Empire's 'open house'; Are stocks cheap?; DWAC and Trump returning to Twitter; Berkshire Buys $9 Billion in Stocks; Scott Galloway predicts Bezos will return as Amazon's CEO – and gives advice to people entering their 30s

1) For the first time in Empire Financial Research history, we're hosting a special "open house" for our research...

It's like an open house in the real estate market – if you find a home you're interested in, an open house gives you the chance to go inside, take a look, and see if you like it.

If you do, great... You can put an offer down. If not, you can walk away – no questions asked.

And with Empire's open house, we're doing the same thing. For 30 days, you can look through all of our research services. You'll have instant access to our entire archive of research – including everything we've published since we started publishing in 2019.

Get the details on how to register right here.

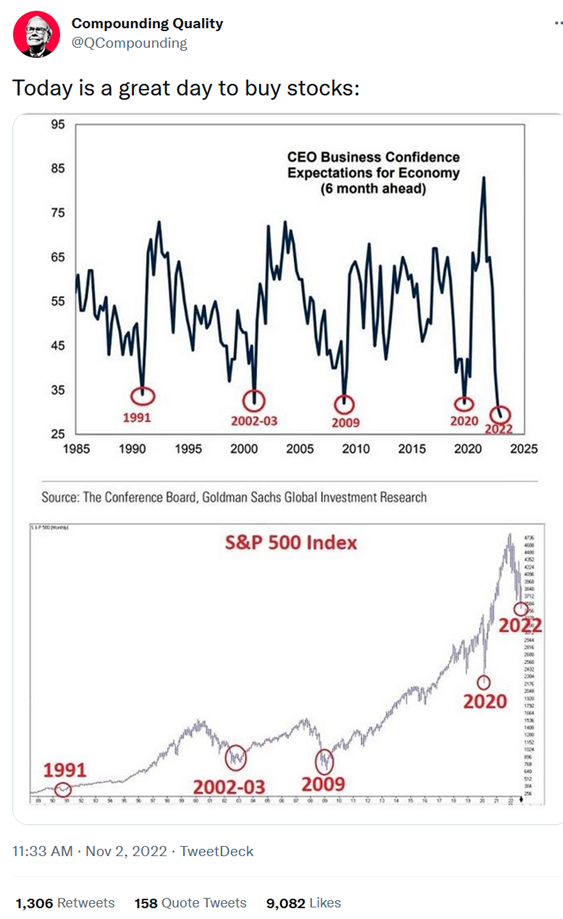

2) Are stocks cheap today? These charts would seem to indicate so, as the past four times business confidence expectations have been this low, it has been a good sign of a market bottom:

I'm not sure the historical analogy is relevant, however, because if I recall correctly, the Fed was easing in the prior four periods, whereas it's still tightening today...

3) Here's another indicator regarding the tech sector, which shows that today it's trading at roughly four price-to-earnings (P/E) multiples higher than the S&P 500 (I'm guessing 19 times versus 15 times), which sounds about right to me – certainly not expensive, but not hugely cheap either...

4) In the past month, my least-favorite stock, Digital World Acquisition (DWAC), nearly doubled from $16 to $29 on news that its merger partner, Truth Social, was getting some traction – see this New York Times article: Truth Social's Influence Grows Despite Its Business Problems.

It has since pulled back to today's level around $21 as investors realize the SEC isn't likely to approve the merger and Truth Social's main draw, former President Donald Trump, is likely to return to Twitter. This meme captures his decision:

I don't think this is a hard decision for him, as he only has 4.6 million followers on Truth Social, 95% fewer than the 89 million he had on Twitter...

I continue to believe that DWAC will fall to its cash value of $10 – roughly half today's price – when it ultimately calls off its merger.

5) Turning to my favorite stock, it's good to see Warren Buffett, Todd Combs, and Ted Weschler putting Berkshire Hathaway's (BRK-B) huge cash hoard to work: Berkshire Buys $9 Billion in Stocks. Excerpt:

The stock market has had a rough year.

That has made it irresistible to Warren Buffett's Berkshire Hathaway.

Berkshire spent roughly $9 billion on the stock market in the third quarter, with roughly a third of that money going toward energy companies Occidental Petroleum (OXY) and Chevron (CVX) according to filings.

Berkshire also opened new positions in Taiwan Semiconductor Manufacturing (TSM), American building-materials manufacturer Louisiana-Pacific (LPX), and Jefferies Financial (JEF), and added to its existing stakes in Paramount (PARA), Celanese (CE), and RH (RH), formerly known as Restoration Hardware.

The stocks that Berkshire revealed new positions in got a boost in after-hours trading Monday.

Overall, Berkshire spent $66 billion buying stocks in the first nine months of the year. That is more than 13 times its spending over the same period in 2021.

"This is classic Buffett," said David Kass, a finance professor at the University of Maryland's Robert H. Smith School of Business. "He is being greedy when others are fearful and fearful when others are greedy."

6) The news that Disney (DIS) has brought back Bob Iger as CEO reminds me of this prediction NYU marketing professor Scott Galloway made on his Pivot podcast last week: He thinks Jeff Bezos will return as CEO of Amazon (AMZN). I'm not sure how likely this is, but I love the bold prediction!

7) Speaking of Galloway, I think this eight-minute interview with him should be required watching for every young person (I sent it to my three daughters):

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.