An activist short seller gets his day in court; 10 Reasons to Short; Hong Kong Stock Market Dives After China Party Meeting; Nasdaq Freezes Chinese Small-Cap IPOs After Price Spikes; Ice on a plane; Why You Should Book Your Holiday Flights Now

1) Over the weekend, the New York Times profiled activist short seller Nate Anderson of Hindenburg Research: An activist short seller gets his day in court. Excerpt:

On Oct. 14, a federal jury convicted Trevor Milton, the founder of Nikola (NKLA), of three counts of defrauding investors. The verdict was a stunning fall for the entrepreneur, who sold Wall Street on the vision of Nikola's doing for hydrogen-powered long-haul trucking what Tesla had done for the electric vehicle. In today's newsletter, we look at what it means for Nathan Anderson, the activist short seller who first accused Nikola of fraud – and for the role of whistle-blowers and activist short sellers in exposing corporate wrongdoing...

But for Anderson and other activist short sellers, the Milton trial had potential to reset the narrative. At a time when regulators are stretched and journalists are underfunded, they say, it's activist short sellers who are sniffing out corporate fraud.

Anderson's firm has exposed wrongdoing at dozens of publicly listed companies over the years. In most cases, Anderson shorted his targets, often turning a profit. None were bigger than his investigation into Nikola.

As I've written many times before, it's outrageous that regulators are harassing Anderson as part of wild goose chase/fishing expedition that's impacting at least 30 activist short sellers:

Corporate executives tend to portray activist short sellers as vigilantes with nefarious motives, or even as "un-American" for betting against business. Retail traders try to squeeze them into oblivion, and critics have suggested that their ability to move stock prices is a potentially destructive force in capital markets. The Securities and Exchange Commission and the Department of Justice are investigating nearly 30 activist short sellers as part of a sweeping inquiry into potential market trading abuses...

The moment of vindication arrived as activist short sellers are facing more scrutiny than ever before.

Hindenburg is on the list of activist short sellers being investigated by the SEC and the Department of Justice, Bloomberg reported in February. Anderson said he was still in the dark about what investigators were seeking.

"We haven't received anything," Anderson said. He added that he was confident investigators wouldn't find any smoking gun: "The industry is far more mundane than most people realize. It's really a lot of reading filings, speaking to former employees and industry sources, and long-form research."

This professor nails it:

Luigi Zingales, a professor of entrepreneurship and finance at the University of Chicago's Booth School of Business, thinks any efforts to muzzle whistle-blowers and activist short sellers would be bad for markets, and for democracy.

"In a free society, one of the most valuable sources of news is negative news. Everyone's happy to give you good news," Zingales told DealBook. "We need more incentives in society to report that bad news."

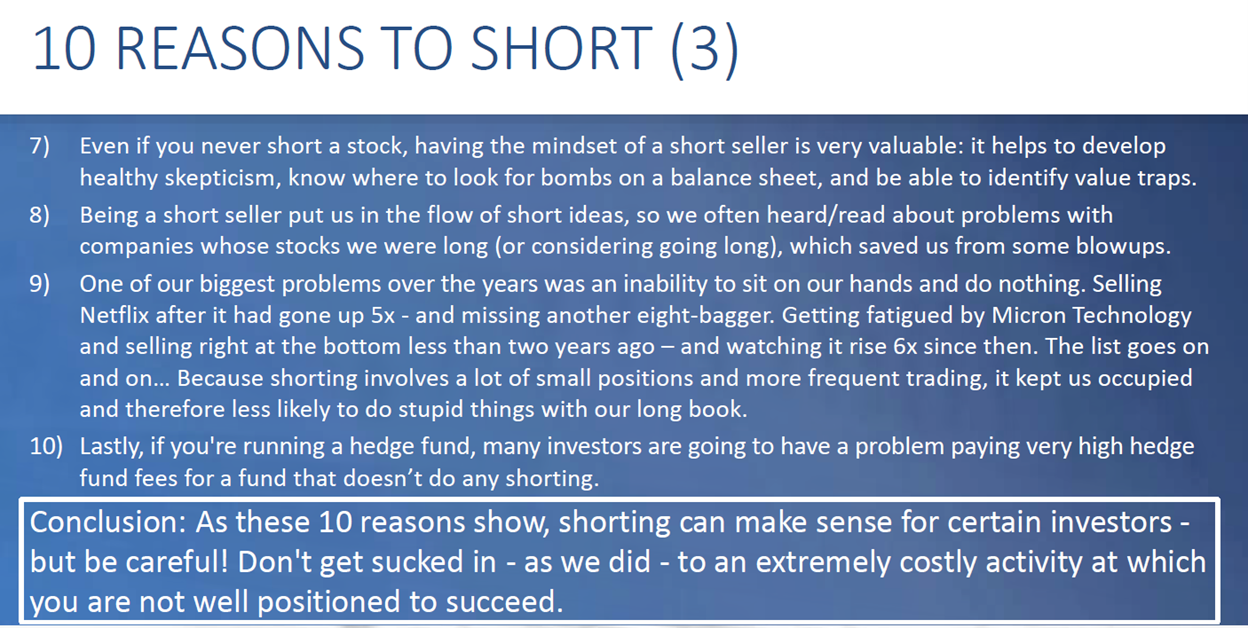

2) Speaking of short selling, picking up where I left off a month ago, where I outlined my history as a short seller and the 12 reasons not to short, here are the 10 reasons to short, from my presentation entitled, "Lessons From 15 Years of Short Selling":

3) Chinese stocks around the world are cratering in the wake of the Chinese Communist Party's national congress meeting over the weekend: Hong Kong Stock Market Dives After China Party Meeting. Excerpt:

The Hang Seng Index fell 6.4% on Monday, the biggest one-day decline since the global financial crisis, according to Wind data. It closed at its lowest level since April 29, 2009. Shares in mainland China were also down, although not by as much. The benchmark CSI 300 was 2.9% lower, and the Shanghai Composite Index was down around 2%.

The selloff came after Chinese leader Xi Jinping cemented his control over the ruling Communist Party, appointing a number of loyalists to the party's most powerful decision-making body and getting a convention-defying third term.

"The makeup of the investor base of the Hang Seng Index is markedly more international than the onshore market," said Eli Lee, head of investment strategy at Bank of Singapore. "Warranted or not, this is clearly, at least over the near term, a vote of reduced confidence in the new body of power that's just been announced."

Foreign investors rushed to exit from China's domestic stock market, pulling out 17.9 billion yuan, the equivalent of $2.5 billion, through the Stock Connect channel on Monday, Wind data shows. That is the biggest single-day outflow since the trading link was launched in late 2014.

Almost all shares in the Hang Seng Index traded lower, but Chinese internet and technology stocks were particularly hard hit. The shares of Alibaba, Baidu, JD.com, Meituan, and Tencent were all down more than 11%.

The selloff didn't appear to be driven by the fundamentals of those companies but instead by investors' expectations about the shifting balance between state-owned and privately owned enterprises in China, said Kinger Lau, Goldman Sachs' chief China equity strategist. He said that Mr. Xi's vision of common prosperity and his plans for state-owned enterprises to take a more prominent role in the economy were key points in the speeches last week.

Why should American investors care? Because we foolishly allowed hundreds of Chinese companies to list on our exchanges, a massive number of which were total frauds, resulting in tens of billions of dollars of losses...

4) More than a decade later, regulators are finally acting, but why were these obvious scams ever allowed to be listed here? Nasdaq Freezes Chinese Small-Cap IPOs After Price Spikes. Excerpt:

The Nasdaq Stock Market has quietly halted listings of small-cap Chinese companies, holding up approval letters and demanding more information about related parties in deals, after a series of meteoric run-ups – and dramatic collapses – in IPOs this year.

Shares of more than 20 recently listed companies have risen over 100% on their first day of trading. They include Hong Kong-based fintech company AMTD Digital (HKD), which briefly jumped over 320-fold after its July listing, and Chinese garment maker Addentax (ATXG), which rose more than 130-fold on its market debut in August. The two stocks have since lost more than 98% of their value.

The exchange has privately informed lawyers over the past few weeks that new listings of small-cap companies were being subjected to additional reviews, and approvals were suspended until further notice. It also asked for details of investors that have been allocated shares in an IPO, the lawyers said.

Although companies across the board faced this increased scrutiny, the exchange has been paying particular attention to companies from China and the rest of Asia, said Douglas S. Ellenoff, a partner in the law firm Ellenoff Grossman & Schole. He said this was because the IPO price swings in recent months involved companies from Asia.

I continue to believe that all Chinese companies should be banned from ever listing on our exchanges...

4) I flew to Boston yesterday to attend the annual Stansberry Conference today, tomorrow, and Wednesday. I'm one of the last speakers on Wednesday, when I'll be sharing my two favorite investment ideas. In the meantime, I'm looking forward to hearing what the many outstanding speakers have to say...

It's a rare week when I'm not on a plane, so I wanted to share two travel tips...

First, I like to drink lots of water when I'm traveling.

When I'm packing light, I bring a squeezy flask ($14 on Amazon here – it originally came with my trail running vest) because it takes up less and less space as I drink from it (and almost nothing when empty).

But I really like drinking super cold water, so if I'm not packing light, I now bring my insulated water bottle ($17.25 on Amazon here) – here's the key: filled with ice.

I didn't know this, but you can bring a bottle of ice through security as long as there's no water (or other liquid) in it.

Here's a picture of my two options:

Second, if you're looking to book flights between now and the end of the year, this Wall Street Journal article explains Why You Should Book Your Holiday Flights Now. Excerpt:

The best holiday present you can give yourself is to book flights immediately.

Already-high prices will likely rise significantly in the coming weeks, analysts and fare-trackers say. Holiday airfare is historically expensive, but is compounded this year by airlines' attempts to manage schedules and capacity.

After a rocky spring and more troubles early in the summer, airlines have pared their schedules in the hopes of delivering better service, analysts say.

The average price for domestic travel during Thanksgiving week this year is $468, up 48% from the same time last year, according to recent search data from travel site Kayak. The data considered searches from Sept. 11 to Sept. 25, the company says. Current prices reflect reduced schedules and high demand. Prices will fluctuate, but the average price generally increases as the travel date approaches.

Prices in late December are higher, as well. The average price for domestic travel during Christmas week this year is $574, up 52% compared with the same time last year, according to Kayak data.

"If you find a fare that works for your budget, and the airline and schedule meet your needs, book it," says Henry Harteveldt, a travel-industry analyst and president of Atmosphere Research, a market-research firm.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.