Electric vehicles hit 5% of new cars sold in the U.S.; Twitter's lame defense; 3D printing company Roboze; Is it time to revisit a 'STUUUUUUUUUPID bubble'?; Real tennis

1) On February 5, 2020, I released an in-depth video in which I shared my bullish thesis on electric vehicles ("EVs") and autonomous vehicles ("AVs") and recommended one stock, Alphabet (GOOGL), because of its Waymo division, which is a leader in autonomous driving technology. Since then, the stock is up 52% versus 15% for the S&P 500.

The accompanying report, which we sent to anyone who subscribed to our flagship Empire Stock Investor newsletter (only $49 for the first year – click here to learn more about this special offer and subscribe) had four more stock recommendations. These have performed even better, rising 54% on average.

Today, nearly two and a half years later, my thesis is playing out exactly as I predicted and I'm as bullish as ever. I think my colleague Enrique Abeyta is right, tweeting "#EV at the S-curve tipping point?!?" in response to this article: Electric vehicles hit 5% of new cars sold in the U.S. Excerpt:

Remember when you and a handful of other fashion trailblazers were the only people wearing Crocs... until the floodgates opened and they were on everyone's feet?

That moment could be here for electric vehicles in the US. EVs accounted for 5.6% of the total auto market in Q2, according to a new report from Cox Automotive. While that share is still pretty small, it carries major implications.

Why? Because 5% is the tipping point after which EVs skyrocket from niche mainstream, according to a Bloomberg analysis of 19 countries. It happened in Norway in 2013, in China in 2018, and in South Korea in 2021. Five percent is apparently the threshold where people go from thinking "My neighbor has an EV... that's odd" to "Three people on my street have EVs... I think I want one, too."

This adoption pattern isn't exclusive to electric vehicles – you see it play out across the tech industry. It's called "the S curve."

2) Speaking of EVs, Tesla (TSLA) CEO Elon Musk's initial response to Twitter's (TWTR) lawsuit, arguing that the trial shouldn't take place until February, is laughable.

If this is all he's got, Chancellor Kathaleen McCormick, head of Delaware's Chancery Court, will quickly order "specific performance" – meaning Musk will have to buy Twitter for the contractually agreed-upon price of $54.20 per share.

Here's Techdirt's take on it: Elon Musk's Response To Twitter's Legal Filing May Impress His Fans on Twitter, But Is Not a Good Legal Argument. Excerpt:

I expected that Musk would have a strong comeback, but many of the points Twitter raised would be difficult to refute.

Well, Musk has filed his opening in reply... and he (1) doesn't have a strong comeback, (2) basically just ignored the points he's going to need to refute, and (3) seems entirely focused on pushing the narrative about spam accounts (which is legally meaningless). Musk has good lawyers, and they've been dealt a tough hand by their client. But, still.

Amusingly, as a PR strategy, perhaps this is working. If you sample the discussions on Twitter, there are lots of very ignorant people who seem to think this filing is a strong one. They're wrong. Musk could still succeed in this case, but it will be in spite of this filing, not because of it...

Again, anything can happen in court, and the Delaware Chancery Court is no exception. But, if you can get past the narrative and some fairly ignorant Musk fans, this case still looks like Twitter has a massive advantage. Musk may enjoy spinning narratives for his fans online, but it seems like it will be harder to string along a Delaware chancellor the same way...

And here's Doomberg: Deal or No Deal. Excerpt:

We would argue that specific performance is not drastic whatsoever. It was intentionally bargained for by Twitter and conceded to by Musk, it has comfortable precedence in Delaware law, and is strongly supported by the fact set of this case. If specific performance cannot be imposed here, when could it ever again in the future?

Others point to the rarity of specific performance rulings as proof of the Court's reluctance. We would counter that such infrequence can be explained by the evolving strength of M&A agreements. While the Rohm and Haas case did not formally set legal precedence through a decision handed down in the Court, you can bet it set a strong commercial precedence for countless target companies that dissected every detail of Liveris' foolishly signed agreement to improve their own. The reason specific performance rulings are rare is that merger agreements have become virtually bulletproof, and it takes a special combination of recklessness and hubris to cut a seller-friendly deal like Musk did and then try to get out of it in a matter of weeks. In fact, we estimate the global size of the population set to attempt such a thing to be precisely one...

Have we dissolved so far as a society that one man – rich, reckless, and combative – can flout fundamental tenets of contract law with no ramifications? The Delaware Court of Chancery has been fairly adjudicating contract disputes since 1792. The equity owners of Twitter are due $54.20 a share for their stock. Twitter's bondholders are due the benefits that come with a change of control. Will fear of one man undo 230 years of excellence in jurisprudence? Here's to hoping McCormick is firing up a little mojo of her own.

Finally, it's clear that Chancellor McCormick understands the urgency of the situation. She just contracted COVID-19, but rather than delaying the initial hearing, scheduled in court for 11 a.m. today, she simply moved it to Zoom.

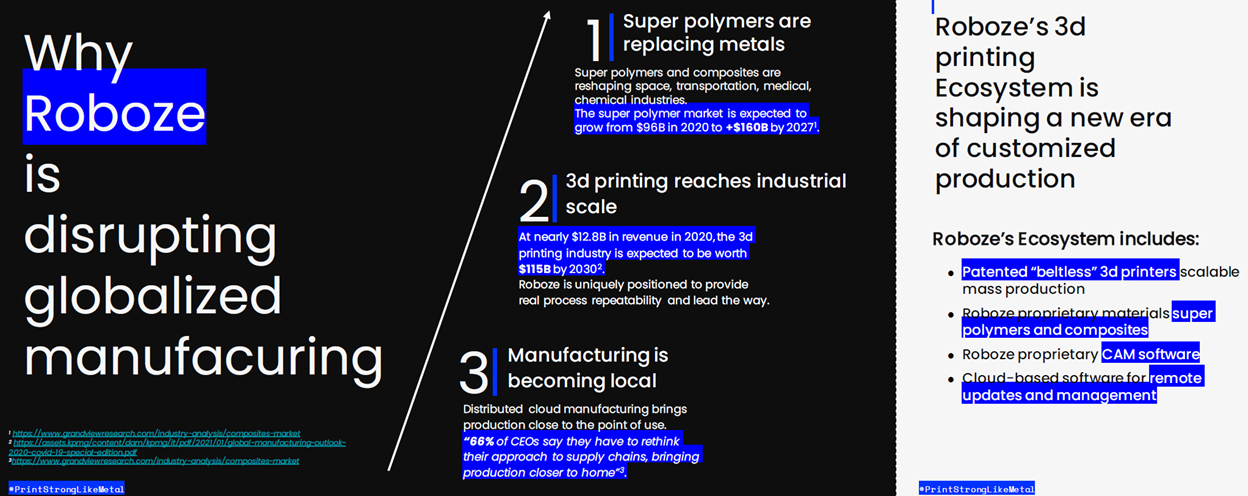

3) The most exciting idea I learned about at the recent Value Investing Seminar in Italy is a 3D printing company called Roboze.

It's based in Bari, just down the road from where the conference took place in Trani, but unfortunately, we can't invest in it, as it's very small and still private.

But someday it'll come public... at which point I'll look hard at buying its shares, as I was very impressed with the 33-year-old founder and CEO, Alessio Lorusso, who gave an interesting presentation (slides here) about his company. Here's one slide:

4) I very publicly nailed the top of the 3D printing sector in early 2014 just before it collapsed by 90%: 3D Printing Is a 'STUUUUUUUUUPID Bubble'. Excerpt:

This could well be the beginning of the end for the 3D printing bubble (I'm short five stocks across the sector, the largest of which is DDD).

I'm not the slightest bit inclined to cover anything today and, in fact, just shorted a bit more DDD as it bounced above $62 on the entirely predictable rush by analysts to reiterate their buy ratings – "move along, nothing to see here." What, you think they're going to admit they're wrong? And risk losing the banking business of a highly acquisitive company? HA!

3D printing is real, but the stock valuations aren't. For example, coming into today, DDD was trading at 17x revenues. So now it's trading at 14x. So what? Even if DDD is accounting properly for its nearly three dozen acquisitions in the past three years – which I highly doubt – it's maybe worth 3x.

The story is the same for pretty much every company in the sector, which is in a completely obvious and STUUUUUUUUUPID bubble.

But this article in the New York Times earlier this week caught my eye and got me thinking about taking a fresh look at the sector, given that the stocks are still in the toilet despite major technological advances over the past eight years: 3D Printing Grows Beyond Its Novelty Roots. Excerpt:

For 3D printing, whose origins stretch back to the 1980s, the technology, economic and investment trends may finally be falling into place for the industry's commercial breakout, according to manufacturing experts, business executives and investors.

They say 3D printing, also called additive manufacturing, is no longer a novelty technology for a few consumer and industrial products, or for making prototype design concepts.

"It is now a technology that is beginning to deliver industrial-grade product quality and printing in volume," said Jörg Bromberger, a manufacturing expert at McKinsey & Company. He is the lead author of a recent report by the consulting firm titled, "The Mainstreaming of Additive Manufacturing."

I was planning on doing some digging in the sector, so meeting Lorusso was very fortuitous.

I'll keep you posted on what I learn...

5) When I was in London two weeks ago, my friend Rupert and I visited the famous Queen's Club, which hosts the main warm-up tournament for Wimbledon because of its lovely grass courts.

We saw the end of the match between Nick Kyrgios and Brandon Nakashima on the TV in the lounge and then watched a bit of tennis in person – but not the tennis you're thinking of...

Little did I know that the sport I've been playing my entire life isn't tennis – it's lawn tennis. Real tennis (that's its formal name) is the original racquet sport, with roots dating back to the 12th century, from which the modern game of tennis is derived. Here's more info about it from Wikipedia.

Below is a picture of the court – one of only 50 in the world, all in the U.K., Australia, the U.S., and France. It's a weird sport that's hard to explain, so I posted a video of the guys playing here. They are the No. 1 and No. 3 players in the world, so it was a treat watching them.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.