Last chance for the best deal we've ever offered at Empire; The Tech Industry's Epic Two-Year Run Sputters; Bursting of two growth stock bubbles; PayPal pitch; Rebutting Russian disinformation

1) It's your last chance to take advantage of the best deal we've ever offered here at Empire Financial Research...

The Empire Junior Partnership.

It's the end of an era at Empire... and you must take action before midnight tonight if you want to get in on our newest venture.

Don't wait any longer... And don't let today's market volatility scare you away from the best deal we've ever offered.

2) The S&P 500 Index has now fallen for five consecutive weeks, its longest such streak since June 2011. Leading the decline are tech stocks, for reasons outlined in this story on the front page of today's Wall Street Journal: The Tech Industry's Epic Two-Year Run Sputters. Excerpt:

The technology industry, which powered the U.S. economy during the pandemic and grew at tremendous scale during a decade of ultralow interest rates, is confronting one of the most punishing stretches in years.

Global powerhouses and fledgling startups are feeling pain from a variety of economic, industry and market factors, spawning post-pandemic turbulence in e-commerce, digital advertising, electric vehicles, ride-hailing, and other segments.

Companies that emerged as job-creating juggernauts in the past two years – collectively adding hundreds of thousands of workers to their payrolls in engineering, warehouse and delivery jobs – have begun to freeze hiring or even lay off employees...

Technology companies delivered the type of growth rarely found in other parts of the economy. In 2020, Meta Platforms (FB), Amazon (AMZN), Google (GOOGL), Apple (AAPL), and Microsoft (MSFT) collectively produced $1.1 trillion in sales, eclipsing the GDP of the Netherlands, Switzerland, Turkey, and Saudi Arabia, according to World Bank data.

The pandemic only strengthened the tech industry's dominance. As the economy shut down, many consumers relied on technology like never before – helping lift the fortunes and share prices of online retailers, videoconferencing platforms, and streaming services to new heights.

A confluence of factors has upended that dynamic this year. Inflation is running at a four-decade high, pressuring wages for drivers and warehouse workers and crimping consumer spending power. Rising interest rates have started to damp the flood of capital seeking high returns in tech investments. The reopening of bricks-and-mortar restaurants and stores has sapped demand for items ordered online, prompting e-commerce companies to recalibrate their expansion. COVID-19 lockdowns in China are creating new supply-chain disruptions for iPhones and other gadgets.

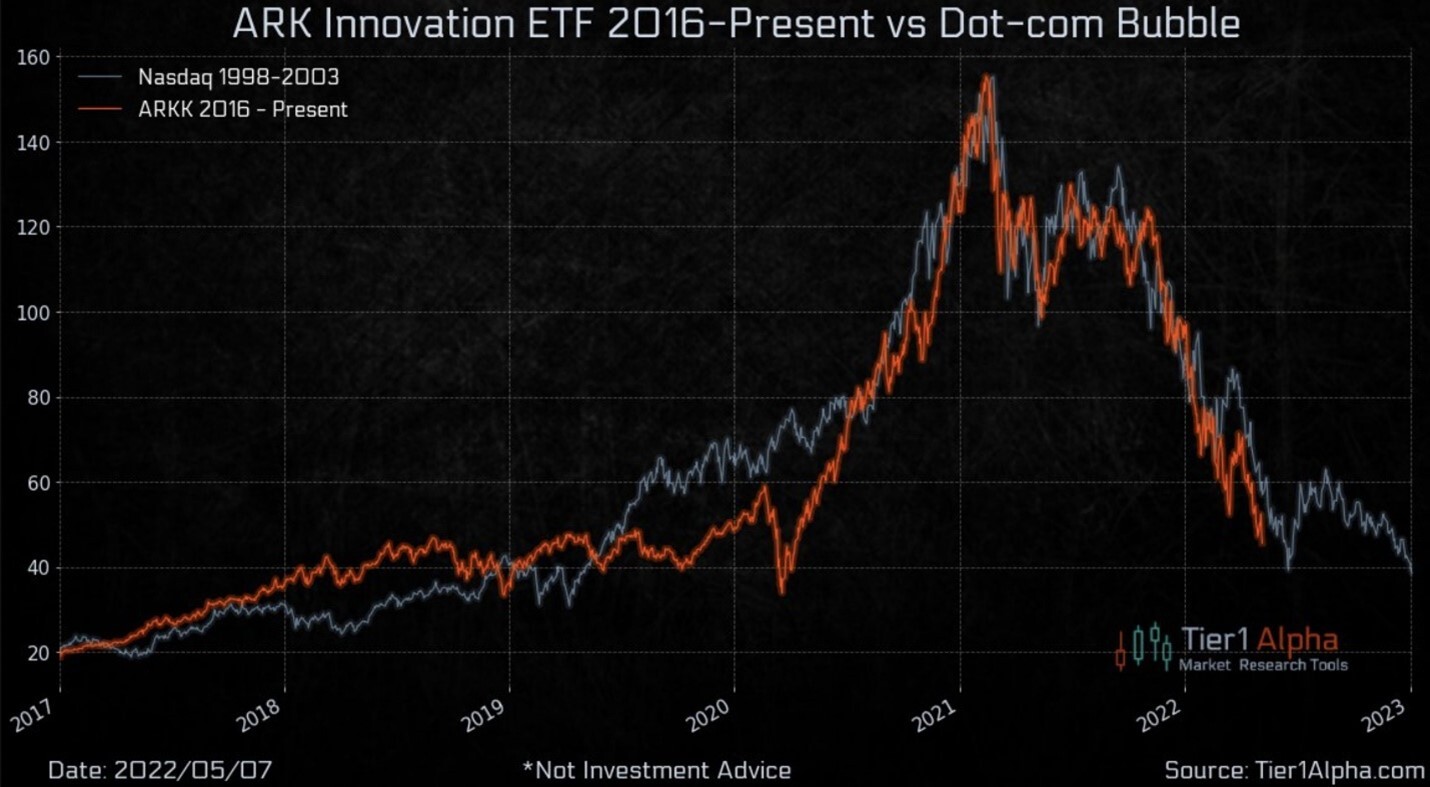

3) It's remarkable how the current crash in high-growth stocks, embodied by Cathie Wood's ARK Innovation Fund (ARKK), mirrors the tech-stock bubble of the late 1990s.

History doesn't repeat itself, but it sure does rhyme, as the chart in this tweet shows...

The Nasdaq Composite Index ultimately declined by a staggering 80% from its March 2000 peak until it bottomed in October 2002.

In comparison, as of Friday's close, ARKK is "only" down 71% from its peak less than 15 months ago on February 12 last year.

My take: When massive bubbles burst, they usually decline by at least 80%, so ARKK has further to fall.

4) That said, I do think it's time to start looking to buy high-quality growth businesses whose stocks have been oversold by panicky retail investors and hedge funds being forced to liquidate (I think it's likely we'll soon be hearing a lot about the latter).

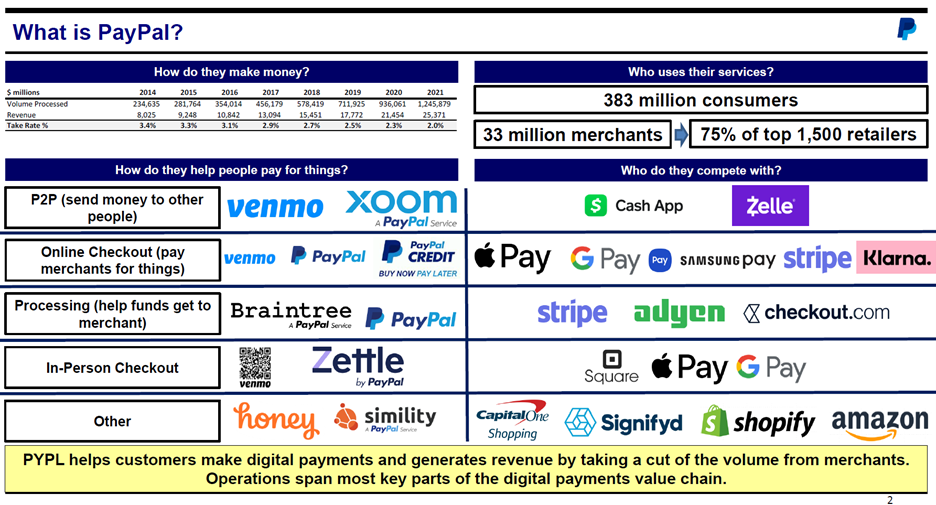

One company that may fit this description is digital payments giant PayPal (PYPL), which in addition to its eponymous service also owns Venmo.

While I've been critical of the company's disclosures about the fees it charges (see my February 2 e-mail here), it's a great business that generates a lot of free cash flow thanks to a market-leading position in a rapidly growing industry.

Personally speaking, as recently as a year ago I used Venmo maybe once a week. But now I use it almost every day, mostly for two purposes: to pay certain service providers (personal training, massage, etc.)... and my wife and I use it to transfer money to and from our daughters.

So I was delighted to see that three Columbia Business School students would be pitching the stock on April 28 as part of the 15th annual Pershing Square Challenge, which was established by my friend Bill Ackman of Pershing Square Capital Management.

Each year, dozens of teams of first- and second-year Columbia Business School students develop stock pitches, and the five finalists present to a panel of judges, which this year included Bill, me, and five others. We awarded the winning team $100,000 and the second-place team $50,000!

I thought the 48-page PayPal presentation, which I've posted here (with the students' permission, of course), was the best, but was outvoted by the other judges (I will share the three other pitches, including the two winners, in upcoming e-mails). Here are three of their overview slides:

PayPal hit a four-year low on Friday and is now down 74% from its all-time high above $300 per share it hit only nine months ago.

The company recently reported weak first-quarter earnings (news release here and slides here) and guided adjusted earnings down to a midpoint of $3.87 per share, which was far below prior expectations, but the stock actually jumped 11.5% the next day because investors feared even worse.

This smelled like a "kitchen sink" quarter to me. With the stock down so much and the long-time chief financial officer announcing his departure less than a month ago, I think the company reset earnings expectations to a level it knows it can beat. It's only after such a reset that I'm willing to consider owning a fallen growth stock...

At Friday's close of $81.68, the stock trades at only 21.1 times this year's expected earnings (and 3.7 times trailing revenues). That strikes me as a reasonably attractive entry point.

5) The Russians are, sadly, world-class at spreading disinformation, as evidenced by this e-mail a friend sent me recently:

I have put some pictures in my blog which have since been deemed old or fake. I am sure horrific things have taken place in Ukraine, but am trying to determine fact from fiction.

There were all kinds of stories of the missile hitting the train station being Russian, but the missile serial numbers were traced to Ukraine. I am not suggesting for a second it could have been done intentionally, but some who follow the situation were suggesting it could have been an errant strike from Ukraine.

I have no way to know what is real or not. Thoughts appreciated.

I forwarded his e-mail to human rights activist Amed Khan (bio here), who's in Ukraine and recently posted this video (warning: very graphic): The Human Cost of Russia's War on Ukraine. Amed replied (be sure to read his last paragraph):

Yeah that's a Russian propaganda thesis. They have been quite effective at this stuff for the last 20 years. I was at Kramatorsk and this is the best thing published on it to date: Russia's Kramatorsk 'Facts' Versus the Evidence. Excerpt:

On April 8, 2022, a Tochka-U short-range ballistic missile struck the main railway station in Kramatorsk in the Donetsk region of government-controlled Ukraine. The missile killed at least 50 people, including five children. Civilians had gathered at the station to flee the approaching Russian offensive, which has pivoted to the country's east in recent weeks.

A recent BBC report stated it had found "clear evidence" that the missile which struck the station had a cluster munitions warhead.

Russian officials have blamed the strike on Ukraine, citing claims that the Russian military does not use the Tochka-U. Pro-Russian media cited other assertions relating to the missile's serial number, and a hypothesised flight path of the missile.

Bellingcat, and others in the open source community, have cross-referenced these claims with publicly available footage in an attempt to establish the origin of the Tochka-U missile that took dozens of lives at the Kramatorsk railway station on April 8.

At the time of writing, the available open source evidence remains insufficient to reveal all details about the strike, including the direction of origin of the missile. However, it does appear to debunk a central argument by the Russian state in its defense: that its military does not operate the Tochka-U missile system.

They will be publishing again soon with updates on where it was launched from, etc.

I don't read much coverage as I'm in middle of all this, but I don't think it could possibly be exaggerated. In person, it's significantly worse than any words could capture. I worked in Rwanda, Bosnia, Syria, Iraq, Afghanistan, and others, the scale and speed of this civilian infrastructure destruction is quite something. We are only now scratching the surface of the mass graves and sexual violence crimes against women and children that have occurred.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.