This year's incredible long-term investment opportunity; Thoughts and articles on the cannabis sector; Biotech Wizard Left a Trail of Fraud – Prosecutors Allege It Ended in Murder; Inside the secret, often bizarre world that decides what porn you see; Pay it forward

1) If you're feeling pain in the markets, it's not hopeless...

This isn't the first time I've seen a major market crash. I managed money through both the dot-com bubble and the Great Recession. When the COVID-19 pandemic hit, Empire Financial Research was just a year old.

Times like these create plenty of fear and doubt... But in each crash, folks had the opportunity to make huge gains with smart investments.

In a brand-new presentation, I explain why this market reminds me a lot of the dot-com bubble – when Amazon (AMZN), eBay (EBAY), and Apple (AAPL) had taken major losses. And just like back then, the carnage this year has created some fantastic opportunities in the markets.

In my presentation, I'll explain what to do to take advantage of them. Watch it right here.

2) I've been very bullish – and, so far, very wrong – on the cannabis sector, as the AdvisorShares Pure U.S. Cannabis Fund (MSOS) is down nearly 60% this year.

I'm not willing to throw in the towel however, for reasons I outlined in my June 9 e-mail, in which I shared an interview I did with the Cannabis Investing Network podcast and slides I presented on June 2.

Two recent articles caught my eye recently...

The first, from Politico, highlights the possibility that Congress might pass the SAFE Banking Act, which would be a big catalyst for the sector given investors' ultra-low expectations: Democrats are looking for a weed deal. Excerpt:

Senate Majority Leader Chuck Schumer doesn't have the votes to pass a sweeping marijuana decriminalization bill – despite repeatedly touting his support for ending federal prohibition.

That realization is leading Senate Democrats to look for a compromise on weed.

In interviews with more than a dozen lawmakers, staffers, advocates, and lobbyists, all agreed that in recent weeks the tone has changed on Capitol Hill. Senators previously opposed to anything but a major marijuana decriminalization bill are slowly warming to another option: adding provisions to a broadly supported bill that would allow financial institutions to offer banking services to the cannabis industry, called the SAFE Banking Act.

The second, from the New York Times, highlights the dangers of teenagers using marijuana: Psychosis, Addiction, Chronic Vomiting: As Weed Becomes More Potent, Teens Are Getting Sick. Excerpt:

Although recreational cannabis is illegal in the United States for those under 21, it has become more accessible as many states have legalized it. But experts say today's high-THC cannabis products – vastly different than the joints smoked decades ago – are poisoning some heavy users, including teenagers.

Marijuana is not as dangerous as a drug like fentanyl, but it can have potentially harmful effects – especially for young people, whose brains are still developing. In addition to uncontrollable vomiting and addiction, adolescents who frequently use high doses of cannabis may also experience psychosis that could possibly lead to a lifelong psychiatric disorder, an increased likelihood of developing depression and suicidal ideation, changes in brain anatomy and connectivity, and poor memory.

But despite these dangers, the potency of the products currently on the market is largely unregulated.

My take: I want to be clear that my view that the sector is an attractive – albeit somewhat speculative – area for investment does not mean that I endorse usage of the product.

I don't recommend that anyone, especially young people, use marijuana or ingest any derivative products like THC (unless medically necessary, of course). I've never tried them myself and would be furious with my daughters if they did so.

That said, my feelings are the same about not only any other drug, but also cigarettes, vaping, and excessive alcohol consumption.

We don't criminalize many things – even addictive ones – that are bad for people. In my view, marijuana should be regulated like cigarettes and alcohol, not treated like cocaine or fentanyl.

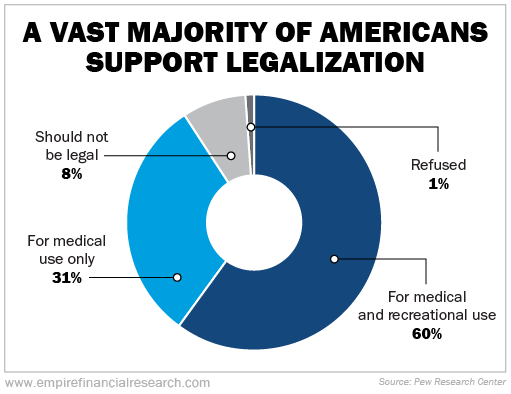

An increasing number of Americans agree, as a 2021 Pew Research Center survey shows:

As a result of this shift in public attitudes, I think it's inevitable that legalization and a more favorable regulatory environment will follow, which will provide a huge, long-term tailwind to the sector.

Combined with growing margins and incredibly cheap stocks, these factors are exactly what I look for in multi-bagger return situations.

3) In my June 2 e-mail I wrote:

Nate Anderson of Hindenburg Research once again demonstrated why I consider him one of the best activist short sellers in the world when he released this damning report yesterday, sending the stock of his target, Enochian Biosciences (ENOB), crashing 28% to $3.76, which still leaves it with a $200 million market cap.

Why it's not at zero is beyond me... You cannot make this stuff up! Miracle Cures and Murder for Hire: How a Spoon-Bending Turkish Magician Built A $600 Million Nasdaq-Listed Scam Based on A Lifetime of Lies.

Sure enough, the stock tumbled another 22% yesterday to $2.60 in the wake of this Wall Street Journal article that confirmed much of what Anderson wrote: Biotech Wizard Left a Trail of Fraud – Prosecutors Allege It Ended in Murder. Excerpt:

Yet much of what people saw in Gumrukcu was an illusion he cast, misrepresenting himself and his credentials, according to state and federal authorities, court records, former colleagues and those who have sued and won judgments against him over fraudulent medical and financial dealings.

Prosecutors now allege that Mr. Gumrukcu arranged the murder of a business associate, Gregory Davis, who threatened to expose him as a fraud. Such a revelation would have put at risk the 39-year-old entrepreneur's deal with Enochian, they said.

Mr. Gumrukcu has been in custody at the Metropolitan Detention Center in Los Angeles since his arrest on May 24. A federal grand jury indicted him on murder conspiracy charges, an offense punishable by death.

4) What a fascinating article on so many levels in the Financial Times (and kudos to my college buddy Bill Ackman!)... I suspect that the credit card companies do a better job regulating the sector than any government would: Inside the secret, often bizarre world that decides what porn you see. Excerpt:

Bill Ackman was at home in the Hamptons, killing time on a Saturday morning in December 2020, when a New York Times article caught his eye. He read it on his phone, got angry, re-read it and logged on to Twitter (TWTR) to express his outrage. Then, the 56-year-old billionaire started plotting the downfall of America's best-known porn site...

Now Ackman had found a new target in the pages of the Times: Pornhub, the most-visited website of the world's biggest porn company, MindGeek. Nicholas Kristof's column that week included testimony from victims of abusive videos, spy cams, and revenge porn and argued the site was "infested with rape videos," from which it was profiting. (Pornhub denied the allegations, insisting it had better moderation than most social media platforms.)

While Ackman is not against pornography per se, the "appalling accounts of exploitation" just "hit a nerve." "The problem with the topic is people don't want to talk about it," he says, which is why he took a public position with his tweets.

What he did next was more consequential. Ackman texted Ajay Banga, who was then the chief executive of Mastercard (MA), writing "Ajay, please read the above" and sharing Kristof's piece. Ackman wrote that Mastercard was "facilitating sex trafficking" and should immediately stop working with Pornhub. "Call to discuss if you disagree," he concluded, with delicious passive aggression. Not long after Banga replied: "On it."

Pornhub went from hosting 13 million videos to about 4 million. It was probably the biggest takedown of content in Internet history.

Ackman knew Banga from the tennis circuit; they share a passion for the sport. He also understood the power Mastercard and Visa (V) wielded over Pornhub's parent company. Most videos on the site are free to watch, but MindGeek offered subscriptions and took credit-card payments from small advertisers. Roughly half of the company's overall revenues, which peaked at about $460 million in 2018, came from paid-for porn.

Within days of Kristof's piece and Ackman's message, the payments giants cut Pornhub off. The effect on MindGeek was debilitating. The company's cash flow dried up. It broke the conditions of its loans, prompting a notice of default from its lenders. And the pressure kept building, as Visa considered making its temporary suspension permanent.

So MindGeek buckled. Almost overnight, the company removed most of the porn available on its flagship site. Pornhub went from hosting 13 million videos to about four million. Millions of videos uploaded by "unverified" providers disappeared. It was probably the biggest takedown of content in Internet history.

Mastercard and Visa hardly ever shut out a big merchant. Ackman's text wasn't the main reason they did so in late 2020, but it is not hard to imagine it helped tip the balance. While governments might be slow and bureaucratic, Ackman realized that payment companies, when they want to, can act decisively. "They have to be de facto regulators of what's permissible content and what's not," he says.

What Ackman didn't realize is that Visa and Mastercard have increasingly been doing that job for close to 20 years. The biggest and third-biggest financial companies in the world now exercise more control over the global porn business than any government.

They wield this power in total discomfort and do so by relying on a cadre of satraps responsible for making precise and occasionally bizarre distinctions – what distinguishes a performer dressed as an alien from bestiality, what are the conditions of acceptable vampire sex – that determine exactly what you can and cannot see.

This article resulted from an in-depth investigation by Financial Times reporter Patricia Nilsson. I'm learning a lot from her new podcast about it, Hot Money: Who Rules Porn?

5) Let's all try to treat others the way this woman treated me and pay this forward...

There was no ticket machine at the bus stop in Milan on Saturday for the ride to the airport, and I couldn't get the app to work on my phone, so a nice young woman who saw my struggles bought me a 2-euro ticket on her phone and let me take a screenshot of it. The only euro cash I had was a 5-euro note, but she wouldn't take it.

Thank you, whoever you are!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.