My bold and controversial prediction; An update on Wolverine World Wide; What Wall Street's Top Recession Gauge Is Saying Now; Elon Musk and Mark Zuckerberg trash talk about their cage match

1) I literally put my life on the line to make my latest big prediction...

I traveled across the globe and witnessed devastation and destruction on a scale that I never could have imagined... But I also saw an extreme level of hope and determination.

It all led me to make my boldest prediction yet – one I'm calling "Prediction X."

In a special presentation, I share all the details – including how this could also be my most profitable prediction yet. Watch it here before it comes offline.

2) After seeing the management of shoe maker Wolverine World Wide (WWW) present at the ICR conference in Orlando in January, I shared my full analysis of the stock – and why I was passing on it – in my January 18 e-mail, in which I concluded:

I looked at the management team and immediately saw that Wolverine got a new CEO at the beginning of 2022, Brendan Hoffman. And when I looked at his background on LinkedIn, I saw some warning flags: His prior job was CEO of apparel retailer Vince (VNCE) from October 2015 until September 2020, a period in which the stock went from $40 per share to $5 per share. And prior to that, he was CEO of Bon Ton Stores from February 2012 to September 2014. I can't see what the stock did then – because it went bankrupt in 2018!

This resume, combined with what happened to inventory in 2022, really makes me question whether Wolverine is a good bet for a turnaround.

That said, it might be a good candidate for a shorter-term trade, as selling down inventory will generate a lot of cash – and, assuming they are correct in having no write-downs, investors will likely respond favorably to this...

It turns out that I got this exactly right...

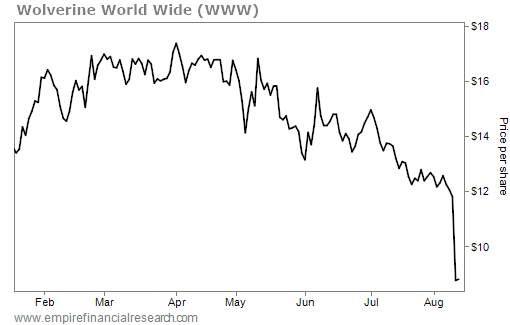

First, WWW shares were indeed a good short-term trade, as they quickly rose from $13.58 that day to the $16 to $17 range, where they stayed for the next four months. But after that, the stock steadily declined... and then collapsed last week, as you can see in this chart:

WWW shares closed Friday at $8.81, close to a two-decade low, as the company reported dismal earnings and guidance last week – and, after a disastrous 18-month tenure, sacked CEO Brendan Hoffman ("who is no longer with the Company"). How could the board have been so stupid as to hire a guy who sank every prior company he helmed?

With a new CEO – an insider who HAs been with the company for 15 years – and a far more depressed stock price, could WWW finally be a buy? Probably not – this smells like a value trap – but I'll take a fresh look with an open mind...

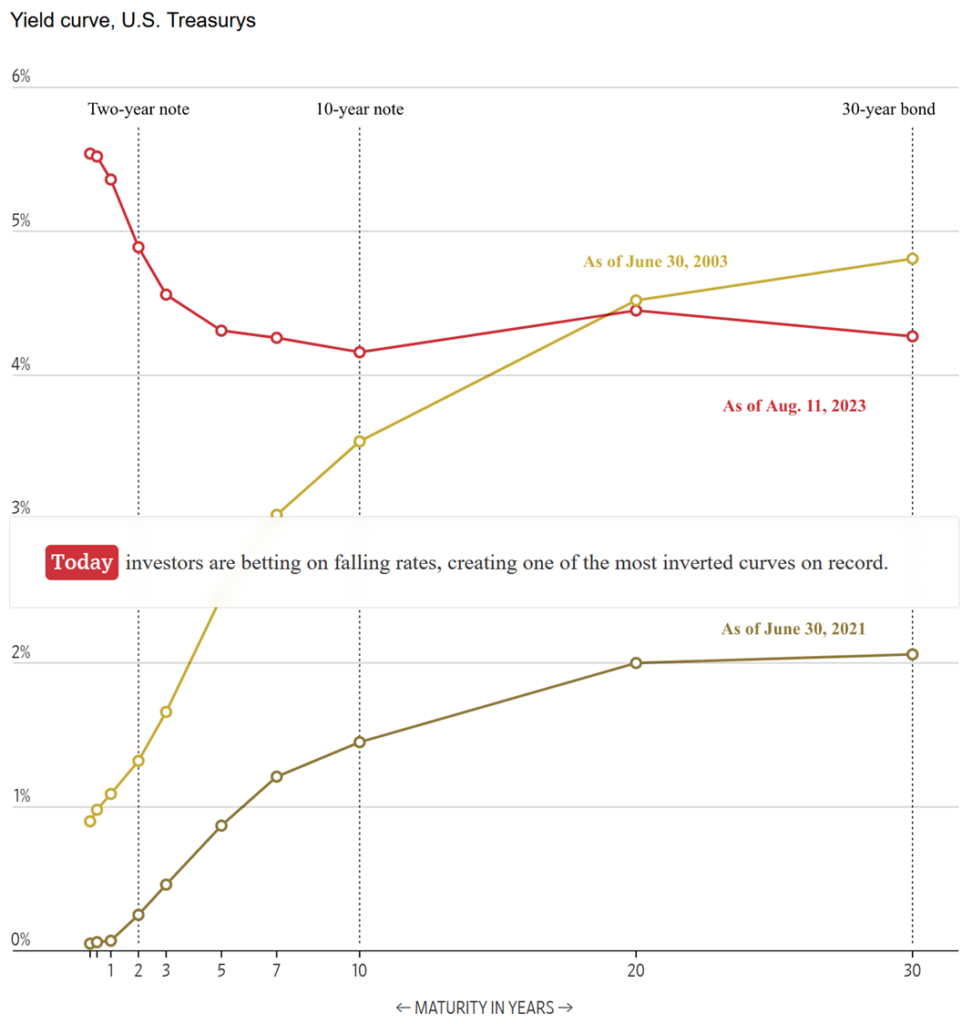

3) The Wall Street Journal had an interesting analysis over the weekend of the inverted yield curve and why it might not mean a recession is looming: What Wall Street's Top Recession Gauge Is Saying Now. Excerpt:

Can this time be different?

The simplest message sent by inverted yield curves is that investors think that short-term interest rates will be lower in the future than they are now. But that doesn't mean that a recession is guaranteed.

There have, in fact, been times when the Fed first raised, then lowered, rates and managed to skirt a recession. That might have even happened after it cut rates in 2019, if not for the pandemic.

Investors and economists have become more optimistic in recent months because inflation has subsided even as unemployment has remained near a five-decade low. That is true even of the Fed's preferred inflation gauge, which strips out volatile food and energy categories...

As the Fed sees it, short-term rates, adjusted for short-term inflation expectations, are currently above a so-called neutral level and therefore working to push inflation down.

Notably, bond yields and Fed forecasts both suggest that real rates will fall gradually over years before leveling off, a sign that investors and officials don't foresee a sharp economic downturn. Fed officials have also said that they might cut rates partly just to offset falling inflation, which would drive up real rates if they didn't take any action.

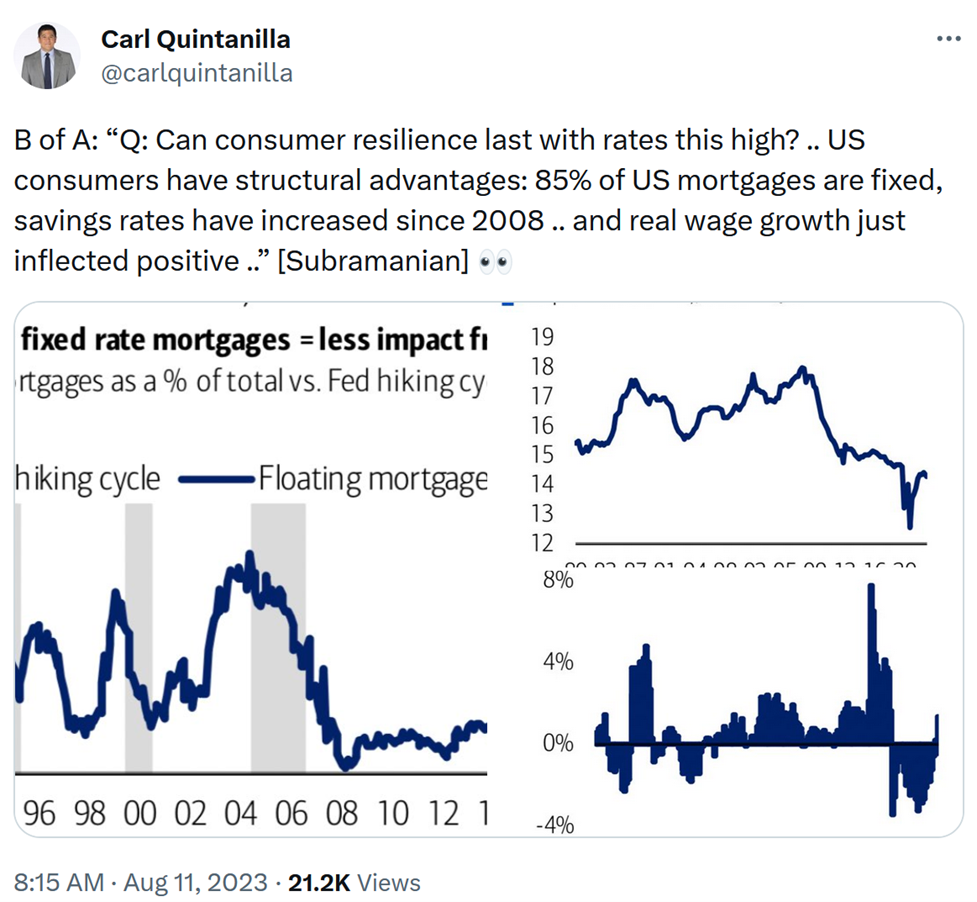

4) Here's CNBC's Carl Quintanilla with a tweet that captures some of the reasons why I think we're likely to avoid a recession in the next year:

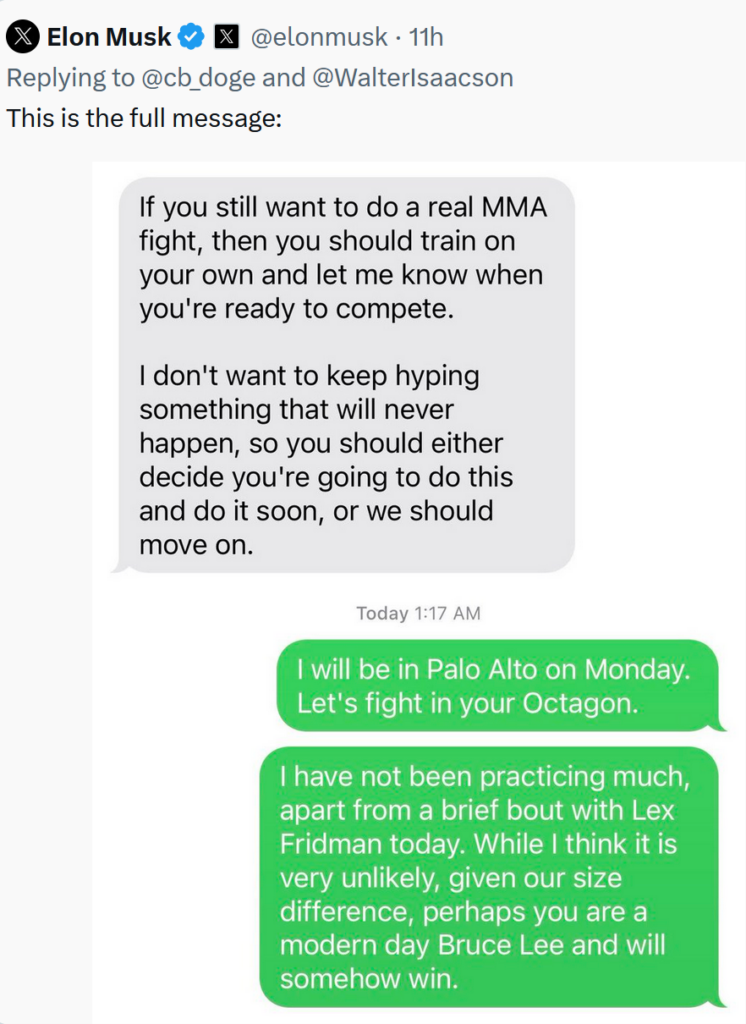

5) Tesla's (TSLA) Elon Musk and Meta Platforms' (META) Mark Zuckerberg were at it again over the weekend, talking trash about their much-hyped cage match...

First, Zuckerberg wrote (in gray) and Musk replied (in green):

Then, Zuckerberg wrote:

This is unbelievably stupid and juvenile, and far beneath how I expect CEOs of leading companies to act. That said, I would definitely pop a bowl of popcorn and enjoy watching them beat on each other!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.