Rising Bond Yields Change the Calculus for Stocks; You can get history to say whatever you want; Chancellor McCormick's ruling against Musk; Electric Vehicles Took Off. Car Makers Weren't Ready; Man saves dog

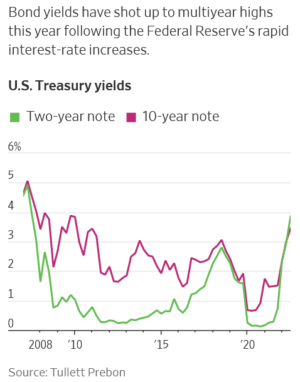

1) Yesterday, the two-year Treasury note hit a 15-year high and the 10-year reached an 11-year high, as this chart from a Wall Street Journal article shows:

This is great news for retirees and conservative investors, who are now earning 3.5% to 4.0% on their savings.

But what about the effect on stocks?

Here, the story is mixed... though overall higher rates are a net negative for a variety of reasons, including removing the TINA ("there is no alternative") effect. Here's the Wall Street Journal article with some color: Rising Bond Yields Change the Calculus for Stocks. Excerpt:

Meanwhile, the Fed's interest-rate increases also threaten to put more pressure on an already slowing economy. Last week, mortgage rates jumped above 6% for the first time since the 2008 financial crisis. Rising borrowing costs have led to declining sales of existing homes for six straight months.

Consumers' spending on other areas, including clothes, food, and big-ticket items like cars, has remained strong. Corporate earnings have also proved to be better than feared, even with companies being hit by higher costs for everything from freight to raw materials to wages, and the labor market has continued to be a bright spot for the economy.

Yet investors say they can't help but wonder how long those trends will last, especially since the Fed doesn't look anywhere close to done with its rate increases.

2) Though I often discuss macro things like interest rates, inflation, and where the market might be going, I mainly focus on bottoms-up stock picking, where my expertise lies. This tweet reminds me that "you can get history to say whatever you want":

3) The judge hearing Twitter's (TWTR) case against Elon Musk, Chancellor Kathaleen McCormick, handed down a brief six-page ruling yesterday related to discovery motions and pretty much slapped Musk around. She concluded:

Defendants took a similar approach in the last motion for reargument, criticizing me for failing to unilaterally limit Defendants' sprawling orchard of discovery requests to order Plaintiff to produce the "low-hanging fruit."

Defendants appear to be under the impression that they can take unreasonable positions in their discovery requests, when conferring with their opponents, and in motion practice, and then, through reargument, propose a more reasonable approach. A motion for reargument is not a vehicle for renegotiation. A court makes rulings, not proposals for the parties to counter. Defendants' approach wastes judicial and litigant resources.

Defendants should be forewarned that I will give future motions for reargument the attention they deserve. If a motion appears to have merit, then I will address it promptly. Otherwise, I will take the motion under advisement for the full 90-day period and address the motion, to the extent a ruling remains warranted, in connection with post-trial briefing.

My friend commented:

Chancellor McCormick did the equivalent of handing Musk a yellow card in soccer in her ruling today.

In summary, she said: "You're spamming the court with ridiculous requests for reconsiderations on my rulings on the various motions. I really don't have to address any more of this wasteful incoming spam from your lawyers, so I have the option of simply ignoring them until I summarily dismiss them all when I write my verdict after the trial has been concluded."

Ouch, ouch, ouch, ouch, quintuple ouch!

4) This story on the front page of yesterday's WSJ underscores how far behind the big automakers are on the production front – and how prescient Musk was in anticipating high demand: Electric Vehicles Took Off. Car Makers Weren't Ready. Excerpt:

A few years ago, auto executives weren't sure there would be enough buyers for plug-in electric models. Now, they worry they can't build them fast enough, while they intensify a multibillion-dollar rush to accelerate timelines and bring factories online.

EVs account for only about 6% of overall U.S. vehicle sales. But that percentage has tripled in the last two years, while sales of other types of vehicles have declined, according to research firm Motor Intelligence. General Motors, Ford, Rivian Automotive, and other auto makers say they have waiting lists of longer than a year for their new electric models.

In July, five of the six fastest-selling vehicles in the U.S. were electrics or plug-in hybrids, which pair a battery with a gas engine, according to data from consumer site Edmunds.com. EVs sold in 19 days on average in July compared with 47 days a year earlier – and went four days faster than internal combustion vehicles, Edmunds data show.

"With EVs, right now it's like, 'You build it, and they come,'" said Steven Center, operations chief for Kia Corp.'s U.S. business. He has been surprised by strong demand for the Korean auto maker's recently released electric SUV, the EV6 SUV, which has a backlog of three to six months. "We're trying to electrify the lineup as quickly as possible."

Federal and state tax breaks have helped stoke consumer demand for EVs. The recently signed law dubbed the Inflation Reduction Act extends until 2032 a $7,500 federal tax credit, in place since 2009. It expands availability of the subsidy to some buyers while also imposing income and price caps to qualify, as well as domestic-manufacturing requirements.

The pressure is on auto makers to grab EV market share early and narrow the gap with front-runner Tesla. Executives from GM, Ford, and VW have all said they believe they can pass Tesla. Over the summer, Volkswagen ousted Chief Executive Herbert Diess in part for stumbling on a software strategy that delayed some EV rollouts.

Car companies find themselves behind in the supply-demand balance in part because many lowballed early EV production volumes, hesitant to go big on a technology that carries skinnier profit margins than internal-combustion vehicles. When EV demand took off during the pandemic, it caught many auto executives off guard.

(If you wish to subscribe to my Tesla e-mail list, simply send a blank email to: tsla-subscribe@mailer.kasecapital.com.)

I've been pounding the table on the future of transportation with EVs and autonomous vehicles ("AVs") – a trend I've been calling "Transportation as a Service" ("TaaS") – since February 2020.

In a decade or less, I predict it will be hard to imagine how we survived before this transformation took place – just as today it's hard to imagine how we functioned before smartphones. And I believe it's all going to happen much faster than almost anyone thinks.

In fact, I put together a special presentation outlining my bullish thesis – including the name and ticker symbol of my favorite way to take advantage of this trend today. You can watch it free of charge right here.

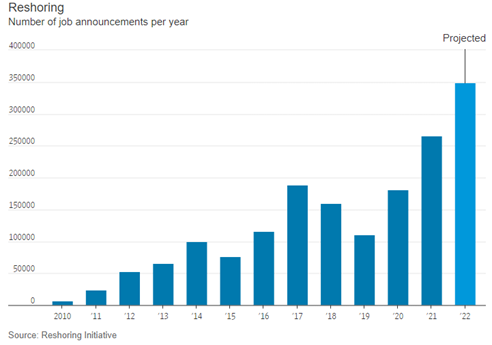

5) I meant to include this WSJ article in yesterday's e-mail about a wonderful trend: U.S. Companies on Pace to Bring Home Record Number of Overseas Jobs. Excerpt:

U.S. companies are bringing workforces and supply chains home at a historic pace.

American companies are on pace to reshore, or return to the U.S., nearly 350,000 jobs this year, according to a report published Friday by the Reshoring Initiative. That would be the highest number on record since the group began tracking the data in 2010. The Reshoring Initiative lobbies for bringing manufacturing jobs back to the U.S.

Over the past month, dozens of companies have said they had plans to build new factories or start new manufacturing projects in the U.S.

6) I love stories like this! Watch the video here.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.