Every investor makes mistakes and goes through tough times; How to tell who's likely to recover

Every investor makes mistakes... usually frequently. That's OK. As long as what you make on your winners is more than what you lose on your mistakes, you'll likely do fine over time.

But on occasion, all investors – I can't think of a single exception – go through periods in which some combination of mistakes and an unfavorable market causes them to get beaten like piñatas.

For Exhibit A, look no further than growth stock investors over the past year – in particular, the past four months.

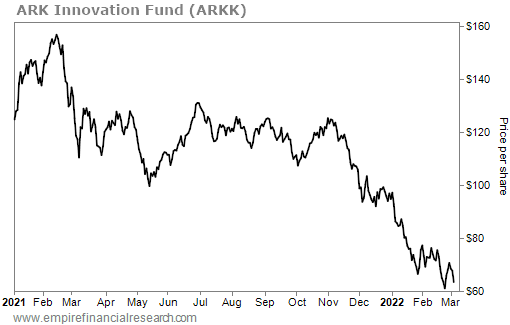

To see what I mean, check out the ARK Innovation Fund (ARKK), which manager Cathie Wood, the "Queen of the Bull Market," stuffed with the most speculative growth stocks. Here's its stock chart since the beginning of last year:

From its peak on February 12, 2021 through November 12, nine months later, it had "only" declined by 24.3%, but since then, it has collapsed by 46.2% – a total decline of a staggering 59.3%.

While ARKK is an extreme case, I want to repeat: every investor goes through periods of dreadful performance.

However, not every investor recovers.

What differentiates those that do from those that don't?

Many factors: the severity of the underperformance, the investor's resilience (and bank account!), how many investors stick with them or pull their money, etc.

But the single biggest factor I've observed is whether an investor is able to accurately and honestly identify, acknowledge, and analyze their mistakes – at least to themselves and ideally to their investors as well.

Until an investor does this, they won't be able to fix current mistakes, nor avoid future ones.

So, when I see an investor – or, come to think of it, anyone – in trouble, the most important thing I look for when gauging whether I think they can recover is an honest and accurate assessment of what went wrong and, in particular, what mistakes they made.

A great example is how Netflix's (NFLX) brilliant founder and CEO, Reed Hastings, recovered from the Qwikster debacle in 2011 (you can read more about it here: Netflix Looks Back on Its Near-Death Spiral) – and how I made a fortune from it.

Hastings had made a misguided attempt to spin off the company's cash-cow DVD-by-mail business into a new company called Qwikster, which infuriated customers.

I e-mailed Hastings to tell him he'd made a mistake and, to my surprise, he replied, acknowledging that he'd "shot himself in the foot."

That kind of humility is rare among CEOs and gave me the conviction that he would rectify his mistake (which he soon did), so I started scooping up NFLX shares around $11 (they closed yesterday at $368.07).

The two other case studies I want to share are of two women, one of whom is among the savviest investors I've ever encountered (which is why I pulled out all the stops to persuade her to join us at Empire Financial Research) and the other I wouldn't trust with even one dollar of my money...

The former is, of course, my colleague Berna Barshay, who has been giving phenomenal, highly profitable, and free advice to her 200,000 readers for nearly two years in her Empire Financial Daily (to which our newest colleague, Herb Greenberg, also now contributes... so if you're not already receiving Empire Financial Daily, you can sign up for free right here).

But what impresses me even more than all of her winners is how she handles the occasional loser...

In the October 18, 2021 Empire Financial Daily, Berna wrote that Foot Locker (FL) looked like a good buy, but the stock is down 35% since then. To address this, here's what she wrote in yesterday's Empire Financial Daily: A Mea Culpa, Lessons Learned, and What to Do Now About Foot Locker. Excerpt:

Before I get into what I think about the stock now, let me share the research error that led me to get so blindsided...

I had several conversations with former Nike (NKE) employees who told me they thought the Foot Locker relationship was stable. These were people who left Nike as recently as late 2020 or early 2021. Clearly, their perspective was out-of-date because we now know the relationship with Foot Locker was about to change. Rarely does corporate strategy shift so dramatically and so quickly... I thought a few quarters out-of-date was current enough to rely on.

But what I missed was that Nike has a relatively new CEO who came from outside the company and was applying a fresh perspective to everything. He was probably still getting his bearings when the people I spoke with were on their way out, and his decisions were made after they left. Simply put, I relied on bad, out-of-date intel. It was a research error... which happens sometimes. It sucks when it does, but it's part of the game.

The important question is what to do now...

I went on my colleague Enrique Abeyta's Hard Money's Million Dollar Podcast to discuss Foot Locker, and we collectively concluded that the stock is a buy down here.

I think that what she wrote was perfect: she acknowledged her mistake, apologized to any readers who lost money, gave an honest, insightful analysis of what went wrong, and made a compelling case for why the sell-off is overdone and FL shares are a buy here.

In marked contrast is Cathie Wood, who has not acknowledged her numerous mistakes, not apologized to her investors she's incinerated, not given an honest, insightful analysis of what went wrong, and not made a compelling case for why the sell-off in the stocks she owns is overdone and why they are buys here.

To see what I mean, read this recent in-depth profile of and interview with her in the Financial Times: ARK Invest CEO Cathie Wood on everything from deflation to Elon Musk. Excerpt:

The bust made cautionary tales of fund managers such as Garrett Van Wagoner and Alberto Vilar, once hailed for their golden touch. "Cathie's a boom or bust investor because she doesn't disinvest or risk manage," says Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management and Wood's former boss at asset manager AllianceBernstein. "This is the challenge that she has had for her entire career."

None of which seems to have dampened Wood's conviction. "We're at our best when the odds are against us," she says. "For compliance reasons, I've been asked not to give numbers, but the compound annual rate of return expectation that we have during the next five years is the largest I have ever seen in my career"...

"We are as calm and focused as you could possibly imagine," she says. Despite the market turmoil and the mounting losses in her portfolios she sleeps "very easily" at night, "knowing that we have never been in a period of more innovation in history".

There's one exception: the prospect of investors pulling their money from Ark's fund at the worst possible moment. If clients do so now, Wood says they will turn "what we believe are temporary losses into permanent losses. What's going to happen is the same thing that happened in 2008-2009. Those who got out had such seller's remorse" because they missed the subsequent market rebound.

I hate to be such a persistent critic of Wood, as I really want to see more women succeed in this male-dominated business... But in good conscience I have to warn my investors away from her – and tell them to listen to people like Berna instead!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.