The Swiss franc soars...

The Swiss are letting us in on a secret... European easing a certainty?... Treasurys tumble... Gold soars... Jeff Clark says the rally in gold stocks is underway... A 'tremendous opportunity' in junior miners today...

The Swiss National Bank (SNB) abandoned the cap on the Swiss franc-euro rate today... and all hell broke loose.

The Swiss National Bank (SNB) abandoned the cap on the Swiss franc-euro rate today... and all hell broke loose.

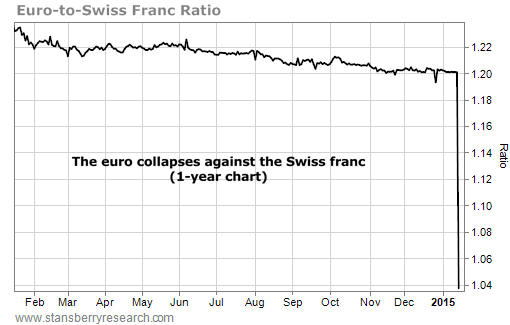

The SNB had capped the rate at 1.20, meaning that 1.2 francs purchased one euro for the past three-and-a-half years. It was designed to keep the franc – a global "safe haven" asset – from appreciating too much against the euro. A stronger franc would hamper Switzerland's exports.

In December, the SNB said it would defend the peg (the fixed exchange rate) with "the utmost determination." Just two days ago, SNB Vice President Jean-Pierre Danthine said the peg would "remain the pillar of our monetary policy."

In December, the SNB said it would defend the peg (the fixed exchange rate) with "the utmost determination." Just two days ago, SNB Vice President Jean-Pierre Danthine said the peg would "remain the pillar of our monetary policy."

But SNB President Thomas Jordan said he wanted to surprise the markets. And it worked... The franc soared as much as 39% against the euro – the largest one-day move in a major currency traders can remember.

We won't cover the full details of the move. You can read that everywhere else. (The Wall Street Journal wrote a good article about it right here.)

But we do want to note that this is a good reminder to never trust a central banker. And in today's Digest, we'll share some thoughts on what this move means... and some possible repercussions.

But we do want to note that this is a good reminder to never trust a central banker. And in today's Digest, we'll share some thoughts on what this move means... and some possible repercussions.

First, in order to maintain its 1.20 peg to the euro, the SNB would print francs and buy euros. It was building a massive stockpile of a deteriorating currency.

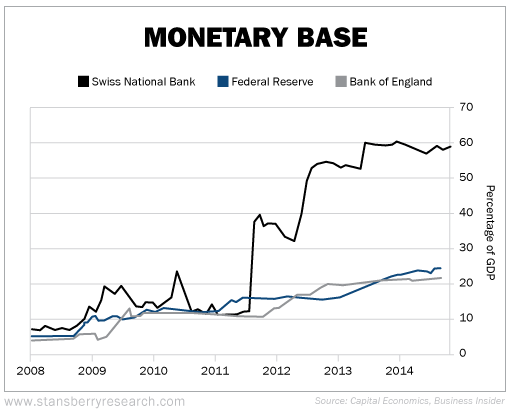

You can see from the chart below how large the SNB's monetary base is as a percentage of its gross domestic product (GDP)...

The SNB's foreign-currency reserves hit a record $490 billion in December. As of the third quarter of 2014, 45% of its reserves were in euros... Only 29% were in U.S. dollars.

According to Steven Englander, head of G10 FX Strategy at Citibank, the SNB took a 60 billion franc ($68 billion) hit to its reserves after today's move.

If you're Switzerland, why abandon the peg now?

If you're Switzerland, why abandon the peg now?

The most obvious reason is because the Swiss expect the European Central Bank (ECB) to begin quantitative easing following the meeting on January 22. The ECB would fill the SNB's role in purchasing massive amounts of euros.

Investment bank Goldman Sachs agrees, writing in a research note, "This is a massive message from SNB to the market: ECB is going to do QE, and it's going to be big."

SNB President Thomas Jordan also hinted at further weakness in the euro, saying that once the SNB realized the peg was unsustainable, it was best to act immediately. "It is better to do it now than in six or 12 months when it would hurt more," he said.

The Swiss could also fear a collapse in Russia.

In addition to abandoning the peg, the SNB said it would lower its target range for three-month Libor (London Interbank Offer Rate) to the range of -1.25% to -0.25% from the previous range of -0.75% to 0.25%. (The Libor is the rate at which banks lend each other short-term money... It's a key interest rate for banks.)

In addition to abandoning the peg, the SNB said it would lower its target range for three-month Libor (London Interbank Offer Rate) to the range of -1.25% to -0.25% from the previous range of -0.75% to 0.25%. (The Libor is the rate at which banks lend each other short-term money... It's a key interest rate for banks.)

SNB hoped that negative interest rates – where depositors pay the bank to hold money – would stem flows into the franc. As you can see below, it didn't work...

That's how desperate the world is for safety today... It's happy to pay 125 basis points (1.25%) to park cash.

One final point on the SNB's surprise move...

One final point on the SNB's surprise move...

There was a lot of highly leveraged money betting that the SNB would continue its peg. (After all, the central bank committed to doing so only two days ago.) It was a supposed "safe" trade.

Today's huge uptick in the franc killed some traders today. We may see some bodies wash up to the shore after this shakes out.

In a further rush to safety, we saw yields on the 10-year Treasury fall to less than 1.8%. Yesterday, the yield on the 30-year Treasury hit an all-time low of 2.398%.

In a further rush to safety, we saw yields on the 10-year Treasury fall to less than 1.8%. Yesterday, the yield on the 30-year Treasury hit an all-time low of 2.398%.

Oil initially rallied on the news. (Hard assets tend to rise in advance of quantitative easing.) But it closed the day down more than 4%. That shows you how strong the fundamentals against oil are today.

Oil initially rallied on the news. (Hard assets tend to rise in advance of quantitative easing.) But it closed the day down more than 4%. That shows you how strong the fundamentals against oil are today.

Speaking of oil, Stansberry Research Editor in Chief Brian Hunt and research analyst Ben Morris just wrote a great essay about why you shouldn't buy oil stocks in today's DailyWealth. In short, prices could go nowhere for years after this massive collapse.

It's a good essay with an important message for traders and investors. You can read it for free right here.

Another asset that spiked higher (and stayed there) today was gold, which staged a big 1.8% rally today to nearly $1,260 an ounce.

Another asset that spiked higher (and stayed there) today was gold, which staged a big 1.8% rally today to nearly $1,260 an ounce.

Stansberry Pro Trader editor Jeff Clark believes the bullish price action in gold means we could see a major gold-stock rally. (The Market Vectors Gold Miners Fund – GDX – rose nearly 6% today.) As Jeff told subscribers this morning...

Gold stocks kicked off 2015 the same way they started 2014 – by breaking above resistance of both the nine-day exponential moving average (EMA) and the 50-day moving average (DMA).

Take a look at this chart of the Market Vectors Gold Miners Fund (GDX)...

The chart also shows a "bullish cross" of the nine-day EMA over the 50-DMA.

This is how strong gold-stock rallies begin.

In Monday's Digest, we explained why today's market reminds Stansberry Resource Report editor Matt Badiali of 2009...

In Monday's Digest, we explained why today's market reminds Stansberry Resource Report editor Matt Badiali of 2009...

Back then, everyone was terrified of junior resource stocks. After an 80% selloff, Matt found dozens of high-quality companies trading below their intrinsic value... And he urged people to buy them. But everyone had just gotten burned, sentiment was awful, and nobody wanted to buy these companies.

Matt took the opportunity to recommend a handful of high-quality resource stocks in 2009. His Stansberry Resource Report subscribers made a fortune. As we explained on Monday...

Matt took the opportunity to recommend a handful of high-quality resource stocks in 2009. His Stansberry Resource Report subscribers made a fortune. As we explained on Monday...

In 2009, he urged Stansberry Resource Report subscribers to buy shares of elite silver royalty firm Silver Wheaton. His subscribers made 345% in a year and a half.

In the November 2009 issue of Phase 1 Investor, Matt recommended three junior stocks: Rainy River (which climbed 161% in two months), AuEx Ventures (which was bought out for a huge gain of 198%), and ATAC Resources (which soared 597% and now holds the No. 3 spot in the Stansberry Research Hall of Fame).

Today, Matt is once again "hearing crickets" whenever he brings up investing in the junior resource sector. And in his latest issue of the Stansberry Resource Report, he once again went long a handful of junior-resource stocks.

Today, Matt is once again "hearing crickets" whenever he brings up investing in the junior resource sector. And in his latest issue of the Stansberry Resource Report, he once again went long a handful of junior-resource stocks.

The recent super-bullish action in gold only supports his thesis... which means huge gains are even more likely.

In total, Matt recommended five stocks... These are five of the best junior-mining stocks out there. When these stocks do take off, Matt believes they'll jump hundreds of percent. He says investors have a "tremendous opportunity" today. Right now, most of these stocks are within a penny or two of their maximum buy prices.

In total, Matt recommended five stocks... These are five of the best junior-mining stocks out there. When these stocks do take off, Matt believes they'll jump hundreds of percent. He says investors have a "tremendous opportunity" today. Right now, most of these stocks are within a penny or two of their maximum buy prices.

You can get immediate access to one year of Matt's research – and the names of these five companies – for just $39. And if you decide it's not for you, we're offering a four-month, 100% money-back guarantee.

In total, Matt recommended five stocks... These are five of the best junior-mining stocks out there. Given the volatility in the sector, if these companies move above their recommended buy-up-to price, we're sure you'll be able to get in below the maximum buy price as long as you're patient. And Matt believes that when these stocks do take off, they'll jump hundreds of percent. He says investors have a "tremendous opportunity" today.

In total, Matt recommended five stocks... These are five of the best junior-mining stocks out there. Given the volatility in the sector, if these companies move above their recommended buy-up-to price, we're sure you'll be able to get in below the maximum buy price as long as you're patient. And Matt believes that when these stocks do take off, they'll jump hundreds of percent. He says investors have a "tremendous opportunity" today.

If these resource stocks take off as Matt expects they will, it could be the best $39 you ever spend. Click here to learn more.

As we noted yesterday, the Volatility Index (the "VIX") – which acts as the market's "fear gauge" – crossed above 20. Porter says that's an important threshold... It shows that investors are getting scared.

As we noted yesterday, the Volatility Index (the "VIX") – which acts as the market's "fear gauge" – crossed above 20. Porter says that's an important threshold... It shows that investors are getting scared.

New 52-week highs (as of 1/14/15): Brookfield Property Partners (BPY), Cempra (CEMP), Esperion Therapeutics (ESPR), Altria (MO), Constellation Brands (STZ), and ProShares Ultra 20+ Year Treasury Fund (UBT).

New 52-week highs (as of 1/14/15): Brookfield Property Partners (BPY), Cempra (CEMP), Esperion Therapeutics (ESPR), Altria (MO), Constellation Brands (STZ), and ProShares Ultra 20+ Year Treasury Fund (UBT).

In today's mailbag, a subscriber argues that Porter isn't seeing the entire picture when it comes to his bearish stance on electric-car maker Tesla... and Porter responds. If you had to invest in Tesla shares today, would you be long or short? We look forward to hearing your answers. Send them to feedback@stansberryresearch.com.

In today's mailbag, a subscriber argues that Porter isn't seeing the entire picture when it comes to his bearish stance on electric-car maker Tesla... and Porter responds. If you had to invest in Tesla shares today, would you be long or short? We look forward to hearing your answers. Send them to feedback@stansberryresearch.com.

"I read Porter's commentary on Tesla and conclude that he looks at this company from one perspective only. He fails to note that Consumer Reports stated that it is the BEST car they have ever tested. He also fails to note that although BMW is a larger automaker, they are heavily invested and tooled in the combustion engine. The billions in capital that will be required for them to seriously compete with a Tesla in the EV market is going to make for a slow developing product line.

"I read Porter's commentary on Tesla and conclude that he looks at this company from one perspective only. He fails to note that Consumer Reports stated that it is the BEST car they have ever tested. He also fails to note that although BMW is a larger automaker, they are heavily invested and tooled in the combustion engine. The billions in capital that will be required for them to seriously compete with a Tesla in the EV market is going to make for a slow developing product line.

"And to Porter's own admission, cheap gas for the foreseeable future should be a sufficient catalyst to warrant a pause by BMW management. I also am surprised that Porter doesn't seem to get it that Tesla isn't just about an electric car, it's about environmentally conscious consumers. He seems to think that people won't buy a Tesla with cheap gas abundant, it's not all about economics Porter. People buy Tesla's because they believe that combustion engine technology is OLD, inefficient, and dirty, and does not have a place in the 21st century transportation system.

"Porter is correct in that Tesla does not currently look great as an equity investment however, I believe that investors see the HUGE potential with this company. The real question is are investors' willing to wait to recognize that potential." – Paid-up subscriber Tom Parker

Porter comment: Given a choice between counting on consumers to make "responsible" choices and economics, I'm betting on economics every time.

Also, while I personally believe what Tesla CEO Elon Musk and Chief Technical Officer J.B. Straubel have done with Tesla is an amazing feat of entrepreneurship, I don't believe there is any logical way to justify Tesla's share price – an opinion Elon shares.

Additionally, over the longer term, I'm certain that the vast research and development (R&D) budgets of the major automakers will be difficult to compete against. Ford, for example, routinely spends $4 billion to $6 billion a year on R&D. To think Ford can't build a great electric car is foolish. That Ford hasn't done so yet means it is wise – the technology is not yet competitive with existing cars.

I'm also certain that a small, boutique automaker that loses hundreds of millions per year and prints hundreds of millions of new shares to pay for it will NOT be the apple of investors' eyes for long.

So yes... there is more than one way to look at it.

Regards,

Sean Goldsmith

January 15, 2015