Former security chief claims Twitter buried 'egregious deficiencies'; New whistleblower allegations could factor into Twitter vs. Musk trial; Welfare Queens; The Boy Bosses of Silicon Valley Are on Their Way Out; Pranks Destroy Scam Callers

1) Today's Washington Post has a damning article about Twitter (TWTR), based on an explosive whistleblower complaint: Former security chief claims Twitter buried 'egregious deficiencies'. Excerpt:

Twitter executives deceived federal regulators and the company's own board of directors about "extreme, egregious deficiencies" in its defenses against hackers, as well as its meager efforts to fight spam, according to an explosive whistleblower complaint from its former security chief.

The complaint from former head of security Peiter Zatko, a widely admired hacker known as "Mudge," depicts Twitter as a chaotic and rudderless company beset by infighting, unable to properly protect its 238 million daily users including government agencies, heads of state and other influential public figures.

Among the most serious accusations in the complaint, a copy of which was obtained by The Washington Post, is that Twitter violated the terms of an 11-year-old settlement with the Federal Trade Commission by falsely claiming that it had a solid security plan. Zatko's complaint alleges he had warned colleagues that half the company's servers were running out-of-date and vulnerable software and that executives withheld dire facts about the number of breaches and lack of protection for user data, instead presenting directors with rosy charts measuring unimportant changes.

The complaint – filed last month with the Securities and Exchange Commission and the Department of Justice, as well as the FTC – says thousands of employees still had wide-ranging and poorly tracked internal access to core company software, a situation that for years had led to embarrassing hacks, including the commandeering of accounts held by such high-profile users as Elon Musk and former presidents Barack Obama and Donald Trump.

Twitter says Zatko's claims are "riddled with inconsistencies and inaccuracies" and are "sensationalistic and without merit," but the Post reporters were able to find current and former employees to back up some of Zatko's charges:

One current and one former employee recalled that incident, when failures at two Twitter data centers drove concerns that the service could have collapsed for an extended period. "I wondered if the company would exist in a few days," one of them said.

The current and former employees also agreed with the complaint's assertion that past reports to various privacy regulators were "misleading at best."

2) So what does this news mean for Twitter's stock?

The answer depends on how it affects the company's lawsuit against Tesla (TSLA) CEO Elon Musk in the Delaware Chancery Court, seeking to force him to go through with the contract he signed to buy Twitter.

The New York Times Dealbook notes:

The allegations detailed in The Post and CNN do not exactly align with Musk's current legal argument, which focuses largely on deal terms and Twitter's public disclosures. But they could offer Musk new legal arguments, and raise potential national security issues. Twitter struck a 2011 settlement with the F.T.C. over safeguarding user information. If it were found to have violated that agreement, could Musk have finally obtained that "material adverse change" argument he has been pursuing?

And the Post writes: New whistleblower allegations could factor into Twitter vs. Musk trial. Excerpt:

Elon Musk alleges Twitter is vastly undercounting the number of spam and bot accounts on its platform. A new whistleblower complaint from a recently fired top Twitter executive could add ammunition to that argument, though it provides little hard evidence to back up a key assertion...

Importantly, however, Zatko provides limited hard documentary evidence in his complaint regarding spam and bots, so the potential impact of those allegations is difficult to initially gauge...

But any new allegations that Twitter misled shareholders and regulators could bolster Musk's case in Delaware Chancery Court in October, according to half a dozen legal experts who spoke with The Post before the complaint became public, who were not briefed on the complaint. The arguments would depend on the severity of the revelations, as well as data supporting any new claims – and the extent to which Musk relied on such claims in consummating the deal.

My take: Zatko's complaint is clearly a gift to Elon Musk, as it both increases the odds that the Delaware Court lets him weasel his way out of the deal and also that the company either accepts a financial settlement or a lower price.

That said, I still think Chancellor Kathaleen McCormick is going to rule in favor of Twitter and order Musk to buy the company at the agreed-upon price of $54.20 – but the odds of this have dropped slightly from, say, 80% to 70%. Thus, the modest decline in the stock today seems about right to me.

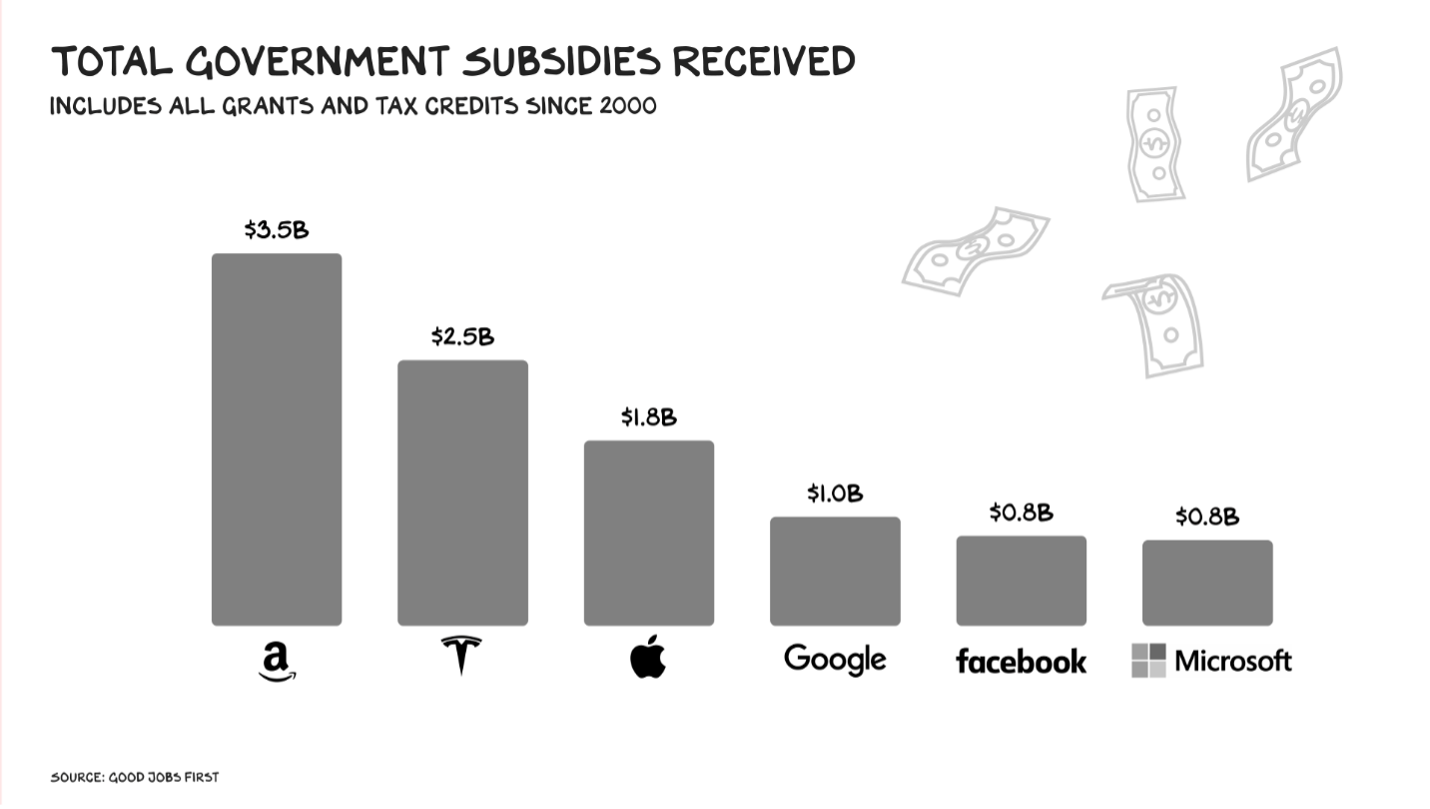

3) Speaking of Musk, this is a spot-on essay by NYU marketing professor Scott Galloway, who praises the U.S. government as the greatest venture capitalist ever and blasts the tech bros like Musk who criticize it and try to evade taxes while being among the biggest beneficiaries of government largesse – hence his title, Welfare Queens. Excerpt:

The biggest critics of the government are, oddly, some of its biggest beneficiaries. Tech billionaires are often the first to shitpost America, even as they continue to harvest wealth from the investments taxpayers make via the U.S. government.

In fact, the biggest bitch(er) may be the biggest (financial) beneficiary. Elon Musk says we should "get rid of all" government subsidies, that "the government is the biggest corporation with a monopoly on violence," and last week mocked Washington for hiring more employees at the IRS.

Let's be clear: Elon didn't build an EV company in South Africa or start a rocket company in Canada. He built Tesla and SpaceX in the United States. And both continue to be heavily dependent on U.S. government support.

There would be no SpaceX without NASA, its largest customer. Tesla built its Fremont factory with a $465 million DoE loan in 2010, and its first 200,000 cars benefited from tax credit subsidies of up to $7,500. For years the company was able to report profits thanks to the "sale" of emissions credits to other carmakers. All told, the company has accepted an estimated $2.5 billion in government support.

Marc Andreessen says he's "pro-gridlock," because "when the government does things, it usually doesn't end well." Except for providing the state-sponsored platform for his career – the University of Illinois and NCSA. Now @pmarca is making news because he's concerned about our nation's "housing crisis." "We aren't building enough houses," he wrote recently, and that's "a driving force behind inequality and anxiety." Except when the housing is near... his house.

Another outspoken billionaire, Peter Thiel, says the U.S. government is "socialist" and believes we have "much worse outcomes than the Soviet Union in the 1950s." (His solution is to take up seasteading – i.e., building floating autonomous ocean communities that aren't subject to regulations or taxes.)

But Thiel's current venture, Palantir, is a government contractor that provides data analytics to the CIA, DoD, and other government agencies – and these contracts make up almost 60% of its revenue. Note: Palantir has lost money every year of its existence. That feels like a Soviet outcome.

4) Speaking of tech bros, many of them have been shown the door as this New York Times article notes: The Boy Bosses of Silicon Valley Are on Their Way Out.

While I mostly applaud them for building important and innovative companies, many of them are too young and inexperienced to run big companies, especially during times of turmoil... Excerpt:

The young kings of Silicon Valley are dismounting their unicorns.

They're writing sentimental blog posts that outline their legacies. They're expressing hope for their companies' prospects. They're quitting their jobs leading the start-ups they founded.

In recent weeks, Ben Silbermann, a co-founder of the digital pinboard service Pinterest, resigned as chief executive; Joe Gebbia, a co-founder of the home rental company Airbnb, announced his departure from the company's leadership; and Apoorva Mehta, the founder of the grocery delivery app Instacart, said he would end his run as executive chairman when the company went public, as soon as this year.

The resignations signify the end of an era at these companies, which are among the most valuable and well-known to emerge from Silicon Valley in the past decade, and of the era they represent. In recent years, investors have dumped increasingly large sums of money into a group of highly valued start-ups known as unicorns, worth $1 billion or more, and their founders have been treated as visionary heroes.

Those founders fought for special ownership rights that kept them in control of their companies – a change from the past, when entrepreneurs were often replaced by more experienced executives or pressured to sell.

But when the stock market fell dramatically this year, hitting money-losing tech companies especially hard, this approach began to change. Venture capitalists pulled back on their deal-making and urged Silicon Valley's prized young companies to cut costs and proceed cautiously. The industry began to talk of "wartime C.E.O.s" who can do more with less, while bragging about lessons learned from previous downturns.

Patience for visionaries wore thin. Founder-led companies started to seem like liabilities, not assets.

"All of that changed in the last 90 days, and it's not coming back anytime soon," said Wil Schroter, the founder of Startups.com, an accelerator program for young companies. The "we'll figure it out later" story is no longer attractive to investors, he added.

In addition to Mr. Silbermann, Mr. Gebbia and Mr. Mehta, founders at the top of Twitter, Peloton, Medium and MicroStrategy have all resigned this year.

5) I actually learned a lot from this extremely clever and funny prank played on call centers in India that conduct industrial-scale phone fraud on mostly elderly victims in the U.S. and elsewhere: Pranks Destroy Scam Callers – GlitterBomb Payback.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.