My new prediction; Presentations from the Italy Value Investing Seminar; Berkshire Hathaway, Petrobras, Banco do Brasil; Elon Musk's deal to buy Twitter is in peril

1) I'm making a new prediction...

The nightmare of March 23, 2020 – the bottom of the COVID-19 crash that I predicted to the day – is about to repeat... But, as with last time, there will be opportunities to earn great wealth in the aftermath.

This could be a chance to make multiples of your money due to a huge turning point in the market that few people are expecting. Find out more – including how to get a free copy of a new report with more details on my big prediction – right here.

2) The first day of the Value Investing Seminar I'm co-hosting here in Trani, Italy went well, with presentations by nine speakers, including myself, my friend and former partner Glenn Tongue, and my co-host, Ciccio Azzollini. Here's a picture of us from the first time I visited 18 years ago and last night (I know, I know – neither of us has aged a day, right?):

3) I presented on Netflix (NFLX), Meta Platforms (META), and Berkshire Hathaway (BRK-B) – which we shared with our subscribers (you can become one for only $49 for the first year of our flagship newsletter, Empire Stock Investor – just click here).

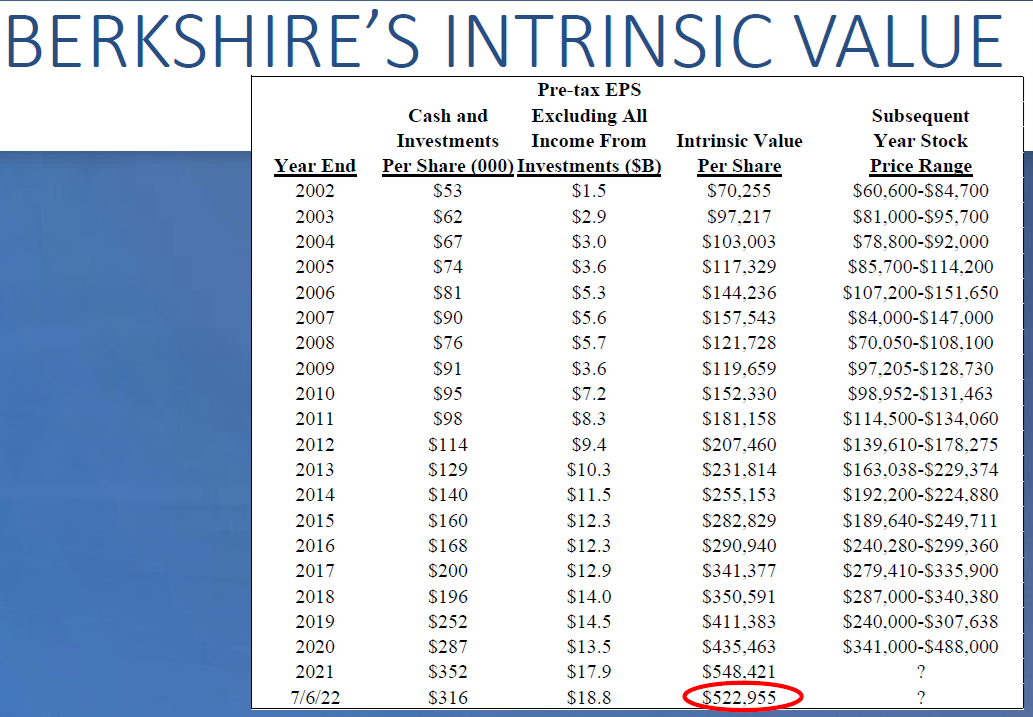

We're publicly releasing the Berkshire slides, which you can download right here. This slide shows my estimate of Berkshire's intrinsic value over the past two decades and today:

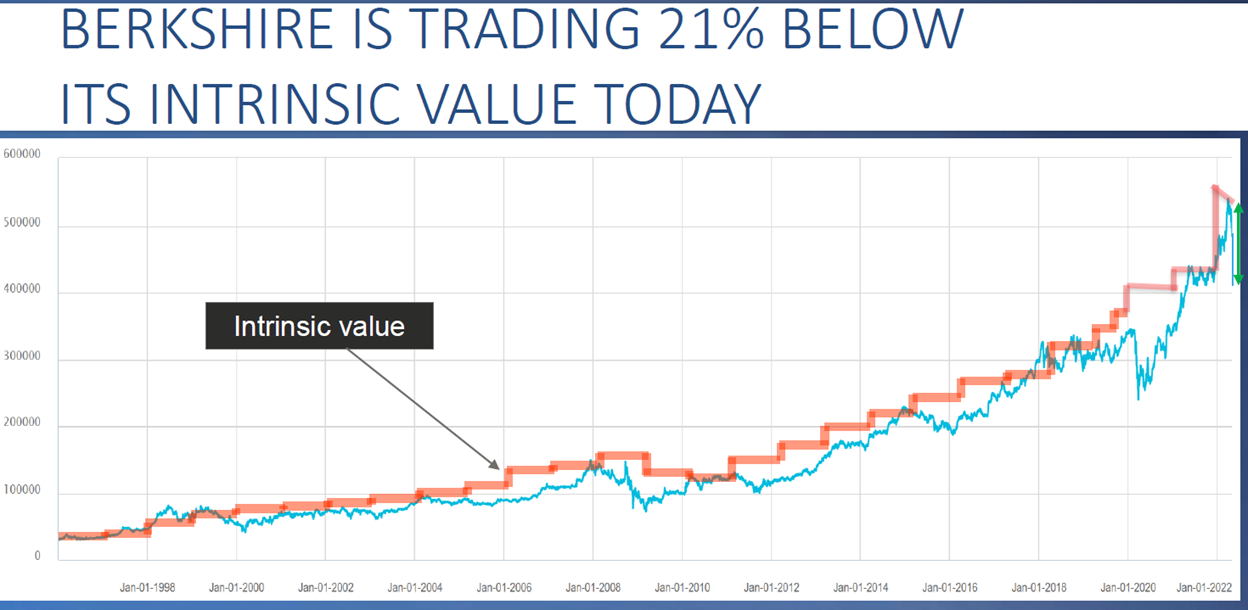

And this slide shows the stock price relative to my estimate of intrinsic value over time:

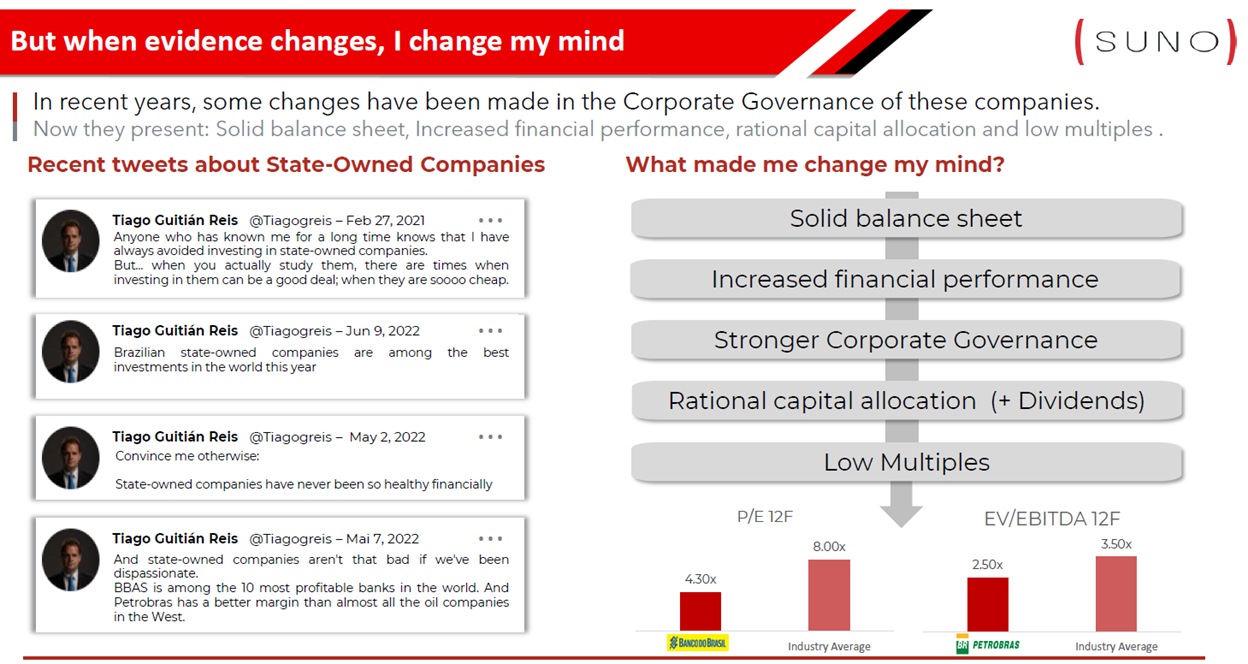

4) Tiago Reis of Suno Research in Brazil (here's his LinkedIn profile and here's a video of an interview he did in April) gave an interesting presentation (slides here), pitching two state-owned giants whose stocks trade in the U.S., oil company Petrobras (PBR) and Banco do Brasil (BDORY).

They both, as we say in the industry, have a lot of "hair" on them... and I'm certainly not recommending that anyone buy either one. But for anyone comfortable with this kind of investment, they're certainly worth a look – they're among the cheapest stocks I've ever seen, and Tiago made a compelling case that they've made big positive changes and thus aren't the value traps they've always been. Here's one slide:

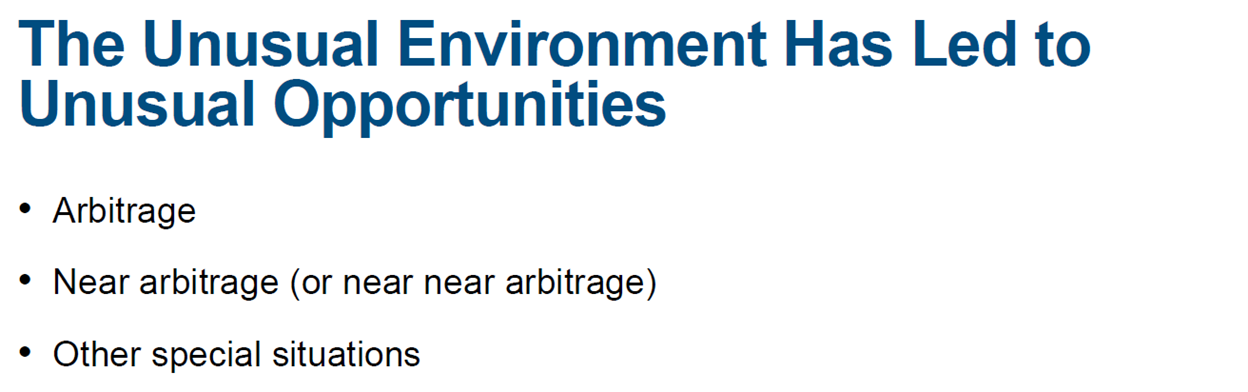

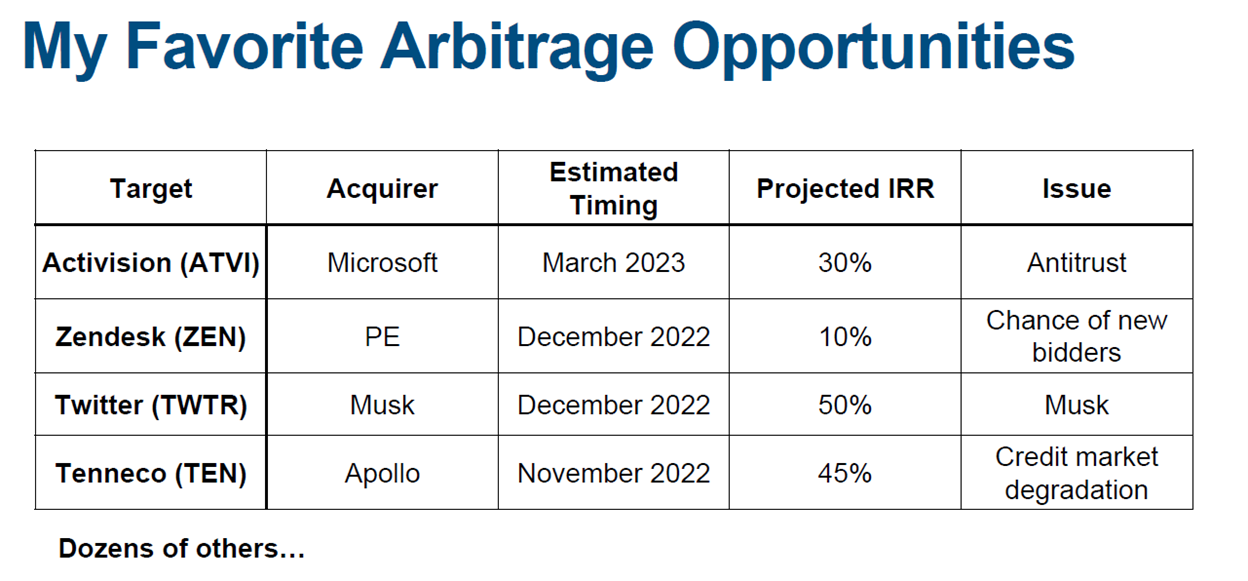

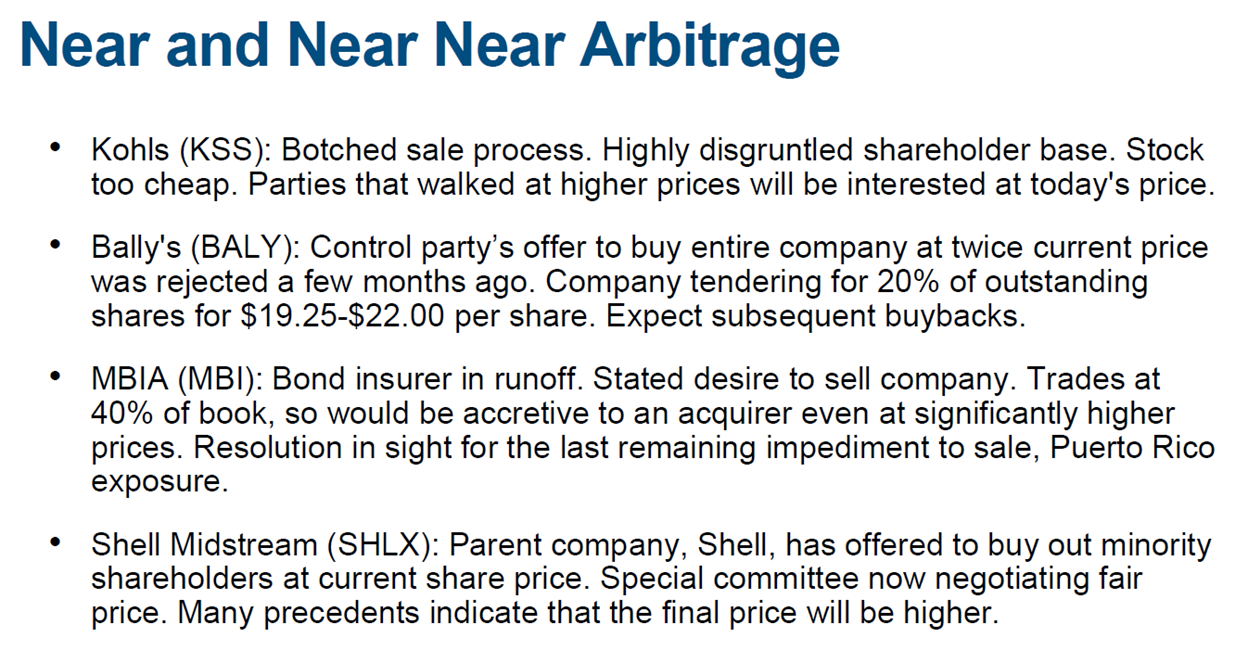

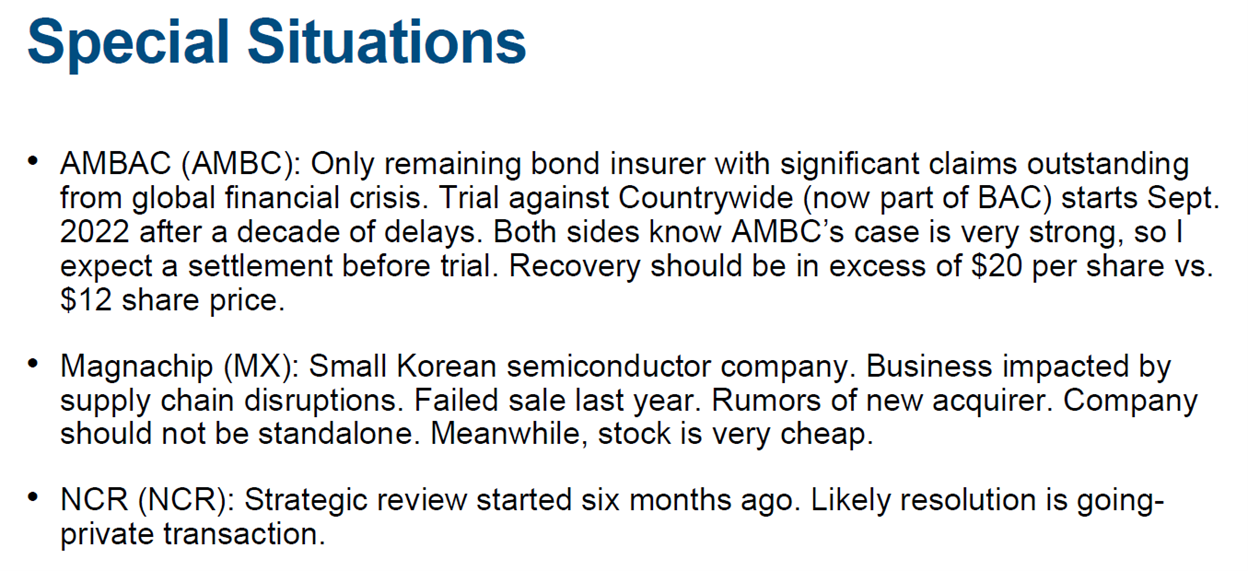

5) Then Glenn shared a number of interesting ideas in his presentation – here are the four key slides:

6) Speaking of one of the stocks Glenn likes, Twitter (TWTR) is down today on this news: Elon Musk's deal to buy Twitter is in peril. Excerpt:

Elon Musk's deal to buy Twitter is in serious jeopardy, three people familiar with the matter say, as Musk's camp concluded that Twitter's figures on spam accounts are not verifiable.

Musk's team has stopped engaging in certain discussions around funding for the $44 billion deal, including with a party named as a likely backer, one of the people said. The people spoke on the condition of anonymity because of the sensitivity of the ongoing discussions.

Talks with investors have cooled in recent weeks as Musk's camp has raised doubts about the recent data "fire hose" – a trove of data sold to corporate customers – they received from Twitter. Musk's team's doubts about the spam figures signal they believe they do not have enough information to evaluate Twitter's prospects as a business, the people said.

Now that Musk's team has concluded it cannot verify Twitter's figures on spam accounts, one of the people said, it is expected to take potentially drastic action.

My take: I view this as further shenanigans by Musk to try to pressure Twitter's board to lower the price.

Viewed in this light, it's totally rational for him to leak this story.

I agree with New York Times tech columnist Kara Swisher, who tweeted:

Um, this is sourced entirely from the Musk side and taking its word on bots as if it were anything but a feint. But he signed a binding contract, and no hand-waving negotiation tricks going to change that.

I continue to believe that the deal will go through at or very close to the agreed-upon price of $54.20.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.