The end of the pandemic is clear; Why JPMorgan's Earnings Report Is Bad for All Equities

1) I continue to closely follow the pandemic and send updates to my coronavirus e-mail list roughly once a week (to join it, simply send a blank e-mail to: cv-subscribe@mailer.kasecapital.com). Below is the e-mail I sent last night, which has important – and highly positive – implications for our economy and the stock market...

In my December 14 e-mail, I wrote:

I don't want to get too excited because of how many times this awful virus has been like Lucy pulling the football away from Charlie Brown (me), but every day that passes, evidence is building that the omicron variant, rather than being a global nightmare, may actually soon lead to the end of the pandemic.

Note that I am choosing my words carefully here, as there is still high uncertainty. But I agree with Dr. Kevin Maki, who writes (see below for his full quote):

"I think we transition from the pandemic phase to the endemic phase of SARS-CoV-2 over the next 6-8 weeks, perhaps a bit faster if omicron really takes hold more quickly and is truly less virulent."

I actually Googled "pandemic vs. endemic" to make sure I was clear on the difference and came up with this:

A PANDEMIC is an epidemic that's spread over multiple countries or continents... ENDEMICS, on the other hand, are a constant presence in a specific location. Malaria is endemic to parts of Africa. Ice is endemic to Antarctica.

To be clear, COVID isn't going away. But as this article notes:

But failure to eradicate the virus does not mean that death, illness or social isolation will continue on the scales seen so far. The future will depend heavily on the type of immunity people acquire through infection or vaccination and how the virus evolves. Influenza and the four human coronaviruses that cause common colds are also endemic: but a combination of annual vaccines and acquired immunity means that societies tolerate the seasonal deaths and illnesses they bring without requiring lockdowns, masks and social distancing.

In summary, the "best" combination for a COVID variant would be:

a) Highly transmissible (so that it displaces delta and other variants);

b) Is blocked by vaccines or natural immunity; and

c) Has minor short- and long-term symptoms.In other words, it just becomes something akin to the seasonal flu (but with better vaccine protection).

At the time, I had perhaps 60% confidence "that the omicron variant, rather than being a global nightmare, may actually soon lead to the end of the pandemic."

Today, I'm more than 90% certain.

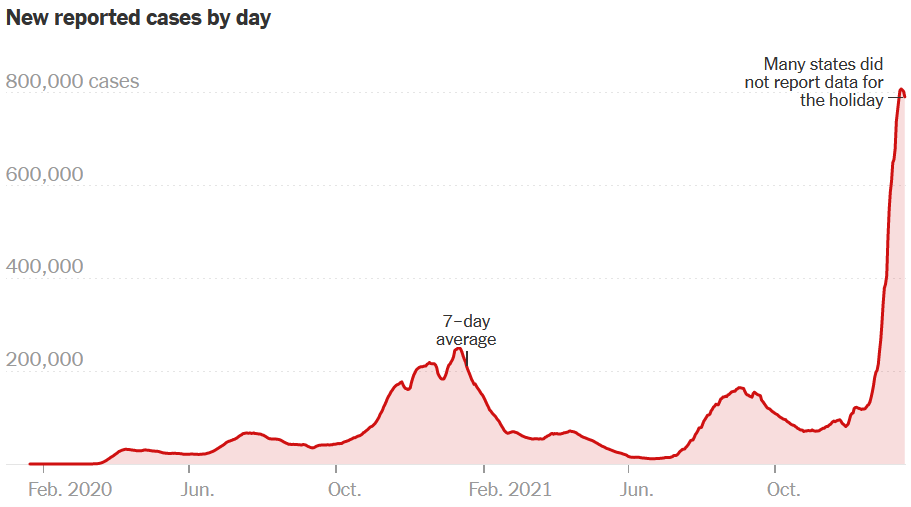

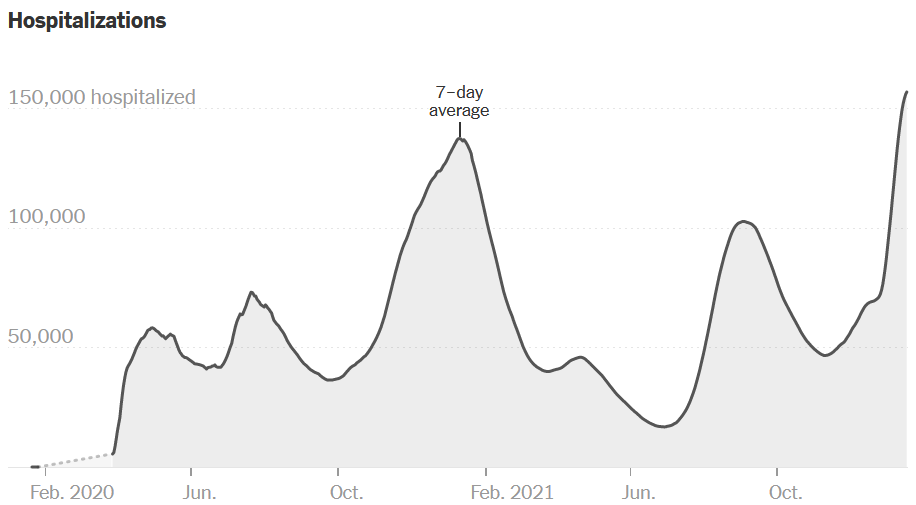

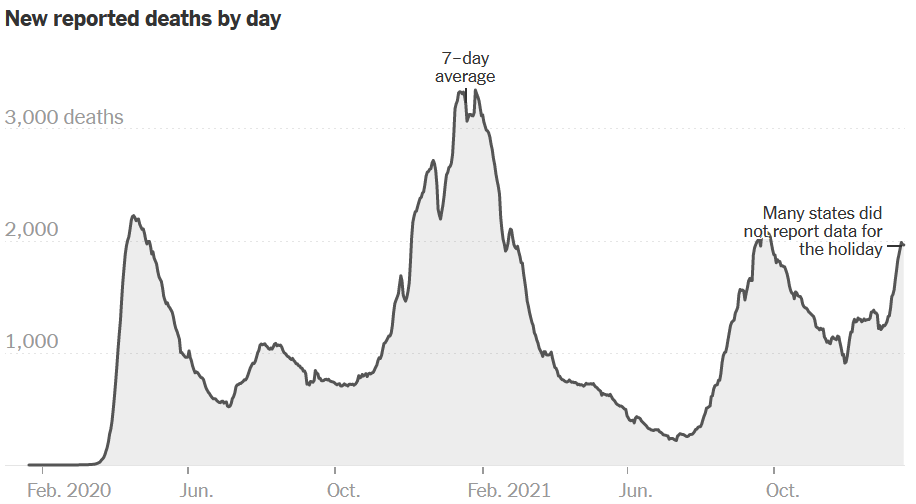

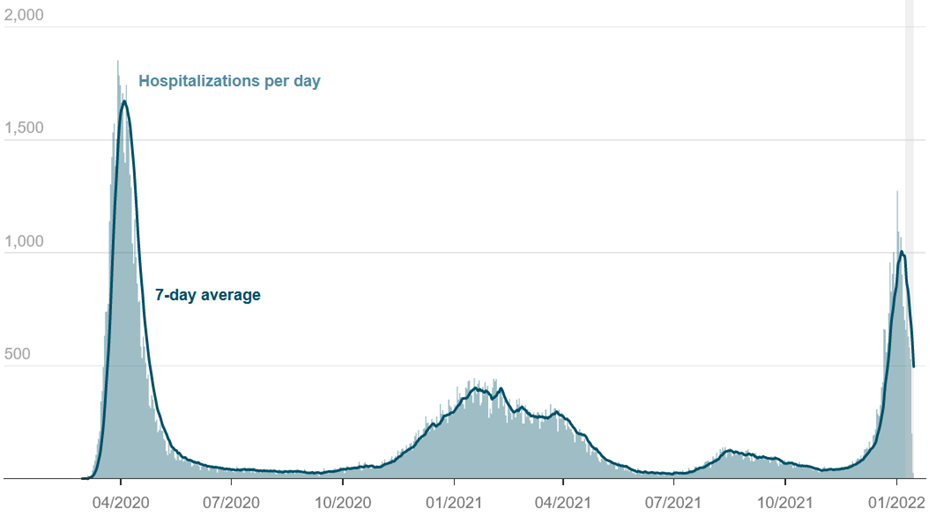

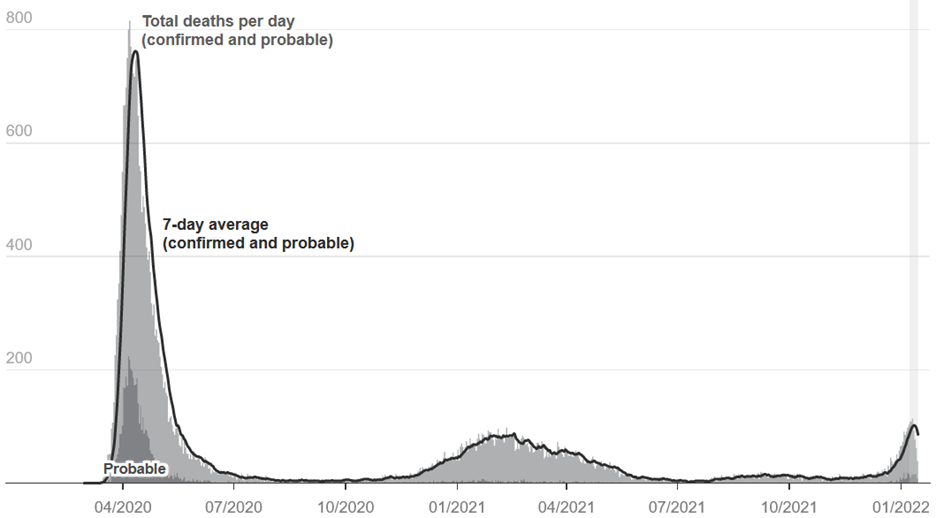

That may sound strange, given that daily cases right now in the U.S. are more than triple their previous peak a year ago, hospitalizations have spiked to an all-time high, and daily deaths are surging, as you can see in these charts (source):

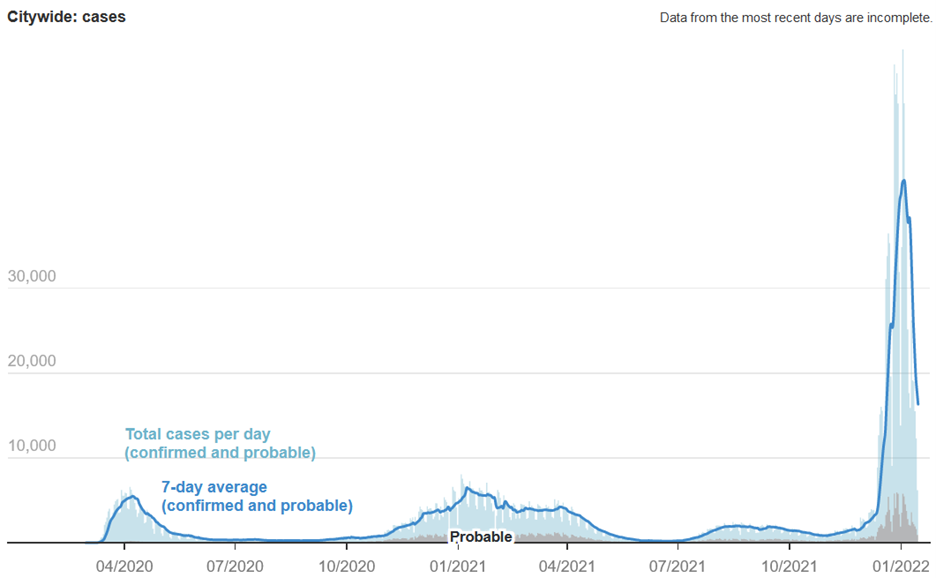

So why am I so confident? In part because of what happened in South Africa and the U.K., but mostly because of what's happening in the U.S. in the areas that were hit first by the omicron variant such as New York, New Jersey, Connecticut, Rhode Island, Massachusetts, Florida, and Puerto Rico. As you can see in the charts on this New York Times tracker, in each place, cases are declining and hospitalizations and deaths are stabilizing.

The most vivid data is from New York City (source):

In summary, while daily cases nationally likely won't start declining rapidly for another week or two (with hospitalizations and deaths following roughly 10 and 20 days later) because the extremely transmissible omicron variant is still spreading rapidly in much of the country, we can now see the ending clearly.

2) In yesterday's e-mail, I shared my friend Doug Kass' take on why he has turned neutral on bank stocks. Here's his follow-up missive...

Why JPMorgan's Earnings Report Is Bad for All Equities

It is also another vivid example of "Group Stink"

JPMorgan Chase (JPM) is acknowledged as the preeminent money center bank in the U.S.

Nevertheless its shares took an unexpected $10/share pounding on Friday after an earnings release that was riddled with rising costs.

JPM is a popular stock, with over 70% of the shares owned institutionally and, going into the earnings release, it traded at nearly 2x book value, far in excess of any banking peer.

Perhaps, with the benefit of hindsight, JPMorgan's shares were too popular!

Fortunately, I recently positioned a long Citigroup (C)/short JPM in a pairs trade bet on an expected narrowing in the valuation differential between the best loved and least loved large U.S. banks. (Note: I covered my JPM short on Friday's sizeable drop.)

But, the purpose of this column is not to rejoice in a profitable short of JPM, but rather to emphasize that the problems that led to the bank's sharp price decline will be problems that many other non-financial companies will face.

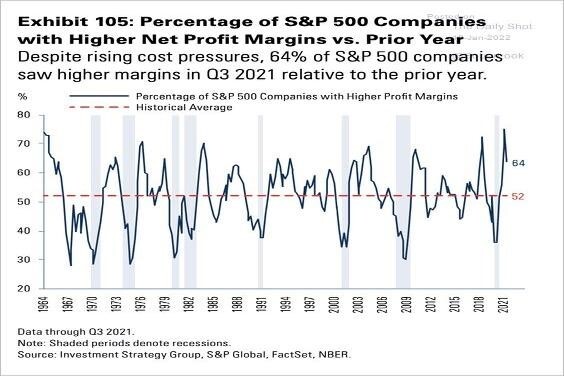

Rising Costs and Peaking Margins Suggest That Consensus S&P 2022 EPS Estimates May Be Too High

At the source of JPM's "disappointment" were rapidly rising costs, and especially a ramp in wages, which pulled down profit results and returns on invested capital, both absolutely and relative to expectations.

It is important to reemphasize that JPM is the best-run money center bank based on any measure of returns (assets, capital, etc.). So, if CEO Jamie Dimon's team is having problems, everyone else – banks and non-banks – likely will as well.

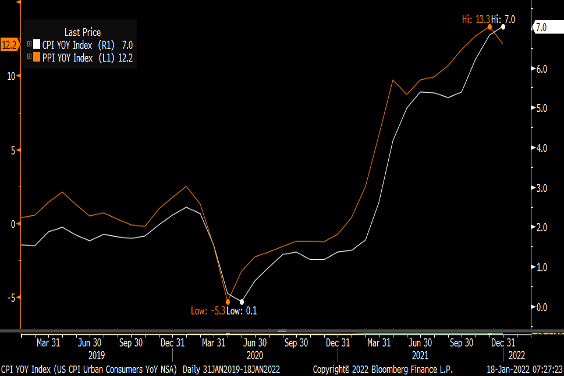

These risks are demonstrated in the wide differential between the reported Producer Price Index compared to the Consumer Price Index:

Source: Peter Boockvar

Stated simply, cost inflation not only eats into valuations, it eats into and provides a headwind to profits.

As an example of the continuing challenges to maintain profit margins by financial companies, this morning, Goldman Sachs (GS) beat on revenue and missed on EPS , as expenses rose by 23% with revenues up by only 8%. I can't remember the last time that happened!

From my perch, we will find in the next few months that non-financial companies not only face the challenge of raising prices to offset rising costs, but will also face the challenge of extended supply chain disruptions, exacerbating further the ability to sustain profits and profit margins.

Margins may have already peaked and consensus 2022 EPS estimates for the companies in the S&P 500 Index may be far too optimistic and, with interest rates rising, some of the ambitious price targets for the index will, at best, be very difficult to achieve.

More Group Stink

JPMorgan's shortfall also underscores the foul odor of the consensus and herd.

Remember that JPM's shares fell by over 6% after its earnings release on Friday, which caught all of the pundits by surprise.

Would you prefer to be a sheep herded by someone else's opinion or be someone who thinks critically using others' opinions as input?

Being a sheep is far too easy to many because it requires little effort.

JPMorgan is an example of why success in the markets is never achieved by simply following others' opinions or of the consensus, but rather, by learning how to digest data and opinions and form an independent view.

Bottom Line

Always apply critical thinking when investing and always question the consensus, as Group Stink often has a foul odor.

Thank you, Doug!

So, in light of his last two missives, am I telling subscribers to our Empire Stock Investor newsletter to sell two of our best-performing recommendations, Goldman Sachs (up 59%) and Wells Fargo (WFC) (up 132%)? (Click here to learn more about Empire Stock Investor and find out how to get instant access to our reports on both stocks – plus our entire portfolio of open recommendations – for only $49 for the first year.)

In a word, no.

Doug may be right, but he has a different strategy than we do. As my colleague Enrique Abeyta often says, you should either trade a lot or almost not at all. Doug runs a hedge fund and trades a lot. In Enrique's Empire Elite Trader, he also trades a lot.

But in most of our newsletters, we aim to do the opposite: identify great companies, buy their stocks at reasonable (or, ideally, cheap!) prices, and then hold for years and let the magic of compounding work for us. That's what we've done – and intend to keep doing – with Goldman Sachs and Wells Fargo.

Even if Doug is right that their stocks are flat or trail the market for a while, that's OK. Our investment strategy not only anticipates but requires weathering periods like this.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.