The media is a contra-indicator for stocks; Tech stocks oversold?; 10-year Treasury yield peak?; Google Chrome is the most popular browser in the world; Five days in Florida; Dinner with Doug Kass

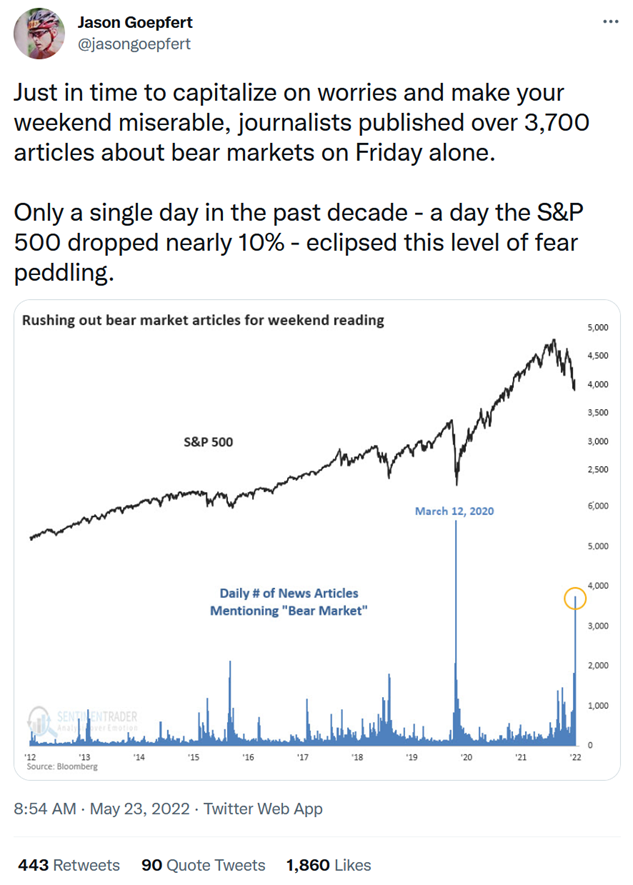

1) The media is generally a good contra-indicator for stocks – the more negative articles there are, the more likely it is that we're at or near a bottom.

So I view this as a positive sign – there were more articles last Friday that mentioned "bear market" than any day in the past decade other than one day during the COVID crash:

And the covers of Barron's have been a good contra-indicator as well, as this graphic shows:

2) Speaking of interesting tweets, I don't pay much attention to charting, but I found these two charts intriguing...

The first shows that the relative strength of the tech-heavy Nasdaq 100 Index relative to the S&P 500 Index has hit a two-year low (meaning tech stocks have significantly underperformed the markets), possibly indicating a market low:

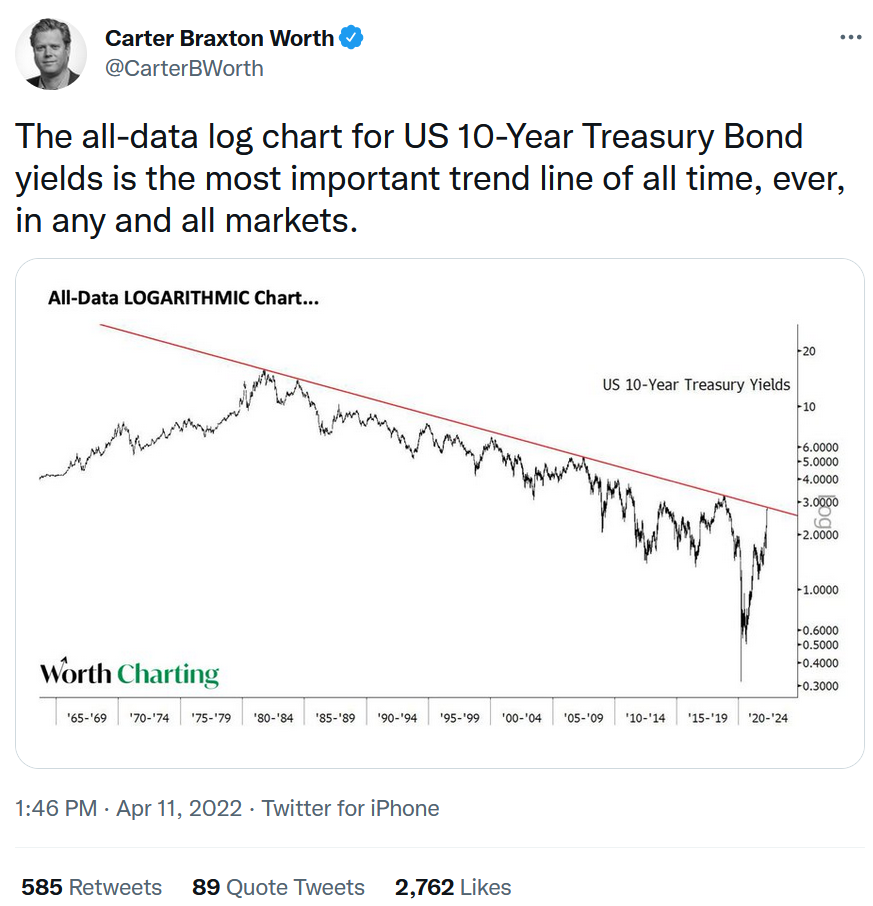

The second shows that the yield on 10-year U.S. Treasurys has spiked to a level not seen since late 2018 and may be at a resistance point:

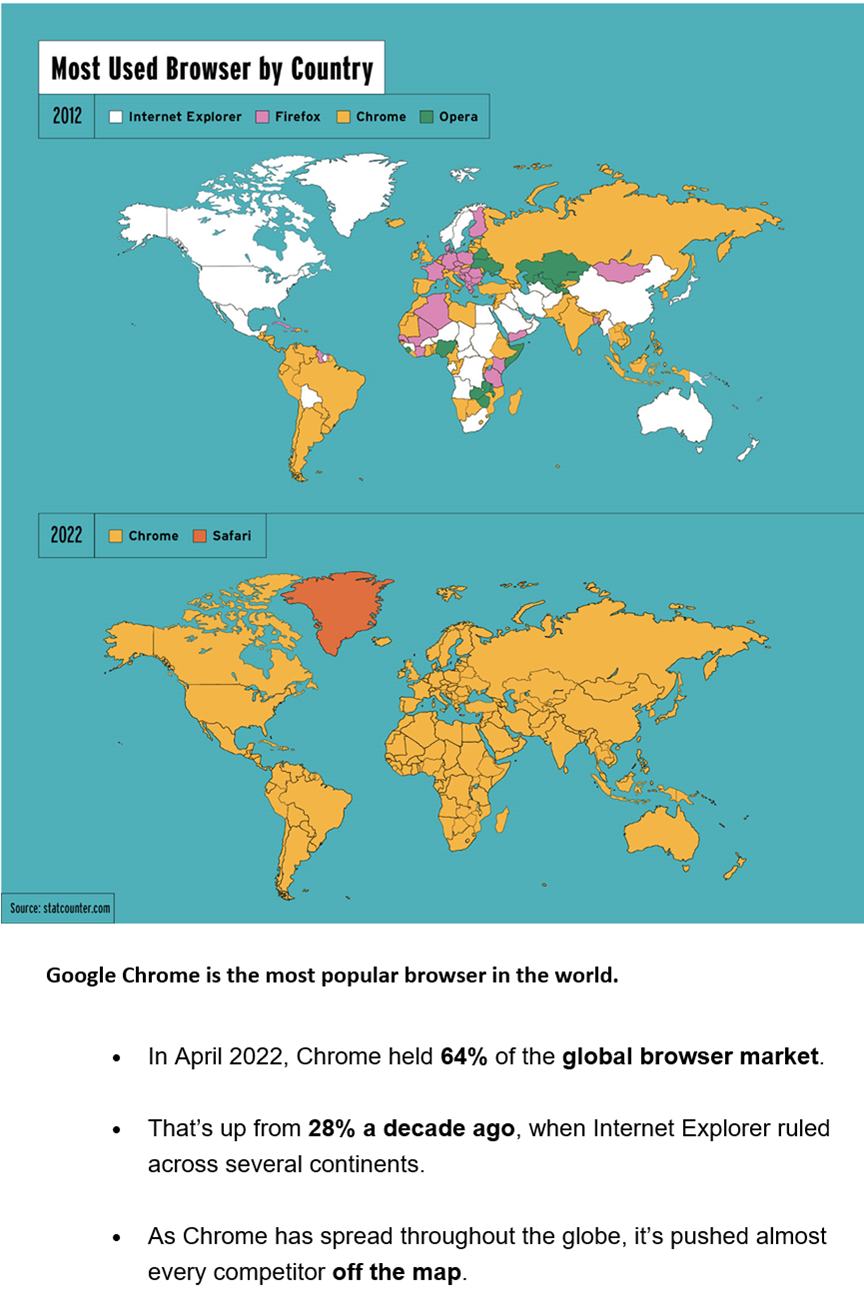

3) NYU marketing professor Scott Galloway shared an interesting Chart of the Week that shows the enormous gains in market share around the world by Google's Chrome browser – this is one of the many reasons my colleagues and I remain bullish on Google's parent company Alphabet (GOOGL). Take a look:

4) I posted a report and pictures from my five days in Florida last week around the National Senior Games on Facebook here, including going to the Celtics-Heat game, visiting the International Swimming Hall of Fame Museum and learning about Ronald Reagan's swimming history, and watching badminton, table tennis, and cornhole (and getting whooped by my cousin at the latter – grrrr!).

On Saturday night, I drove to Palm Beach and had dinner with my old friend Doug Kass of Seabreeze Partners:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.