Buffett and Wood debate the future of railroads; What might Buffett be doing now?; Gas spending as percent of all consumer spending; Seattle

1) Given what a fan I am of Berkshire Hathaway (BRK-B) CEO Warren Buffett and how much scorn I've heaped upon ARK Invest's Cathie Wood, you might be surprised to hear that I'm not sure Buffett is right in this debate: Warren Buffett thinks railroads will be his firm's key asset in 100 years, while Cathie Wood calls it a 'bad idea'. Excerpt:

"BNSF continues to be the number one artery of American commerce, which makes it an indispensable asset for America as well as for Berkshire. If the many essential products BNSF carries were instead hauled by truck, America's carbon emissions would soar," Buffett said in his annual letter.

BNSF Railway, which is the largest railroad in America by revenue, reported record earnings of $6 billion in 2021. And Buffett expects that record to be continually broken for many years into the future.

"I'll venture a rare prediction: BNSF will be a key asset for Berkshire and our country a century from now," Buffett said.

But Wood's ARK Invest sees the railroad business differently. ARK in its Bad Ideas Report called it a "bad idea" that investors should avoid as it is ripe for disruption.

That disruption, according to Wood, will be driven by the adoption of autonomous electric trucks that will "compete cost-effectively with freight rail and will offer better, more convenient service."

The potential convenience and cost effectiveness of autonomous electric driving trucks should help reverse the market share gains and pricing power railroad companies have gained from truckers since the early 2000s, according to the report, leading to the potential value destruction of $400 billion in fixed assets.

"The combination of electric and autonomous technology will increase productivity and lower the costs of trucking dramatically," the report said. Wood expects autonomous semi-trucks to reduce the cost of trucking by 75% to $0.03 per ton-mile, "undercutting rail prices with the help of lower electricity and maintenance."

Combined with the potential for autonomous vehicles to take different form factors over time like drones and rolling sidewalk robots, "we believe freight rail companies will have trouble competing with antiquated technology tied to dedicated infrastructure assets," the report said.

"ARK wonders which, if any, freight rail operators will survive."

Wood expects the transition from rail to autonomous trucks to happen within the next four to nine years, according to the report.

As I first laid out in this video two years ago, I'm extremely bullish on autonomous and electric vehicles and think they will develop faster than almost anyone thinks.

I don't think autonomous trucks are going to put railroads out of business, as Wood warns, but they could start taking market share from railroads by the end of this decade and be a headwind for the industry thereafter.

2) Speaking of Buffett, a friend asked me what he might be doing in light of the recent market turmoil, so I passed the question along to my friend and former partner Glenn Tongue, who replied (correctly I think):

I doubt any equities have fallen into his "very attractive" zone. Buffett is likely continuing with repurchases and trying to snag large acquisitions.

I'm sure Todd Combs and Ted Weschler are making moves with their collective $34 billion.

The real action is more likely going on in the insurance businesses, where I would imagine there is tremendous demand for Berkshire's policies.

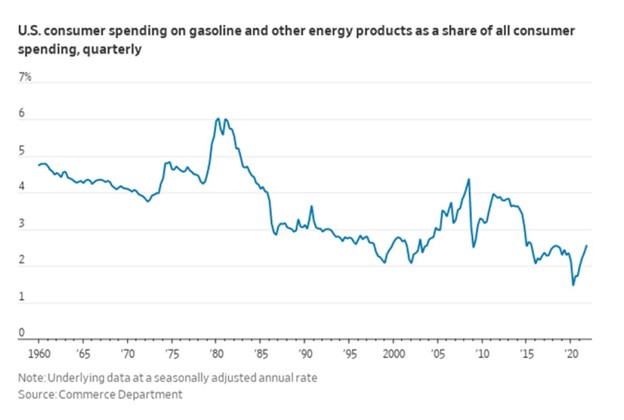

3) Soaring gas prices are hitting a lot of Americans hard, but the silver lining is that the increase is from an all-time low base, relative to total consumer spending, as you can see in this chart (hat tip to CNBC's Carl Quintanilla):

4) After returning from Kenya in the first week of January, I spent nearly six weeks at home – I can't remember the last time I did that – but then resumed my usual insane travel schedule... going to the Pivot conference in Miami, then Mont-Tremblant, visiting my parents in New Hampshire and skiing for nine days, then driving with them to New York City on Friday and flying to Seattle on Saturday morning for my uncle's funeral that afternoon.

We then spent the day on Sunday on the Lake Union waterfront, seeing all sorts of boats (I especially love the old wooden ones) and visiting the Museum of History and Industry, which I'd never heard of but was super interesting.

It had many exhibits on the history of the Seattle area, including the first order Amazon (AMZN) ever fulfilled, Douglas Hofstadter's Fluid Concepts and Creative Analogies: Computer Models of the Fundamental Mechanisms of Thought, and the sign outside the first Starbucks (SBUX).

There was also a special exhibit on Leonardo da Vinci, which was fascinating. I never knew that he was a 6' 6" gay vegetarian born out of wedlock. He never had a formal education, but nevertheless distinguished himself as a draughtsman, engineer, scientist, theorist, sculptor, and architect. He didn't do much painting but is perhaps best known for the Mona Lisa. And while a pacifist, to pay the bills he designed many weapons of war – including new versions of old weapons like lances, chariots, catapults, and crossbows... and entirely new weapons like guns, cannons, and mortars.

Afterward we had dinner at a famous old seafood restaurant, Ivar's, and watched the ferries and the gorgeous sunset...

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.