Replay of last night's Prediction Summit 2022; Tesla Now Runs the Most Productive Auto Factory in America; I toured that factory in April 2013, a 105-bagger ago; TaaS; EV market share soaring; Chinese Stocks Glimpse Light at the End of the Tunnel; Convictions at Real-Estate Firm Are Win for Investor Kyle Bass

1) Nearly 200,000 people signed up to attend our Prediction Summit 2022 event that I hosted last night with my colleagues Enrique Abeyta, Berna Barshay, and Herb Greenberg.

We added it up – our combined 100-plus years of experience to help you secure your financial legacy beginning immediately.

We shared our boldest predictions on the biggest financial trends in 2022, the stocks and sectors that have us licking our chops (and those we're still avoiding), and our thoughts on numerous other topics – including inflation, the prospects for high-growth stocks, the cannabis and ESG sectors, cryptocurrencies, SPACs, and more.

It was so enjoyable and thought-provoking that afterward the four of us agreed that we should do this more regularly...

If you missed it, you still have time to watch a replay of it free of charge here.

2) I don't have an opinion on Tesla's (TSLA) earnings – which the company will report after the close today – but this is astoundingly impressive, especially since this is Tesla's least productive factory: Tesla Now Runs the Most Productive Auto Factory in America. Excerpt:

Elon Musk has a very specific vision for the ideal factory: densely packed, vertically integrated and unusually massive. During Tesla's early days of mass production, he was chided for what was perceived as hubris. Now, Tesla's original California factory has achieved a brag-worthy title: the most productive auto plant in North America.

Last year Tesla's factory in Fremont, California, produced an average of 8,550 cars a week. That's more than Toyota Motor's (TM) juggernaut in Georgetown, Kentucky (8,427 cars a week), BMW's Spartanburg hub in South Carolina (8,343) or Ford Motor's (F) iconic truck plant in Dearborn, Michigan (5,564), according to a Bloomberg analysis of production data from more than 70 manufacturing facilities.

In a year when auto production around the world was stifled by supply-chain shortages, Tesla expanded its global production by 83% over 2020 levels. Its other auto factory, in Shanghai, tripled output to nearly 486,000. In the coming weeks, Tesla is expected to announce the start of production at two new factories – Gigafactory Berlin-Brandenburg, its first in Europe, and Gigafactory Texas in Austin. Musk said in October that he plans to further increase production in Fremont and Shanghai by 50%.

I took a tour of the Fremont factory on April 11, 2013 with my buddy Patrick Blott and my cousin's wife – here's a picture of us that day:

I was very impressed with the factory, but for some stupid reason I didn't buy the stock, which was a very costly mistake. Adjusted for the subsequent 5:1 split, it closed that day at $8.72, meaning it's up 105 times since then – ARRRRHHHH!!!!

3) Almost exactly two years ago on February 5, 2020, we released an in-depth video detailing why we were incredibly bullish on electric and autonomous vehicles, and how these new technologies would lead to the creation of an enormous, world-changing new industry called Transportation as a Service ("TaaS"). You can watch the latest version of it here.

At the end of the video, we made a special offer to receive a year of our flagship Empire Stock Investor newsletter for only $49, which also included three reports recommending our five favorite EV/AV stocks, which have risen an average of 100% (through yesterday's close) versus only 30% for the S&P 500 Index. (The offer is still open – to take advantage of it, just click here.)

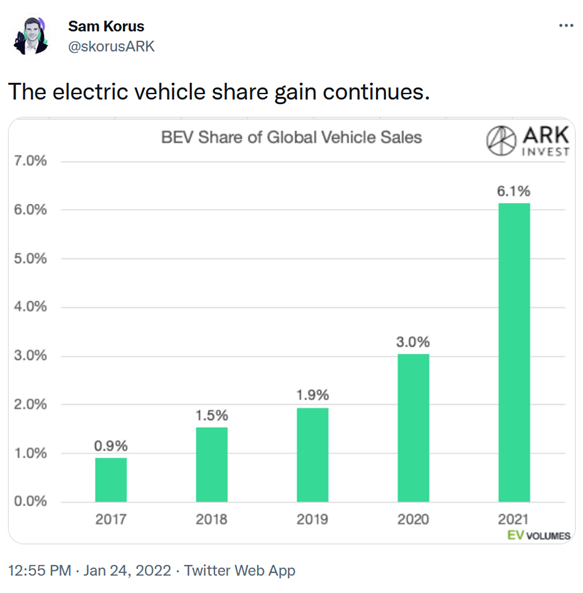

Our thesis is playing out pretty much as we expected. Autonomous driving technology is advancing rapidly and being incorporated into more and more vehicles, and electric-vehicle sales and market share are in the early stages of hockey-stick growth, as you can see in this chart:

Click here to read the rest of the missive I sent yesterday to my Tesla e-mail list (which you can join by sending a blank e-mail to: tsla-subscribe@mailer.kasecapital.com).

4) I also have a smaller, personal e-mail list for articles and commentary related to China (to join it, simply send a blank email to: china-subscribe@mailer.kasecapital.com).

Personally, I don't invest in China because it's outside my circle of competence, but those who do might be interested in this Wall Street Journal "Heard on the Street" article: Chinese Stocks Glimpse Light at the End of the Tunnel. Excerpt:

Chinese stocks had a terrible 2021. This year could be better, in no small part because China's government finally looks ready to relent on some of the fierce policy measures that hammered them in the first place.

U.S. investors in the market for a bit of diversification in the face of an increasingly hawkish Fed could do worse than cast their eyes east.

Chinese indexes are off to a decent start in 2022: The MSCI China has gained 2.5% so far versus a 7.7% decline for the S&P 500. U.S. stocks have been hit hard by investor perceptions that the Federal Reserve could raise rates sooner and faster than seemed likely just a few weeks ago.

Historically, Chinese stocks have usually performed poorly early on in Fed tightening cycles, according to Goldman Sachs. But this time around, China's central bank will likely buck the tightening trend of its peers in most other major economies. The People's Bank of China has started easing more aggressively since late 2021. Last week it cut a few key lending rates, including one that is commonly used for mortgages.

That is a sign that Beijing's policy priorities are shifting: The government is getting increasingly uncomfortable with the severe economic drag from the property downturn, which began in the middle of last year.

5) Kudos to my old friend Kyle Bass of hedge fund Hayman Capital, who has been completely vindicated in his activist short campaign against a fraudulent Texas real-estate lender: Convictions at Real-Estate Firm Are Win for Investor Kyle Bass. Excerpt:

A federal jury found four executives of Texas real-estate lender United Development Funding ("UDF") guilty of fraud. The verdict was a vindication for hedge-fund investor Kyle Bass, who made millions wagering against the company but faced a lawsuit and a government investigation.

Mr. Bass accused UDF in 2016 of operating a Ponzi scheme. His Dallas-based Hayman Capital Management LP made $34 million shorting the shares. But the firm came under investigation by U.S. securities regulators, who examined whether Mr. Bass's criticism of UDF – including his allegations of widespread undisclosed problems in its loan portfolio – conveyed false or misleading statements that amounted to market manipulation. The SEC closed its investigation into Mr. Bass's firm and took no action, he says.

The federal jury convicted UDF Chief Executive Hollis Morrison Greenlaw and three other executives of 10 counts, including conspiracy to commit wire fraud affecting a financial institution, conspiracy to commit securities fraud, and securities fraud.

Here's what I wrote in my November 25, 2020 e-mail about this:

I've been writing frequently about activist short-sellers, in part because I think they're healthy for our markets, and because I want to warn my readers about stocks that could blow up in their faces.

I also have a great deal of respect for these folks. What they do is extremely hard and dangerous, not only because of the inherent risk in short selling, but also because – in speaking out and sharing their research and conclusions publicly – they risk being pilloried in the media, investigated by regulators, and attacked by the companies they're targeting.

This BNN Bloomberg article is an in-depth look at one such case, when Kyle Bass of Hayman Capital went after a Texas real estate investment trust called United Development Funding – and, as a result, became involved in a lawsuit filed by UDF and is under investigation from the local Texas U.S. Securities and Exchange Commission office: Kyle Bass's Texas Feud Spotlights Short-Selling Tactics.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.