How to protect yourself against inflation; The world's best, safest inflation hedge; What about TIPS?; How to buy I bonds; Elon Musk speaks to Twitter employees; Warriors win championship; Enrique Abeyta's latest presentation

1) With inflation at 40-year highs, I – like pretty much every other investor – am looking for the best, safest ways to preserve and grow my wealth... especially if I'm wrong about inflation and it continues to rage.

The best way I know is to buy the stocks of high-quality companies that have pricing power at a discount to their intrinsic value.

For example, in Wednesday's e-mail, I discussed Berkshire Hathaway (BRK-B), which I've long called "America's No. 1 Retirement Stock" for its combination of safety, growth, and cheapness. As of yesterday's close at $403,971 per A-share, it's trading at a 21% discount to its intrinsic value using my conservative valuation method, which I outlined in my May 6 e-mail.

2) But all stocks have some degree of risk and might not keep up with inflation, or even lose value – even Berkshire is down 25.8% from the all-time high it hit in March as the market has tanked...

So, in addition to well-chosen stocks and/or index funds, consider buying U.S. Treasury Series I Saving Bonds ("I bonds").

These are government savings bonds, which means there's virtually zero risk to your principal, and they pay an interest rate that adjusts every six months based on the current inflation rate (technically the "non-seasonally adjusted Consumer Price Index for all Urban Consumers"). Here is information about them.

Given the recent spike in inflation, I bonds are currently paying a staggering 9.62% interest. That's higher than any amount of inflation we've seen so far this year!

And you don't have to pay taxes on the interest until you redeem the I bond (as much as 30 years later) – and then the interest is only subject to federal taxes, not state and local ones.

There are some caveats, however...

Most important, you're not guaranteed to earn 9.62% for the 30-year life of the bonds – that's only for the first six months. Then, the rate will go up or down depending on what inflation does. But that's ok – your purchasing power will always be protected.

You can also only invest $10,000 per year in these bonds (plus, if you're clever, another $5,000 via your tax refund – details here) – that's per person.

You have to buy them directly from the U.S. Treasury via the TreasuryDirect program – you can't buy them through your brokerage account or via exchange-traded or mutual funds, nor can you buy them in a retirement account, only a taxable one.

And then you must hold the I bonds for at least a year... After that, there's a three-month interest rate penalty if you sell them before five years. But even with that penalty, the interest is attractive enough to consider selling at any point after 12 months.

3) But what about the other way the U.S. government offers to buy bonds that protect you against inflation, Treasury Inflation Protected Securities ("TIPS")?

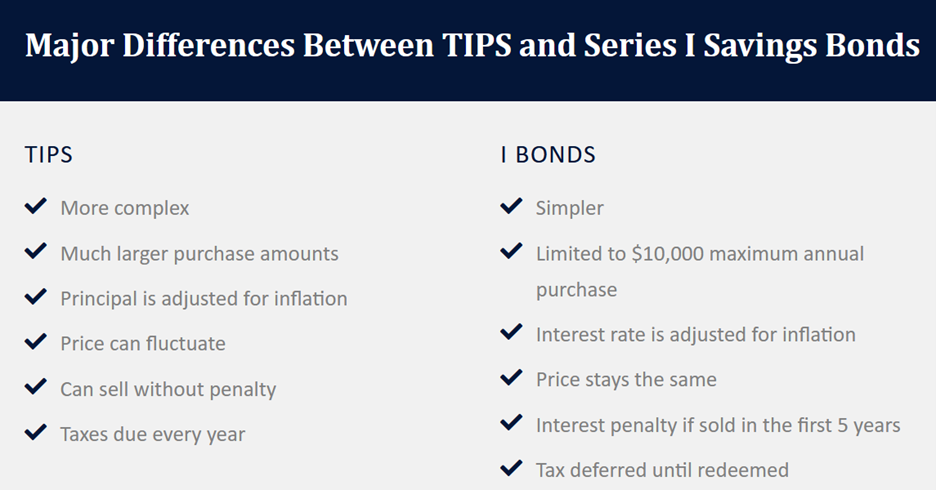

This is a very complex question... But the short answer for most investors seeking maximum protection against inflation is that TIPS are good, but I bonds are better – so first max out on I bonds, then buy as much as you want of TIPS (the limit is $5 million).

For more details, I recommend this Morningstar article, TIPS Versus I-Bonds, and this one from a website called Money for the Rest of Us, A Complete Guide to Investing in TIPS and I Bonds. Here's a summary chart from the latter:

4) The Treasury doesn't make it easy to purchase I bonds... but once you figure it out, it only takes five minutes.

You first have to open a TreasuryDirect account, which you can do here.

Once you've verified your e-mail, you'll receive an account number and you can log in.

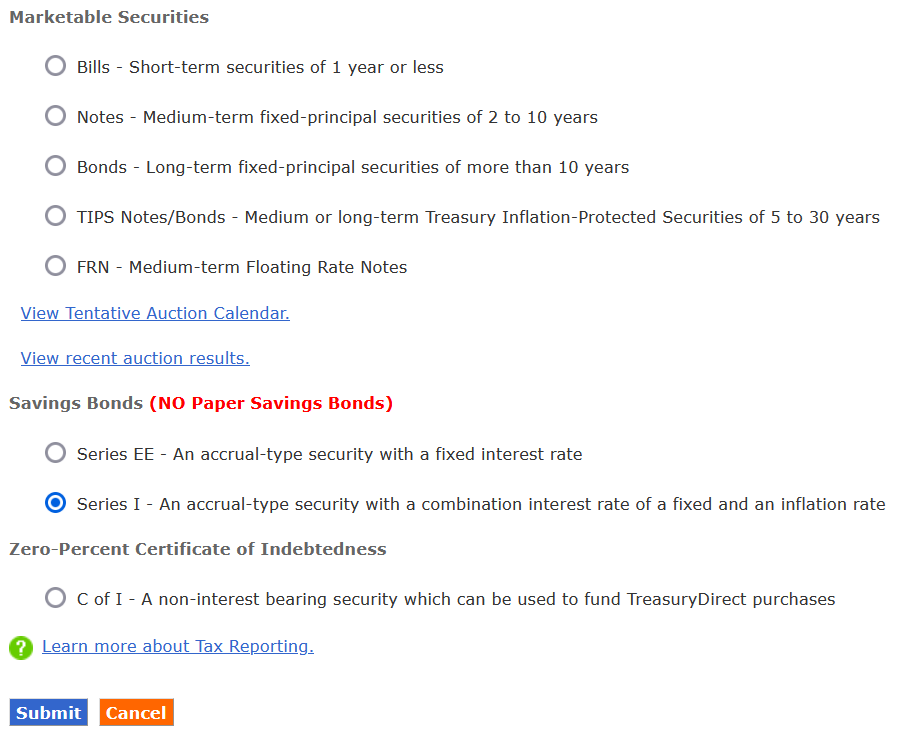

Then click the BuyDirect tab at the top and select the type of bond you'd like to buy. Here's what the page looks like (note that in the screenshot below, I selected "Series I" for I bonds):

Then enter the amount you'd like to buy (anywhere from $25 to $10,000), confirm your bank information, and you're done! (You can also purchase paper I bonds – perhaps to give as a gift – in increments of $50, $100, $200, $500, and $1,000.)

5) Elon Musk spoke to Twitter (TWTR) employees yesterday and was his usual odd self: Elon Musk tells Twitter's employees he wants the service to 'contribute to a better, long-lasting civilization.' Excerpt:

For weeks, Elon Musk has publicly trashed Twitter, even though he is buying the company in a $44 billion deal. On Thursday, he finally acted like an owner.

In an hourlong question-and-answer session in the morning with Twitter's 8,000 or so employees – the first time Mr. Musk has spoken with them since he agreed to buy the social media company in April – the world's richest man opened up about his plans for the service. In an effusive and at times rambling address, he touched on topics as varied as growth, potential layoffs, anonymity, Chinese apps, the existence of alien life-forms and even the cosmic nature of Twitter.

"I want Twitter to contribute to a better, long-lasting civilization where we better understand the nature of reality," Mr. Musk said in the meeting, which was livestreamed to Twitter employees and which The New York Times listened to.

The 50-year-old added that he hoped the service could help humankind "better understand the nature of the universe, as much as it is possible to understand."

The meeting, which Mr. Musk participated in from his cellphone in what appeared to be a hotel room, suggested that he was set on closing the blockbuster acquisition.

My take: This is further evidence that he's committed to closing the deal to acquire Twitter, making its stock, which closed yesterday at $37.36, 31.1% below the acquisition price of $54.20, even more of a table-pounding buy.

6) My favorite team, the Boston Celtics, lost the NBA championship last night to the Golden State Warriors – boo hoo! – and I lost my various bets – double boo hoo!

The interesting question is: Were they bad bets?

Now, you might be thinking: "You lost all your money, so of course they were bad bets, duh!"

Not so fast...

In the messy real world, good bets often don't pay off (and bad bets often do) – and it's easy to learn the wrong lessons.

Here's a simple example: if I offered you a 5:1 payoff on a coin flip, that's obviously a great bet. So let's say you bet $1,000, call heads, flip the coin, it's tails, and you lose all of your money.

It was still a good bet – and if I offered you a chance to play again, you should leap at it, again and again. The more times you can play, the more certain a good outcome. You just need to size each bet appropriately.

Unfortunately, when an investment (or sports bet) fails, it's much harder to know if you made a good bet – meaning the odds were in your favor – and just got unlucky, or whether you just made a bad bet. It's very easy to deceive yourself that the former is the case rather than to admit a mistake.

But thinking clearly about this and learning the right lessons is critical to long-term investment success...

7) On a final note, be sure to check out my colleague Enrique Abeyta's latest presentation...

Enrique is a master trader who outperformed the S&P 500 during the past two bear markets... And he just put the finishing touches on a presentation detailing the exact strategy he used to make money during every market crisis over the past three decades.

It's a simple strategy... but the vast majority of investors don't know about it. You can watch this brand-new presentation right here.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.

P.P.S. The Empire Financial Research offices are closed on Monday in observance of Juneteenth. Look for my next daily e-mail in your inbox on Tuesday, June 21.