My interview with the Cannabis Investing Network; My cannabis presentation slides; China pivoting?; Tough Mudder on Saturday

1) I did a 74-minute interview recently with the Cannabis Investing Network podcast, which I really enjoyed. You can listen to it here, and here's a summary:

Whitney Tilson is a well-known value investor with a long and varied past in financial markets. He joins us to discuss markets, value investing and how he got interested in cannabis stocks.

We discuss:

- How Whitney got started in investing

- Being a late 1990's "Bull Market Genius"

- How that bull run compares to today's

- Getting religion by learning about Buffett and value investing

- The ups and downs of starting his own hedge fund

- Market timing: indicators that Whitney looks for

- What attracted Whitney to the cannabis sector

- How the current rout in cannabis compares to tech in 2000

- The three things Whitney looks for in a winning company

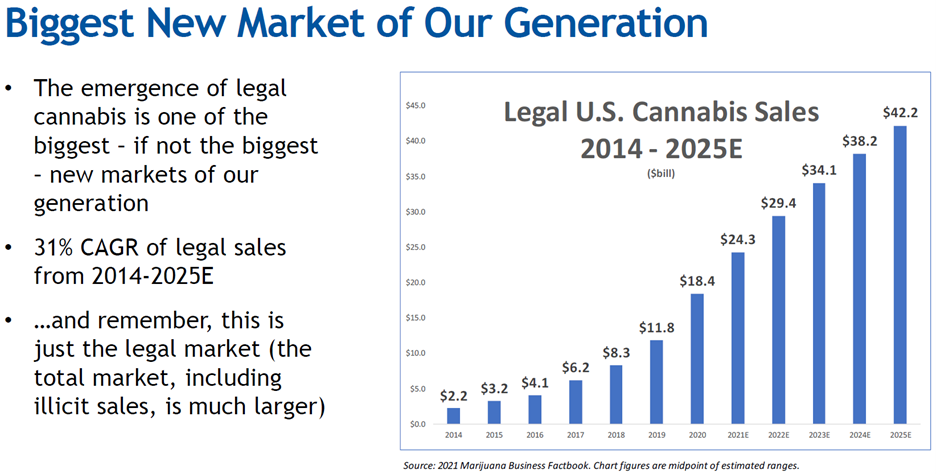

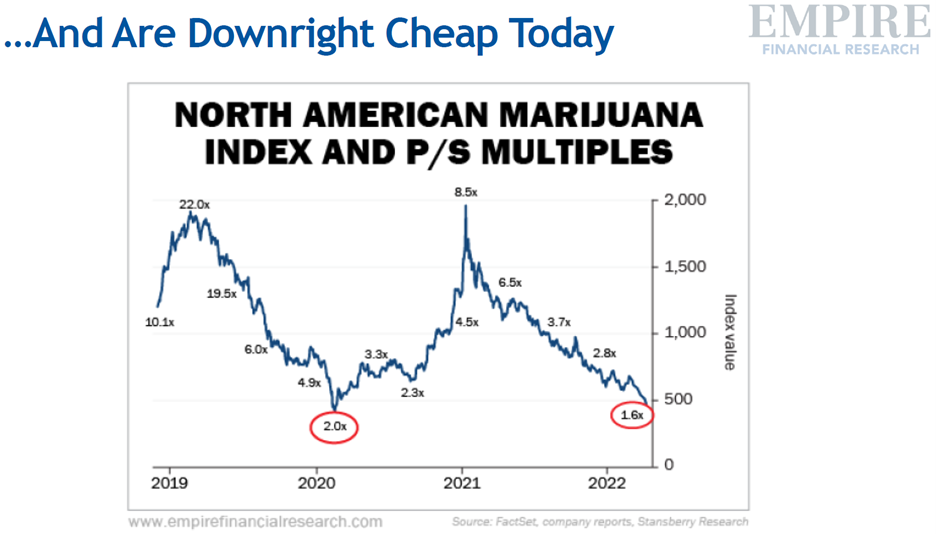

2) I presented the cannabis sector as one of my favorite ideas at the Empire Financial Research event my colleague Berna Barshay and I hosted a week ago in New York City. Here are four of the slides I presented:

Empire subscribers can access the 75 slides Berna and I presented last Thursday, along with a video of the entire event (including the Q&A) right here.

In addition to my full presentation on the cannabis sector – highlighting our favorite stock in the industry, which is our latest recommendation in Empire Investment Report – I also shared my updated slides on Berkshire Hathaway (BRK-B) and Meta Platforms (FB).

Berna also shared her in-depth research on Netflix (NFLX), and I shared Enrique's slides on his favorite small-cap idea right now (he was sick, so he couldn't join us).

During the Q&A after the presentation, I shared my thoughts on Twitter (TWTR), and Berna discussed one of her highest-conviction small-cap names, as well as Target (TGT) and Walmart (WMT). We also both explained why we think oil prices will remain much higher than the market expects them to for many years to come... As such, we're bullish on energy stocks.

If you'd like to access the complete presentation and the video, you can become a subscriber – and receive a full year of our flagship newsletter, Empire Stock Investor – for only $49 right here.

3) This is an interesting post on ValueInvestorsClub that I shared with my China e-mail list yesterday (to join it, simply send a blank e-mail to: china-subscribe@mailer.kasecapital.com):

China pivoting?

May 30, 2022 EST by gocanucks97

Figure this may be an appropriate time/place to discuss. There has been a palpable and potentially seismic change in the political environment in China over the last 2-3 weeks. First, the WSJ article documenting internal disagreement amongst leadership (China's Top Two Leaders Diverge in Messaging on Covid Impact).

Then, the 10,000-member meeting led by the Premier – if you know Chinese history, a similar meeting (7,000-member meeting in 1962) was held right after the disastrous Great Leap Forward.

Today, there was an article published in Seeking Truth, the official magazine of the Party (open in Chrome to read the translation). My friends and I are absolutely floored by the article – less about what was in the article, but the fact that Xi was not mentioned a SINGLE time, with Deng/Jiang (pro economic reform) referenced throughout.

Of course, the country is facing the worst economic backdrop in over 40 years. And we could see more skeletons in the closet and who had been swimming naked given the high debt in the system. But as I speculated in my Weibo (WB) write-up, this is precisely what is necessary for an "authoritarian" regime to pivot, as it has done numerous times in history. But even I have been stunned by the pace of change.

I think the base case now is that Xi will see his power greatly reduced even if he gets a 3rd term this fall, and it is now plausible that he may step down altogether. The latter was UNTHINKABLE just 2-3 months ago and game changer for various industries/companies and perhaps global growth.

To sum up, you have: 1) a landmark shift in government policy/regulation, 2) potentially monster stimulus to counter unprecedented economic malaise (not that dissimilar to what the U.S. experienced in April 2020), 3) bombed out sectors/companies at trough valuation, cutting costs and focusing on cashflow – some are already gushing cashflow and some may see major inflection in Q4/'23 (Tencent set-up going into 2023 feels eerily similar to GOOGL in 2021), and 4) sentiment still extremely negative (most investors outside the country consider them uninvestable) while stocks had acted much better and mostly ignored Q2 guidance.

My take: I think these developments in China – in particular, the prospect of major stimulus in the world's second-largest economy – bode well for stocks there... and here.

4) After stopping by my 35th high school reunion on Friday afternoon (see Monday's e-mail) and staying until 9 p.m., I drove 45 minutes to my friend Bob Fisher's house in southern Vermont. He and I have been buddies since we were classmates at Northfield Mount Hermon School.

On Saturday morning, I drove another 45 minutes up to Stratton Mountain with Bob's son Finn (my godson), and we ran the Tough Mudder race (my first since the World's Toughest Mudder last November – see my November 15 e-mail).

The weather was beautiful and we had great fun. The course was only 8.8 miles and the obstacles were mostly easy, but the 3,871 feet of vertical – as we hiked up and jogged down the mountain multiple times – was a quad burner over the two hours and 40 minutes we were out there!

Here are some pictures from Saturday:

I posted more pictures on Facebook here and here's a short video of Finn and me going through the final obstacle, Electroshock Therapy, which gives you a few electric shocks – sometimes strong enough to knock you down, but generally not...

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.