My Twitter presentation; Elon Musk's latest Twitter adventure; Two key tech execs quit Truth Social after troubled app launch

1) Wow, I sure nailed the timing of this one!

At a presentation on Friday to a few hundred people at the Legacy Research Conference in Washington, D.C., I pitched my two favorite stock ideas, Meta Platforms (FB), which I'll discuss in tomorrow's daily e-mail, and Twitter (TWTR), which we first recommended in the August 2020 issue of Empire Stock Investor (click here for more information about Empire Stock Investor and a special $49 first-year offer).

Here are the 12 slides I presented on Friday about Twitter, and here's an overview...

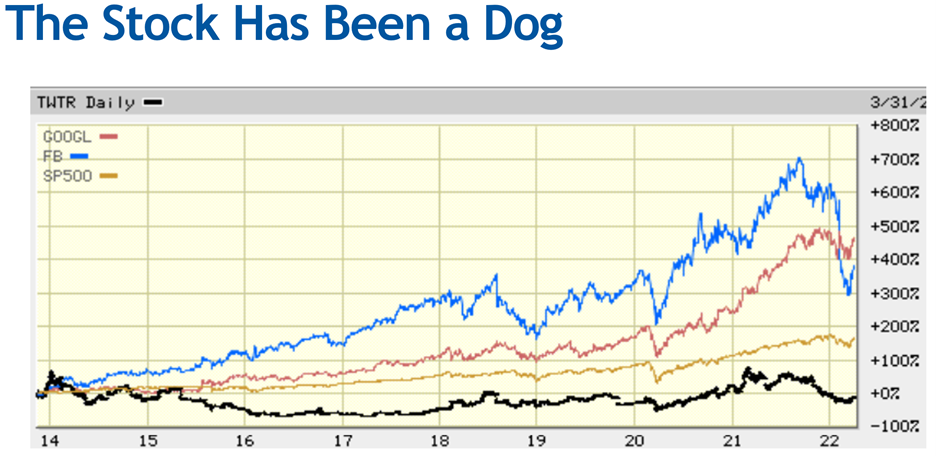

Twitter's stock (until today) was actually down since its IPO in late 2013, badly trailing Meta, Alphabet (GOOGL), and the S&P 500 Index:

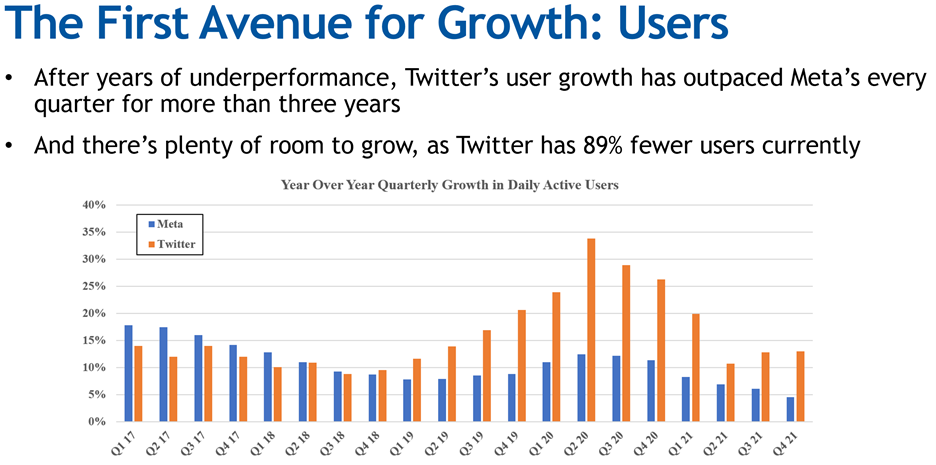

The business has been terribly managed, but there are signs of improvement, most notably that user growth has been strong in the last three years, far surpassing Meta's:

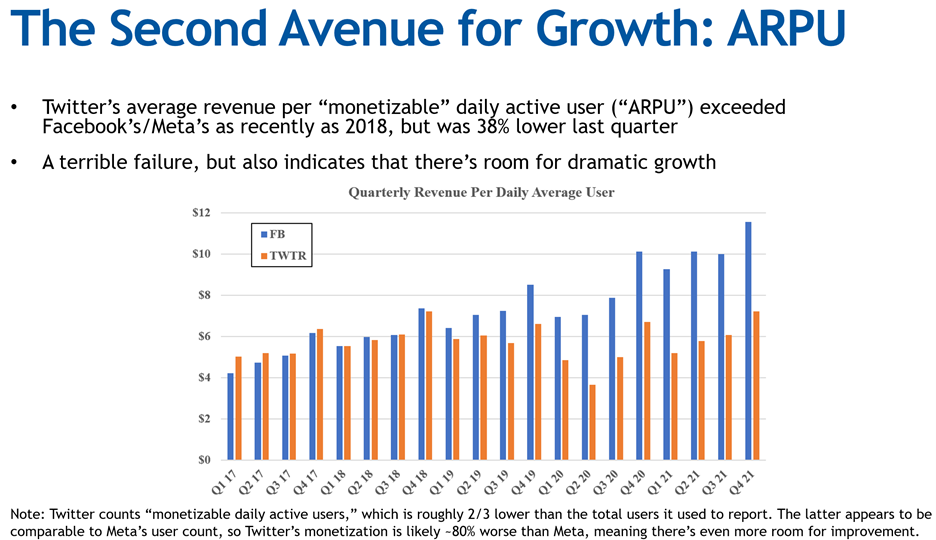

However, Twitter does an exceptionally poor job monetizing its users. Even using its preferred measure of "monetizable" daily average users (which is only roughly one-third of its total users), its average revenue per user ("ARPU") trails Meta's – and the gap is steadily widening:

The silver lining here, however, is that there's lots of room for improvement.

As for valuation, the stock appears expensive at 43 times trailing EBITDA (before today's jump), but I believe earnings are depressed. Even with Meta's stock down so much, the market values each Twitter user at less than half of each Meta user: $146 versus $307 per daily average user (again, before today's jump).

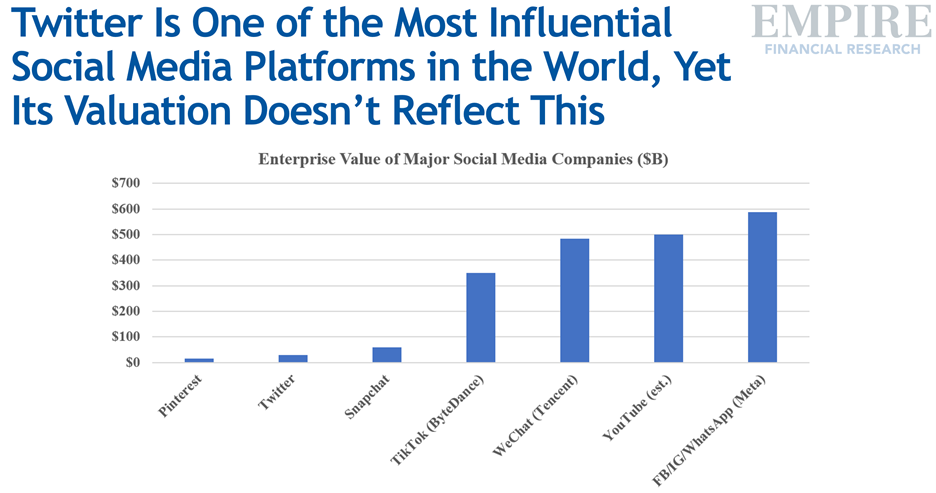

I can't argue that Twitter is cheap based on traditional valuation metrics, but my "Spidey sense" sees a huge disconnect between one of the biggest, most influential social media networks in the world versus its tiny enterprise value:

Here was my summary:

- Buy Twitter (TWTR)

- $31 billion for the greatest platform for idea sharing is cheap

- Continued user growth combined with better monetization via improved ad targeting could cause Twitter's stock to double

- Hold for the long term... Twitter will either start to execute or get acquired

2) During the Q&A after my presentation, I said it would be madness for Tesla (TSLA) CEO Elon Musk to try to start his own social media network, as he had hinted, but would be brilliant for him to acquire Twitter, which he could easily afford given that his nearly $300 billion net worth dwarfs Twitter's nearly $40 billion market cap.

Sure enough, the news broke this morning that Musk recently bought 9.2% of Twitter's shares. Here's commentary by Andrew Ross Sorkin of the New York Times: Elon Musk's latest Twitter adventure:

What's the plan?

Shares of Twitter soared 25% in premarket trading on news that Elon Musk had personally bought a 9.2% stake in the social media company, making him its largest shareholder. The stake, revealed in a regulatory filing, was amassed before Musk criticized Twitter in – yes – a series of tweets, questioning the company's commitment to "free speech" and wondering whether a new social media platform was needed. With more sway over the company, will he try to reinvent Twitter to be more to his liking?

Musk's relationship with Twitter is long and complicated, involving most notably his legal wranglings with the SEC over his tweets about Tesla's finances. Will Musk now agitate for Twitter to alter its policy on moderating content in the name of freer speech? What is Elon Musk doing now? Will he push for Twitter to open up its algorithm, which the company's co-founder and former CEO Jack Dorsey appeared to support last week? (Musk and Dorsey are friendly.)

We have many more questions:

- Musk built the stake through passive investments — will he keep buying or even try to acquire the company outright? (It would put a relatively small dent in his $270 billion-plus net worth.)

- Will Musk ask to join Twitter's board? Will Twitter invite him to join?

- What do Tesla and SpaceX shareholders think of this? Will they see it as a distraction for Musk? And if Musk steers Twitter in a direction that irks policymakers, who have been trying to rein in social media platforms, could that create complications for Tesla or SpaceX? Recall that President Trump took a dim view of Amazon (AMZN) because he disagreed with coverage in the Washington Post, which Jeff Bezos owned separately.

- Given Musk's history with PayPal (PYPL) and interest in cryptocurrency, might he push Twitter to do more in payments?

- How much money did Musk make off this morning's news? Musk's disclosure came out today, but the document detailing the stake, worth about $3 billion at Friday's closing price, is dated March 14. Twitter's shares are up about 50 percent since then.

My take: Musk has now put Twitter into play, meaning that someone is going to buy this company. The questions are who and at what price?

Regarding the former, the most obvious buyers, Meta, Alphabet, or Microsoft (MSFT), are likely blocked for antitrust reasons, and there's no way the U.S. government will allow a foreign company to buy Twitter. But I wouldn't rule out Salesforce (CRM), PayPal – which bid for Pinterest (PINS) recently – or Oracle (ORCL).

But I think the most likely scenario is that Twitter is purchased by a private equity firm, with Musk's participation.

As for price, even with today's big move, I think the takeout price will be much higher, so the stock remains a strong buy.

3) During the Q&A, I also discussed my least favorite stock, Digital World Acquisition (DWAC), the SPAC that is planning to merge with the Trump-backed conservative Twitter clone, Truth Social.

As I've argued in many prior dailies, Truth Social is an absolute bust and is totally worthless – a view that is reinforced by this damning article Reuters published this morning: Two key tech execs quit Truth Social after troubled app launch. Excerpt:

The two Southern tech entrepreneurs had the two qualities that Donald Trump's Truth Social startup needed: tech-industry expertise and a politically conservative worldview aligned with the former president, a rare combination in the liberal-leaning industry centered in San Francisco.

Josh Adams and Billy Boozer – the company's chiefs of technology and product development – joined the venture last year and quickly became central players in its bid to build a social-media empire, backed by Trump's powerful brand, to counter what many conservatives deride as "cancel culture" censorship from the left.

Less than a year later, both have resigned their senior posts at a critical juncture for the company's smartphone-app release plans, according to two sources familiar with the venture.

The departures followed the troubled launch of the company's iPhone app on Feb. 20. Weeks later, many users remain on a waiting list, unable to access the platform. Trump Media & Technology Group ("TMTG") Chief Executive Devin Nunes, a former Republican congressman, said publicly that the company aimed to make the app fully operational within the United States by the end of March.

The company has an app for iPhones but no app for Android phones, which comprise more than 40% of the U.S. market, though the company has advertised seeking an engineer to build one...

Another open question is how TMTG is funding its current growth. The company is planning to go public through a merger with blank-check firm Digital World Acquisition. The deal is under scrutiny by the Securities and Exchange Commission and is likely months away from being finalized.

DWAC disclosed in a regulatory filing last December that the SEC was probing the deal. The SEC has not addressed the nature of the inquiry and did not respond to a request for comment on Sunday.

Investors have pledged $1 billion to TMTG but they won't hand over that money until the DWAC deal closes.

Trump's level of involvement with his namesake company and the Truth Social platform also remains unclear. The former president so far has written only one post – or "truth" – on the platform, writing on Feb. 14: "Get Ready! Your favorite President will see you soon!"

Downloads of the Truth Social app have declined precipitously, from 866,000 installations the week of its launch to 60,000 the week of March 14, according to estimates from data analytics firm Sensor Tower. The firm estimates the Truth Social app has been downloaded 1.2 million times in all, trailing far behind rival conservative apps Parler and Gettr at 11.3 million and 6.8 million installations, respectively.

With today's decline, the stock has now been cut in half since I called a "blow-off top" in my daily e-mail less than six weeks ago.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.