What to do when the market starts falling...

What to do when the market starts falling... Has the economy gone 'too far, too fast'?... Why one popular chain is raising prices... These oil stocks are bucking the trend... What IBM's 'Watson' is doing now...

![]() There are plenty of reasons to be concerned about the market...

There are plenty of reasons to be concerned about the market...

Given the recent plunge in Chinese stocks, the ongoing crisis in Greece, and rumors of a Federal Reserve rate hike just around the corner, it's only natural to wonder if the markets here in the U.S. could be in trouble, too.

But like us, our colleague Dr. David "Doc" Eifrig believes it's important to look past the headlines and keep the "big picture" in perspective.

![]() Longtime readers know Doc has been one of the most outspoken bulls on the recovery in U.S. stocks and the economy over the past several years. He shared his latest thoughts in the August issue of Retirement Millionaire, published last night...

Longtime readers know Doc has been one of the most outspoken bulls on the recovery in U.S. stocks and the economy over the past several years. He shared his latest thoughts in the August issue of Retirement Millionaire, published last night...

The best you can do when the market starts falling is to ask yourself if there's a real reason to be scared of the state of the economy. We don't think there is.

For years now, we've been arguing that the economy has been "grinding higher." Others have warned of double-dip recessions, secret unemployment statistics, inflation, bankrupt municipal borrowers... We've been bullish on America and the country's future.

![]() As Doc explained, the good news is everywhere...

As Doc explained, the good news is everywhere...

The latest data show the economy is growing at nearly 3%, as measured by gross domestic product (GDP)... Unemployment is trending lower... Initial jobless claims – the number of people losing jobs today – are the lowest since at least 2000... And consumer sentiment, as measured by the University of Michigan's survey, is the highest it has been since before the financial crisis.

More important, Doc says you can finally see the improvements in the "real world" as well...

Every flight I'm on is packed like a sardine can. My winemaker friend Brenda tells me that a pedicure place that used to have walk-ins now requires at least a week's notice. Fancy restaurants near our Baltimore office are bustling, and it seems like a new one opens every other week. Rental cars in Florida are double the price that they were five years ago, and often there are not enough in each car class.

![]() In fact, Doc says the most important question is no longer whether or not the recovery is "real." Instead, it's whether the economy has gone "too far, too fast" and is in danger of overheating again.

In fact, Doc says the most important question is no longer whether or not the recovery is "real." Instead, it's whether the economy has gone "too far, too fast" and is in danger of overheating again.

Fortunately, Doc says that's not a concern just yet. There are still a few important parts of the economy that are "lagging" behind...

![]() First, wage growth hasn't kept up with the economy. According to the U.S. Bureau of Labor Statistics (BLS), private-sector wages have only grown by about 2% a year since the financial crisis, compared with nearly 3% for the economy.

First, wage growth hasn't kept up with the economy. According to the U.S. Bureau of Labor Statistics (BLS), private-sector wages have only grown by about 2% a year since the financial crisis, compared with nearly 3% for the economy.

Second, price inflation – as measured by the BLS' consumer price index (CPI) – has remained less than 2% for the past few years. And rather than increasing recently, it has actually been falling... sitting near 0% for most of this year.

Finally, and maybe most important, Doc says housing and construction still need to catch up to the rest of the economy...

Building houses used to be about 4.5% of the economy. Now, it's just 2%. If you know anyone who used to work in the industry, you probably know that it hasn't been busy. But it has been picking up. Just over the last year, construction spending has picked up 7.7% and the stocks of homebuilders have risen.

![]() Doc is watching the situation closely, but says it's still far too early to be worried about the economy and the stock market...

Doc is watching the situation closely, but says it's still far too early to be worried about the economy and the stock market...

We can't get overheated until we're firing on all cylinders. As each of these laggards picks up, they'll have a feedback effect that will drive the economy even faster. That leaves us plenty of room for this bull market to continue, even if there's a correction or two along the way...

There's simply no reason to run scared based on all the evidence out there... Above all, avoid the headlines and enjoy your summer.

![]() In the August issue of Retirement Millionaire, Doc also shares his No. 1 "strong buy" today... It's a simple way to earn 8%-plus yields in today's 0%-interest world, and it's on sale. It's like buying $1 of assets for just $0.87.

In the August issue of Retirement Millionaire, Doc also shares his No. 1 "strong buy" today... It's a simple way to earn 8%-plus yields in today's 0%-interest world, and it's on sale. It's like buying $1 of assets for just $0.87.

If you aren't already a Retirement Millionaire subscriber, click here to take advantage of a 100% risk-free trial. At just $39 for an entire year, there is no greater value in the investment world.

![]() In related news, a recent move by popular coffee chain Starbucks (SBUX) suggests Doc's economic "laggards" could finally be starting to recover, too...

In related news, a recent move by popular coffee chain Starbucks (SBUX) suggests Doc's economic "laggards" could finally be starting to recover, too...

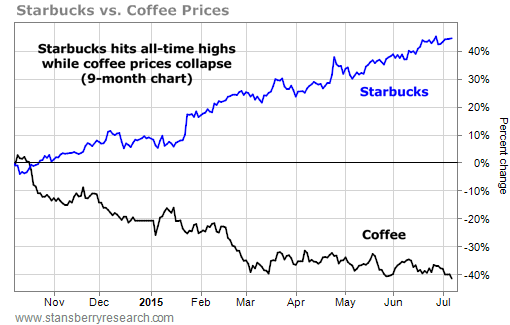

Starbucks is doing well. Shares are hovering near an all-time high, and CEO Howard Schultz recently noted that the company achieved record revenues, operating income, and earnings per share in the second quarter.

But while coffee prices are down more than 40% over the last nine months, Starbucks isn't passing those savings along to its customers. Instead, the company announced this week that it's actually raising prices on some of its popular menu items.

![]() The Wall Street Journal published an article earlier this week explaining the move...

The Wall Street Journal published an article earlier this week explaining the move...

The Seattle company, like other coffee purveyors, often raises prices for its products when coffee prices increase, but the latest move comes despite a decline of about 42% in Arabica futures prices from a peak late last year. The increase, which takes effect Tuesday, will increase the cost of the average customer order by about 1%, Starbucks said. Bagged coffee won't be affected.

The increase comes from an overall need to manage business costs, including labor and rent expenses, a Starbucks spokeswoman said.

![]() As the article noted, rising wages across the country have forced fellow food retailers, like Chipotle Mexican Grill (CMG), to raise prices of items on their menus, too – particularly in the cities with the largest wage increases.

As the article noted, rising wages across the country have forced fellow food retailers, like Chipotle Mexican Grill (CMG), to raise prices of items on their menus, too – particularly in the cities with the largest wage increases.

Starbucks is increasing the prices of some of its coffees and lattes anywhere from $0.05 to $0.20 per beverage – a minimal hit to consumers' wallets, but a hit nonetheless.

As you can see from the chart below, Starbucks shareholders aren't hurting. Shares have steadily moved higher while the spot price of coffee continues to decline...

Despite recovering some in recent months, the price of West Texas Intermediate (WTI) crude oil – the U.S. domestic benchmark – is still down nearly 50% in the past year. And as we mentioned earlier this week, prices appear to be heading lower again.

The decline in oil prices has pulled down shares of oil giants ExxonMobil (XOM), Chevron (CVX), and Royal Dutch Shell (RDS) – all of which hit new 52-week lows this week. But it hasn't been bad for all oil companies. In fact, one group of oil stocks is breaking out...

![]() Oil refiners – the companies that take crude oil and turn it into gasoline, diesel, and fuel oil – are buying up cheap oil and selling their products at higher prices. Stansberry Resource Report analyst Brian Weepie explained the situation in the June 10 Growth Stock Wire...

Oil refiners – the companies that take crude oil and turn it into gasoline, diesel, and fuel oil – are buying up cheap oil and selling their products at higher prices. Stansberry Resource Report analyst Brian Weepie explained the situation in the June 10 Growth Stock Wire...

To take advantage of current prices, refiners are processing record amounts of crude oil. For example, in 2014, they processed more crude oil than ever before. And their earnings are at some of their highest levels over the past few years.

For example, large refiner Valero (VLO) earned $7 of operating income for every $100 of sales in the first quarter. It hasn't earned margins this high since 2007.

Brian noted that Valero isn't alone. Many of its competitors are making money – and seeing their share prices rise as a result. But Valero is the big winner in the space, up nearly 30% in 2015. And Brian says this uptrend could continue, regardless of oil prices...

Greg Armstrong, chairman and CEO of midstream master limited partnership (MLP) Plains All American Pipeline (PAA), believes refiners will continue to benefit this year. He expects refineries to process at least 250,000 more barrels of oil per day this year than last. To put this number into perspective, it's nearly 3% of the crude oil produced last year.

In short, as long as crude-oil prices remain low, refiners will continue to pump out profits... And their share prices will continue to benefit.

If you're looking for a way to invest in oil right now, Brian recommends looking into oil refiners like Valero.

![]() Switching gears, the Washington Post recently published a fascinating piece on tech giant IBM (IBM) and its "Watson" supercomputer...

Switching gears, the Washington Post recently published a fascinating piece on tech giant IBM (IBM) and its "Watson" supercomputer...

Watson is most famous for beating the world's best players on the game show Jeopardy!, but over the years IBM has shown off its artificial intelligence machine in roles ranging from call center operator to cookbook author.

But as the article explained, these feats were mostly "gimmicks." Now, IBM is using Watson to tackle a much more serious problem...

IBM is now training Watson to be a cancer specialist. The idea is to use Watson's increasingly sophisticated artificial intelligence to find personalized treatments for every cancer patient by comparing disease and treatment histories, genetic data, scans, and symptoms against the vast universe of medical knowledge.

Such precision targeting is possible to a limited extent, but it can take weeks of dedicated sleuthing by a team of researchers. Watson would be able to make this type of treatment recommendation in mere minutes.

![]() This idea may sound familiar to regular Digest readers. It's just the latest example of how "Big Data" is set to revolutionize the world.

This idea may sound familiar to regular Digest readers. It's just the latest example of how "Big Data" is set to revolutionize the world.

Our colleague Paul Mampilly, editor of our new Professional Speculator advisory service, explained the Big Data trend in the May 26 Digest...

Imagine walking into a restaurant and the waiter already knows what you're going to order. Walking into a Starbucks and your pumpkin-spice latte is waiting for you already. Shopping for a new pair of pants online and the website shows you only the items in your size with the colors and styles you like.

The world I'm describing is custom-made for you. And it isn't science fiction. It's an emerging trend called "Big Data," which allows for the storage of incredible amounts of data on computers... like what songs you're listening to, what stores you shop in, and more.

Over time, this huge amount of data can accurately predict behavior in things like what consumers are interested in buying. And when you can predict these things, you can anticipate their needs before they even know them.

![]() While Big Data has the potential to change a huge number of industries, health care, in particular, is likely to see dramatic improvement. As Paul noted...

While Big Data has the potential to change a huge number of industries, health care, in particular, is likely to see dramatic improvement. As Paul noted...

In 2013, the U.S. spent $2.9 trillion on health care... nearly $10,000 per person. Research suggests that as much as one-third of that spending is wasteful and, worse, potentially harmful to patients.

![]() Paul shared his thoughts on the story in a private note this morning...

Paul shared his thoughts on the story in a private note this morning...

IBM's Watson is now using everything we already know about cancer to improve cancer diagnoses.

This is great news for you, if you should get cancer... You're more likely to get an accurate diagnosis when you go see the doctor, and you're also more likely to get the right treatment prescribed to you.

This also means huge potential savings in terms of health care costs.

![]() Paul says IBM could eventually generate 12% of its revenue from its Watson Big Data service alone. He thinks investors could do quite well buying IBM stock right now.

Paul says IBM could eventually generate 12% of its revenue from its Watson Big Data service alone. He thinks investors could do quite well buying IBM stock right now.

But Paul believes the really big gains – gains of 100% or more – will be found in the small companies on the front lines of this trend, where Big Data accounts for 100% of their revenue.

These are the types of companies Paul recommends in his Professional Speculator service...

In fact, he recently recommended one small company that's using Big Data to help individuals save money on their personal health care spending in a way that was unthinkable just a few years ago. Paul believes this stock could rise at least 200% over the next two years.

Out of fairness to Paul's Professional Speculator subscribers, we can't reveal the name of this recommendation. But you can get all the details on it and the rest of Paul's research with a six-month risk-free trial to Professional Speculator. For a limited time, you can take advantage of a one-time introductory offer and claim a free year of Paul's service. If you're interested, please note this offer ends soon. Click here for the details.

![]() New 52-week highs (as of 7/8/15): Direxion Daily CSI 300 China A Share Bear 1x Shares Fund (CHAD) and short position in Viacom (VIAB).

New 52-week highs (as of 7/8/15): Direxion Daily CSI 300 China A Share Bear 1x Shares Fund (CHAD) and short position in Viacom (VIAB).

![]() A busy day in the mailbag: Vitriol on China... a question about evaluating bank stocks... and another subscriber weighs in on discount brokerages. Tell us what's on your mind at feedback@stansberryresearch.com.

A busy day in the mailbag: Vitriol on China... a question about evaluating bank stocks... and another subscriber weighs in on discount brokerages. Tell us what's on your mind at feedback@stansberryresearch.com.

![]() "Comes as no surprise to me, but I continue to be unlucky with investments and investment advice. I probably received late word on the China stock recommendations, but there was no sign of it being late word, so I acted swiftly on 7/6/2015 after purchasing your [recommendations in True Wealth]... Today I got word from you to sell [these positions] – get out now! Lost a fair amount again. Sigh. So now what is suggested regarding these stocks? Are you going to give us hopefully more accurate and time stamped advice on getting back in when it appears we have gotten past the bottom? Or do we forget about these stocks and our losses?" – Paid-up subscriber Doug Williams

"Comes as no surprise to me, but I continue to be unlucky with investments and investment advice. I probably received late word on the China stock recommendations, but there was no sign of it being late word, so I acted swiftly on 7/6/2015 after purchasing your [recommendations in True Wealth]... Today I got word from you to sell [these positions] – get out now! Lost a fair amount again. Sigh. So now what is suggested regarding these stocks? Are you going to give us hopefully more accurate and time stamped advice on getting back in when it appears we have gotten past the bottom? Or do we forget about these stocks and our losses?" – Paid-up subscriber Doug Williams

![]() "Please tell Steve Sjuggerud he doesn't know a dam thing except how to lose subscribers' money. He recommends Chinese stocks, does a big presentation of how it's the opportunity of a lifetime, and the market crashes like never before. You guys really suck." – Paid-up subscriber Dominick DiBenedetto

"Please tell Steve Sjuggerud he doesn't know a dam thing except how to lose subscribers' money. He recommends Chinese stocks, does a big presentation of how it's the opportunity of a lifetime, and the market crashes like never before. You guys really suck." – Paid-up subscriber Dominick DiBenedetto

Brill comment: As Steve noted in yesterday's update, True Wealth subscribers who got in on the China trade late were sitting on big losses. And losses hurt. But Steve believes Chinese stocks will ultimately move much higher. If you practiced proper position sizing and followed your trailing stops, you shouldn't have lost more than approximately 1% of your overall portfolio on each position. And just as important, you'll have "dry powder" ready if and when the uptrend resumes in China.

![]() "I have been using your criteria for company/stock valuations. One sector I am interested in is the banks. I've run into a problem in that the key statistics page does not give the EBITDA values. Without this, I cannot calculate the 10 x EBITDA/share. Is there another way I can access these data (I cannot find this on Cash Flow, Balance Sheet or Income Statement either)? Alternatively, is there another parameter I can use to see if the stock is undervalued? Thanks!" – Paid-up subscriber M.S.

"I have been using your criteria for company/stock valuations. One sector I am interested in is the banks. I've run into a problem in that the key statistics page does not give the EBITDA values. Without this, I cannot calculate the 10 x EBITDA/share. Is there another way I can access these data (I cannot find this on Cash Flow, Balance Sheet or Income Statement either)? Alternatively, is there another parameter I can use to see if the stock is undervalued? Thanks!" – Paid-up subscriber M.S.

Brill comment: Remember, we can't give individual investment advice. And unfortunately, there is no "one size fits all" metric for evaluating whether a stock is cheap or expensive across every sector. But for bank stocks, some metrics to pay attention to include return on equity, book value, leverage ratio, and net interest margin.

![]() "Just a note to suggest to Ameritrade customers: I found out that you really don't have to be trading too many option contracts a month and TD will significantly lower your option commission rate... at least they did for me. It never hurts to ask!" – Paid-up subscriber Gary R.

"Just a note to suggest to Ameritrade customers: I found out that you really don't have to be trading too many option contracts a month and TD will significantly lower your option commission rate... at least they did for me. It never hurts to ask!" – Paid-up subscriber Gary R.

Regards,

Justin Brill

Baltimore, Maryland

July 9, 2015

|