Last call for my inflation event tonight; Nasdaq market cap losses; Day Trader Army Loses All the Money It Made in Meme-Stock Era; Mom and Pop Investors Took a Billion-Dollar Bath Trading Options; Individual Investors Step Back From Options Bets; Market Pain Isn't Over, but You Will Get Through This

1) A final reminder for the special event I'm hosting tonight at 8 p.m. Eastern time, during which I'll share my latest inflation forecast for the rest of this year and how I think it will affect markets.

In fact, just for attending, I'll even give away the name and ticker symbol of a stock that could double your money in the coming months and years, all thanks to an "inflation shock" that could be coming as soon as next month.

The big event is completely free to attend, but just make sure to reserve a spot in advance – you can do so right here.

See you tonight!

2) As of yesterday's close, the S&P 500 Index, the small-cap Russell 2000 Index, and tech-heavy Nasdaq Composite Index are down 15.8%, 20.2%, and 25.5%, respectively. It's been one of the worst starts to the year in the past century.

Those numbers are grim enough, but the reality for most investors is far worse, as there has been absolute carnage in many of the stocks and sectors most widely owned by retail investors.

This chart that appeared on CNBC yesterday shows that the market value loss among Nasdaq stocks in the current crash is far greater than the past three:

And this doesn't even factor in the more than $1 trillion in losses in the crypto sector.

3) This tweet shows the extreme losses in dozens of widely held stocks:

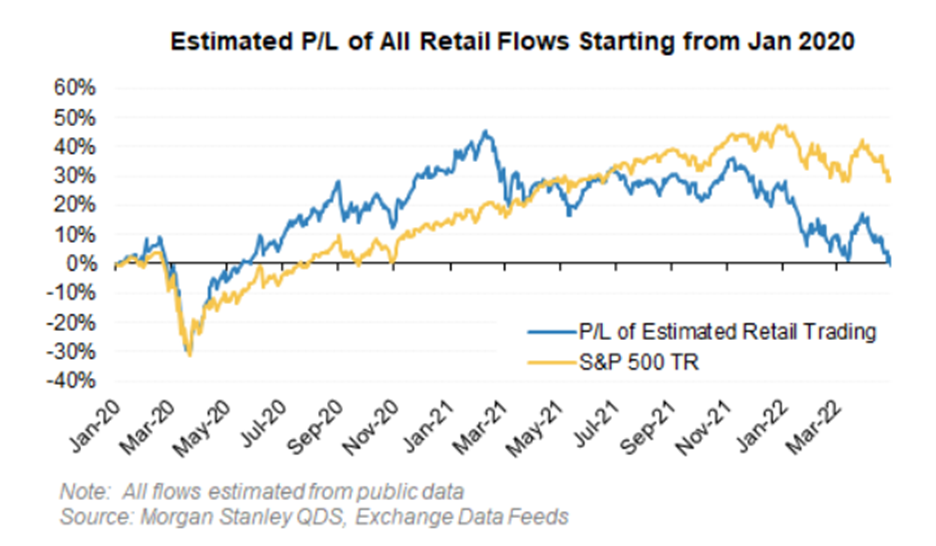

4) Meme stocks, as I warned many times, have been decimated, as this Bloomberg article highlights: Day Trader Army Loses All the Money It Made in Meme-Stock Era. Excerpt:

It's ending as fast as it began for retail day traders, whose crowd-sourced daring was the pre-eminent story of pandemic equities.

Nursing losses in 2022 that are worse than the rest of the market's, amateur investors who jumped in when the lockdown began have now given back all of their once-prodigious gains, according to an estimate by Morgan Stanley (MS). The calculation is based on trades placed by new entrants since the start of 2020 and uses exchange and public price-feed data to tally overall profits and losses.

A craze born of the coronavirus outbreak and nurtured by Federal Reserve largesse is being laid low by a villain of identical lineage, inflation, which global central banks are racing to combat by raising the same interest rates they cut. The result has been a lumbering bear market in speculative companies that surged when the stimulus started flowing in March 2020.

"A lot of these guys started trading right around Covid so their only investing experience was the wacked-out, Fed-fueled market," said Matthew Tuttle, chief executive officer at Tuttle Capital Management. "That all changed with the Fed pivot in November, but they didn't realize that because they have never seen a market that wasn't supported by the Fed," he said. "The results have been horrific."

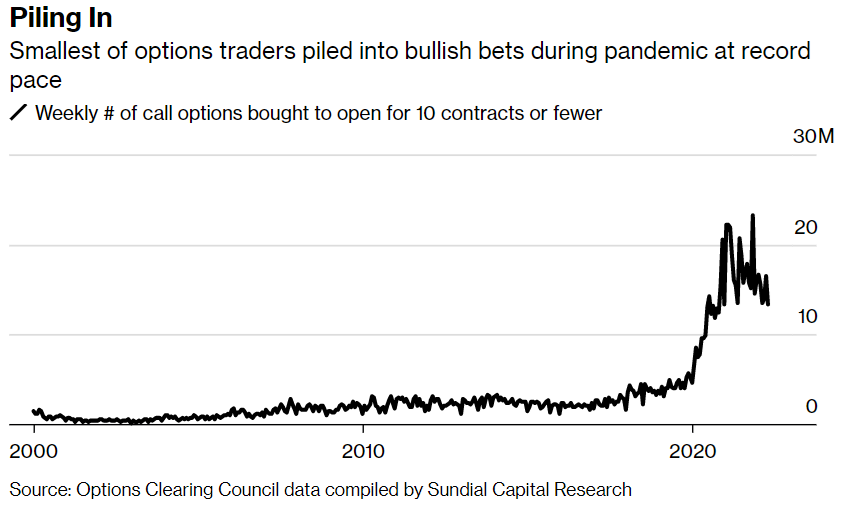

5) Another reason retail investors have gotten killed is that they didn't just own wildly overvalued stocks, but also exacerbated their losses by trading options on them! Mom and Pop Investors Took a Billion-Dollar Bath Trading Options During the Pandemic. Excerpt:

New research from economists at the London Business School found that mom-and-pop day traders managed to lose more than $1 billion during the bull market. The bill climbs to $5 billion when the cost of doing business with market-makers is factored in.

The study, "Retail Trading in Options and the Rise of the Big Three Wholesalers," shines considerable light on the fate of individual investors who became obsessed with side bets on the stock market in the era of zero-commission trading. Spurred by Reddit posts and urged on by Twitter (TWTR) and TikTok influencers, daily volume in bullish contracts set record after record as stuck-at-home tinkerers flocked to the contracts in an effort to juice up returns.

Researchers Svetlana Bryzgalova, Anna Pavlova, and Taisiya Sikorskaya estimated that retail investors lost $1.14 billion trading options from November 2019 to June 2021, assuming a 10-day holding period. Trading costs ate up an additional $4.13 billion. To measure the performance of nonprofessional traders, the authors tracked options orders coded as originating with retail brokerages and sent to high-volume market makers known as wholesalers.

A few factors were at play, said the authors, among them hapless market timing by the retail group. Super-wide bid-ask spreads in their options of choice ate up a large portion of the cohort's potential gains...

"The more they trade, the more they lose because of these bid-ask spreads – every time, they have to pay the round-trip trading costs," said Pavlova in an interview...

"So it is about market timing," said Pavlova. "They were buying these names, but at the wrong time," and are sometimes choosing the wrong contracts.

Perhaps most striking is that the market during this period racked up impressive gains, even accounting for a 35% COVID-induced decline during the first quarter of 2020. The S&P 500 rose more than 40% between November 2019 and mid-2021. And just about everything caught a bid during that stretch – three of the index's sectors each added more than 50%.

6) So how are individual investors dealing with the losses? The good news is that they seem to be learning the right lessons...

They're mostly sitting tight: Investors Stay Put, Because They Can't Think of Better Options. Excerpt:

Even the worst markets are supposed to have havens. Some unnerved investors are wondering if this one doesn't.

The S&P 500 is down 16%, its worst start to a year since 1970, according to Dow Jones Market Data. But assets of all kinds are also falling. Gold, typically considered a haven, has swung into the red. Bonds are typically another shelter, but this year they are falling alongside stocks, an unusual tandem that reflects investors' uncertainty.

The risk-on cryptocurrency market, pitched for years as a counterweight to traditional stocks, is also imploding, with bitcoin losing more than a third of its value in 2022.

This sell-everything market is confounding big and small investors alike after a string of years when markets seemed to go only straight up. Now, investors are confronting red-hot inflation and the end of easy monetary policy. There is also the question of whether the U.S. is headed for a recession, which some investors fear could happen if the Federal Reserve raises interest rates too quickly.

Many traders say they are on the prowl for other investments, but even tried-and-true alternatives have lost their allure. A dash for cash – a usual strategy during turmoil – looks less appealing when inflation is hovering above 8%, chipping away at purchasing power. Investing in real estate can feel like a nonstarter when mortgage rates are rising and home prices have soared to records.

The only option, some investors say? Sitting tight.

"There's paralysis," said Greg Swenson, founding partner of Brigg Macadam, a London-based investment bank. "Even as people sell, they don't know how to reinvest it."

Some investors are holding on to their stocks because they are betting they will eventually be rewarded, and even buying more on down days. Others are holding on because they can't think of anything better to do.

In fact, some folks are buying the dip, which is what I started to do last week, as I wrote in Thursday's and Friday's e-mails: 'Buy the Dip' Believers Are Tested by Market's Downward Slide. Excerpt:

This year's stock market volatility has turbocharged a favorite strategy among individual investors: buying the dip. The dramatic plunge in major indexes will test their resolve.

On Thursday, when the stock market had one of its worst days of the year, individuals rushed in, setting a one-day buying record. In March, they invested the largest ever monthly sum, according to Vanda Research data beginning in 2014, and continued to pour money into the markets in April...

Despite the turning tides, many individual investors said they have relished the chance to buy stocks at a discount. Many said the calculation is simple: History has shown that stocks eventually go up.

Small investors plowed $114 billion into U.S. stock funds through March as the S&P 500 tumbled into a correction, falling at least 10% from its high, according to Goldman Sachs (GS). That marks a sharp shift in the group's strategy for much of the past two decades. Typically, individual investors have sold about $10 billion in the 12 weeks after a market peak when the S&P 500 has tumbled that much.

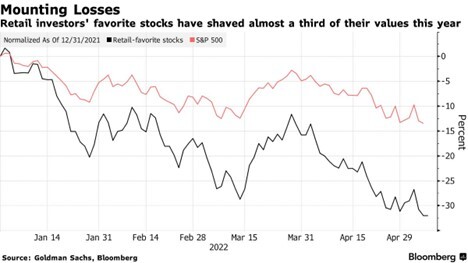

And they've reduced trading, especially in options: Individual Investors Step Back From Options Bets. Excerpt:

Options trading by individual investors is fading, the latest sign that the stock market's speculative fever has broken.

Those individual investors had embraced options as a way of riding the stock market's momentum that drove shares of companies from Apple (AAPL) to Nvidia (NVDA) to new heights. Now, the Federal Reserve's move to raise interest rates to tame inflation has thrown that dynamic into reverse, sending the prices of stocks skidding.

Individual investors made up 26% of total options activity in March, down from nearly 30% early last year. That marked the lowest level since March 2020, though was still well above prepandemic levels, according to calculations by Bloomberg Intelligence's Larry Tabb, who analyzed figures from the 12 largest online brokers.

Meanwhile, their share of stock-trading activity hit a low of 10.7% in January, based on data from the largest brokers. Activity has ticked up slightly since then but remains below levels last year when it peaked at 21%.

A punishing stretch of volatility has prompted many individual investors to abandon a host of momentum trades such as blank-check companies known as SPACs, crypto plays like nonfungible tokens and unprofitable technology companies.

7) In summary, this article captures my views reasonably well: Market Pain Isn't Over, but You Will Get Through This. Excerpt:

A period of wrenching volatility is inescapable. This happens periodically in financial markets, yet those very markets tend to produce wealth for people who are able to ride out this turbulence.

It is important, as always, to make sure you have enough money put aside for an emergency. Then, assess your ability to withstand the impact of nasty headlines and unpleasant financial statements documenting market losses.

Cheap, broadly diversified index funds that track the overall market are being hit hard right now, but I'm still putting money into them. Over the long run, that approach has led to prosperity.

Count on more market craziness until the Fed's struggle to beat inflation has been resolved. But if history is a guide, the odds are that you will do well if you can get through it.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.