It's hard to get the timing right; Crashing Pot Stocks Are Flush With Cash; Republican Congresswoman Nancy Mace Is on a Mission to Legalize Cannabis – And Amazon Just Got Behind Her; Twenty Years of Sub-Four-Minute Miles

1) It's so hard to get the timing right when buying and selling stocks...

Sometimes I nail it to the day, as I did buying Berkshire Hathaway (BRK-A) the day the Nasdaq peaked on March 10, 2000, McDonald's (MCD) at $12.79 per share when it hit a 10-year low on March 13, 2003, Netflix (NLFX) when it hit a multiyear low of $7.78 per share on October 1, 2012 (see my slide presentation that day here), or the exact bottom of the COVID-19 crash on March 23, 2020, when I pounded the table that "this is the best time to be an investor in more than a decade."

On the bearish side, I warned my readers about the 3D printing bubble on January 6, 2014, bitcoin at $20,000 on December 16, 2017, Tilray (TLRY) at $300 per share on September 19, 2018, and the meme stock bubble a year ago on January 27, 2021.

It is an incredible feeling getting the timing exactly right.

But that's in part because it's so rare.

I'd estimate that, across the hundreds of investments I've made during my career, more than 90% have involved some suffering – namely, seeing the stock price decline meaningfully from the price at which I first bought it.

I had been buying Berkshire Hathaway – and telling my investors how cheap it was – when it was above $70,000 per share in January 1999 and had kept on buying it all the way down before loading up the day it bottomed at $41,500 per share more than a year earlier.

I had first bought McDonald's at $15.80 per share on the last day of 2002 and then watched it decline by 20% until I more than doubled my position two and a half months later.

I had owned Netflix for well over a year at an average price above $10 per share and was down more than 25% when I pitched it at my Value Investing Congress and on CNBC on October 1, 2012 (it's up 55 times since then).

This is why any time I buy a stock, I assume that, at some point, it will run at least 20% against me.

By having this expectation, if it happens (which it does most of the time), I'm not surprised, demoralized, or emotional.

Instead, I can calmly evaluate the situation and, using the approach I laid out in Friday's e-mail, make the correct decision whether to buy more, hold, trim, or exit.

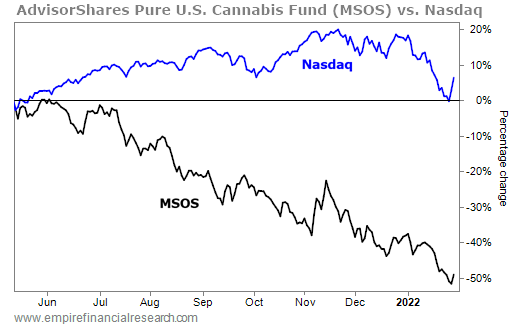

2) A good example of what I'm talking about is the AdvisorShares Pure U.S. Cannabis Fund (MSOS), which I first mentioned on May 11, when it was at $41.48 per share. Since then, it has been cut in half, far underperforming the Nasdaq Composite Index, as you can see in this chart:

Clearly, I was way too early.

But here's the vexing thing: being early and being wrong look exactly the same on the way down.

So am I wrong?

I think not. The single most successful type of investment I've made over and over again in my career is getting in front of a huge, long-term growth story – think Apple (AAPL) and Amazon (AMZN) in 2000, McDonald's and Home Depot (HD) in 2003, Netflix in 2012, etc.

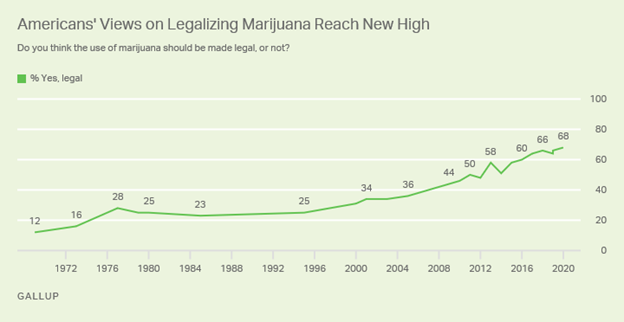

There's no question in my mind that the cannabis industry in the U.S. is going to be massively bigger than it is today, as the legal and regulatory framework inevitably catches up with the public. More than two-thirds of Americans now support the legalization of marijuana – up dramatically over the past half-century, as you can see in this chart from Gallup:

I've already shared my bull case in this interview and the thoughts of my friend Doug Kass of Seabreeze Partners here, so today I'd like to share this Wall Street Journal article, Crashing Pot Stocks Are Flush With Cash, and this blog post by my friend Chris Irons, This Potentially Generational Sector Opportunity Still Looks Ripe, And Now, Even the Wall Street Journal Is Catching On.

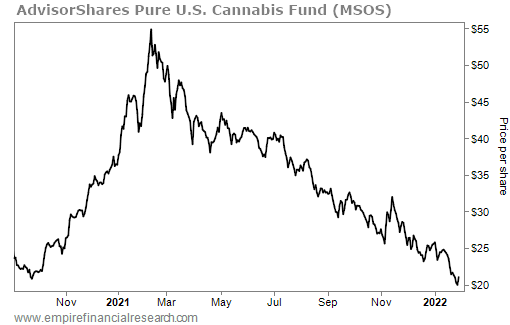

In summary, I think history is likely to repeat itself. The last time the AdvisorShares Pure U.S. Cannabis Fund was at these levels, it nearly tripled in less than five months, as you can see in this chart:

3) Here are three related articles:

- Congressman Files New Marijuana Banking Reform Amendment to Large-Scale House Bill

- Schumer Gives Update on Federal Marijuana Legalization and Banking in Meeting With Equity Advocates

- Republican Congresswoman Nancy Mace Is on a Mission to Legalize Cannabis – And Amazon Just Got Behind Her. Excerpt:

On the second floor of the Cannon House Office Building, across Independence Avenue from the U.S. Capitol, Representative Nancy Mace is drinking rosé out of a can as her Havanese named Liberty – who is a very good boy, she assures – sits next to her in a leather chair. As the sun sets over The District, Mace talks about why cannabis should be legal.

"There's a million reasons to end federal prohibition and the only place where this is controversial is up here," says Mace. "It's an enormously popular idea. America is like: 'WTF, D.C., why have you not done this yet?'"

In November, the 44-year-old freshman Congresswoman, who represents South Carolina's coastal swing district spanning Charleston to Hilton Head, introduced the States Reform Act, a bill that would end the federal government's 85-year prohibition on marijuana. Mace is certainly not the first politician to introduce a cannabis legalization bill, although it's been impossible to get one passed by both chambers of Congress.

But Mace already has one of the most powerful conservative groups in the world in her corner: Charles Koch's Americans for Prosperity. And now she has one of the world's largest companies supporting her bill: Amazon.

4) I ventured out into the blizzard on Saturday to watch the last two hours of the 114th annual Millrose Games, which took place at the Armory Track in upper Manhattan.

The last race was the signature event, the Wanamaker Mile, which attracts some of the best milers in the world. It was a great race (you can watch it here), but as I was walking out, I couldn't understand what all the fuss was about – the announcer said multiple times that Nick Willis broke the four-minute mile.

"So what?" I thought. "He finished ninth!"

It wasn't until reading this story in yesterday's New York Times, Twenty Years of Sub-Four-Minute Miles, that I realized what a phenomenal accomplishment this was – it was the 20th consecutive year in which he has run a sub-four-minute mile, extending his record (one that, I suspect, will never be broken). It's simply an awesome achievement!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.