Thursday's event with Herb Greenberg; The curse of success; Berkshire buys Alleghany; Razzlekhan: The Untold Story of How a YouTube Rapper Became a Suspect in a $4 Billion Bitcoin Fraud

1) Long before he joined the team at Empire Financial Research, my longtime friend Herb Greenberg had become famous for exposing frauds on Wall Street – often doing so long before the public caught on...

For example, shares of Valeant Pharmaceuticals plummeted more than 90% after his investigation of the company's business model...

The CEO and CFO of Media Vision both went to prison after his exposé of the company's fake revenue...

And the CEO and CFO of Tyco also went to prison for committing corporate fraud, which Herb foresaw years earlier in an exposé of their accounting practices.

And now that he's a part of the Empire team, Herb is breaking his next big story (it won't send anybody to prison this time)...

On Thursday, at 8 p.m. Eastern time, he's going on camera to explain how a "backdoor" in the massive shakeup we're seeing in the market this year is offering the chance to create serious wealth. Everything from the Ukraine crisis to historic inflation is opening this "backdoor" in a way we haven't seen in two decades.

To help break the story, I'll be joining Herb for the big event. We'll share all the details about how this "backdoor" allows you to turn the tables on Wall Street and take advantage of the shakeups in a way the biggest institutions hope you'll never figure out.

This event is totally free to attend, but you just need to reserve a spot in advance. You can register here.

See you on Thursday!

2) During my recent visit to Seattle's Museum of History and Industry, this quote from Microsoft (MSFT) founder Bill Gates on the wall caught my eye...

Gates is right that success can lead to one's undoing, in two major ways. First, as Gates notes, it can cause someone to become an egomaniac, refuse to listen to others, fail to pull the plug on doomed projects/investments, etc.

But there's a second way that what I call the "curse of success" can kick in: distractions.

In the first dozen years of running my hedge funds starting in 1999, I crushed the market – tripling my investors' money while the S&P 500 Index was flat, and I grew assets from $1 million to over $200 million.

I became one of the highest profile investors in the world, hosting and speaking at investing conferences, launching two mutual funds, talking to reporters, and appearing on 60 Minutes once and CNBC weekly.

Many charities wanted me on their board. Feeling like I was well positioned to make a real difference in the world, I didn't say "no"... and I ended up on 13 nonprofit boards simultaneously!

Lots of young, aspiring investors wanted career advice from me, and I didn't say "no" enough to them, either.

You get the idea...

As a result, I took my eye off the ball. The market invariably punishes people for this, and I was no exception.

During my early years running my hedge funds, I developed a wonderful virtuous cycle: I worked hard and was super-focused, which led to me finding great stocks and generating strong returns, which led to happy investors and growing assets, which felt great and motivated me to continue to work hard and stay focused.

But over time, in part because I allowed myself to get distracted in so many ways, this turned into a vicious cycle: lousy returns led to unhappy investors and redemptions, which made me feel like I had lost my mojo, was out of sync with the market, and was letting my investors down. This sucked at my energy and optimism and demoralized me, such that I was no longer "tap dancing to work every day," which led to more lousy returns. Lather, rinse, repeat...

I tried my best but was unable to escape this vicious cycle.

The lesson I want to share is that, almost without exception, people who achieve success are going to encounter a myriad of distractions.

It's a high-class problem to be sure, but if you're fortunate enough to achieve real success, you need to think carefully – and be disciplined – about how you allocate your time.

Don't think that you can do it all. You can't.

So you're going to need to do two things:

First, make tough trade-offs and say "no" a lot.

Second, hire outstanding people and build a team to do the things that you used to do yourself.

3) This acquisition is a good one, but it won't move the needle for Berkshire Hathaway (BRK-B), with its nearly $800 billion market cap and almost $150 billion in cash: Buffett's Deal Drought Ends With $11.6 Billion Alleghany Buy. Excerpt:

Warren Buffett is back on his dealmaking roll thanks to a more volatile stock market and some very familiar assets.

His Berkshire Hathaway announced an $11.6 billion deal to buy Alleghany (Y) on Monday, on the heels of massive purchases of Occidental Petroleum (OXY) common stock that gave it a roughly $7.2 billion stake in the oil giant. Buffett has been putting more of Berkshire's $146.6 billion cash pile to work, aided by an S&P 500 Index that's fallen nearly 6.4% this year through Friday.

This news brought back memories, though... I remember meeting with Alleghany's CEO long ago – I'd guess 2004 – and I was impressed with him and the company, which was sort of a mini-Berkshire. But I never bought the stock, as I figured I would rather own the real thing (Berkshire's stock).

It was a wise decision....

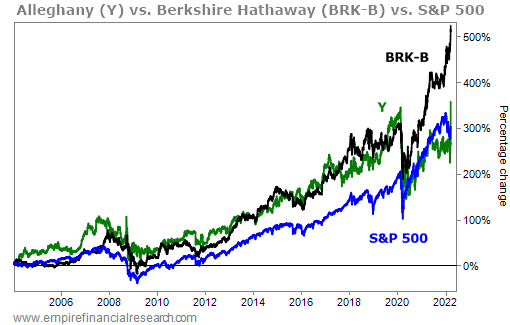

As you can see in this chart, Alleghany's stock, even with yesterday's 25% pop, has only roughly matched the S&P 500 Index and substantially trailed Berkshire's since the start of 2004:

4) In my February 10 e-mail, I wrote about two of the world's dumbest criminals: Heather Morgan and her husband Ilya Lichtenstein. And now, Forbes has more details... What a crazy story! Razzlekhan: The Untold Story of How a YouTube Rapper Became a Suspect in a $4 Billion Bitcoin Fraud. Excerpt:

Behind the headlines and telecasts, what remained a mystery was how Morgan, 31, a woman of humble beginnings in rural California, where she once described picking walnuts and cleaning houses, allegedly came into unimaginable wealth – a sum that grew from $70 million to more than $4 billion as the price of Bitcoin soared – and then became an object of international ridicule.

With global interest growing in the case – Netflix (NFLX) and Forbes announced separate documentaries days after the arrests – a tragic portrait has emerged of Morgan. In interviews with 18 people who knew the couple, some of whom shared text messages, audio, video and photos, Forbes found that Morgan was determined to make herself a Silicon Valley thought leader and launched her own startup, a marketing company called Salesfolk. That was before she met Lichtenstein, a man who seemed to bring out her worst instincts, according to people who knew her.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.