The 2022 Exodus is live; U.S. Railroad Strike Averted; SoftBank Considers Launching a Third Vision Fund; The Congressional Gravy Train Chugs On; Charity poker tournament in NYC October 6

1) I was stunned to see that more than 270,000 folks have signed up to attend the 2022 Exodus Event, which went live this morning.

It will feature a special guest you won't want to miss, as well as the name and ticker symbol of one of my favorite stocks to buy today. To make sure you catch it, click here.

2) This is great news via the Wall Street Journal, as a strike could have really disrupted the economy and increased inflation: U.S. Railroad Strike Averted as Tentative Deal Is Reached. Excerpt:

The White House said Thursday it had reached a tentative agreement to avoid a railway strike that threatened to cripple swaths of the U.S. economy.

The Biden administration had been holding talks with representatives from both sides to avoid transport disruptions that could have snarled supply chains, putting new pressure on prices when inflation has been hovering near four-decade highs. Business groups and key rail customers, such as energy companies and national retailers, had been calling on the government to avoid a strike.

The overall U.S. job market is tight, with wages rising and unemployment low, and the railroads struggling with service issues they say have been caused by worker shortages. Union members had been working without a contract since 2019 and labor leaders had used the negotiations to protest new attendance policies some of the companies had adopted.

Both sides said Thursday they wrung concessions from the negotiations, which produced a deal that largely reflected a proposal put forth by a federal panel a month ago, including about 24% in wage increases over five years. The tentative agreement must now be ratified by members of the various unions covered by the contracts.

3) I shook my head reading this article in today's Wall Street Journal: SoftBank Considers Launching a Third Vision Fund.

Two thoughts come to mind. First, I guess I respect the chutzpah of CEO Masayoshi Son (whom I view as Japan's version of Ark Invest's Cathie Wood) for even thinking of raising money after what's happened to the first two Vision funds. But second, anyone who invests in this fund deserves the losses they're sure to incur. Excerpt:

Global tech investor SoftBank Group Corp. is considering the launch of a new giant startup fund after ill-timed bets and massive losses weighed down two earlier attempts to dominate startup investing, according to people familiar with discussions at the company.

The Tokyo-based tech conglomerate, by far the world's largest startup investor in recent years, would likely use its own cash for what would be the third SoftBank Vision Fund if it moves ahead with the plan, some of the people said.

The company is also considering putting additional money into Vision Fund 2, its main investment fund for the past few years, instead of starting a new fund, one of the people said. Vision Fund 2 is currently worth less than the investment that went into it. Those losses significantly reduce the pay for SoftBank staff working on the fund – a factor in its decision making. The company expects to make a decision in the coming months, the people said.

SoftBank, led by Chief Executive Officer Masayoshi Son, has been hit particularly hard by the rout in tech valuations that began last fall, posting a record $23 billion loss in the three months ended in June.

Much of that red ink is a product of its first two Vision Funds, the startup investment unit that Mr. Son formed in 2017 in a bid to dominate the venture sector. The $100 billion initial Vision Fund, which raised $60 billion from Saudi and Emirati wealth funds, was beset by giant soured bets on companies including WeWork Inc. and Didi Global Inc., leading to meager gains over five years.

Here's ZeroHedge's take: After Two Spectacular Blowups, SoftBank Hopes To Launch Third "Vision Fund" To Evade High-Water Mark. Excerpt:

Meanwhile, the pain – in the form of the company's portfolio investments in various non profitable venture companies – has hit an all-time high as the company's hilariously named Vision Funds have suffered losses of various magnitudes.

So what's one of the biggest bubble-era circular ponzi schemes to do when the tide flows away? Why hope and pray it can do it all over again and launch yet another venture fund (even if this time there will be no greater fools to market it to).

And that's precisely what Masa Son is doing: according to the WSJ, SoftBank is considering the launch of a new – third – giant startup investment fund, part of what the WSJ calls is "a plan to turn a new leaf after the poor performance at its two earlier funds" but what it really is, is a way to circumvent the gargantuan high-water mark on its previous two funds which ensures that SoftBank (and Masa) won't collect any money on these for years to come.

This plan is certainly not lost on potential outside investors, which is why unlike its previous funds which it marketed to the ever-gullible Mrs. Watanabe, the world's largest startup investor (i.e. money loser) in recent years, will likely use its own cash for what would be the third SoftBank Vision Fund if it moves ahead with the plan, as nobody will even dream of giving Masa Son a penny of their money.

4) I've written a few times on the outrageous appearance – if not reality – of insider trading by members of Congress, so I was glad to see my colleague Herb Greenberg write about this in his Empire Financial Daily on Tuesday, "The Congressional Gravy Train Chugs On." Excerpt:

I have no doubt that most members of Congress who ambitiously trade are not trading on insider information or have conflicts of interest.

The problem is the appearance and avoiding that one trade that inadvertently causes a problem.

A ban on stock trading would appear to be one of the obvious tradeoffs for that level of public service...

Today, most large news organizations, especially ones engaged in covering companies and stocks, have stock-trading rules. Even here at Empire Financial Research, editors can't own the stocks they recommend. (I think that rule is absurd, but I fully understand why it exists.)

With that as the backdrop, it's hard to understand what's taking Congress so long... its broader dysfunction notwithstanding.

A stock ban is the ultimate no-brainer.

Herb's timing was good, as this story took up nearly half of the front page of yesterday's New York Times: Stock Trades Reported by Nearly a Fifth of Congress Show Possible Conflicts. Excerpt:

These lawmakers – all of whom defended the transactions as proper – are among 97 current senators or representatives who reported trades by themselves or immediate family members in stocks or other financial assets that intersected with the work of committees on which they serve, according to an extensive analysis of trades from the years 2019 to 2021 by The New York Times.

The potential for conflicts in stock trading by members of Congress – and their choice so far not to impose stricter limits on themselves – has long drawn criticism, especially when particularly blatant cases emerge. But the Times analysis demonstrates the scale of the issue: Over the three-year period, more than 3,700 trades reported by lawmakers from both parties posed potential conflicts between their public responsibilities and private finances...

But many instances show how legislative work and investment decisions can overlap in ways that at a minimum can leave the appearance of a conflict and that sometimes form a troubling pattern – even if they technically fall within the rules.

At least, as a whole, members of Congress aren't profiting from their trading, based on a study by Bruce Sacerdote, my old buddy from Boston Consulting Group more than 30 years ago. Like most investors, they'd be better off if they stuck to index funds!

But a Dartmouth College study published earlier this year said the specific stocks that members of Congress reported buying and selling between 2012 and 2020 did not, on average, subsequently perform any better or worse than other, similar stocks.

"You cannot rule out that there's some serious insider trading going on," said Bruce I. Sacerdote, an economics professor who was a co-author of the study. "What you know for sure is on average they don't do particularly well, and these House members and senators would be better served if they were just in index funds."

I'm glad to see that the pressure is finally forcing House speaker Nancy Pelosi to act: Pelosi Says Bill on Investing Rules for Lawmakers Will Face Vote This Month. Excerpt:

Speaker Nancy Pelosi said on Wednesday that Democrats would bring legislation to the House floor this month that would place new restrictions on the ability of lawmakers to buy and sell stocks.

Her announcement came after months of negotiations over whether and how to restrict personal financial activity by members of Congress that could create real or perceived conflicts of interest with their public duties. And it came a day after The New York Times published an analysis showing that between 2019 and 2021, 97 representatives and senators or their immediate family members had reported trades of stocks, bonds, or other financial assets that could have been influenced by committees they were serving on.

Ms. Pelosi declined to provide details of the legislative proposal other than to call it "very strong."

I'll be curious to see whether it's really "very strong." I'm not holding my breath...

5) This is not surprising, but still: SAY IT AIN'T SO ROGER!

Roger Federer Announces Retirement from Tennis. (You can listen to his 4:34 audio he posted on Instagram here.)

I'm extra glad that Susan and I are flying to London a week from today for next weekend's Laver Cup, which will be his final ATP event.

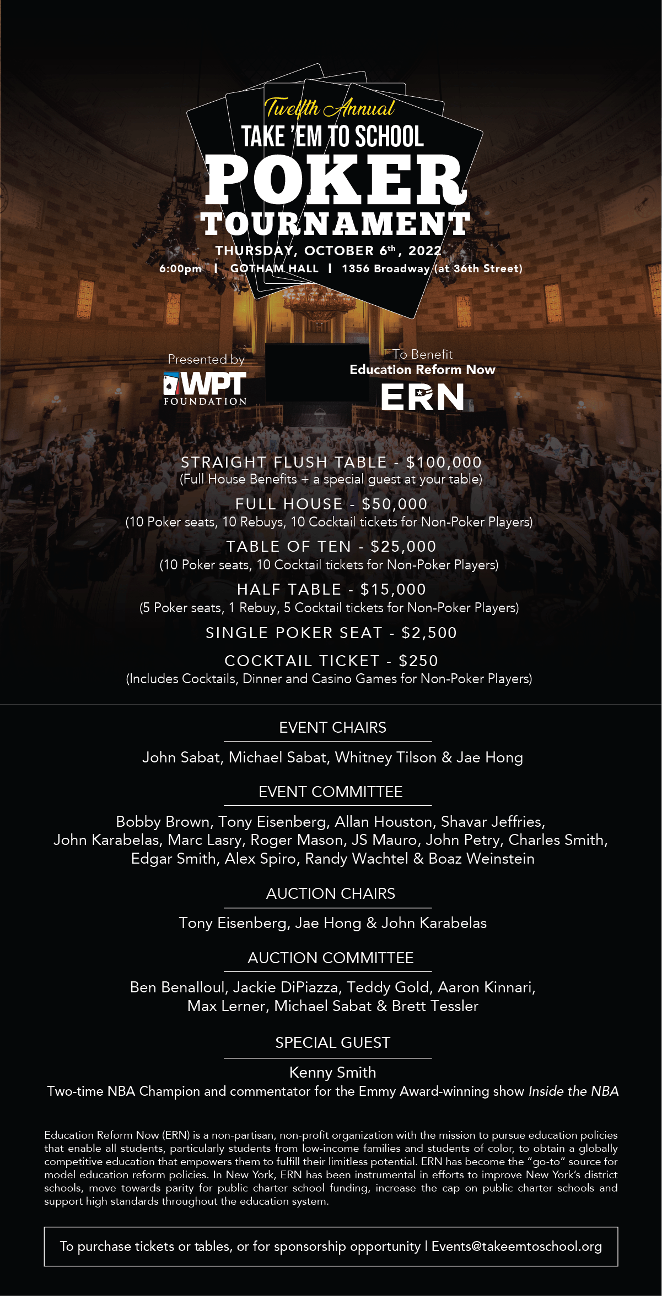

6) Please join me at the 12th annual Take 'Em to School Charity Poker Tournament at Gotham Hall three weeks from today on Thursday, October 6 at 6 p.m. Eastern at Gotham Hall at 1356 Broadway.

It benefits Education Reform Now (ERN), a wonderful nonprofit organization I co-founded that's committed to ensuring that all children have access to a high-quality public education, regardless of race, gender, geography, or socioeconomic status.

If you'd like to purchase a ticket or table or want more information, please go to our website or send an e-mail to events@takeemtoschool.org.

The event will feature poker players battling for prizes that in past years have included two courtside tickets to a Milwaukee Bucks home game with owner Marc Lasry (including private air transportation to the game), a Sebonack golf trip with a cottage stay, a table at Rao's, power lunches with some of the world's top investors, and a set visit for The Walking Dead.

For those attending as cocktail guests, there will be a variety of casino games and entertainment. The event also features a full swing golf simulator, which will host longest drive and closest-to-the-pin contests.

This year's event will feature special guests including Kenny Smith, two-time NBA Champion and commentator for the Emmy Award-winning show Inside the NBA.

Click here to see highlight videos from some of our previous events. I hope to see you there!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.