The Period of Bank Outperformance May Now Be Coming to an End; Ackman on inflation; China comment and articles; I've made $7,334 on sports betting in 10 days; A risk-free $800

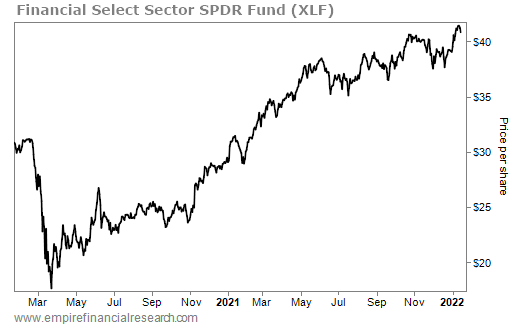

1) My friend Doug Kass of Seabreeze Partners and I have been very right on bank stocks, pounding the table on them in the summer of 2020, right before they nearly doubled, as you can see in this two-year chart of the Financial Select Sector SPDR Fund (XLF):

Doug has now turned cautious on the sector – and I think he's right. Here's an excerpt from his latest missive about it:

The Period of Bank Outperformance May Now Be Coming to an End

Bank and brokerage stocks are "over-owned" and too popular now just as industry EPS progress may disappoint in the quarters ahead

I have favored bank and financial stocks for several years but I suspect the sector's outperformance may soon come to an end.

I am not suggesting marked underperformance of banks and brokerages – just a reduced limited upside and flat to lower relative performance against the S&P Index.

There are several reasons for a change in my previously bullish position:

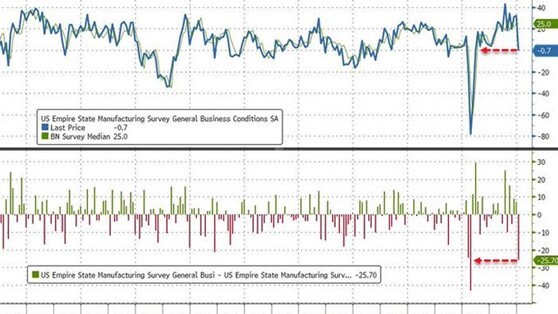

- Domestic economic growth is already about to slow – below is the Empire State Manufacturing Index shortfall just announced:

- The Fed seems destined to tighten into a domestic slowdown. As a result, I expect the yield curve to flatten as a rising federal funds rate will adversely impact economic activity. (This is not good for bank industry earnings.)

- The modest improvement in loan demand – seen in the last few months – will likely fizzle out if inflation remains elevated and economic growth is slowing (relative to expectations).

- Banks have grown too popular and after a lengthy period of outperformance they are everyone's go-to value stocks.

- As seen by Goldman Sachs (GS) and JPMorgan Chase (JPM) earnings reports, growing costs have and will likely continue to threaten ambitious bank industry consensus 2022 to 2023 EPS forecasts.

- After large credit benefits (and loan loss reserve releases) bank industry earnings face difficult compares during the next few quarters.

Disappointing earnings and a possible reset of valuations could be an unhealthy cocktail for financial stocks.

And here's a recent Wall Street Journal article echoing some of the same themes: Pandemic Profits Begin to Ebb at America's Biggest Banks. Excerpt:

The tumultuous pandemic economy sent big-bank profits to great heights. They're coming back down to earth.

Fourth-quarter profit fell 14% at JPMorgan Chase and 26% at Citigroup (C), sending what had been a streak of big gains for most of 2021. Revenue didn't budge much, but expenses rose. JPMorgan shares fell 6.1%, and Citigroup fell 1.3%.

Banks have enjoyed unparalleled growth during the pandemic, buoyed by a deal-making boom, market volatility that supercharged trading arms and a housing market that made mortgage lending more profitable than ever. At the same time, the doomsday scenarios that banks girded against in the pandemic's early days never materialized, which freed up additional profits. Bad loans remain near record lows, and consumer and commercial customers alike have weathered the pandemic with, on average, plenty of cash on hand.

Now, some of the forces that pushed bank profits to new records are starting to weaken. JPMorgan said the shifting environment and higher costs would mean it wouldn't hit its longer-term profitability targets in 2022 and maybe 2023.

"The headwinds likely exceed the tailwinds," JPMorgan's finance chief Jeremy Barnum told analysts. "We are in for a couple of years of sub-target returns."

2) I don't always agree with my friends, however...

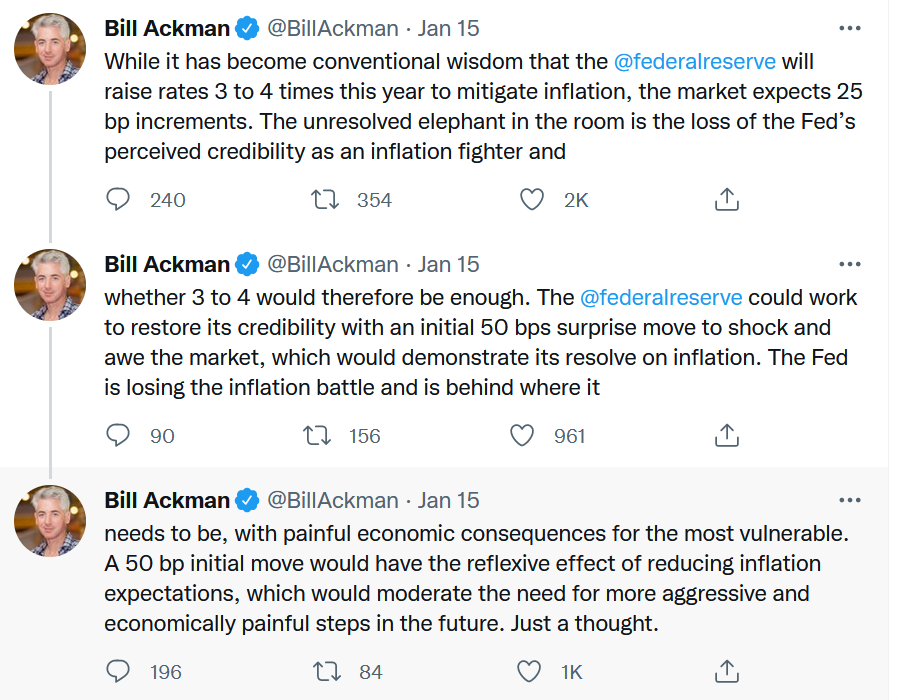

Pershing Square's Bill Ackman just tweeted that "the Fed is losing the inflation battle" and needs to "to shock and awe the market" with a 50 basis point initial increase in rates (the market expects 25), "which would demonstrate its resolve on inflation."

3) I sent a comment and four articles to my China e-mail list yesterday (to subscribe to it, simply send a blank e-mail to: china-subscribe@mailer.kasecapital.com):

My note: The country's zero-tolerance policy on COVID-19, now that the highly transmissible omicron is here, is doomed to fail – and will cause a huge amount of needless, self-inflicted harm...

- From the front page of today's New York Times: Supply Chain Woes Could Worsen as China Imposes New COVID Lockdowns

- Also in today's NYT: China's Economy Is Slowing, a Worrying Sign for the World

- Ditto: China's Births Hit Historic Low, a Political Problem for Beijing

- From the Financial Times: China's GDP growth slows as COVID restrictions and property woes hit demand

4) I'll admit that there's some irony in my opposition to New York legalizing online sports betting as of 10 days ago – while making a profit of $7,334 almost risk-free since then by taking advantage of the companies' incredibly generous promotional offers, which I described in detail in my e-mails on Monday and Wednesday last week.

That said, I want to repeat my warning that online sports betting has terrible odds (generally the house is taking 10% to 15%) and is thus a sucker's game... so if you choose to play, do not get hooked on it!

You must have the discipline to only bet with the free-money and enhanced-odds offers the companies are making. (As I think about it, it's no different from opening a brokerage account and starting to invest in the stock market. If you're a reckless fool who loves "action" and/or a clueless one who can't tell the difference between a high-probability bet and low-probability one, you will soon lose a lot of money.)

I have two pieces of good news for those who want to take advantage, as I have...

- First, to my surprise, the companies continue to send me offers for bets in which the odds are heavily in my favor. For example, BetRiver allowed me to wager $50 on the Buffalo Bills versus New England Patriots NFL game last weekend and, if I won, the payout, instead being roughly $45, was $100. (On another site, with $40 of free bonus money, I'd bet on the Patriots, so I bet on the Bills with this $50 and pocketed $100.) Sure, I could have lost $50, but if someone offers me essentially a coin flip in which the payout is twice as much as my loss, I'll flip that coin all day long...

- The other piece of good news is that a fifth company entered the market yesterday, MGM Resorts (MGM), with the identical offer for new customers as FanDuel's: deposit $1,000 in your account, bet it (it must be your first bet), and, if you lose, they'll credit your account with a $1,000 bonus.

Here's the way I recommend playing it, which guarantees a roughly $800 profit with zero risk...

Open new accounts at both FanDuel and MGM and fund both with $1,000. Pick any game and bet $1,000 on both sides. After the game, you'll have approximately $1,900 in the account that won and a $1,000 bonus in the account that lost.

You can't withdraw bonus money, however, so you need to make a second offsetting bet – $1,000 from each account – on any game.

At that point, you will either have $900 in one account and $1,900 in the other, or $2,800 in one account and zero in the other. Either way, you can withdraw all of the money and bank an $800 profit. (I recommend, however, keeping a little money – maybe $250 – in both accounts so you can take advantage of the ongoing promotional offers.)

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.