Inflation debate; Bill Ackman's latest presentation; Elon Musk Bought Twitter. Now He Must Own It; 12 Hours of Misery at One of the World's Busiest Airports

1) The U.S. Bureau of Labor Statistics ("BLS") reported on Wednesday that inflation, as measured by the Consumer Price Index, rose 9.1% in June – the fastest pace in more than 40 years.

This led many economists to predict that the Fed would need to raise interest rates even more than expected, as this Wall Street Journal article notes: Hot Inflation Report Puts Pressure on Federal Reserve. Excerpt:

Economists said Wednesday's inflation report suggested the Fed will face pressure to continue big rate rises for a longer period, boosting the risks of a recession over the next year...

"There was nowhere to hide in this report," said Tim Duy, chief U.S. economist at SGH Macro Advisors. It "was a straight-up disaster for the Fed."

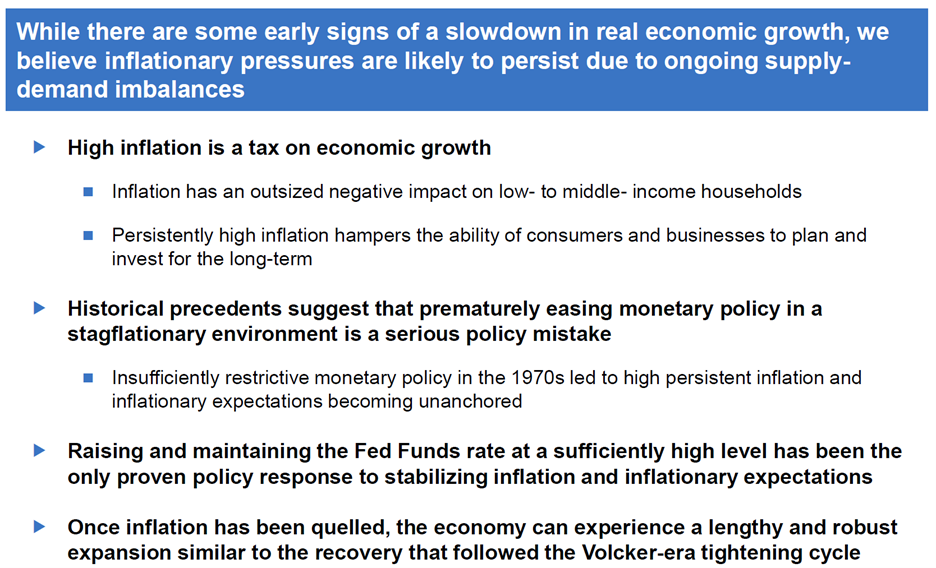

My college buddy Bill Ackman of Pershing Square Capital Management agrees, and has he been calling on the Fed to act aggressively to rein in inflation. Two days ago, he released this 42-page slide deck with his latest thoughts. Here's his conclusion:

Investors don't appear to share this view, however, as the market has barely moved since the inflation report. Here's why...

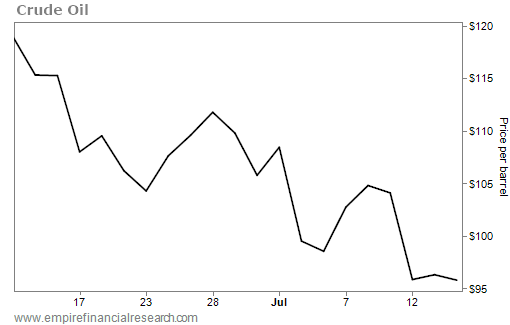

The June inflation number is already stale as many drivers of inflation are in sharp decline. For example, the price of oil per barrel has tumbled from more than $120 a month ago to less than $100 today:

As a result, the wholesale price of gasoline has fallen by more than $1 per gallon since its peak a month ago. This is slowly making its way into prices at the pump, which have fallen for 30 consecutive days from $5.01 to $4.58:

(For more, see this New York Times article: Gas Prices, a Big Inflation Factor, Are Coming Down Sharply.)

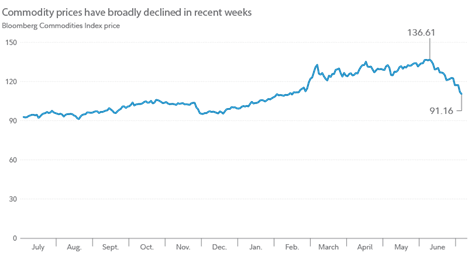

Numerous other commodities are down sharply as well, as this chart shows:

One offsetting factor, which will likely keep reported inflation higher than it really is over the next year, is the significant lag effect for the "shelter index," which accounts for roughly a third of the BLS's calculation of inflation.

This means that even if housing and rent costs stabilize or decline over the next year, the big increases over the past year will still be reflected in the reported inflation number for at least a year. (If you want to understand why, see this report: Measuring Changes in Shelter Prices in the Consumer Price Index.) But I'm sure the Fed will take this into consideration when analyzing what the real rate of inflation is.

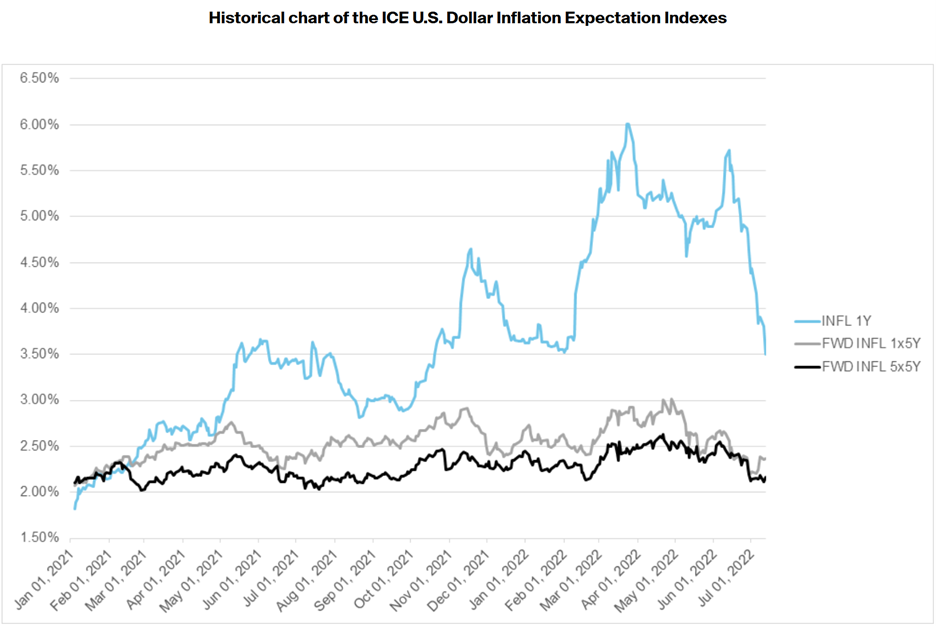

Investors are certainly looking past the June inflation report, as their one- and five-year inflation expectations haven't risen materially in the past year and a half, even as the short-term inflation has soared, as this chart shows:

And as my friend Harris Kupperman just tweeted:

My take? I agree with Harris wholeheartedly.

That's why I just joined forces with another friend, Louis Navellier – a billion-dollar money manager whose fund rose 4,000% over 15 years – to explain how we're on the brink of what could be the biggest investment opportunity in three generations.

In fact, Louis and I think that a massive trend we've been following for 40 years could take a turn that will forever define who saw it coming and had their money there first... and who missed it completely. Learn more here.

2) Tesla (TSLA) shareholders should be following the Twitter (TWTR) saga carefully because, if I'm right and the court rules that Elon Musk has to honor the contract that he signed and buy Twitter for $54.20 per share, he's going to have to sell a bunch more Tesla shares – and everyone will know it and front-run him, thus tanking the stock.

Also, you can be sure that Musk's usual tricks to prop up the stock like promising total nonsense (like a million Tesla robotaxis on the road within a year, generating income for owners) will finally fall flat.

Lastly, he's going to have to spend a ton of time undoing the damage he's inflicted on Twitter...

So with that in mind, here are three more quick items about it...

First, this op-ed in yesterday's New York Times by Yale and Georgetown law professors is spot on: Elon Musk Bought Twitter. Now He Must Own It. Excerpt:

Elon Musk is trying to walk away from his $44 billion agreement to buy Twitter, but the Court of Chancery in Delaware, where the company is incorporated and is now suing Mr. Musk, should order him to buy the social media company...

A failure to hold Mr. Musk to his bargain could reverberate throughout corporate boardrooms, deterring otherwise beneficial mergers, for years to come...

The fact that Mr. Musk and Twitter may be a bad fit should give the court no pause. The parties are still free to mutually bargain for a breakup after the court has ruled. The question is what the starting point for those negotiations should be. The answer should be given by the agreement Mr. Musk signed, not his after-the-fact maneuvering.

The remedy in this case will set expectations that will shape the merger market for decades. Litigators have long said that bad facts make bad law. Allowing Mr. Musk to walk away from the deal he struck would do just that. Instead, in light of evidence that the market has applauded such steps in the past, the court should order Mr. Musk to perform the contract he signed.

Second, here's a follow-up blog post by Rangeley Capital, which has a 10% position in Twitter and yesterday published an open letter to the board: Some updated $TWTR thoughts. Excerpt:

I believe a lot of investing is pattern recognition. As I was reading Twitter's complaint against Elon, I was struck by how familiar the feeling I got reading it was to the AT&T (T)/Time Warner case against the DOJ...

T handily won the case, and the merger closed shortly after.

I'm reminded of that case when reading Twitter's complaint against Musk. If you assume TWTR's downside in a break is $20 and the upside is the deal price ($54.20), Twitter's current stock price of ~$37 is pricing in ~50/50 chances of TWTR winning. We've yet to see Musk's response to the Twitter case, but based on the facts as I've seen from the outside and as alleged in the court case, I think it's crazy to think the case is a coin flip...

Twitter is overwhelmingly likely to win (based on my read of the case!); the only question is if Musk will get off on some technicality where a judge doesn't want to order specific performance (I'll discuss this risk later).

Lastly, I couldn't agree more with NYU marketing professor Scott Galloway in his latest podcast, The Prof G Pod, who said, in part:

Twitter is still an operating business with employees and shareholders to worry about, so a lengthy legal battle isn't what they want to endure.

That's the narrative out there right now, and I think that's total bullsh*t and people are getting it wrong.

As someone who has been a shareholder of Twitter a couple times, I think every shareholder here is entitled to $54.20. Why? Because the company has endured a tremendous amount of damage and distraction, whether it's advertisers losing faith in the platform, whether it's management and the board being wildly distracted, whether it's a decrease in morale among employees, many of whom have likely left, this company has been significantly damaged by Elon Musk.

Now, why did they incur that bullsh*t, that brain damage, that sort of abuse? Because he signed an agreement saying that, on closing, he would show up and give every shareholder $54.20 per share.

Twitter has lived up to their end of the agreement. They have done everything he has asked. And now, he owes every shareholder $54.20.

So what do I think's going to happen here? I think the board understands this, and I think the media has it wrong.

They keep saying, "Well, Twitter doesn't want to endure discovery." Twitter doesn't want to endure discovery?!

This is an individual who, last year, decided to that have a baby with his girlfriend – good for him – but at the same time had a subordinate carrying twins and no one knew about them. They didn't disclose it until six months after he'd given birth to the other kid. By the way, do we realize that, at approximately the same time, the company had paid hush money to someone accusing him of sexual misconduct?

Let's pick another really popular person. What if Tom Brady in the same month/quarter/year had said, "Oh, I'm having a baby through surrogate with my partner. Oh, by the way, someone in the franchise who I have power over who reports into me is also carrying twins and, oh, the Patriots had to pay off somebody for hush money."

I don't think he'd be on the Patriots. As a matter of fact, I think he'd be kicked out of the league.

Our idolatry of innovators here has to stop. And where does it stop? In my opinion, in the Chancery Court. What is the Chancery Court? It's a court set up to deal with corporate disputes. It does not have juries. They have a lot of discretion here, it's usually over economic settlements requiring a decent amount of nuance here.

And this is simple: for an economy to work, you have to have agreements that people, when they sign and review these agreements, live up to!

What happens when nobody feels a need, because they're rich or their superpower is shamelessness, they no longer have to live up to agreements?

What happens when you agree to show up for work because you have a signed contract and the employer says, "You know what? Fu*k you, we decided we don't really need you. Sorry you quit your job."

What happens when you agree to buy a house and you show up and you sell your own house and the seller says, "You know what? The market's gone up. I'm not going to sell you my house. You're sh*t out of luck."

What happens when you sign adoption papers?

If we don't have a rule of law here, or if we have rule of law for everyone else except for billionaires, and specifically billionaire tech innovators, the economy doesn't work.

Emerging from Silicon Valley over the past decade has been a culture that has been very damaging to capitalism. One, the way you make a lot of money has been to exploit your users, to radicalize them, to play on their depression, to play on their need for addiction. And two, that management can act like total fu*king a**holes and have no decorum and believe that the law does not apply to them.

This needs to stop. You signed a contract, he's a big boy, he has the money. Twitter shareholders are entitled to $54.20 per share.

Elon, pay the fu*k up!

Hear, hear!

3) Here's another nightmare travel story, this time from my friend Glenn Tongue...

He was at London's Heathrow Airport a couple of days ago for his flight home and said the security line went outside the terminal and back and forth in front of the terminal three times. It took him more than two hours to get through it.

This Wall Street Journal article captures what's happening there: 12 Hours of Misery at One of the World's Busiest Airports. Excerpt:

At 5:30 a.m. on a recent weekday, Heathrow Airport's departure boards were blinking optimistically with hundreds of on-time flights.

It didn't take long for the airport to fall into what has become a near-daily meltdown.

Within a few hours, human traffic jams formed as lines converged and spilled into each other. Passengers knocked into each other as people trying to get to ticket desks and bag drop-offs collided with an overflow line for those waiting for a different set of kiosks. By early afternoon, travelers with missing bags were stuck outside a lost-luggage office that had closed without explanation.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.