Companies Brace for Onslaught of New Activists After Change in Proxy-Voting Rules; Ethics Watchdog Group Seeks Probes Into Oversight of Officials' Stock-Trading Conflicts; Final Curtain (for AMC); Trevor Milton accused of repeated sexual assaults; Scott Galloway interview; Blinking helmet

1) Activist investors have a mixed record... But as I have argued many times over the years, they are a clear net positive for our markets and economy, so I view this as good news: Companies Brace for Onslaught of New Activists After Change in Proxy-Voting Rules. Excerpt:

Sinking stock prices and a change in proxy-voting rules are emboldening many first-time shareholder activists to seek changes at some of the biggest names in American corporations.

Companies, always wary of activist advances, are feeling particularly vulnerable as a result of new rules imposed by U.S. regulators in September requiring the use of a so-called universal proxy card in corporate-director elections, bankers and lawyers say.

In the new format, directors nominated by a company must be listed on the same ballot as those put forth by activists, enabling investors to pick and choose, rather than voting entirely with either the company or the activist.

Advisers to companies say the likelihood of at least gaining one board seat will increase significantly for smaller players. That's especially true given that they will no longer incur the substantial expense – sometimes running into six figures or more – of printing and mailing proxy cards to all shareholders, lowering the barriers to entering the activist game.

2) And another topic about which I have long written...

It's good to see possible movement in this area of total disgrace: Ethics Watchdog Group Seeks Probes Into Oversight of Officials' Stock-Trading Conflicts. Excerpt:

A nonpartisan group that monitors government ethics filed a series of legal complaints alleging the federal government is failing to adequately enforce conflict-of-interest rules.

The Campaign Legal Center called on the executive-branch agency that oversees ethics rules to investigate what it called deficiencies in enforcement at several agencies. The group also requested that internal investigators at four federal agencies examine whether their ethics programs complied with federal rules.

The legal filings were prompted by a series of articles in the Wall Street Journal revealing that thousands of federal employees at 50 federal agencies held stock in companies that were regulated by the agencies where those employees worked.

The agencies "have repeatedly allowed senior officials to own and trade stock in companies that appear to create conflicts of interest with their official duties," the complaint said. "An investigation can determine whether the scope and severity of deficiencies in the ethics programs' guidance on financial conflicts of interest is greater than currently publicly known."

Separately, some lawmakers on Capitol Hill say that changes in the political landscape in Washington could make it more likely that Congress takes up legislation next year to overhaul the government's rules regarding stock ownership by federal officials.

Rep. Kevin McCarthy of California, the Republican lawmaker who is the front-runner to serve as House speaker, is considering a sweeping ethics-reform package aimed at restoring public trust in the government, an aide told the Journal.

3) Here's Doomberg with a spot-on post on why theater operator AMC Entertainment (AMC) – a once-popular meme stock – is a likely zero: Final Curtain. Excerpt:

Do any of these shenanigans alter the fate of AMC as it spirals toward a likely bankruptcy? Not according to the debt markets. AMC's 10% coupon 2nd lien bonds due in 2026 – which sit behind nearly $3.4 billion in 1st lien debt on the company's capital table but well ahead of both the AMC and APE equity claims – are trading hands at roughly 36 cents on the dollar. This implies a yield to maturity of ~50%, but in reality, bonds trading at these distressed levels are indicating what the market expects to recover in bankruptcy more than anything else. These quotes from A Very Special Dividend have aged well:

The real impact of the move will be to keep the money train flowing from retail investors to bondholders and management insiders for as long as possible. The company is paying approximately $380 million a year in interest payments to its debt investors, expenses that could be mostly wiped away in a bankruptcy filing and used instead to invest in the business itself...

...When the enthusiasm of retail investors inevitably dries up, and the company is truly of out tricks, it will still be a broken enterprise with too much debt. In the event it declares bankruptcy, bondholders will own the new company that emerges, and management will get fresh compensation plans to stick around. Existing shareholders (including the many future owners of the APE preferreds) will almost certainly be zeroed out.

I have been warning my readers about AMC since I included it in my "Short-Squeeze Bubble Basket" on January 27, 2021, the very day the meme stock craziness peaked, when it closed at $19.90. AMC and its spin-off, APE, closed together yesterday at $8.48, down 57%. (Believe it or not, that makes it the fifth-best performing stock among the two dozen I named, which are down an average of 62% during a period in which the S&P 500 is up 6%.)

4) Speaking of stocks in my Short-Squeeze Bubble Basket...

It's utterly unsurprising that Trevor Milton, the convicted fraudster behind the scam that is electric-truck maker Nikola (NKLA), about which I was warning my readers as far back as September 2020 when the stock was at $32.13 per share (it closed yesterday at $2.35 per share, down 93%), is also accused of repeated sexual assaults:

Here's the article Nate Anderson linked to: Utah AG did not investigate billionaire, future campaign donor for sex assault.

5) NYU marketing professor Scott Galloway shows why he's one of my favorite writers and commentators in this 22-minute YouTube interview...

In it, he talks about young men's struggles, the importance of masculinity (versus toxic masculinity), the awfulness of anti-trans laws, the consequences of the disconnect between productivity and wages that started in the 1970s, our political polarization, the disgrace of elite colleges taking pride in rejecting more than 90% of applicants, and more. (I suggest watching at 2 times speed – touch the screen, select the sprocket, and then select Playback Speed).

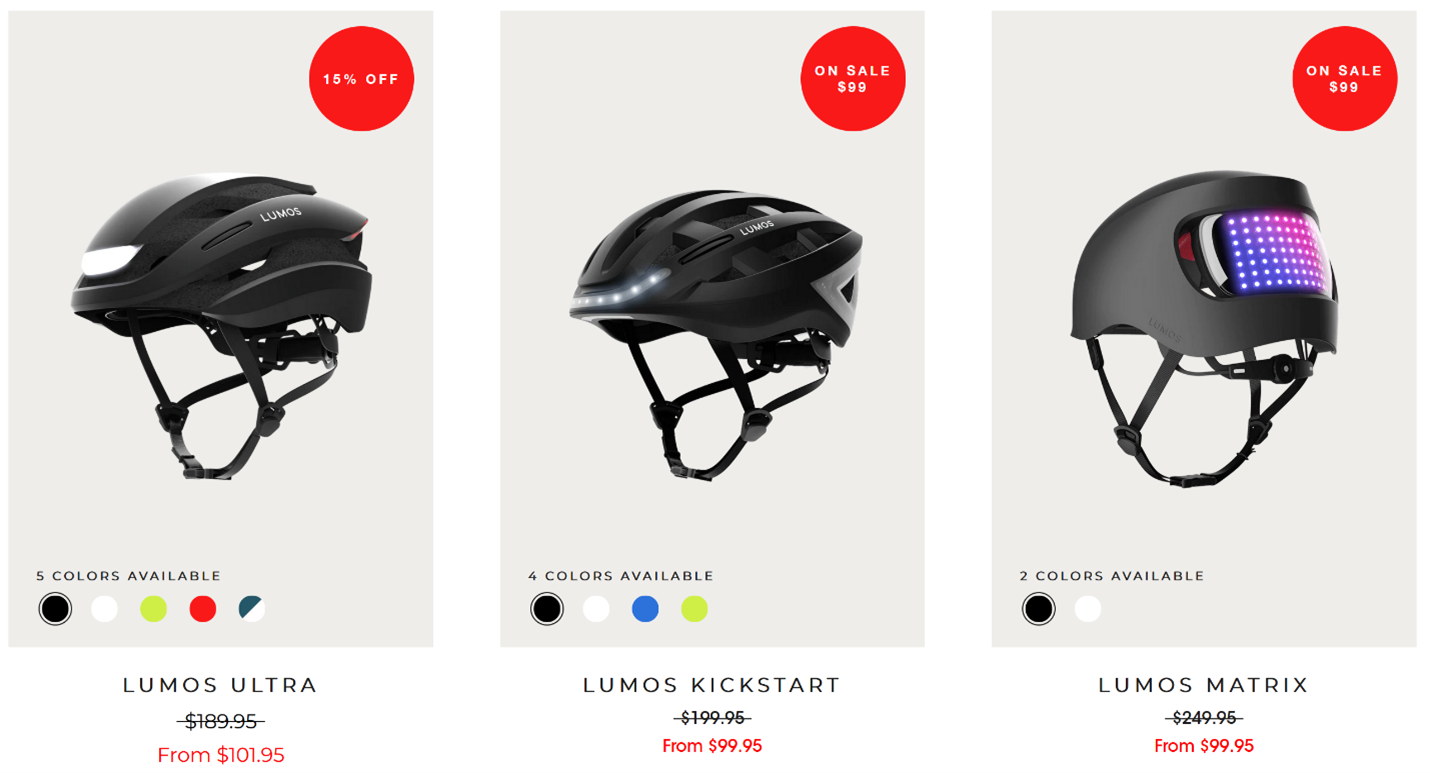

6) Bike riding on the streets of New York City (and most other U.S. cities) is dangerous – it's certainly the most likely thing to kill or seriously injure me – so one way I try to stay safe is to always wear a helmet... And not just any helmet, but one with bright lights embedded in the front and back. I have them blinking like mad, even when I'm riding during the day, and I'm certain the added visibility has saved me from multiple collisions over the years!

So if you're looking for a holiday gift for yourself or anyone who rides a bike or scooter, even occasionally, consider a blinking helmet – it could literally be a lifesaver. Even better, the one I own is on sale – I paid $180 for my Lumos Kickstart a few years ago, and now it's $99.95: https://lumoshelmet.co/collections/helmet.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.