Adobe (ADBE) Buying Semrush (SEMR) Proves AI Is 'Eating' the Software Industry

Venture capitalist Marc Andreessen famously wrote in 2011 that "software is eating the world."

Andreessen argued that software-centric and online businesses would increasingly disrupt and dominate a wide range of industries.

He was right.

Then, in 2017, Nvidia (NVDA) CEO Jensen Huang advanced the metaphor by saying, "Software is eating the world... but AI is eating software."

Huang may have been a bit early on his call. But now he's also looking prophetic.

If you've seen how Software as a Service ("SaaS") stocks are collapsing, then you know the market thinks AI is a genuine threat.

SaaS simply means a company delivers its software via the cloud... so its customers pay relatively small, recurring subscription fees for access instead of owning their software via a perpetual license. It works for the customer, because they get automatic updates. And it works for the software maker since it gives them a more consistent revenue stream.

The SaaS model has grown insanely popular, but it's now hitting a snag...

Across the SaaS landscape, customers are delaying renewals, experimenting with AI-native tools, and demanding deeper automation for the same price – pressure that didn't exist even two years ago.

The best SaaS companies aren't resting on their laurels, though. They're adapting to a world of AI. And that adaptation – rather than retreat – is what sets the stage for one of the most meaningful SaaS deals of the year.

A Big 75% Acquisition Premium, But Not Everyone's Happy...

On Wednesday, shares of a relatively obscure SaaS company called Semrush (SEMR) surged nearly 75%.

Adobe (ADBE), best known for its Photoshop image editing and graphic design software, announced it will acquire Semrush, the leader in search engine optimization ("SEO") tools, for $12 per share. It's an all-cash deal that values Semrush at $1.9 billion.

Semrush's stock had mostly traded in a range from $7 to $8 since August and closed at an all-time low of $6.75 on Monday. So the $12 offer is well above recent prices.

Normally, a big deal premium like this would be cheered. But not all of Semrush's investors are happy.

Semrush went public in 2021 at an offer price of $14 per share and reached an all-time high later that year of more than $30. SaaS stocks were market darlings back then. Most traded at ridiculous valuations, Semrush included.

After a rough 2022 and 2023, Semrush bounced back and traded higher than $12 for most of 2024. It even surged to more than $18 earlier this year.

Therefore, many investors may still be underwater on their Semrush holdings.

Semrush selling to Adobe for less than its IPO price goes to show just how challenging the market has been for SaaS stocks. It's been a long and painful hangover as valuation multiples have come back down to Earth. And now, AI fears are causing further stress.

Consolidation in this environment is to be expected, although it may seem a bit odd that the maker of Adobe Photoshop is acquiring an SEO company.

This acquisition isn't just about SEO... it's Adobe securing the "discovery layer" in a world where AI increasingly answers questions before users ever reach a website.

But as I'll explain, this deal makes a lot of sense to us. It also validates our view that Semrush is a beneficiary of AI, not a casualty... And most important, it gave our paid subscribers a quick double-digit gain in about four months on our SEMR stock recommendation in our flagship Stansberry's Investment Advisor publication.

How AI Is Driving a Big Shift in SEO

Semrush traces its roots to 2006, when Oleg Shchegolev and Dmitri Melnikov, two self-proclaimed "SEO nerds," began creating tools to help websites boost their search-engine rankings.

Over the years, Semrush has become a leader in the fragmented SEO market. Everyone from freelancers to marketing agencies to large enterprises use Semrush's software to boost search visibility.

Suddenly, here comes AI, which is causing the biggest shift in SEO since Google became the top search engine in the early 2000s.

This is the part most investors are missing: SEO isn't dying – it's being redefined in real time.

In May 2024, Google officially rolled out AI overviews in the U.S.

Now, when you search for something on Google, you'll typically get an AI-generated answer at the usual list of website links.

Often, the AI overview has the information the user is looking for or answers their question. So people are clicking on the blue-hyperlinked search results less often. This is the first major disruption to the "traffic pipeline" that SEO has depended on for two decades.

Not only that, but many people are using chatbots like ChatGPT, Claude, and Gemini as if they were search engines.

Historically, SEO has involved techniques such as keyword optimization and backlinking to rank high in search results. That's all still important. But with the rise of generative AI, an additional and increasingly important objective is to optimize content so that it appears in the responses generated by AI models. Industry insiders are calling this generative engine optimization ("GEO").

The market figured that since AI is causing this major shift in SEO and Semrush is the leader in SEO tools, then Semrush must be an AI victim.

To the contrary, Semrush has been incorporating new functionality into its existing products to help its customers navigate the evolving SEO landscape. And recently, the company has released new GEO tools.

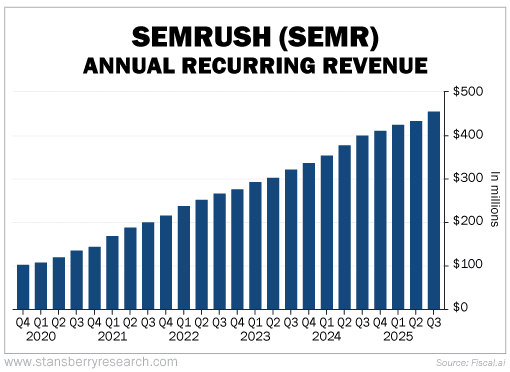

Semrush's AI search products, just launched in 2025, already added $10 million in annual recurring revenue ("ARR") in the third quarter. The company expects its AI tools to generate $30 million in ARR by the end of the year.

Semrush isn't an AI victim. Rather, this is a company that has adapted and is benefiting from AI.

Semrush's Evolution From SEO Tool to Enterprise Digital Marketing Platform

Semrush began as an SEO tool provider catering to freelancers and small- and medium-sized businesses ("SMBs"). But it has grown and diversified.

Semrush is now a "full stack" digital marketing platform. In addition to SEO, its tools help customers manage their marketing campaigns and social media presence.

Semrush has also pushed hard into the enterprise market. These are customers that range from as few as 500 employees to gigantic companies with tens of thousands of employees. For example, Tesla (TSLA), Walmart (WMT), Amazon (AMZN), and Salesforce (CRM) are all Semrush enterprise clients.

Thanks to its focus on the enterprise market and with the AI kicker, Semrush's ARR was up 14% year over year to $455 million in the latest quarter.

You can see Semrush's steady growth in ARR since 2019 in the chart below:

This is not what disruption from AI looks like.

Yet, the market was punishing Semrush even more severely than its SaaS counterparts.

A few months ago, Semrush's enterprise value ("EV") was about $1.1 billion. Consensus sales estimates for the next 12 months ("NTM") were around $490 million. Therefore, Semrush's EV was just 2.2 times NTM sales estimates.

Semrush was trading for less than half the median multiple of 5.1 in our SaaS universe.

We thought that investors had gotten far too pessimistic on Semrush and recommended Semrush last August in our flagship newsletter, Stansberry's Investment Advisory.

Our timing wasn't perfect. Shares did get cheaper. But we were right that they were undervalued.

Semrush has a dual-class structure, and its co-founders still control most of the voting power. They've signed off on the Adobe acquisition already, so this is effectively a done deal.

Semrush shares are trading just below the $12 deal price and our subscribers have a gain of more than 30% in less than four months.

We also think Semrush complements Adobe's business.

Adobe's SaaS Transformation Fueled a Decade of Explosive Revenue Growth

Adobe Photoshop, released in 1990, was one of the original "killer apps" for the Mac and PC. Adobe sold more than 3 million copies of the program in the 1990s alone.

Photoshop for image editing, Illustrator for drawings and illustrations, and Acrobat for PDFs... These were Adobe's first three major programs.

For more than two decades, Adobe sold perpetual licenses for this software.

Under this model, customers make large, upfront payments, own the software forever, and run it on their own computers and servers.

In 2013, Adobe made waves when it began converting to the SaaS model. By 2017, it had largely completed its transition to SaaS – becoming the first major perpetual software company to do so.

The results speak for themselves... Since 2017, Adobe has grown its revenues at a 17% compound annual growth rate ("CAGR").

Revenue growth has slowed to around 10% in recent years. But that's to be expected as the company matures. Plus, it's far easier to grow the top line quickly from $5 billion in revenue than $20 billion.

In Adobe's SaaS era, the company has become a free cash flow ("FCF") machine.

As my colleague Jeff Havenstein pointed out in September when Adobe posted strong third-quarter performance, Adobe's FCF margins (FCF as a percentage of sales) are remarkable:

Adobe generated $9.6 billion of FCF on $23.2 billion of sales over the past 12 months. That's a monster FCF margin of 41%. Only 19 S&P 500 companies do better.

Since 2017, Adobe's FCF margins have ranged from about 35% to 44%.

So Adobe can continue to grow revenue at a 10% CAGR and is generating lots of FCF that will support buybacks and strategic acquisitions.

Importantly, Adobe is diversifying, as evidenced by the Semrush acquisition.

Adobe is well-known for Photoshop and Acrobat. But the company also has a segment called Digital Experience that accounts for about 25% of overall revenues. This segment includes Adobe's own digital marketing suite with products for content management, advertising campaign management, and data and analytics.

Semrush fits into this segment perfectly. Now, Adobe will have the premier SEO and GEO tools within its marketing and commerce suite. For enterprise clients already relying on Adobe, this gives them a single workflow for both creating content and ensuring it's discoverable across AI-driven search experiences.

It seems to us like Adobe is facing another big transition as generative AI proliferates.

Adobe is embracing these trends by introducing generative AI tools like Firefly and GenStudio. The company is also integrating generative and agentic AI into its core products.

Adobe is not dying, despite the stock's price action.

The market's sentiment pendulum swings too far in both directions...

In 2021, Adobe was a SaaS darling. Its FCF yield (FCF relative to market cap) was down around 2%. (The lower the FCF yield, the more expensive the stock, all else equal.)

Now, the market thinks AI is going to eat Adobe's software products. The stock is in a roughly 55% drawdown from its 2021 peak, and its FCF yield has reached a record-high of more than 7%.

AI may be eating software. But that doesn't mean every SaaS company is doomed. The best of the bunch will adapt and evolve, and that's exactly what Semrush and Adobe are doing.

Good investing,

Alan Gula, CFA

P.S. My colleague Whitney Tilson, a former hedge fund manager known for spotting early winners, is sounding the alarm once again...

He called Netflix at $7.78 (up 4,200% since), Apple at $0.35 (up 20,000%), and Amazon at a split-adjust $2.41 (up 3,200%).

Now, this renowned investor just released a new list of his favorite AI stocks... and not a single Magnificent 7 name made the cut.

Instead, an AI stock you've likely never heard of just flagged as "near-perfect" in his new investing scoring system.