Inflation continues to ease; What Layoffs? Top Wall Street Traders Score Giant Paydays; Country distribution of the largest companies; A special shout-out to my buddy Matija Pecotić; I have arrived near my ultimate destination

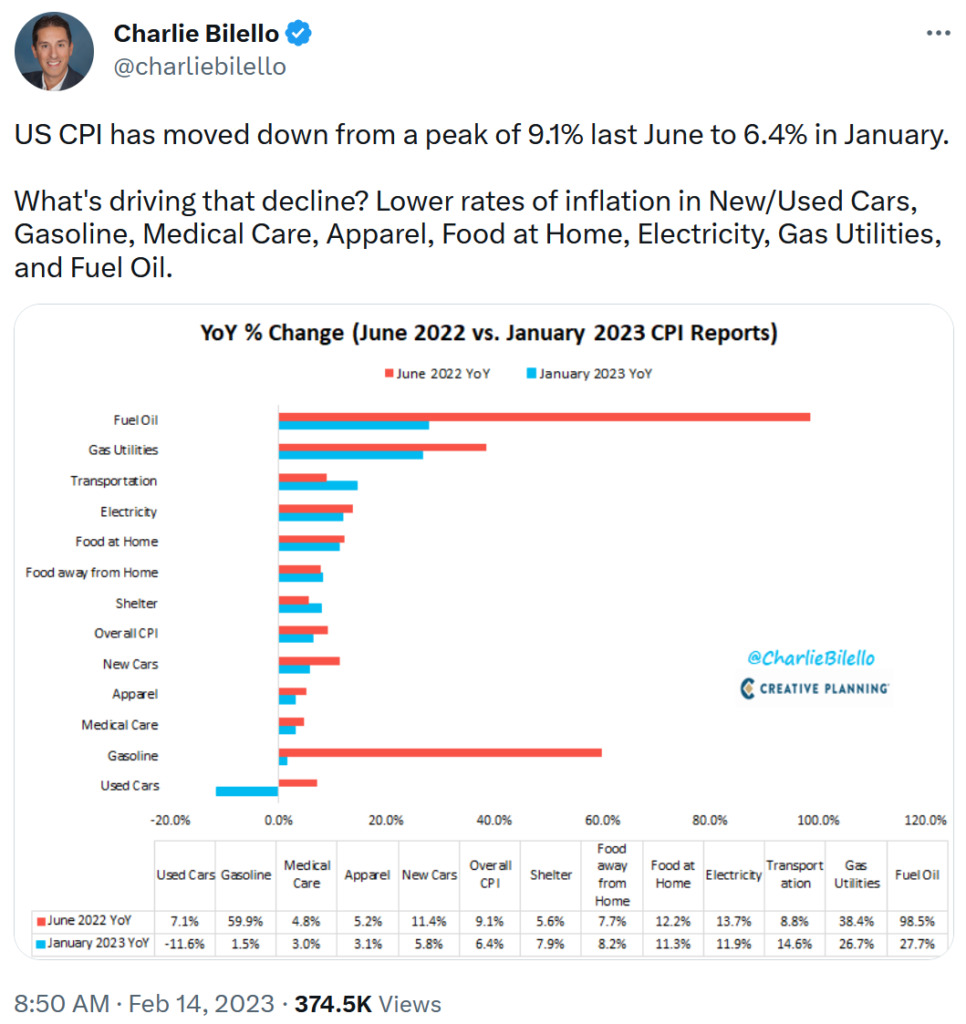

1) Inflation continues to ease, as you can see in these charts and the New York Times DealBook article below (written before the latest Consumer Price Index report yesterday), which bodes well for stocks...

All eyes on C.P.I. Excerpt:

Wall Street is divided on the big question hanging over the market: Will the U.S. economy narrowly avoid recession or plunge into a messy downturn?

Bond yields, which have been on the rise over the past week, indicate tough times ahead. Meanwhile, the impressive rally in stocks through the first six weeks of 2023 signals the opposite – that equity investors are feeling confident.

Tuesday's Consumer Price Index reading will go a long way toward settling which camp is on the right track.

The C.P.I. data, due at 8:30 a.m. Eastern, is expected to show inflation coming down for a seventh consecutive month. Economists forecast the headline inflation number for January climbing by 6.2% on an annual basis – high by historical standards, and well above the Fed's target, but a big improvement from last summer.

The number to watch is core inflation, which strips out energy and food prices. That figure is expected to show a 5.5% annualized increase, and a 0.4% month-on-month jump. This core measure of inflation is showing that consumers are still briskly spending on things like cars, holiday travel, and restaurants.

"Any core reading under 5.5% would likely be a short-term upward catalyst for stocks," George Ball, chairman of Sanders Morris Harris, an investment firm, said in a client note this week. "Any reading above 5.5% would likely be viewed negatively by the markets over the very short term."

2) Wow, I didn't realize the kind of guarantees some hedge fund traders are getting...

From the NYT: What Layoffs? Top Wall Street Traders Score Giant Paydays. Excerpt:

As workers around the country frantically negotiate severance packages amid tens of thousands of layoffs, employees in a tiny, influential, and often secretive corner of Wall Street are being promised some of their biggest paydays ever.

Welcome to the world of elite hedge funds, where risky bets using esoteric number-crunching and cutthroat strategies, applied to the same economic and market uncertainties that have roiled corporate America and led to job cuts, have produced gigantic profits.

Last year, Citadel, a hedge fund run by Kenneth C. Griffin, made $16 billion – the largest annual gain for a firm of its ilk, according to LCH Investments, an investment firm that collects data on the hedge fund industry. To continue their profit-making streak, Citadel and other industry behemoths like Millennium Management, Balyasny Asset Management and Steve Cohen's Point72 are courting potential hires by dangling tens of millions in guaranteed pay over several years, people with knowledge of the negotiations said.

"You're seeing Tom Brady-like pay packages," said Colin Lancaster, a former Citadel executive who now works at Schonfeld Strategic Advisors, another hedge fund that is competing to hire top traders. (Before he retired, Mr. Brady made $25 million per year, plus millions more in endorsements.)

Hedge funds, which often use various strategies to minimize, or "hedge," financial risk, have always been a lucrative corner of the finance industry. Traders who can build complex and successful trading strategies tied to interest rates, stocks, commodities, currencies, and other assets can make nine figures annually because they are typically paid a percentage of the profits they earn for investors in the fund.

What's different now is that the biggest hedge funds are guaranteeing eye-popping compensation to traders before they even start. In the past, when firms have offered such guarantees, they usually stayed below $10 million.

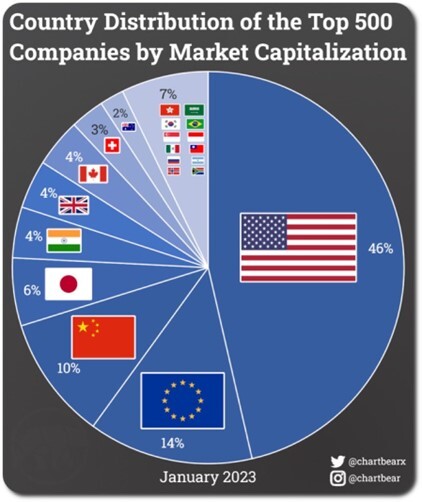

3) It's interesting how dominant the U.S. remains, as you can see in this chart:

4) A special shout-out to my buddy and former Empire Financial Research analyst Matija Pecotić...

Despite being in retirement at age 33, on a lark (and with a bit of luck) he got into the qualifying tournament for the Delray Beach Open, beat two guys, made his first ATP main draw, and last night beat Jack Sock, coming back from a set down to win 4-6, 6-2, and 6-2. Here are highlights from the match. Go Matija!

Here's an article about him, and here's a picture of us:

5) As you read this, I have arrived near my ultimate destination in a faraway country I can't disclose right now, with 14 huge bags, most carefully weighed to be just under 70 pounds (nearly 1,000 pounds total – see picture below), filled with thousands of pieces of hospital supplies, medical gear, sleeping bags, etc.

Susan was an absolute champion at getting all of this organized and packed over the past two days! And a special shout-out to my buddy Ken Shubin Stein, who brought $5,000 worth of medical kits yesterday afternoon and then stayed for hours helping us do the final packing. Another shout-out to Ken's twin, Beth, a surgeon at the Hospital for Special Surgery, who got them to donate 12 pallets of hospital supplies, one of which I'm carrying with me (the rest will be shipped immediately).

Here's a picture of me with one pallet of boxes that I picked up at the HSS warehouse and brought home to pack in my duffel bags:

Here's a picture of Susan and me (and Phoebe the Wonder Pup!) in our living room, with just a tiny fraction of what we packed:

And here I am at the airport with our bags:

If you're interested in learning more about the humanitarian mission I'm on and supporting it, you can send me an e-mail by clicking here.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.