How to find collapsing earnings; Stan Druckenmiller's prescient warning and comments on mentors; The Cost of Space Flight Before and After SpaceX; How Y'all, Youse and You Guys Talk

1) In yesterday's e-mail, where I shared slides from my presentation on "Lessons From 15 Years of Short Selling," I showed that stocks usually follow earnings. So the key, obviously, is to find companies whose earnings are about to collapse. Here are two slides with my thoughts on this:

2) Investing legend Stanley Druckenmiller nailed it in early 2021 in this two-minute video. Here's my transcription of his wise words:

But let's start with the Fed and inequality.

I don't think there has been any greater engine of inequality than the Federal Reserve Bank the last 11 years. So hearing the chairman talk about visiting homeless shelters is very, very rich indeed.

I just had the best year I've had in 15 years last year. Everyone wealthy I know is making a fortune. And why are we making it? Because this guy is printing money like there's no tomorrow.

And the kids in Harlem, in my opinion, are not benefiting from money printing, but Stan Druckenmiller and other wealthy people are.

So for the life of me, I can't figure out why the Left is so excited about money printing when all the data says the people who benefit from money printing are rich people who know how to navigate the markets.

The odds-on bet is we're gonna have inflation, and inflation is going to hurt poor people a lot more than rich people.

How does this thing end?

To me, the asset bubble, which he's blowing up into unbelievable proportions, busts before the inflation ever really manifests itself. That's what happened with the housing thing in '08 to '09. We never really got to the inflation because the asset bubble burst – not dissimilar to what happened in '29.

That's not my central case, but let me just say we've never had a deflationary bust because inflation was too close to zero or 1.5 instead of 2 .

We've had them because we've had these tremendous asset bubbles. It happened here in '29, it happened to Japan in '90, and obviously it happened in the Great Financial Crisis.

And there is no one, no group, that will get hurt more by a bust than the poor. They will be first in line to get screwed. Trust me.

3) Speaking of Druckenmiller, my old friend Alix Pasquet, who runs the hedge fund Prime Macaya, discusses him in this insightful interview: The Learning Mindset for Investors with Alix Pasquet. Excerpt:

The first condition you want to create is having mentors. Stanley Druckenmiller says, if you're early in your career, and they give you a choice between a great mentor or higher pay, tick the mentor every time, it's not even close. And don't even think about leaving that mentor until your learning curve peaks. Nothing to me is so invaluable as having great mentors. And a lot of kids are just too short sighted in terms of going for the short-term money instead of preparing themselves for the longer term.

Two problems here. One, how do you find a mentor? I would start with people in your field that you have direct access to or somebody else can introduce you to and you want to approach them. And you approach them using a technique that I learned from a professor at Columbia University. He says you approach them with three prongs. First prong is "this is what I admire about you." The second prong is "this is what I can do for you." And the third prong is "this is what you can do for me." Always make what you can do for them greater than what they can do for you. And if they don't respond, persist. One thing to remember about highly successful people is they got to where they are through persistence. And what they really respect is people that show persistence.

The second problem you're going to encounter is how to be a good mentee. Part of the value they're going to add to you is not only teaching you things, but also introducing you to other people. And they're only going to do that if you're a good mentee. So follow their advice, show that you've put it into motion. If it worked, you tell them. Be grateful. If it hasn't worked, also tell them. They're going to want to give you even more advice. And when they see that you respond, and that you're somebody that is not wasting their time, then they'll introduce you to other people.

The third problem, I call it the upgrading your mentor problem. Once you've gotten to a certain level, you start realizing that you need another mentor to get you to the next level. And what a lot of people do in a way is totally ignore the guy that helped you to get to the previous level and the upgrade to the next guy. That's a big problem. Well, if you keep doing that, and succeeding, you won't have a problem. But the problem happens when you fail at one level. And the guide that you left at the previous level is not there to pick you up as you fall. So take your mentors along with you on your path to success.

4) I have been very critical of Elon Musk's seemingly endless shenanigans but have also acknowledged that humanity owes him a debt of gratitude for creating, against all odds, both Tesla (TSLA) and SpaceX.

This chart from Visual Capitalist shows how SpaceX has lowered the cost of sending something into space by orders of magnitude (note that the y-axis is logarithmic):

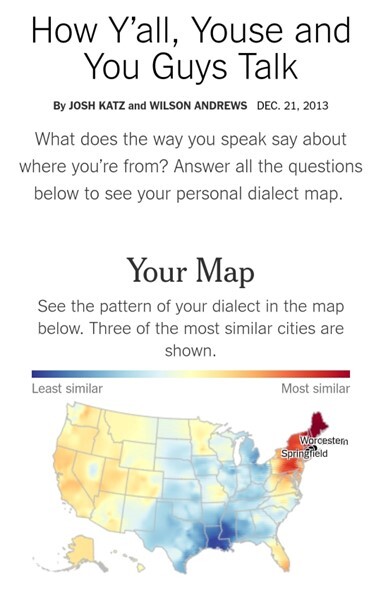

5) This was a hoot – it nailed exactly where I grew up (western Massachusetts from 6th to 12th grade from 1978 to 1985, then Boston from 1985 to 1994): How Y'all, Youse and You Guys Talk.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.