Soaring margin debt; The Rage of Carson Block; Where to go on vacation right now

1) Activist short seller Nate Anderson recently published this interesting tweet and accompanying chart:

2) Speaking of activist short sellers, Michelle Celarier of Institutional Investor recently published this in-depth profile of my friend Carson Block of Muddy Waters Research: The Rage of Carson Block. Excerpt:

A year before Carson Block launched Muddy Waters Capital, his hedge fund firm, he started trying to line up a prime broker – an investment bank that could lend him stocks so he could then sell them short. But the task was proving arduous.

The problem: Block had made his name calling out China frauds, and Wall Street loved China.

After several bulge-bracket banks turned him down, Block decided to try his luck with Jefferies Financial Group, a scrappy up-and-comer known for its trading skill. Muddy Waters, then only a research firm, was based in San Francisco, so he arranged an interview with Jefferies CEO Rich Handler on his next visit to New York City.

But the meeting in Handler's midtown office took him aback.

"You're crazy," the CEO told him, Block recalls.

"I think you're addicted to the attention," Handler went on. Block had catapulted from obscurity to fame in 2011 after a research report he penned took down Sino-Forest, a Chinese company he alleged was a fraud, and tarnished billionaire hedge-fund legend John Paulson, who was one of its investors.

Since then, Block had become a regular presence on both CNBC and Bloomberg TV, where he would rail against his latest short target.

Handler counseled Block that he could make more money with less angst.

"Given where you are right now, you should be doing long stuff as well. If you want to just short, you could get on TV and you could say, 'Yeah, we're long XYZ, but we're also short this thing,' and you don't have to come out and say this thing is a fraud," Handler explained. "There are much more subtle ways of doing it and you could build a better business."

What's more, the CEO said, it was less dangerous. "You wouldn't have all these guys wanting to stick knives in your back, and you wouldn't be living the way that you're living," Handler said, responding to stories Block was telling him about the death threats he'd received and his worries about security.

Block was surprised Handler was so blunt, but he gave it some thought.

"Am I doing this because I'm addicted to the attention? Or do I have a better reason for doing this?" the then-38-year-old asked himself as he walked out.

Block, now 44, knew that Handler was correct about the blueprint for making money as a hedge-fund manager. (Handler did not respond to a request for comment.)

Being an activist short-seller would limit the amount of money he could raise. He probably wouldn't become a billionaire.

Block also knew he could take the Muddy Waters brand and go predominantly long. "But it just never appealed to me to really be that," he says, telling the story to Institutional Investor in a series of conversations capped by two three-hour Zooms in which he discussed – among other things – the demons that have driven him to become the most brazen, profane short-seller on the planet today.

"I'm not an adrenaline junkie," he decided after leaving Handler's office. "What I do is very, very personal to me."

He adds: "I enjoy f**king with people."

In my e-mails on May 20 and July 17 last year, I highlighted Carson's work exposing Chinese education company GSX Techedu (GSX) – and the pain he was taking as the stock ripped upwards. Here are Carson's comments on it in the article:

Block isn't one to give up, so he began trying to figure out what was going on. Was it high-frequency trading? Passive flows from index funds and exchange-traded funds carrying the stock higher?

While he believes both played a role, last summer Block also learned from two insiders in the U.S.-China investment world that some Tiger Cubs – including Bill Hwang, who had been running a family office called Archegos Capital Management since settling insider-trading charges, and his protégé Tao Li, who runs hedge fund Teng Yue Partners – were behind the runup. Hwang and Li used highly leveraged swaps to conceal their positions. Another Tiger Cub, Chase Coleman's Tiger Global Management, was also one of GSX's top shareholders.

Meanwhile, the founder of Singapore-based QQQ Capital Management admitted in a now-deleted tweet that he was trying to squeeze shorts by selling GSX puts.

"Everyone knows GSX is a fraud," says Block. "The problem is the hedge-fund players who decided to squeeze the shorts."

In late March, GSX shares tanked, a victim of the massive liquidation of Hwang's portfolio, creating a fair amount of schadenfreude at Muddy Waters. Notably, the big investment banks, known to have extended Archegos so much leverage, refused to do business with Muddy Waters, according to Block.

Carson has once again been proven right, as the stock has imploded. From a peak of more than $100 as recently as two months ago (I added it to my "Short Squeeze Bubble Basket" in January 27 at $142.70), it now sits at $27.07 per share as of Friday's close.

3) There are so many compelling reasons to get vaccinated: protecting yourself, your loved ones and everyone you come in contact with, helping your country by crushing this terrible pandemic once and for all, going back to the office, socializing again, and going on vacation after being cooped up for more than a year!

Regarding the latter, Americans are flocking to places like Miami Beach and Cancún. But the result has increasingly become a mob scene, accompanied by soaring prices for flights, lodging, and car rentals.

So what should an enterprising, bargain-hunting person do?

To quote baseball legend Willie Keeler: "Hit it where they ain't."

Allow me to explain what I mean...

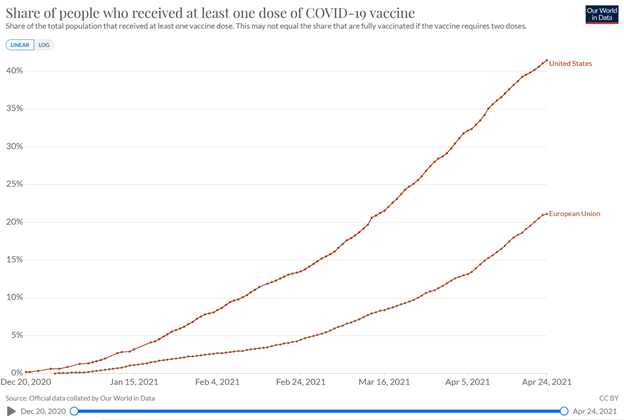

Right now there's a huge disparity in the vaccination rates between the U.S. and Europe, as you can see in this chart (source):

As a result, Europeans aren't yet traveling much, so their favorite vacation destinations are almost empty right now. That's of course terrible for the tourist hotspots – but great for you! No long lines to get into the most popular attractions and restaurants, and bargains galore on hotels, rental cars, and airfares.

For example, last week in Cape Town, my parents, David Berman, and I were able to get into all of the best restaurants... There was no line at all to ride the famous Table Mountain cable car... And for the one night we stayed in a hotel, David was able to negotiate a 75% discount. And on the 14-hour flights to and from Nairobi (there are no non-stops to Cape Town, so I connected through Kenya), I wasn't even tempted to pay the $1,100 upgrade fee each way for flat-bed business class because the flights were only 25% full, so I had a row to myself where I could lie down and sleep.

In summary, for Americans with a bit of time, money, and a sense of adventure, I highly recommend avoiding the mob scenes in Florida and Mexico and instead going to places that are more popular with European tourists. But you need to act quickly... This window of opportunity will likely close in the next few months, as European countries are scrambling to vaccinate their citizens.

Right now, Cape Town is at the top of my list. It's just magical – one of my favorite cities in the world, rivaling San Francisco. Here are my Facebook posts about our trip. If you want someone to take you on some customized adventures while you're there, contact Nick Schooling at Local Knowledge Tours at +27 76 680 2602 (tell him I sent you).

If you can swing an extra week (I was there eight days), add in a drive down the Garden Route and/or take a safari in either South Africa or neighboring Namibia or Botswana (see this article: What It's Like Visiting Botswana Right Now).

For those of you with an even greater sense of adventure, I suggest Kenya, where my parents, sister, and nephew live. My wife, daughters, and I visited them for three weeks in December and January and had a fantastic time (see my Facebook posts here, here, here, here, here, here, and here).

Since then, the country has been hit by a third wave of the pandemic, which has scared off all of the tourists... But if you're vaccinated, Kenya's loss is your gain. I can only imagine the bargains you can negotiate right now, and you'll have the Maasai Mara and Lamu to yourself. And, as I mentioned earlier, there's a nonstop flight from JFK. If you're looking for a good local travel agent, my parents recommend Alan Dixson at Let's Go Travel Uniglobe (tell him Tom Tilson sent you).

All you need to enter Kenya or South Africa is a recent negative COVID-19 test.

As for Europe, most countries are currently closed to American tourists, but the head of the European Commission just made this announcement yesterday: EU Set to Let Vaccinated U.S. Tourists Visit This Summer. As Europe reopens, get over there before all the other Americans clog it up!

In the meantime, Croatia, Greece (see: Tourist-starved Greece takes a gigantic leap of faith on COVID), and Turkey are open to Americans right now without any quarantine – just a negative COVID-19 test or, in the case of the first two, proof of vaccination. I've vacationed in all of them in the past five years, and they're magnificent!

Here's an idea: One alternative I was considering for flying to Cape Town was Turkish Airways, which would have given me a full day in each direction in Istanbul, one of the world's most historic cities. The round-trip airfare was only $832 two weeks ago.

As for Croatia, my wife and I loved the Backroads biking/hiking/sea kayaking trip we did for a week in the summer of 2019 along the Dalmatian Coast, starting in Split and ending in Dubrovnik (where much of the HBO series Game of Thrones was filmed). My youngest daughter, who's taking a gap year before starting college, spent a month there in October and had a fabulous time as well.

For the latest on which countries are open to U.S. tourists, see:

- When will international travel return? A country-by-country guide to coronavirus recovery

- Find out which countries are welcoming U.S. tourists back

Best regards,

Whitney