This Bull Market Has Plenty of Life Left

Bull markets don't die of old age.

It's something I (Jeff Havenstein) learned very early in my career. You should never underestimate the longevity of a bull market... including the one we're in right now.

Yes, valuations are near all-time highs. But if you believe our current bull market can't continue for longer or run higher from here, think again.

Based on history, both of those things are likely.

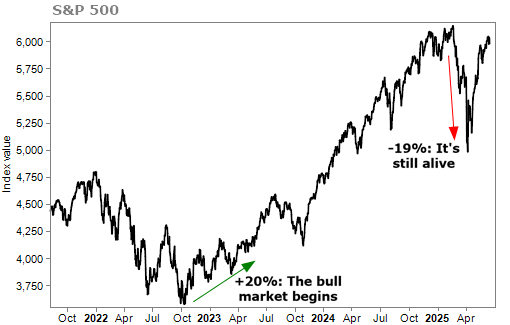

Today's bull market started in late 2022, when the S&P 500 Index rose more than 20% from its lows. It moved higher for years with occasional pullbacks. Then, thanks to President Donald Trump's tariff policies, we got a scare earlier this year that resulted in a 19% drop. But the bull market has almost fully recovered from that interruption and is still chugging along. Take a look...

Now, with the S&P 500 trading for more than 3 times sales, it's understandable if you're worried about a larger crash. After all, the record-high valuation for the market is around 3.3 times sales.

So how much upside can there be from here, and how long will it be until this bull market fails?

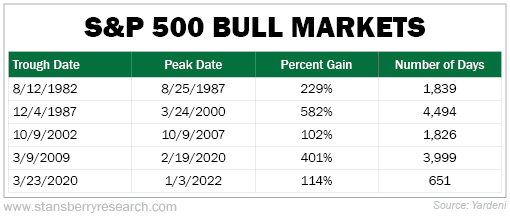

To gauge this, let's look back at the past five bull markets and their gains...

The past five bull markets have earned an average gain of 285%. Not only is that impressive on its own, it's even more impressive when you consider that the average bull market return since 1928 is 121%. So our five most recent bull markets have made more than double the long-term historical average.

Meanwhile, our current bull market has only risen 67% since bottoming in October 2022. That tells us there are probably more gains to come before this bull market is over.

And turning to duration, the past five bull markets have lasted an average of 2,562 days (or about seven years). Since 1928, the average is only about 1,100 days (or a little more than three years).

This proves that bull markets have been growing in age over the decades. Notably, we've only been in our current bull market for 980 days – less than the long-term average and far less than the average from the past five bull markets.

Once again, all signs point to today's bull market having more room to run.

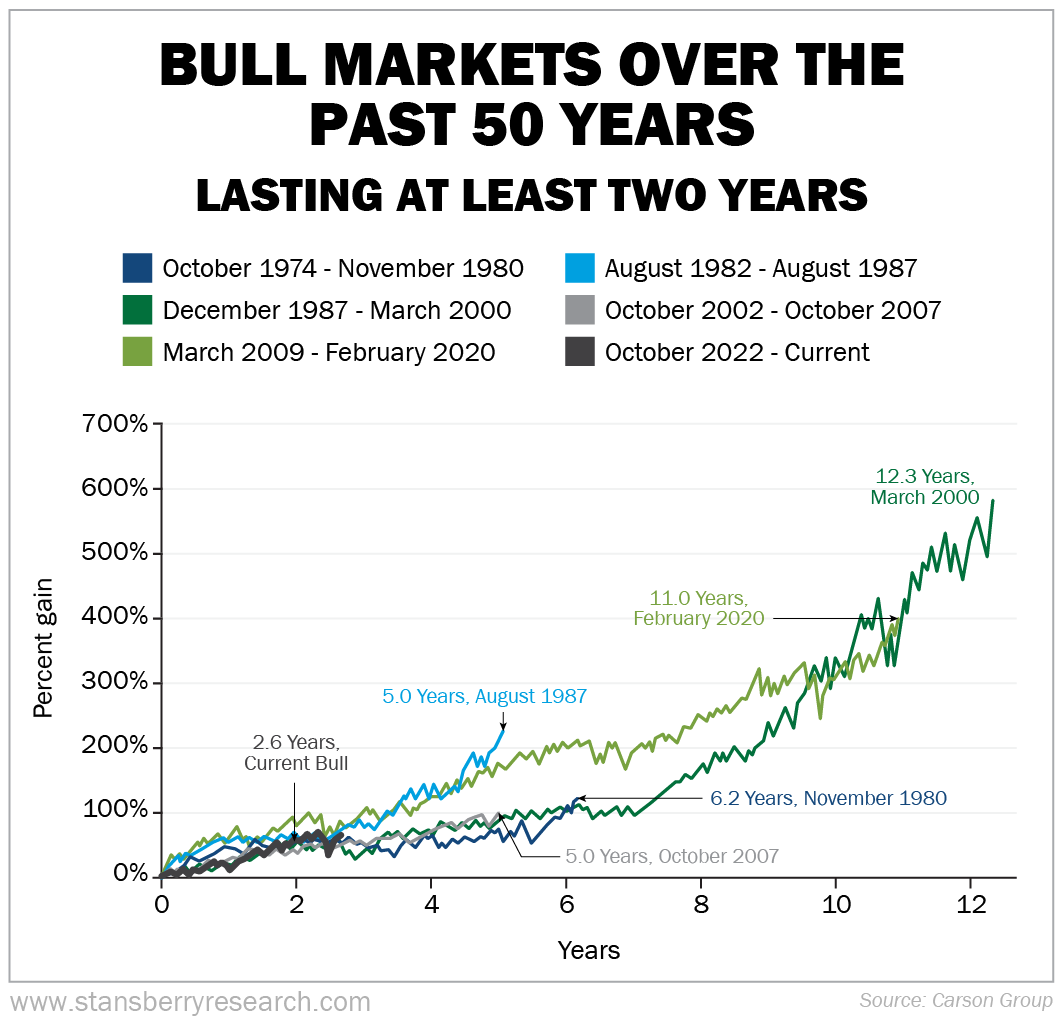

And here's even more data to support that claim... The chart below looks at all bull markets over the past 50 years that have made it to their second birthday. As you can see, the outlook is hopeful for our current bull market that's two and a half years old...

After clearing the two-year hurdle, many of these bull markets went on to last more than three years. We think today's bull market could do the same.

As we said earlier, bull markets don't die of old age. Keep repeating that to yourself.

They only end when investors become exuberant... think the market cannot possibly fall... and take out loans to buy stocks and make risky bets.

Like I've been writing about in recent weeks, we're just not seeing that today. The tariff fiasco led investors to become too bearish. And even though stocks have recovered since then, we're still not seeing signs of excessive greed.

If anything, the correction earlier this year was a good thing for the bull market's health because it spooked a lot of speculators.

Now, a word of caution... According to asset manager Hartford Funds, bull markets are the strongest right out of the gate. Historically, about 75% of the time, the first half of a bull market outperforms the second half.

So if this bull market does go on to last another 980 days, it's likely we won't see the same 67% gain.

Still, no one could complain if we saw something like a 40% or 50% gain from here.

Throughout most of this year, I've been writing to you and trying to convince you to buy stocks. I'm back today with that same message... even with the market hovering around its all-time high.

It could be months before this bull market ends. It could even be years. And there could be some choppy moments in the market while all this plays out.

But looking back at history gives us a good idea that this bull market is still relatively young. Until the only thing your neighbors and coworkers can talk about is stocks, you don't need to worry. We're not there yet.

Expect stocks to make new all-time highs shortly.

And there's no better way to take advantage of these impending highs than with Marc Chaikin's "Power Gauge."

Marc – a Wall Street veteran with more than 50 years of investing experience – developed this simple tool to rate stocks. Each day, the Power Gauge assigns more than 5,000 stocks and more than 2,000 exchange-traded funds a rating from "bullish" to "bearish." It does this by combining 20 separate factors – things like earnings growth, insider activity, and price strength.

On June 25, Marc will unveil a breakthrough feature to the system. It's a new filter that helps identify which companies have durable, repeatable earnings and which are hiding risks behind inflated numbers. That's more important than ever in today's hype-fueled environment, especially when it comes to AI stocks.

Click here to learn more about how the Power Gauge can revolutionize your investing journey.

What We're Reading...

- Something different: JPMorgan Chase unveils new Sapphire Reserve card perks and $795 annual fee.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

June 18, 2025

P.S. Our offices are closed tomorrow, June 19, in observance of Juneteenth. Expect your next Health & Wealth Bulletin issue on Friday, June 20.