Ryan Cohen crashes BBBY; Avoid heavily shorted names; Is GME next?; Why I'm not going to start short selling; Why I think Jake Freeman is lucky, not a crook; Tether Announces Alignment With Top Five Accounting Firm; My upcoming tennis matches

1) Wow...

When I wrote on Wednesday that "Today's spike in BBBY smells like a blow-off top to me, and I expect the stock will be back under $10 per share very soon," I thought it might take a month or two, or perhaps a week or two, but never dreamed that my prediction – a nearly 70% decline – would come so close to coming true within two days!

But the massive collapse is exactly what happened after Ryan Cohen, Bed Bath and Beyond's (BBBY) largest shareholder at 11.8%, disclosed in an SEC filing after the close yesterday that he had sold his entire position, exactly as I predicted in yesterday's e-mail, thus completing what appears to be a blatant, despicable pump-and-dump scheme.

Have we really become a country in which rich folks can flagrantly violate the law and get away with it as long as they do it openly, in public filings and tweets? For example, consider Elon Musk trying to weasel his way out of the contract he signed to buy Twitter (TWTR)... And don't even get me started on politicians from both parties!

I sure as hell hope we haven't come to this... So as a starting point, here's hoping the SEC and the Delaware Chancery Court nail Cohen and Musk!

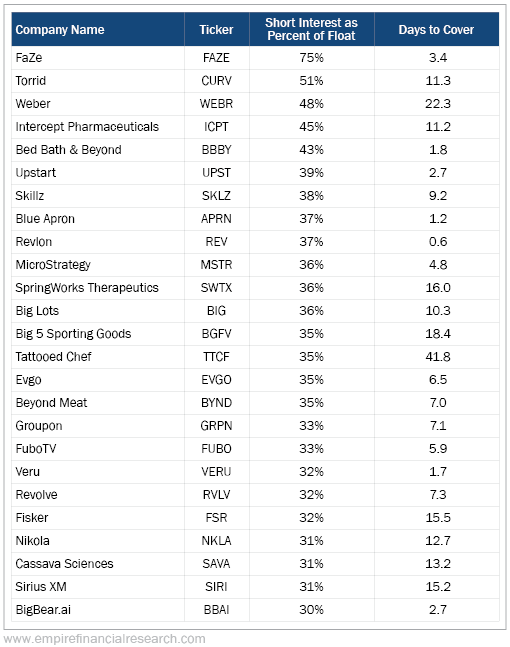

2) Another reason BBBY is moving so violently is because it's the fifth-most heavily shorted stock in the entire market based on how many shares are short as a percentage of the float. Here's a list of the top 25 such stocks (hat tip to Outset Global Trading):

I actually think a few of these stocks are interesting, but in general you would be well advised to run from heavily shorted names. Given how brutally difficult short selling is (see below), those who do it tend to be among the savviest investors in the market. Thus, if you own a heavily shorted name, you're betting against some very smart folks, which occasionally works out (especially if there's a short squeeze), but you're far more likely to get crushed.

And when I see speculators once again playing the "squeeze the shorts" game, it's a sure sign that we're near a top in these stocks...

3) Given that Cohen is chairman of the board of GameStop (GME), it's not surprising that investors are also dumping that stock as well today (it was down nearly 10% this morning). If he's apparently willing to screw BBBY investors so viciously, why not GME ones as well?

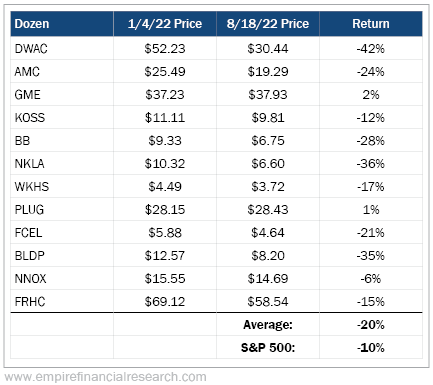

Now that BBBY has cratered, GME is back among my top three stocks to avoid, along with Digital World Acquisition (DWAC) and AMC Entertainment (AMC), as I outlined in my "Dirty Dozen" e-mail on January 4. Here's how that basket has (under)performed since then:

4) Nailing the collapse in BBBY almost makes me want to go back to being a short seller... But then I remind myself what a miserable business it is. For my 52-slide presentation explaining why, see my June 21, 2021 e-mail, in which I wrote:

I've posted my presentation on "The Art of Short Selling" that I gave on Friday at the Ben Graham VIII Annual Conference here.

In it, I give an overview of shorting (including the 12 reasons not to short and the 10 reasons to do so), share all the lessons I learned doing it for 15 years and the advice Charlie Munger gave me (which I ignored – idiot that I am!), highlight the three types of shorts I've had little success with and the one type I've done well with, and reveal 11 current short ideas – including my favorite, AMC Entertainment.

(By the way, AMC closed that day at $55.69. It closed yesterday at $19.29, down 65%.)

5) In yesterday's e-mail, I called this kid a legend: In Surreal Story, 20-Year-Old Student Acquires 6% Of Bed Bath & Beyond, Makes $110 Million In 3 Weeks.

My friend thinks he's likely a crook, writing:

The kid should be investigated. Someone in his group must know Ryan Cohen. This was orchestrated. No one puts $25 million in a near-bankrupt company and then gets the timing so perfect. No one.

I replied:

I totally disagree. You're not understanding the law of large numbers. Anytime a stock goes nuts (think GameStop in January last year), among hundreds of significant shareholders, some lucky ducky will have nailed it perfectly and gets their five minutes of fame (as Roaring Kitty did with GME). And if Freeman had something to hide, he wouldn't be talking to the media...

6) Speaking of investments to avoid, this announcement by Tether (USDT), the largest crypto "stablecoin," does nothing to change my mind that they're almost certainly cooking the books and, once this is exposed, it will break the buck and roil the entire cryptocurrency sector: Tether Announces Alignment With Top Five Accounting Firm And Confirms Attestations Will Now Be Completed By BDO Italia. Excerpt:

Today, Tether Holdings Limited (Tether) the technology company supporting the blockchain-enabled platform that powers the largest stablecoin by market capitalization (USD₮), announced a significant update to its assurance and attestation processes. Tether officially began working with BDO Italia, the Italian member firm of BDO global organization, the top five ranked global independent public accounting firm, in July 2022 for its quarterly attestations. With this alignment, Tether will also focus on moving towards releasing its attestations from a quarterly basis to monthly reports.

Here's a Wall Street Journal article about it, Biggest Stablecoin Issuer, Tether, Switches Accounting Firm to BDO Italia.

Anyone who falls for Tether's pathetic misdirection should contact me immediately, as I have a bridge in Brooklyn to sell them...

As the WSJ article notes:

Tether has long faced scrutiny over the assets backing its coins. Since at least 2017, Tether has been assuring investors that it will get audited, though it has yet to deliver.

The article also highlights the difference between an audit and "attestations":

"Auditors will weigh in on risk management and financial controls. That type of thing doesn't show up in the attestations," said Steven Kelly, a senior research associate focusing on financial stability at the Yale School of Management.

Mr. Kelly said competitive pressures in the market have forced Tether to become more transparent, but it still isn't enough. "If you are going to be regulated by the market, you have to be 100% transparent," he said.

7) I play on a U.S. Tennis Association men's team in which all players must be age 40-plus and be rated 4.0. We are one of six teams that made sectionals, which is taking place today, tomorrow, and Sunday in Schenectady, New York. Each team plays the other five (four doubles and one singles match), with the winner advancing to nationals. Wish us luck!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.