Greenlight Q2 letter; Strong growth in Q3?; Why housing prices are stable despite affordability hitting an all-time low; Homebuilders benefit; Corporate debt mostly fixed; Traveling with my friend in Latvia and Estonia

1) I always enjoy reading the quarterly letters written by my old friend David Einhorn of Greenlight Capital. Here's a link to his second-quarter letter, which begins:

David discusses his macro views here:

I don't dismiss David's concerns about a "reacceleration of inflation and higher rates"... but don't think this is likely, so I'm more bullish than he is. That's what makes markets!

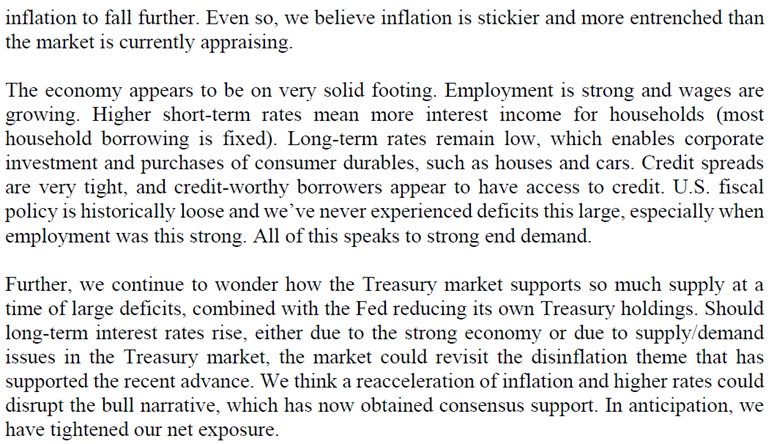

2) Even if David is right about higher inflation and interest rates, I'm not sure it'll be bad for stocks because the driver will likely be a super-strong economy, which the Atlanta Fed is now forecasting for the third quarter:

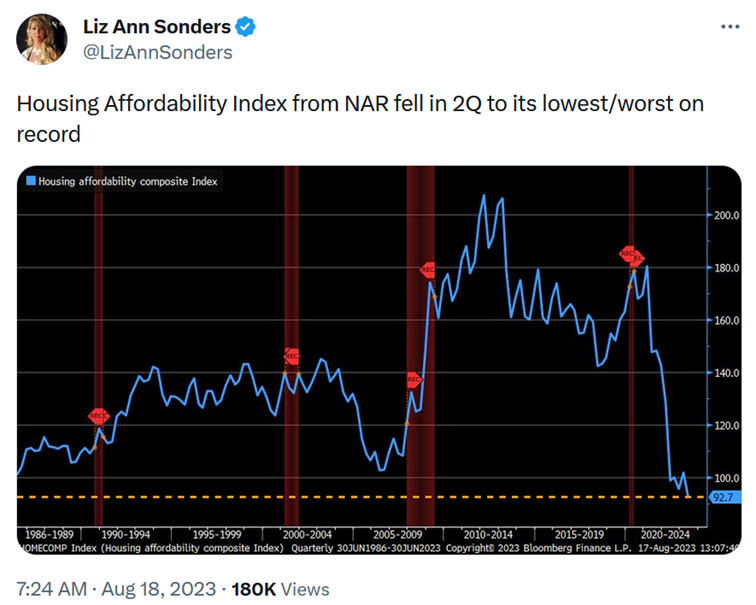

3) Housing affordability (meaning buying, not renting) is the worst it has ever been due to high interest rates and stable housing prices:

Why haven't prices fallen at least somewhat to reflect the much lower affordability?

The lower demand is being matched by lower supply. Of Americans with mortgages, roughly a quarter have fixed rates below 3%, two-thirds have rates below 4%, and more than 90% have rates below 6%... which, with current rates for a new mortgage above 7%, is extremely strong financial motivation not to sell!

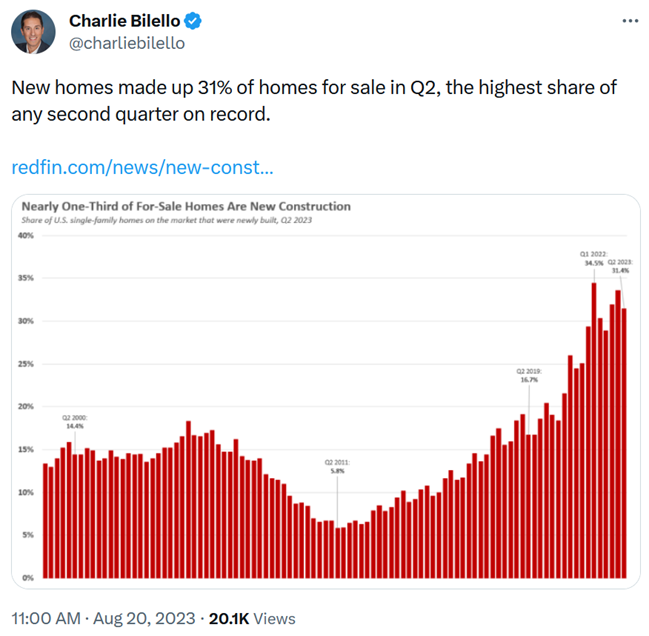

4) The low supply of existing homes has been exceptionally good for builders of new homes, which accounted for a record-high 31% of homes for sale in the second quarter:

This has benefitted the stocks of nearly all homebuilders – like David's largest position, Green Brick Partners (GRBK), and our favorite, Lennar (LEN), which we recommended in our flagship Empire Stock Investor newsletter back in February 2022. Since then, it's up 38% versus 15% for the S&P 500.

You can subscribe to Empire Stock Investor and gain immediate access to our entire archive and open portfolio – including this month's recommendation, an American industrial champion with potential 71% upside in just three years – for only $49 for the first year by clicking here.

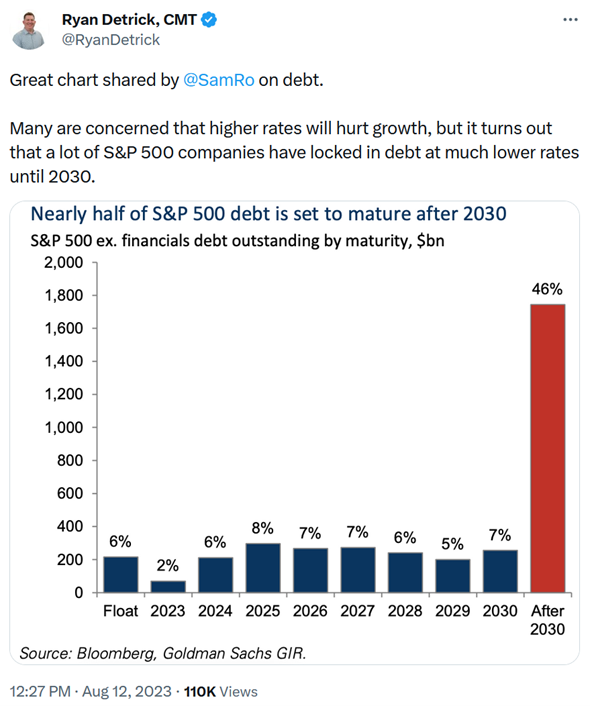

5) It's not just homeowners with fixed-rate mortgages who are insulated from rising rates – large companies that have issued long-term bonds are as well:

6) I'm traveling in Latvia and Estonia with my friend Jesse Jonkman, who runs DIAC Medical in the Netherlands, the company that provided the 27 ambulances that my friends and I purchased (most of the funding came from my old college buddy Bill Ackman).

We gave them to MOAS, a wonderful charity run by an American, Chris Catrambone, that is now operating 50 ambulances all across the front lines in Ukraine, transporting wounded soldiers. Here's a picture of Jesse and me in February when I visited his business outside Amsterdam:

I invited him to join me on this trip and he said sure.

And today, I had the pleasure of meeting and spending three hours with the president of Estonia from 2006 to 2016, Toomas Hendrik Ilves, who actually grew up in New Jersey and attended Columbia University and Penn (I'll share more about him and Estonia in a future e-mail):

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.