Elon Musk Twitter Deal Completed; Lessons from the deal; Optimism on Twitter; Did I make a mistake not selling the tech giants?; I bonds

1) As I predicted more than a dozen times in my e-mails over the past four months, last night Elon Musk was finally forced to complete the deal he signed to acquire Twitter (TWTR): Elon Musk Twitter Deal Completed. Excerpt:

Elon Musk fired several Twitter executives after completing his takeover of the company, according to people familiar with the matter, capping an unusual corporate battle and setting up one of the world's most influential social media platforms for potentially broad change.

Mr. Musk fired Chief Executive Parag Agrawal and Chief Financial Officer Ned Segal after the deal closed, the people said. Mr. Musk also fired Vijaya Gadde, Twitter's top legal and policy executive, and Sean Edgett, general counsel. Spokespeople for Twitter didn't comment.

Hours after those actions, Mr. Musk tweeted "the bird is freed" in a seeming reference to Twitter, which has a blue bird as its logo.

2) There are many important lessons here, none more than this one: No matter how bad the market is, there are always moneymaking opportunities, so even if your portfolio is getting clobbered and you just want to hide under your desk, it's critical to put your emotions aside and find those great investments.

Twitter was one of them – one commentator on the ValueInvestorsClub message board said it was "the best merger arb situation we'll see in modern markets." I agree!

It started out as a normal monthly pick in our flagship Empire Stock Investor newsletter in August 2020 at $37.38. Over the next year and a half, the stock soared, then crashed, and then Musk came along and offered to buy it for $54.20 per share.

We correctly saw that he's one of the flakiest people on earth, so on May 4, we told our subscribers to sell at $50.59, locking in a 35% gain.

But that wasn't the end of the story, which underscores another important lesson: Once you get to know a stock or situation well, follow it closely and look for opportunities, some of which may only last for a brief time.

In this case, the next opportunity was when Musk tried to weasel his way out of the deal and the stock crashed back under $40. I analyzed the situation carefully – especially the merger agreement – and concluded that Musk had no choice but to buy Twitter (though I expected him to negotiate a slightly lower price).

Therefore, in mid-May, I told readers of my daily e-mail that Twitter looked like a good buy.

Four months later, everything played out exactly as I expected... And earlier this month, Musk threw in the towel and said he would buy the company at the agreed-upon price, which popped the stock that day to $51.50.

But then, to my surprise, a third bite at the apple emerged...

Only three days later, as Musk and the company squabbled over a few details, the stock had trickled down to $49.20 – a $5 spread – offering a 10% return in three weeks.

With the deal almost certain to go through, I wrote in my October 7 e-mail:

In Wednesday's and yesterday's e-mails, I said that Twitter investors are better off selling at $52 per share rather than holding out for another $2.20 given the financing and "Musk-is-totally-flaky risks."

Sure enough, Musk moved to delay the closing until October 28 and the judge agreed to postpone the trial, which has knocked TWTR shares down to around $49: Twitter, Elon Musk Trial Postponed as Deal Talks Stall.

I didn't think this was an interesting arbitrage situation with a mere $2.20 spread, but at more than $5, it's very attractive because there's a very high chance you earn more than a 10% return in three weeks.

I hope a lot of my readers took advantage of this fabulous opportunity!

3) As for my outlook for Twitter going forward, I'm optimistic...

The company has been so terribly managed that I have to imagine Musk and his team will find a lot of low-hanging fruit to improve both the service and the business performance.

I view Twitter today as almost unusable, filled with bots and trolls, a problem Musk has pledged to address. As a starting point, I hope he requires Twitter users to confirm their identification, as NYU marketing professor Scott Galloway has argued:

For decades, studies have demonstrated how crowds, anonymity, and obscurity unleash our worst instincts. There's a term for the online version, the "online disinhibition effect." Research shows anonymity is an accurate predictor of cyberbullying. It also causes a lack of empathy. In sum: When we don't have guardrails or face consequences, we're prone to being a**holes. And the incentives of ad-driven media promote the most aggressive and uncivil among us to prominence, coarsening the discourse further and crowding out a key component of civilization's progress: civility.

At least in the physical world, the number of a**holes is capped at one per human. But thanks to technology – and its leadership, which hides behind the illusion of complexity – no limits exist online. A single human can be a virtually infinite number of masked bad actors. Russia has been using armies of bots to sow seeds of unrest in America for years. A recent New York Times article revealed how Putin's regime used bots to pit Americans against one another in 2017. Pretending to be real Americans, Russian operatives posted aggressive and inflammatory tweets about the leadership of the nascent Women's March movement. One message gained traction, targeting a movement co-chair with racial and religious abuse. It shattered the organization. Now China is getting in on the action.

Verifying online identity is not a new idea – it was actually the original plan. For years, Facebook demanded its users go by their "authentic name." Google had a real-name policy for its (now abandoned) Google+ social network. What happened? Google's policy was described as "evil," "dangerous," an "abuse of power." Facebook's was criticized for being racist and transphobic. These criticisms reflect real issues. The list of situations in which attaching your real name to a public online profile can be unreasonable or dangerous is extensive. But these concerns can also be addressed. The real reason the platforms opened the door to bots and fake accounts? Short-term profits. Fanning the flames of incivility generates traffic (at least at first), which means more inventory to sell to advertisers.

Now that our online world has been rendered a post-apocalyptic dystopia, with the living and the undead wandering amongst one another, the platforms claim that cleaning up the mess is just too difficult. The illusion of complexity is a bullshit rap performed by incumbents who want to protect and enhance their wealth. If Amazon can figure out a way to ensure that reviews for Lord of the Rings are from genuine viewers, shouldn't we expect the same veracity our elections, vaccines, and asset values?

There is broad public support for identity verification online; 80% of U.S. adults support verification for creating accounts. To be clear, there should be safe spaces and platforms where people can remain anonymous. We all have the right to send confidential messages to others, and to not have our data surveilled or used against us or without our knowledge. But when you mix real and fake accounts and profit from the explosive results, you're not pursuing anonymity... but fraud.

I also have no doubt that Musk will replace the low-performing employees at Twitter – and there are a lot of them. I talked to a former employee there who told me: "If you went into headquarters after 5 p.m., you could roll a bowling ball through it and not hit anyone except the cleaning people."

In contrast, Musk works 18 hours a day and all of his top people try to keep up. He, like Steve Jobs, Jeff Bezos, and Reeds Hastings, surrounds himself with A-players and ruthlessly weeds out B- and C-players. It's impossible to overstate the difference in a company filled with A-players versus one that tolerates mediocrity.

One final thought on the implications of Musk owning Twitter: He has said he will put former President Donald Trump back on the platform. Given that Trump had 89 million followers on Twitter before he was suspended versus a mere 4.4 million on Truth Social today, I'm sure he will jump back to Twitter – leaving his platform without its biggest draw.

This would, of course, be terrible news for the company planning to merge with Truth Social, Digital World Acquisition (DWAC), yet at around $16 this morning, its stock still trades more than 50% above its cash-in-escrow value around $10, which is why it remains my No. 1 stock to avoid...

4) Shifting gears from doing a victory lap to eating humble pie, my favorite three tech stocks, Alphabet (GOOGL), Amazon (AMZN), and Meta Platforms (META), all reported disappointing earnings this week and their stocks have gotten clobbered, extending their losses.

As of this morning, they're down 38%, 47%, and 74%, respectively, from their all-time highs roughly a year ago.

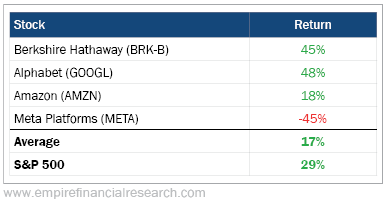

When we launched Empire Financial Research three and a half years ago on April 17, 2019, we recommended in our first newsletter, Empire Investment Report, that our subscribers establish a foundation for their portfolios with a 10% position in Berkshire Hathaway (BRK-B) and 5% positions in the three tech giants noted above. Here's how they've done since then:

Of course, I'm disappointed that they've collectively trailed the market, especially after being well ahead of it until very recently.

On the other hand, we're measuring the performance at a time when the tech giants have sold off massively and, I believe, are screamingly cheap and will outperform massively going forward (plus, Berkshire is trading at an 18% discount to its intrinsic value right now). I will discuss each of these stocks in greater detail next week...

So was it a mistake not selling the tech giants a year ago?

Despite their big drawdowns, I would argue not.

When I first recommended them, I said they were long-term holdings that investors should tuck away for five to 10 years, ignore the short-term noise, and hope for one or more big crashes, which would be opportunities to buy more.

Today is one of these moments... Mark my words: GOOGL, AMZN, and META shares all around $100 are absolute gifts!

5) In Tuesday's e-mail, I called U.S. Treasury Series I Saving Bonds ("I bonds") "the world's best, safest inflation hedge" and explained exactly why. So many people apparently agree with me that it's crashing the U.S. Treasury's website! Treasury Says Orders for I Bonds With 9.62% Rate Might Not Be Completed by Deadline. Excerpt:

So many investors are scrambling to buy I Bonds, which pay a 9.62% interest rate if purchased by Oct. 28, that the Treasury Department said its overwhelmed site might not complete all the orders in time.

The government's TreasuryDirect site, the only place investors can directly purchase securities such as I Bonds and Treasury bills, this week became one of the most visited federal sites on the web, officials said, and has experienced intermittent outages. The interest rate on I Bonds is expected to drop to about 6.47% beginning Nov. 1.

Safe, staid inflation-adjusted Series I savings bonds don't capture much of the investing spotlight in most years. They became breakout stars of 2022 as inflation reached a four-decade high, markets plunged, and investors searched for a safe place to park their money.

During just the final week of October, the Treasury issued $1.95 billion in I Bonds, more than the total for fiscal year 2021. In just one year, some 3.7 million new accounts were created on the site, more than the 2.4 million for the prior 10 years combined.

"The popularity of I Bonds shows how people want to throw whatever they can at a problem like inflation," said Kelly Klingaman, a financial planner in Austin.

6) Susan and I are driving to Lake Sunapee, New Hampshire this evening to spend the weekend with my parents and see our oldest daughter, who's a first-year MBA student at Dartmouth's Tuck Business School. If you're going to the Harvard-Dartmouth football game, look for us!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.