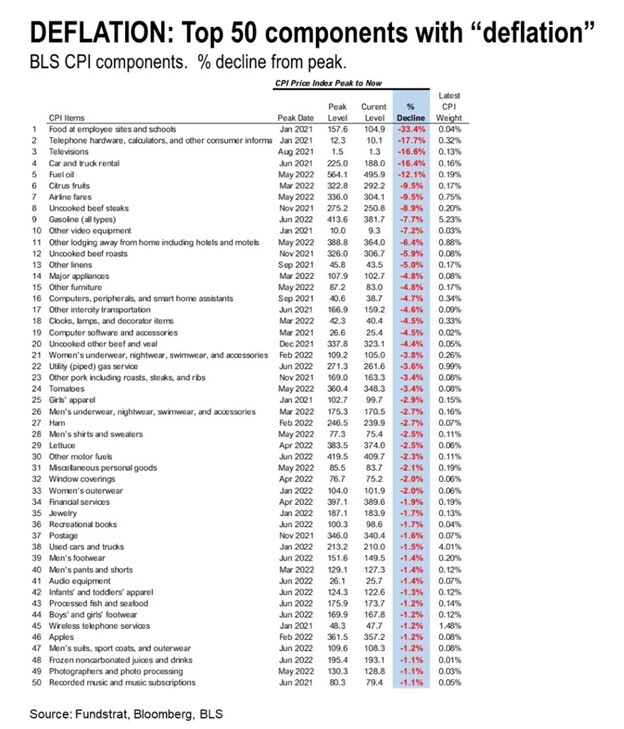

Inflation falling like a rock; Two job openings for every job seeker; U.S. Open ticket prices; SEC Whistleblower Awards Program; How to Beat the Stock Market Without Even Lying; The carbon offset and overdraft fee scams

1) The Fed's numerous interest rate increases are succeeding in slowing the economy – and inflation. This data, according to Fundstrat, shows that many inflation components "are starting to fall like a rock"...

2) The key question is whether the slowing economy will tip us into a recession, a topic I discussed at length in my August 2 e-mail.

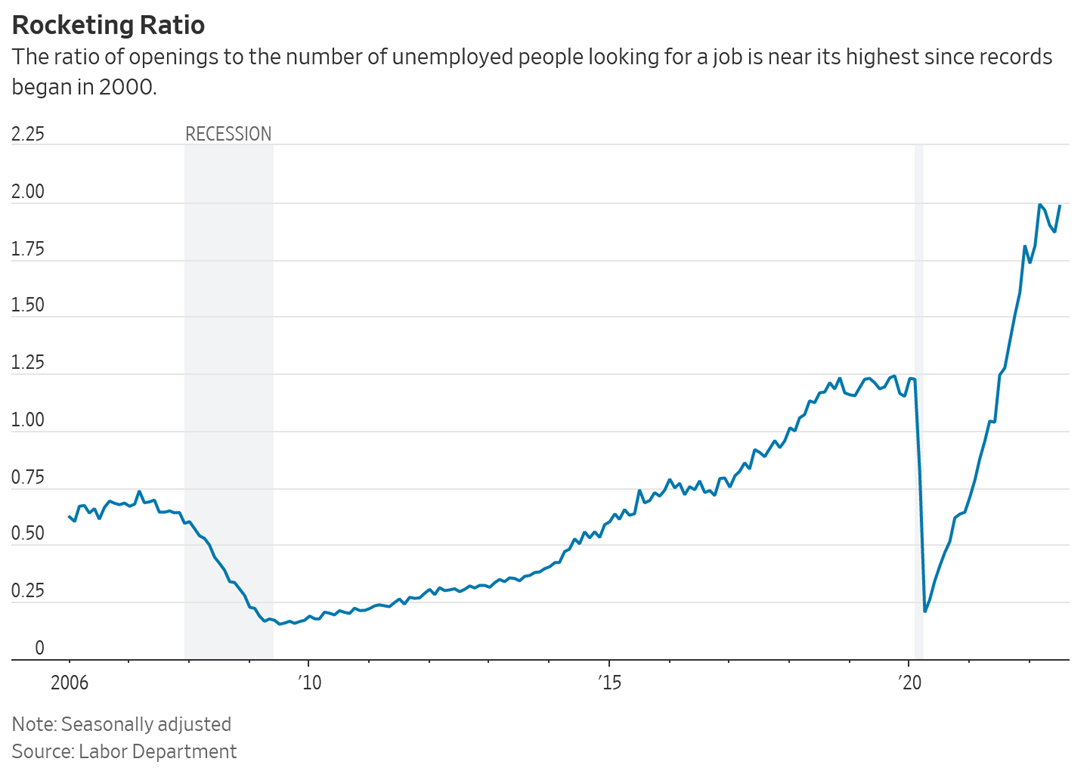

The Department of Labor reported further evidence against this earlier this week – here's the Wall Street Journal with the story: U.S. Job Openings Rose in July as Hiring Accelerated. Excerpt:

U.S. job openings rose in July as employers scooped up workers in a tight labor market.

The Labor Department on Tuesday said there were a seasonally adjusted 11.2 million job openings in July, up from the previous month's upwardly revised 11 million. Job openings have remained elevated and above 10 million since the summer of 2021.

I simply find it impossible to believe that we're heading into a recession when there are currently twice as many job openings as there are unemployed people looking for a job, an all-time high (going back to the first data 22 years ago). Just take a look at this chart from the WSJ article:

3) Here's another anecdote about the strength of the economy...

I've been going to the U.S. Open for two decades, typically attending a half dozen day and evening sessions over the two-week tennis tournament.

I never buy tickets in advance, but rather wait to see what my schedule, the weather, and the matchups look like and then buy tickets on one of the reseller websites, often at the last minute. (I've found that prices can fall as much as 50% if I wait to buy until after a session starts – for example, if I'm on site for the day session and want to attend the evening matches in Arthur Ashe Stadium, which start at 7 p.m. and require a separate ticket, I wait to buy until 7:15 p.m.)

Despite all of my tricks, I'm experiencing sticker shock right now. I paid $194 for Monday's day session and $120 for Tuesday's evening session – both double what I paid in previous years.

And things look even worse for this weekend, when my parents and cousin are coming into town for our annual tradition of going to the Open multiple times. Here's a picture of us last year:

But this year, I'm not sure we can afford to go more than once...

I'm not surprised that the cheapest seat in Arthur Ashe Stadium on Friday night is $550 because the legendary Serena Williams is playing in what could be her last match, but even day session tickets on Friday, Saturday, and Sunday all cost more than $300 – again, twice what we paid a year ago. Let's hope the prices come down by this weekend or the cheapskate Tilsons will be watching from home...

This sure doesn't smell like a recession to me!

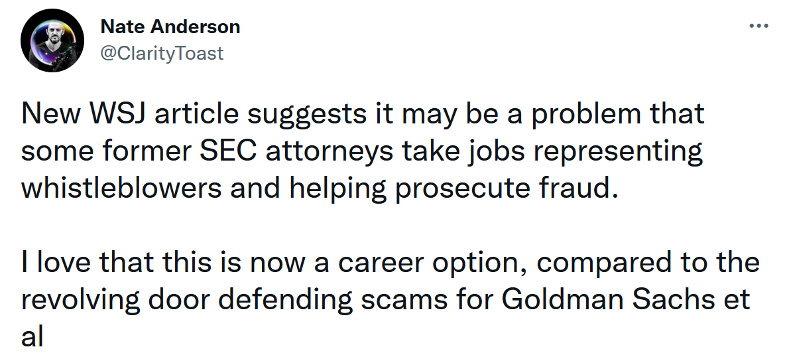

4) I agree with activist short seller Nate Anderson's take on this:

SEC Whistleblower Awards Program Might Have a Revolving-Door Problem, Study Says. Excerpt:

Over the past several , the Securities and Exchange Commission's whistleblower awards program has been championed by lawyers and politicians for offering powerful incentives to tipsters to come to the regulator with evidence of wrongdoing.

A new study, however, finds that almost a quarter of the SEC's whistleblower awards have gone to law firms with attorneys who have close connections to the regulator, potentially deterring other whistleblowers from coming forward.

A decade after a forensic accountant raised red flags about Bernard Madoff's multibillion-dollar Ponzi scheme to regulators who didn't listen, an entire industry is surfacing tips from company insiders and expert analysts who scrutinize corporate filings and submit them to the SEC for monetary rewards.

The SEC said it has awarded more than $1.3 billion to 281 individuals through the whistleblower program since 2011. The program, established by the 2010 Dodd-Frank Act, gives whistleblowers between 10% to 30% of amounts generated through monetary penalties if their tips result in successful enforcement action and fines exceed more than $1 million.

5) What a total scam! How to Beat the Stock Market Without Even Lying. Excerpt:

You know all that stuff you've been hearing for so long about how fund managers can't beat the market?

It isn't true. Fund managers can easily beat the market. All they have to do is change which market they're trying to beat.

Hundreds of them have been doing just that for years. Such maneuvers are perfectly legal – and investors need to fend for themselves, because regulators have so far been paying little attention.

A new study by finance professors Kevin Mullally of the University of Central Florida and Andrea Rossi of the University of Arizona finds that between 2006 and 2018, 37% of all U.S. stock mutual funds pulled this kind of switcheroo.

In as many as two-thirds of the cases, funds made past returns look better by changing the benchmarks they compared themselves to. More than half the time, funds chose a new index that wasn't even a good match for their strategy.

6) Speaking of scams, I learned a lot about two of them from these two segments by late-night comedians John Oliver and Trevor Noah:

- Carbon Offsets (Last Week Tonight With John Oliver)

- America's Out-Of-Control Overdraft Fees (The Daily Show With Trevor Noah)

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.