessed with iced coffee.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

November 18, 2024