Report from my 25th Berkshire Hathaway annual meeting; CNBC hit; My updated estimate of Berkshire’s intrinsic value; My fans trolling my daughters

1) I attended my 25th consecutive Berkshire Hathaway (BRK-B) annual meeting over the weekend and, as always, had a ball.

For a number of years, I've been calling Berkshire "America's No. 1 Retirement Stock" because it offers a unique combination of safety, growth, and undervaluation. While the undervaluation isn't as great as it once was – 11% today (see analysis below), thanks to its huge outperformance this year (Berkshire is up 7.5% versus a 13.3% decline in the S&P 500 Index – I still think Berkshire should be the bedrock of any conservative portfolio).

As I've done for the past dozen or so meetings, I hosted a cocktail party on Friday evening (joined for the first time by my colleague Berna Barshay) for people who had traveled from all over the world to learn from Warren Buffett and Charlie Munger. It was open to everyone, and more than 700 people attended during the course of the evening. We also hosted a private dinner for our lifetime subscribers on Saturday evening after the meeting.

It was wonderful meeting so many new, interesting people as well as catching up with old friends that I hadn't seen in at least three years (the last two meetings were virtual due to COVID-19).

I draw so much energy from meeting and talking to folks, plus it was nice hearing from many of them that they really enjoy and learn from my daily e-mails – not just the investing stuff, which is the focus, but also what I add at the end: the life lessons, travel tips, tales of my frequent adventures and travels, etc.

Here are pictures from the auditorium and me yukking it up at the Oriental Trading, NetJets, and GEICO booths:

2) I did a four-minute hit on CNBC before the meeting started about Buffett's massive $51 billion of stock purchases during the quarter ($41 billion net of $10 billion in sales), the largest of which was buying another roughly $20 billion of Chevron (CVX) stock: Warren Buffett makes massive investment in Chevron – now one of Berkshire's top positions.

3) During the hit, I also shared my analysis of Berkshire's first-quarter earnings (earnings release and 10-Q here and here) and my updated estimate of its intrinsic value.

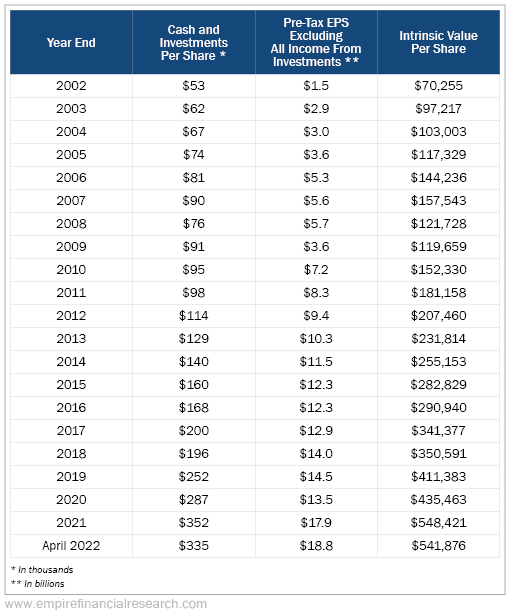

I have used a consistent method to estimate Berkshire's intrinsic value for the past two decades, which I believe is similar to the one Buffett uses: take the cash and investments per share and add the value of the operating businesses.

At the end of the first quarter, cash and investments were $363,000 per A-share, but Berkshire's stock portfolio declined in April by $28,000 per share, so that's $335,000 today.

Berkshire's pretax operating earnings over the past 12 months through the first quarter, including an estimate for normalized insurance earnings, were $18.8 billion per share.

To this, I apply a conservative below-market multiple of 11 times to arrive at a value of $207,000 per share.

Thus, my estimate of Berkshire's intrinsic value is $335,000 plus $207,000, for a total of $542,000.

This table shows the same calculation for each year-end since 2002:

The A-shares closed Friday at $484,340, meaning that I believe the stock is trading at an 11% discount to its intrinsic value.

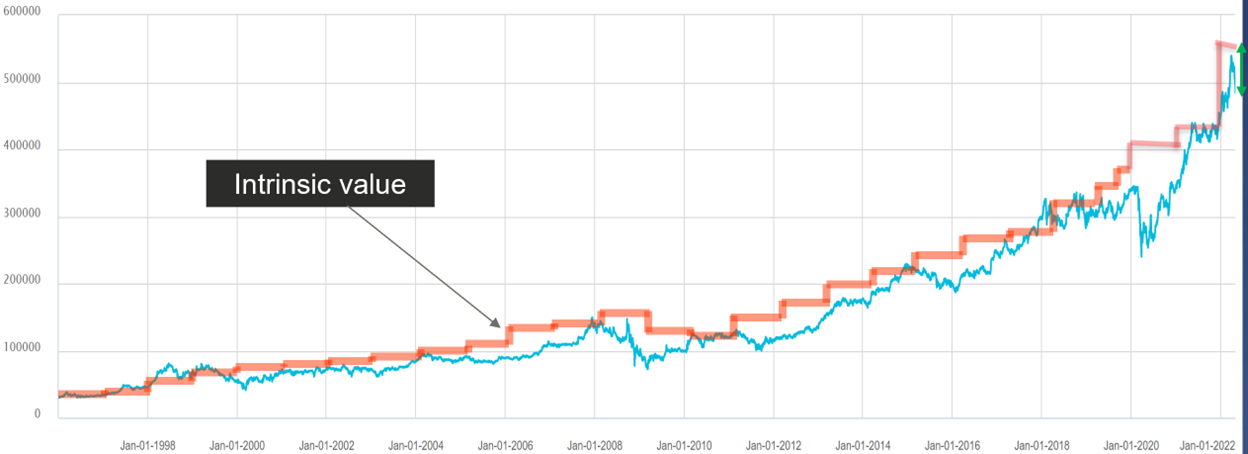

This chart shows Berkshire's share price (blue line) relative to my estimate of its intrinsic value (red line, from the table above) going all the way back to 1996:

In upcoming e-mails, I'll share my updated deep-dive analysis of Berkshire, the highlights of what Buffett and Munger had to say, and their strange response to the second-to-last question my friend and former partner Glenn Tongue asked about share repurchases.

4) I love this so much... (To see why, you first need to understand that, most of the time, my three daughters – who are 26, 23, and almost 20 – think I'm an idiot and don't listen to anything I have to say.)

There was such a stark contrast between what I was hearing on Friday night at our cocktail party versus what I usually hear from my daughters that I took three short videos just for them (posted here – only one minute total).

The moment after I took them, I texted them to my daughters and was delighted to get exactly the responses I was hoping for – LOL! 🤣🤣🤣

- They're lying

- They all look like liars to me

- You've brainwashed them

- How much did you pay them?

- You've gotta stop going out to these meetings

- I don't take advice from fellow freshmen

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.