FTX Was Not Very Careful; Slippery slopes; What We Know – and Don't Know – About Tether's Books; Did Andreessen Horowitz sell its soul?; Fidelity/infidelity

1) I think Bloomberg's Matt Levine is likely right in his speculation about what happened at bankrupt crypto firm FTX: FTX Was Not Very Careful. Excerpt:

I don't want to minimize the likelihood of intentional fraud and theft. Stuff seems bad.

But I want to say that the story of FTX also reads like what would happen if you and a few of your college friends set up a gigantic international financial exchange after like a year or two of working in finance. Oh, your friends are smart. They have decent intuitions about financial stuff; they have good ideas for what products to trade and how to trade them; they can code up a good-looking website.

But do they have hard-won expertise, built up over many years, in accounting controls and business processes for running a giant organization? Are they excited about making sure all the paperwork is correct?

No, that stuff is boring. Your friends are traders and engineers, not accountants and compliance officers. Also there just aren't that many of them, and they are running a huge exchange; they are too busy for paperwork. They move fast and break things. They break so many things.

To be clear: I continue to believe that FTX's founder, Sam Bankman-Fried ("SBF"), will ultimately be sentenced to 20 years in prison, but not because he was evil in the sense that he set out to create a scheme to steal billions of dollars ($10 billion to $16 billion, according to various estimates) from more than 1 million (!) unsuspecting customers.

In fact, SBF might have had the best of intentions – I think he was likely telling the truth when he said he wanted to make a lot of money so he could give 99% of it away.

Rather, I think this is a story of the dangers of getting on a slippery slope... which actually makes it even more of a cautionary tale for the rest of us.

I don't think SBF is a monster, which would make him an extreme outlier. Instead, I see guys (they're all men) like him all the time: a naïve, cocky, overeducated kid who was caught up in an enormous bubble, got in way over his head (see this summary of the bankruptcy filing), started cutting corners, and it spiraled out of control.

He actually shows some insight when he wrote the following in his now-infamous direct message exchange with a Vox reporter:

I didn't want to do sketchy stuff, there are huge negative effects from it... and I didn't mean to... each individual decision seemed fine and I didn't realize how big their sum was until the end... It was never the intention... Sometimes life creeps up on you...

... each step was in isolation rational and reasonable, and then when I finally added it all up last week it wasn't...

The lesson here is that you must never do even a little bit of "sketchy stuff," by rationalizing that you'll never do it again or that it's necessary to get through a rough patch and you'll make up for it later... Because once you're on a slippery slope, it's very hard to get off – and generally ends in disaster.

2) Amid the ongoing meltdown in the crypto sector, everyone is wondering "who's next?"

In particular, people are asking even more pointed questions about the largest "stablecoin," Tether, about which I've been repeatedly warning my readers since January 2021 (archive here).

I've been wrong so far, but I think there's at least a 50/50 chance that Tether "breaks the buck," which would further roil the sector... (That said, even if it does, I don't think it will collapse like Terra, Luna, FTT, and so many others have, as I believe Tether has plenty of liquid assets in reserve – just not enough to fully support all of the outstanding stablecoins it's issued.)

In order to assuage investors, last Thursday Tether released an "Independent Auditors' Report on the Consolidated Reserves Report," prepared by the Italian subsidiary of accounting firm BDO. You can read the 10-page report here.

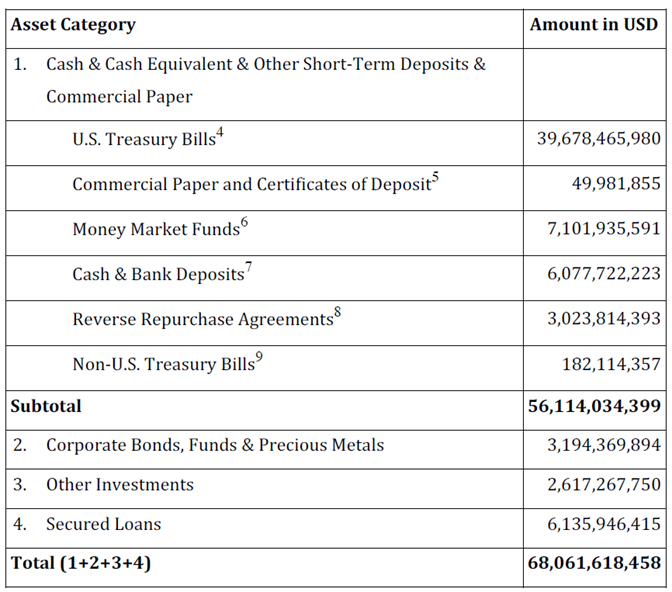

At first glance, all appears well as Tether claims to have $68.1 billion in assets, offsetting liabilities of $67.8 billion, as this table from the report shows:

A few things to note...

Assets minus liabilities – the definition of equity – is a mere $250 million, which isn't much of a cushion...

And while Tether would like you to believe that this is an audit, it's not (Tether has long promised to provide one, but never has). Instead, the first line says that this is "a reasonable assurance engagement" (whatever that means).

In the next paragraph, BDO further covers itself:

Management is responsible for the preparation of the Consolidated Reserves Report... and for such internal control as management determines is necessary to enable the preparation of CRR that is free from material misstatement, whether due to fraud or error.

Translation: If management is hiding something, we won't know it – and don't blame us.

Later, BDO says that "The reporting date is... September 30, 2022." Great, but what investors care about is what Tether's assets are right now.

Lastly, and most important, there's this:

The valuation of the assets of the Group have been based on normal trading conditions and does not reflect unexpected and extraordinary market conditions, or the case of key custodians or counterparties experiencing substantial illiquidity, which may result in delayed realizable values.

Well, that's a pretty big caveat in light of what has happened to the crypto market since September 30!

Here's a Wall Street Journal article with more on BDO's report: What We Know – and Don't Know – About Tether's Books.

In conclusion, I don't believe the numbers Tether is having BDO attest to. If they were accurate, why wouldn't Tether have BDO perform a full audit? If I had to guess, Tether only has liquid reserves equal to half of the value of its outstanding stablecoins.

And even if the reported numbers are correct, I think the latest turmoil in the markets has impaired the assets by at least 10%.

Either way, Tether is insolvent – the only question is, by how much?

But as long as the redemptions aren't too much and regulators don't require a full audit, Tether may be able to continue to skate by...

3) Another possible casualty of the meltdown in the crypto sector is leading venture capital firm Andreessen Horowitz, which had $28 billion in assets earlier this year.

According to this Twitter thread by crypto entrepreneur Cory Klippsten, the CEO of Swan Bitcoin, the "formerly venerated firm sold its soul for quick profits and massive management fees" and pushed "fraudulent crypto efforts":

4) Speaking of the dangers of getting onto slippery slopes, here's an excerpt about how it can end a marriage from my book, The Art of Playing Defense:

Fidelity/Infidelity

Fidelity is like virginity: it's relatively easy to maintain, but once lost, it's impossible to restore.

The surest way to end your marriage is to cheat on your spouse. Even if you don't get caught, it'll mess with your head and make divorce far more likely.

Sometimes, infidelity occurs in an unplanned way: you get drunk in the wrong place at the wrong time, like a bachelor party in Las Vegas. (Note: what happens in Vegas does not usually stay in Vegas!)

More often, it's not a momentary lapse of judgment but a consensual affair. It usually begins with flirting that appears harmless but then gradually escalates.

There's a simple way to avoid this: don't flirt, ever!

Absolutely no good can come of it. Think about it: either the person you're flirting with welcomes it, in which case you're on the slippery slope to an affair, a ruined marriage, and divorce, or the person doesn't welcome it and thinks you're creepy and gross. Why would you engage in this lose-lose proposition?

The answer, of course, is that it can be fun to flirt, and it's flattering when someone shows a romantic interest in you. It never ceases to amaze me how many married people flirt. They're like horny teenagers who can't control themselves. Maybe they tell themselves it's harmless and rationalize, "All I did was tell her she looks hot in that dress. I'm not planning on sleeping with her!" Most of the time, they're right – it probably is harmless. But it's still dumb, so don't do it!

My mom often says, "If you never go to first base with flirting, there's no chance that you'll arrive at the home plate of infidelity."

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.