Joby Aviation Stock Soars on Two Big Announcements... Should You Buy?

If you've ever needed a taxi or Uber to get from Manhattan to John F. Kennedy International Airport ("JFK"), you know how grueling that ride can be – especially if you're in a rush.

Typically, it takes about 45 minutes to an hour. You have to fight your way through downtown traffic. If you get the timing wrong or the roads are too crowded, you could easily miss your flight.

But what if you could make the same journey... bypass all the stress and traffic... and arrive within just 7 minutes?

Joby Aviation (JOBY) wants to make that a reality. Joby's vision is to create a fleet of electric vertical takeoff and landing ("eVTOL") air taxis. It'd be like calling your own personal helicopter just as easily as an Uber.

Shares of JOBY popped nearly 20% last week. Investors are excited about two big developments...

The first piece of news is Toyota Motor's (TM) $250 million investment in Joby. This marks the first payment of a $500 million commitment. And it cements Toyota as the company's largest shareholder, with an ownership stake of more than 15%.

Then, this morning, Joby and Saudi Arabian investors announced plans for a deal worth up to $1 billion. While details are sparse, the parties are nearing an agreement that would prompt Joby to sell up to 200 air taxis to Saudi investors. This is a huge step for Joby, bringing the company closer to commercialization.

So, is Joby Aviation a good investment? Let's take a look.

Is Joby's Air Taxi the Future? Pros and Cons

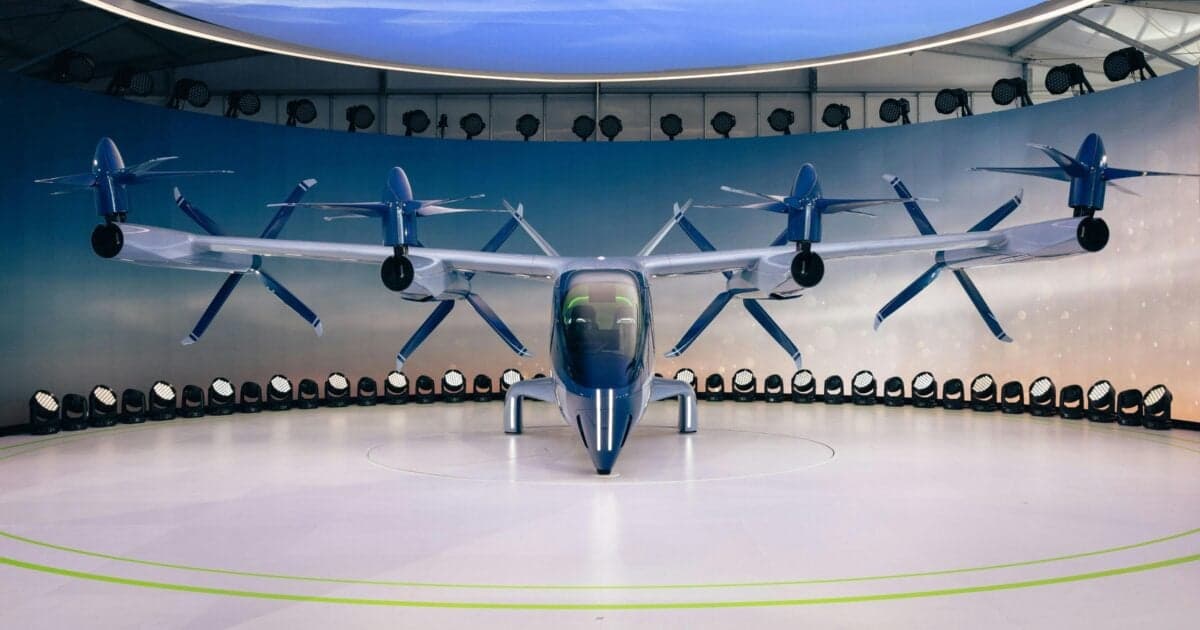

Joby's carbon-fiber airframe vaguely resembles a helicopter. However, once its six propellers get going, that resemblance is whisked away.

The propellers can tilt, pivoting from a vertical position to a forward position in midair. Plus, the aircraft has wings. With this combination, the aircraft can take off efficiently, then generate lift to fly easily like a plane.

Joby's eVTOLS have two advantages that may help them eventually replace helicopters as the primary form of short-distance air travel: price point and safety.

Joby anticipates the aircraft will cost two-thirds less to make and operate than traditional helicopters. It will also be much safer because there's no single point of failure.

For example, if the engine on a helicopter fails, its rotating blade would stop turning. It'd fall out of the sky. However, the eVTOL's wings allow it to glide to safety if faced with engine failure.

The downside of battery power is that it significantly limits the aircraft's range. Currently, Joby's aircraft is limited to flights a little more than an hour and a range of roughly 100 miles. But as the company continues to develop and improve its technology, the aircraft's range should increase.

That doesn't mean it'll be easy. Designing and building the aircraft is just the beginning. Once operational, these aircraft must overcome a series of outside hurdles before they can begin to fly commercially.

As my colleague John Robertson pointed out in his update on Joby's competitor, Archer Aviation (ACHR)...

They also need infrastructure, public acceptance, and – perhaps most importantly – regulatory approval.

That means appealing to authorities like the U.S. Federal Aviation Administration ("FAA"), Europe's EASA, and China's CAAC. And that's no small feat. These agencies are still writing the rulebooks on eVTOL aircraft. They're considering how they fit into existing airspace, how pilots (or autopilot systems) should be certified, and what safety standards must be met.

The road to the first commercial air taxi will be difficult. But the few companies that reach commercialization will be rewarded.

Joby Aviation Sports World-Class Talent and Partnerships

Stansberry Research got a firsthand look behind the scenes of Joby Aviation when Senior Editor Whitney Tilson was invited to the company's Silicon Valley headquarters.

He has detailed the trip extensively throughout editions of his Whitney Tilson's Daily e-letter.

One of his observations was that Joby has immense talent on its side. Here's how Whitney described his experience with members of Joby's team...

I can confirm that Joby has world-class talent.

When I visited the company in September, I was accompanied by a friend who is a Stanford-educated mechanical engineer and I felt like I was watching a Stanford nerd reunion.

He knew many of the Joby executives, including the CEO, and was blown away by the electric motor, battery, and other technology they've developed.

Whitney shared his thoughts on a detailed Joby pitch from one of his favorite websites. Check out the full piece in his e-letter for more about how investors should be thinking about Joby's potential.

Joby could rise to win the eVTOL race... And it's adding incredible business deals to its strong base of talent and engineering.

The company acquired Uber Technologies' (UBER) air-taxi service Elevate back in 2020 and subsequently agreed to a partnership. The agreement would allow users to order a Joby aircraft using Uber's app, just like they would for a car.

Given the range limitations, the initial trips are expected to be less than 50 miles (like our hypothetical trip to JFK). But as Joby continues to improve its technologies and prove itself a dependable player, longer flights may become an option. Some examples might include Miami to West Palm Beach, Florida (65 miles), and New York City to East Hampton, New York (97 miles).

Joby's first commercial launch is planned for Dubai in early 2026. The company is still working with regulators both directly and abroad.

In the meantime, Joby has partnered with big names like Delta Air Lines (DAL) to provide a few aircraft – and, of course, Toyota for funding.

Again, Toyota's ownership stake in Joby is now more than 15%. That's larger than the Joby CEO's stake.

Until an official deal is struck with Saudi investors, Joby only has one main customer so far... Uncle Sam. The first delivery of a Joby aircraft was to the U.S. Air Force back in 2023.

It must have gone well. The Air Force requested two more aircraft be delivered this year. Joby's current contract with the Air Force is worth about $130 million.

That's crumbs compared to what larger military contractors like Lockheed Martin (LMT) and Northrop Grumman (NOC) receive from the U.S. government. But it's a start. We know the Department of Defense is a powerful backer for promising industries.

And right now, Joby needs all the cash it can get...

The Big Downside Joby Investors Should Know

Investors have reason for caution.

As I write, Joby has a market cap of about $6 billion and holds cash reserves of $813 million. In the company's most recent quarter, which ended March 31, 2025, Joby lost $82 million.

Over the trailing 12 months ended March 31, the company burned about $490 million.

That's not necessarily a deal-breaker. Joby operates on the cutting edge, in an industry that requires high research and development spending. Some negative quarters or years are to be expected.

However, it's completely unsustainable over the long term. If the business does not find commercial success soon, it's at risk of depleting its war chest. While companies like Toyota are here to help get the company through until its big break, if they don't begin to see a return on their invested capital, funding may dry up.

The coming months will be crucial as Joby nears its launch in Dubai. Any additional setbacks or delays could risk depleting cash reserves at an even higher rate.

We've seen a lot of potential from this company. Investors have good reason to be excited. But Joby is burning cash... And that's too big a risk to ignore today.

Is JOBY a Good Stock to Buy?

Joby looks attractive to a lot of investors right now... especially after the recent 20% gain. The big question is, should you get on board?

Our Stansberry Score doesn't seem to think so. Take a look at how our proprietary grading system ranks Joby...

The company ranks near dead last in capital efficiency, since it quite literally has no cash flow to return to shareholders. Valuation paints a similar picture... With no past cash flow, our system has a difficult time predicting future cash flow.

Moreover, with limited sales, Joby's traditional valuation metrics like the price-to-earnings and cash-flow-to-earnings ratios are suffering.

However, if Joby's launch in Dubai succeeds and the company begins to win over regulators, the outlook could change completely.

In short, this is a highly speculative play on an emerging industry. Joby could be one of the top players if the winds blow in its favor.

However, this opportunity is not for your rent money... So if you want to buy JOBY today, make sure you act accordingly and use proper risk management. Any money you invest in Joby should be cash you're comfortable losing if the opportunity doesn't play out.

Good investing,

Tyler Jarman