Prediction Summit 2022; Thoughts on the market pullback; My interview on cannabis stocks; Free rapid tests

1) For the first time ever, I'm sitting down with my colleagues Enrique Abeyta, Berna Barshay, and Herb Greenberg to have a free-wheeling, wide-ranging discussion that we're calling "Prediction Summit 2022."

Based on our collective 100-plus years of experience, we'll be sharing our outlook for the market, our favorite (and least favorite) stocks and sectors, and our thoughts on numerous other topics including inflation, high-growth stocks, cryptocurrencies, SPACs, and more.

The Summit will air this coming Tuesday, January 25 at 8 p.m. Eastern time.

It's completely free to attend, but you need to sign up ahead of time – to do so, just click here. It'll only take a moment.

We look forward to seeing you there!

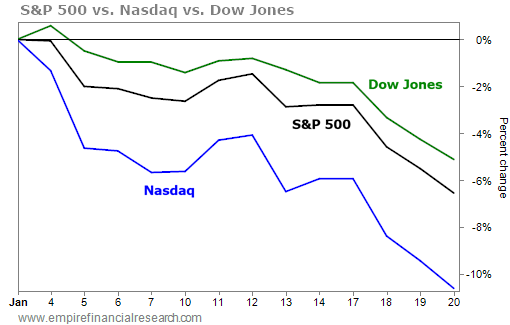

2) The markets are off to a rocky start this year, with the tech-heavy Nasdaq Composite Index down around 10% year to date and the Dow Jones Industrial Average and S&P 500 Index down roughly half that, as you can see in this chart:

But the experience for the average investor is much worse, however, as the broad-based indexes mask the carnage in some areas – such as profitless, high-growth stocks. Cathie Woods' ARK Innovation Fund (ARKK), which is a good proxy for these stocks, is down 53% from its peak just under a year ago, as you can see in this chart:

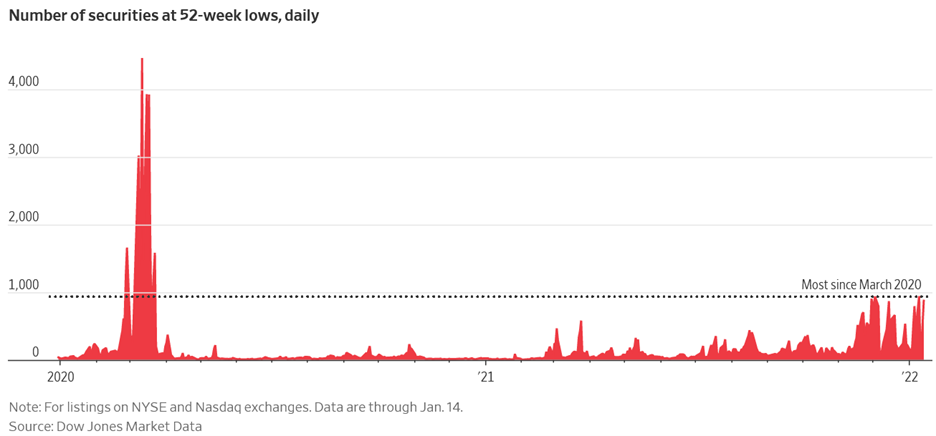

You can also see the underlying weakness in these two clever charts in this Wall Street Journal article, Giant Stock Swings Kick Off 2022. The first shows the big surge over the past couple of months in stocks hitting 52-week lows each day:

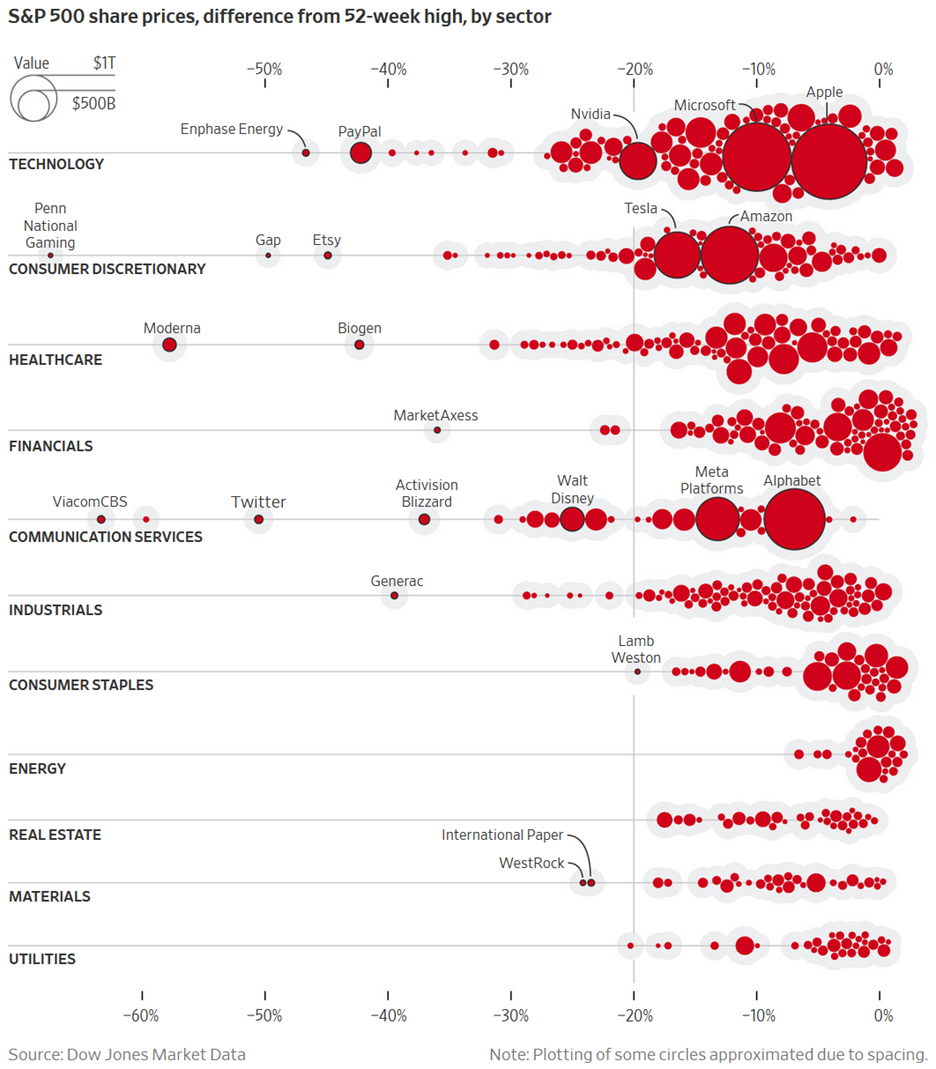

And the second shows how much each stock is below its 52-week high, by market cap and sector:

You can see how a few mega-cap stocks like Apple (AAPL), Alphabet (GOOGL), and Microsoft (MSFT) are only down 5% to 10% from their all-time highs, but many smaller stocks are down 20% or more. This graphic also shows the weakness in the tech and biotech sectors and the strength among energy stocks, almost all of which are within a few percentage points of their 52-week highs (not surprisingly, as Oil Prices Hit Seven-Year High on Rising Geopolitical Tensions).

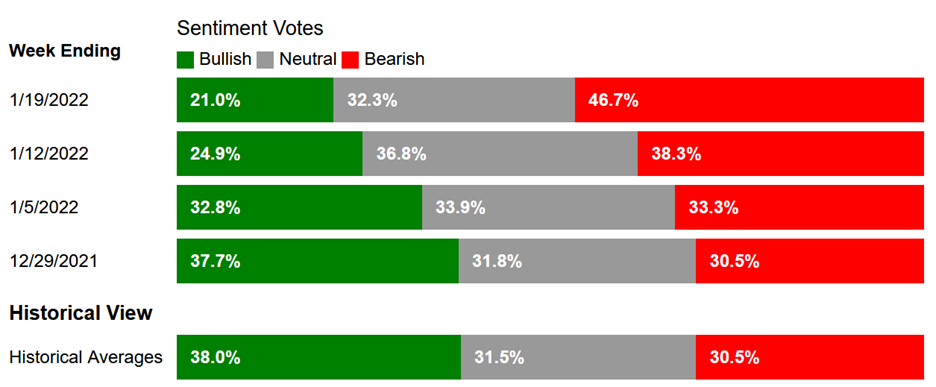

Also not surprisingly, retail investors are the most bearish they've been in the past year, well above the 35-year average, as measured by the weekly AAII Investor Sentiment Survey:

So how does all of this affect my investment outlook? Not at all.

Yes, a bunch of stocks and a few sectors have gotten whacked. But in most cases, I think this is healthy... as many had experienced silly bubbles. And some of this was highly foreseeable – for example, just read the multiple warnings, starting last February, that Berna and I gave our readers about ARKK (summarized here).

One of the most important things investors need to do (which I learned too late to save my hedge fund business) is ride bull markets and not get scared out of the markets by short-term volatility or pullbacks and the ever-present chorus of those predicting Armageddon.

The long bull market we've been in (with only a few hiccups) since March 2009 will, of course, come to an end at some point and turn into a bear market.

But I don't think we're there yet. I continue to believe that we're in the 7th or 8th inning – not the 9th inning.

It's also important to keep in mind that sudden bear markets are very rare. Rather, they usually happen slowly, giving wise and experienced investors plenty of time to reposition their portfolios defensively to ride out the storm.

Enrique, Berna, Herb and I are monitoring everything closely and we'll let you know when our outlook changes.

3) While I was certainly early in turning bullish on the cannabis sector, I remain confident that I'll eventually be rewarded for many reasons that I discussed in an interview I did last week, about which I wrote the following in last Friday's e-mail:

In my December 29 e-mail, I wrote that the AdvisorShares Pure U.S. Cannabis Fund (MSOS) "is my favorite pick for 2022, for reasons my friend Doug Kass outlined last week."

Following up on that, the two guys who host the Benzinga Cannabis Hour invited me on their show yesterday, which you can watch here (I come on at 6:30).

I really enjoyed our conversation. Over 36 minutes, we not only discussed why I think the cannabis sector is attractive, but we also touched on personal finance, especially to young people, as I shared the investment advice I gave my two older daughters (ages 25 and 22) when they graduated from college.

For those of you who don't have time to watch the 43-minute video, Benzinga posted an article about it, with a number of quotes: Whitney Tilson Bullish On US Cannabis Stocks: 'The Sentiment Is Changing.' Excerpt:

Tilson described himself as an "old school value investor," who "learned investing at the feet of the masters, like Buffet and Munger," adding that he is always trying to expand his mind and remain open to new investment opportunities.

"I just listed my number one stock pick for my newsletter business for this year... and it's AdvisorShares Pure U.S. Cannabis Fund"...

He added that he remains bullish on the cannabis industry because "the sentiment is changing" along with cannabis legislation.

Tilson qualified the advance of legalization in states as irreversible. "Just look at the surveys of Americans who favor legalizing cannabis. It's gone up dramatically, and politicians will follow the voters, eventually, for sure, and the regulators will follow the politicians, and the institutional investors will come along as well."

Setting and Identifying Trends

"I like identifying trends early. As an investor, the single best thing you can do is find an enormous trend and get in early, before all the institutional money comes in," Tilson told Cannabis Hour hosts Javier Hasse and Elliot Lane.

"In particular if you can get in when the sentiment is crappy and the valuations are low!" Tilson added...

Tilson pointed out that younger investors have grown up in the longest bull market in history. "You have been conditioned to buy every dip and that is not the way the stock market works. The meme stocks for example. Just because something goes from 10x revenues to 20x and then trades back to 10x revenue does not mean that stock is cheap!"

4) Every household (not person) in the U.S. can now order four free rapid (antigen) COVID-19 tests, which should arrive in the next week or two.

Here is the government website (www.covidtests.gov) and here is the order form (https://special.usps.com/testkits), which took less than 30 seconds to fill out (no credit card required).

My daughter (who lives with us) and I both ordered tests – I'll let you know if the government's computer systems pick up our inadvertent double order...

5) I have no way of knowing, but I would guess that at least half of my readership is over the age of 60, so I wanted to pass along these two recent thoughtful articles in the New York Times and Wall Street Journal, respectively... but will refrain from commenting on or excerpting from them to avoid offending anyone (and getting this past my editors!):

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.