Netflix earnings; Word of Trump Media Deal Is Said to Have Leaked Months in Advance; IBM's dismal earnings; Twitter wins Round One in its lawsuit against Elon Musk; Robinhood Was Behind Phantom Surge in Berkshire Hathaway Trade Volume

1) Netflix (NFLX) reported earnings after the close yesterday that, while poor, were better than investors feared, so the stock is up big this morning.

It's now up more than 10% since I discussed it less than two weeks ago at the Value Investing Seminar in Italy, which I wrote about in my July 8 e-mail. We continue to like this beaten-down stock, which is an open recommendation in our Empire Stock Investor newsletter (to gain access to the entire portfolio of open recommendations, you can sign up for Empire Stock Investor right here – it's only $49 for the first year).

Here's a New York Times article on Netflix's earnings and outlook: Netflix Says It Lost Nearly 1 Million Subscribers, and Breathes a Sigh of Relief. Excerpt:

"Not only were losses not as bad, but expecting growth in Q3, even if it's modest growth, is probably pretty encouraging to people," said Richard Greenfield, managing director at LightShed Ventures, adding that the company's pronouncement that it was expecting substantial free-cash-flow growth in 2023 to be the most significant news of the quarter.

"They're basically saying that while everyone else in the industry is losing billions of dollars, not only are they making money in 2022 – they're going to make a lot of money in 2023 and beyond," Mr. Greenfield said.

2) A damning story in yesterday's New York Times, Word of Trump Media Deal Is Said to Have Leaked Months in Advance, further increases the odds that regulators will block the merger between Twitter knock-off Truth Social and Digital World Acquisition (DWAC) – the SPAC that I named as my least favorite stock going into this year. It's down 43% since then, but should be down twice that... so it remains my No. 1 stock to avoid right now. Excerpt:

Months before former President Donald J. Trump's social media company unveiled an agreement to raise hundreds of millions of dollars last fall, word of the deal leaked to an obscure Miami investment firm, whose executives began plotting ways to make money off the imminent transaction, according to people familiar with the discussions.

The deal – in which a so-called special purpose acquisition company, or SPAC, would merge with Mr. Trump's fledgling media business – was announced in October. It sent shares of the SPAC soaring.

Employees at the Miami investment firm, Rocket One Capital, had learned of the pending deal over the summer, long before it was announced, according to three people familiar with the firm's internal discussions. Two of the people said that Rocket One officials at the time talked about ways to profit off the soon-to-be-announced transaction with Trump Media & Technology by investing in the SPAC, Digital World Acquisition.

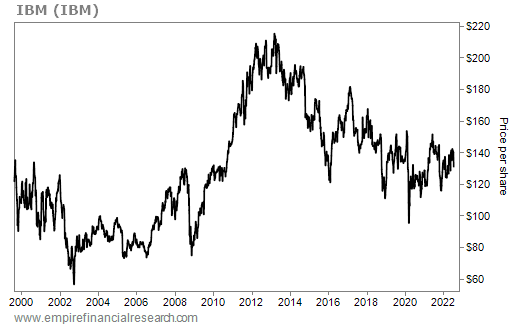

3) Though it didn't make this year's Dirty Dozen – my 12 least favorite stocks I named on January 4 – I've been bearish on IBM (IBM) for more than 20 years, as evidenced by this article I published on February 20, 2002: IBM's Accounting Tricks.

Sure enough, the company reported dismal earnings yesterday and the stock fell more than 5%, underperforming the Nasdaq by more than eight percentage points. The stock is now back to a level it first reached in 1999!

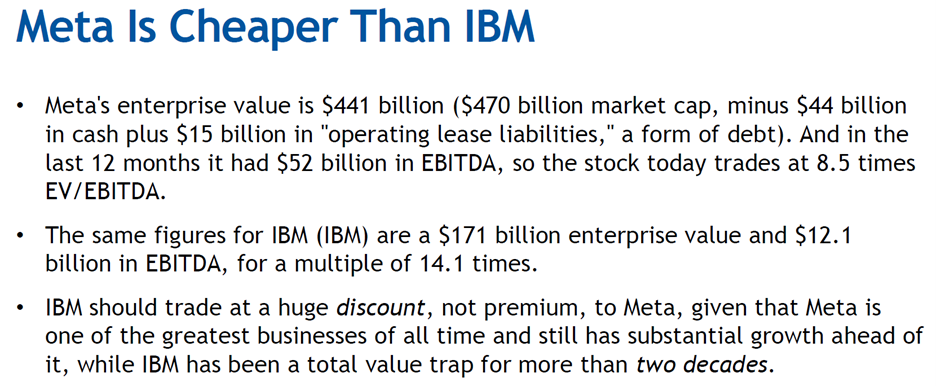

It's not even cheap, as I noted in this slide in my July 7 presentation on Meta Platforms (META) at the Value Investing Seminar:

In summary, continue to avoid IBM, which continues to be a melting ice cube that defines the term "value trap."

4) Yesterday, Tesla (TSLA) CEO Elon Musk suffered the first of what I expect will be many legal setbacks in his sleazy attempt to weasel out of his agreement to buy Twitter (TWTR)...

The judge who will decide the case, Chancellor Kathaleen McCormick of the Delaware Chancery Court, rejected his attempt to delay the trial until February: Twitter-Musk Trial Set for October in Lawsuit Over Stalled $44 Billion Takeover. Excerpt:

Twitter won its first legal fight against Elon Musk on Tuesday when a Delaware judge granted the company's request to fast-track its lawsuit seeking to compel the world's richest person to complete his $44 billion purchase of the social media site.

Chancellor Kathaleen St. Jude McCormick, the chief judge of the Delaware Chancery Court, ordered a five-day trial in October, over Mr. Musk's objections. Chancellor McCormick said the case should be resolved quickly, agreeing with Twitter's claim that it could be harmed by uncertainty about its future as a public company.

"Those concerns are on full display in the present case," Chancellor McCormick said. "Typically, the longer the merger transaction remains in limbo, the larger the cloud of uncertainty cast over the company and the greater the risk of irreparable harm to the sellers."

A friend who listened to yesterday's hearing commented:

While it is true that Twitter's lawyer sounded like Walter Cronkite and that Musk's lawyer sounded like someone defending a New Jersey mob boss on The Sopranos, I am taking the position that the style did not matter at all in terms of this outcome.

The judge had already written her opinion before today's hearing. She just read it. Nothing that was said in oral argument today changed her mind one millimeter. She had already made up her mind when her opinion was written, likely yesterday.

Another friend added: "I would note that she seemed to have no patience for Musk's lawyers."

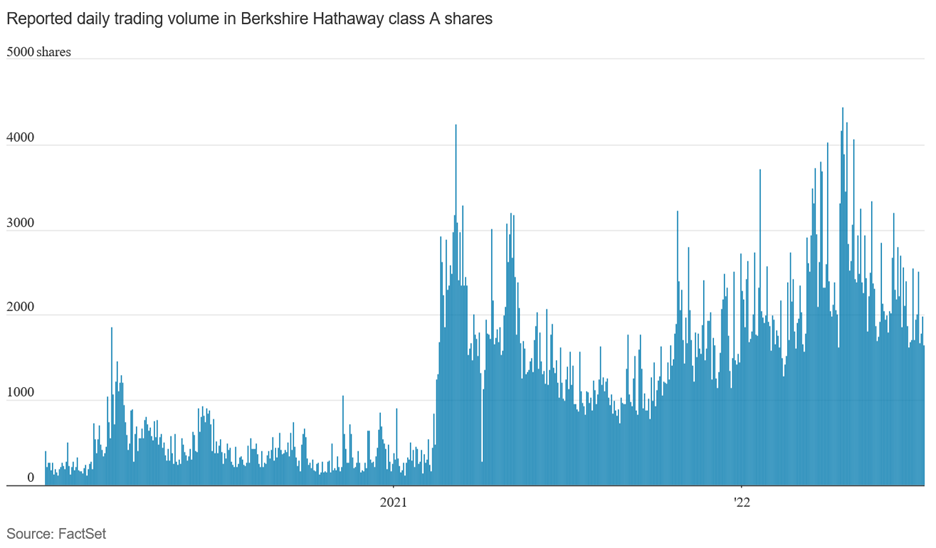

5) Mystery solved! Robinhood Was Behind Phantom Surge in Berkshire Hathaway Trade Volume, Study Finds. Excerpt:

A sudden surge in trading volumes in class A shares of Warren Buffett's Berkshire Hathaway (BRK-A) confounded investors last year. Now, a trio of academics say they have solved the stock market mystery.

The jump in volumes was an illusion caused by a change in how Robinhood (HOOD) reports fractional trades, according to a new study expected to be released Wednesday.

The study suggests that volume data for many other stocks were inflated during the pandemic. Its authors blamed a "misguided" Financial Industry Regulatory Authority rule for how brokers should report fractional trades.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.