Our event last night; Twitter Clears U.S. Antitrust Review; Why I doubled my bet on the Celtics; Implications for investing

1) We had a great event with our subscribers last night, during which my colleague Berna Barshay and I gave presentations on five of our favorite stocks and discussed many more during the Q&A (our other colleague Enrique Abeyta was sick, so he couldn't make it).

We'll soon be sharing our slides and a video of the entire event with Empire Financial Research subscribers, so they can benefit from our latest thinking and take advantage of some (in my opinion) incredible stock ideas.

If you would like to see what we presented but aren't a subscriber, you can become one (and receive a year of our flagship Empire Stock Investor newsletter) for only $49 by clicking here.

2) One of the ideas I shared during the Q&A was Twitter (TWTR), which I've highlighted in numerous e-mails (most recently last Thursday).

I have even more conviction today that the deal will go through at or very near the agreed-upon price of $54.20 per share (versus $40 per share currently) after the company cleared the U.S. antitrust (Hart-Scott-Rodino) review last night: Twitter Clears U.S. Antitrust Review on $44 Billion Musk Deal. Excerpt:

Twitter has passed the U.S. antitrust review, clearing a hurdle for its acquisition by Elon Musk in a proposed $44 billion deal.

Approval was largely expected but the transaction is still subject to acceptance by Twitter shareholders and other regulatory reviews.

Under U.S. merger law, Musk was required to notify the Federal Trade Commission and the U.S. Department of Justice antitrust division to allow an investigation into potential antitrust concerns. The 30-day review period expired Thursday night.

3) In yesterday's e-mail, I discussed my wagers on the Boston Celtics to win the NBA championship – first $200 at the start of the playoffs and then another $1,000 a few days ago before the finals started.

I'll admit that these were, in part, emotional bets because I really want the Celtics to win, as they've been my favorite NBA team since I was a kid.

But to be clear, I understand that sports betting is a sucker's game 99% of the time... so I wouldn't have bet even $1 if I didn't think the odds were heavily in my favor. As I explained yesterday:

But the Celtics are still underdogs, with betting sites giving them +140 odds, or only a 42% chance to win the championship, meaning a $100 bet would pay $240 ($140 in profit).

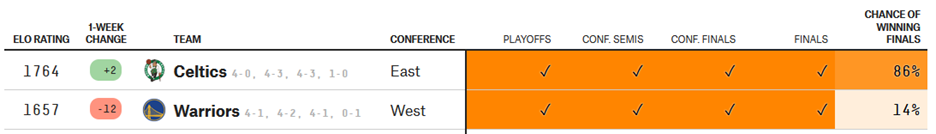

But FiveThirtyEight – using two different statistical models (player ratings and "Elo" forecast) – has the Celtics at 80% and 68% likely to win, respectively, far above the oddsmakers' 42% chance, so I bet another $1,000.

Last night, in Game 1 on the Warriors' home court, the Celtics were down 12 going into the fourth quarter... but pulled off a record-setting comeback to win 120-108.

This clearly shifts the odds on who will win this seven-game series in favor of the Celtics and, sure enough, the betting sites now have the Celtics 62% (-165) likely to win.

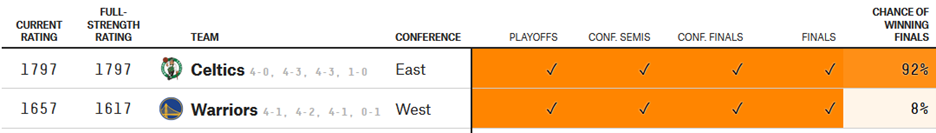

However, FiveThirtyEight now has the Celtics as an overwhelming favorite – at 92% and 86%, respectively, using its player ratings and "Elo" forecast models, as you can see here:

In other words, there's still an enormous 24 to 30 percentage point gap between the odds that bettors are assigning to this outcome versus the unemotional computers at FiveThirtyEight. (Note that the betting sites don't have an opinion on the outcome – they simply set, and adjust as needed, odds that result in an equal amount of money being bet on both sides, so it's bettors who determine the odds.)

Setting aside my emotions, I think the bettors are wrong and the computers are right, so this morning I went "all in"...

I had already wagered everything I had in my accounts at Caesars, FanDuel, PointsBet, and Wynn ($1,200), so I bet everything I had left at DraftKings, BetRiver, and MGM ($1,289) plus took advantage of a special offer from FanDuel (deposit $150 of new money into my account and receive a $75 free bet – that's $225 total) to bet another $1,439.

So, if the Warriors come back to win the championship, all seven of my accounts will be at zero (which is fine with me). But if the Celtics win, I'll have healthy profits in all of them (my $2,639 in total bets will be worth $6,416, for a $3,777 profit).

To be clear, I'm not actually going all in...

If I wanted, I could bet an almost unlimited amount of money on this series, but I'm choosing to only wager a microscopic portion of my net worth because I'm mostly just having fun... So if you make this bet, make sure it's an amount you won't mind losing.

4) I'm spending a lot of time describing what I'm doing because there are three critically important lessons here that apply to investing...

First – and most important – only bet when you're convinced that the odds are heavily (not just slightly) in your favor.

Second, size your bets appropriately. Note that at the beginning of the playoffs, when FiveThirtyEight had the Celtics at 35% likely to win it all versus the 12% chance assigned by bettors, I only bet $200 because there was a 65% chance that I'd lose all my money.

This is similar to investing in a high-risk, high-reward stock (of which there are hundreds in the market today). For example, let's say you've done the work on a particular company and you think the chances of different outcomes for its stock are as follows:

- 60% chance you lose all your money

- 20% chance the stock is flat

- 10% chance it doubles

- 10% chance it goes up 10 times

The expected value here is a highly attractive 50% return (-60+0+10+100). But the most likely outcome is that you lose all of your money, so you have to size it small and look to find many bets like this to spread your risk.

Think about it this way: How much would you bet if I offered you one coin flip and, if tails, you lose your bet or, if heads, I pay you double your bet?

I might wager a few thousand dollars...

But if you offered me 100 coin flips, I'd take 100% of my net worth and borrow every penny I could and bet 1% on each coin flip...

Lastly, it's important to adjust your bets when the odds change.

I bet $200 on the Celtics at the start of the playoffs, $1,000 before the start of the finals, and another $1,439 this morning.

Note that I did two things: First, I didn't hesitate to add to my bet.

How I wish I'd applied this thinking more often when I was running a hedge fund! More times than I care to remember, I'd buy, say, a 1% position in a risky stock at $5, the company would report a few quarters of great earnings, far exceeding my expectations and removing much of the risk, the stock would double to $10... and I'd sit there, feeling good – but not adding to what was still a tiny 2% position, even though I should have been!

Second, note that even though there was a fairly consistent 23- to 30-percentage point spread in my favor (if you believe FiveThirtyEight) each time I bet, I wagered increasing amounts because the risk-reward equation had changed.

The payoff from my bets this morning is lower than my earlier bets, but the risk is much lower – hence a larger bet.

Similarly, in the nearly two decades that I ran my hedge fund, Berkshire Hathaway (BRK-B) was typically my largest position at more than 10% of assets (at one time, it was more than 30%) because, while it was rarely screaming cheap, I considered it the world's safest stock (and still do!). Thus, I could supersize the position. But there are very few stocks you want to do this with...

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.