Update on Cassava Sciences; 12 Reasons Not to Short; Greetings from the Laver Cup in London

1) In my November 3, 2021 e-mail, I wrote the following:

My friend and former student Gabriel Grego of Quintessential Capital Management just released a short report on Cassava Sciences (SAVA). The biotech company has a $2.3 billion market cap despite no revenue based on bullish expectations for its sole drug, Simufilam, which it claims will help treat Alzheimer's disease.

Gabriel's report, which you can read here, documents the shady backgrounds of many people associated with the company and concludes that there's no chance that Simufilam will ever be approved by the Food and Drug Administration ("FDA"). Here's an excerpt:

Simufilam, Cassava's only prospective drug, appears based on allegedly forged scientific research. Phase II trials have been conducted with numerous and serious irregularities, which appear to have allowed management to deceive investors about the effectiveness of the drug.

In our opinion, Simufilam is a worthless compound, and any touted benefit is likely the result of a combination of forgery, "cherry picking" of patients, and statistical manipulation of data, of which we have plenty of disturbing evidence.

This alleged exercise in deception has taken place with the involvement of an astounding number of questionable characters: Cassava's former Senior Clinical Research Associate is a convicted felon with a record in fraud and theft. Cassava's prominent clinical research site (whose CEO is coauthor of critical research on Simufilam), IMIC Inc., is co-owned by a former escort, stripper, and crack addict with a criminal record for consumption and possession of cocaine. IMIC's Principal Investigator has been hit with a rare and ominous FDA warning letter during recent trials. Cassava's CEO and CMO have been caught making allegedly fraudulent statements about Simufilam's predecessor Remoxy, which duly failed, devastating shareholders. Cassava's recent board addition, Richard Barry, has been involved with multiple frauds.

I'm not a biotech expert (to say the least) and haven't independently verified Gabriel's work, but knowing him and his track record, I have no doubt that his report is correct – which is bad news for this high-flying stock and its huge market cap...

That day, SAVA shares closed at $56.66... and since then, they have hit as high as $100 and as low as $14.

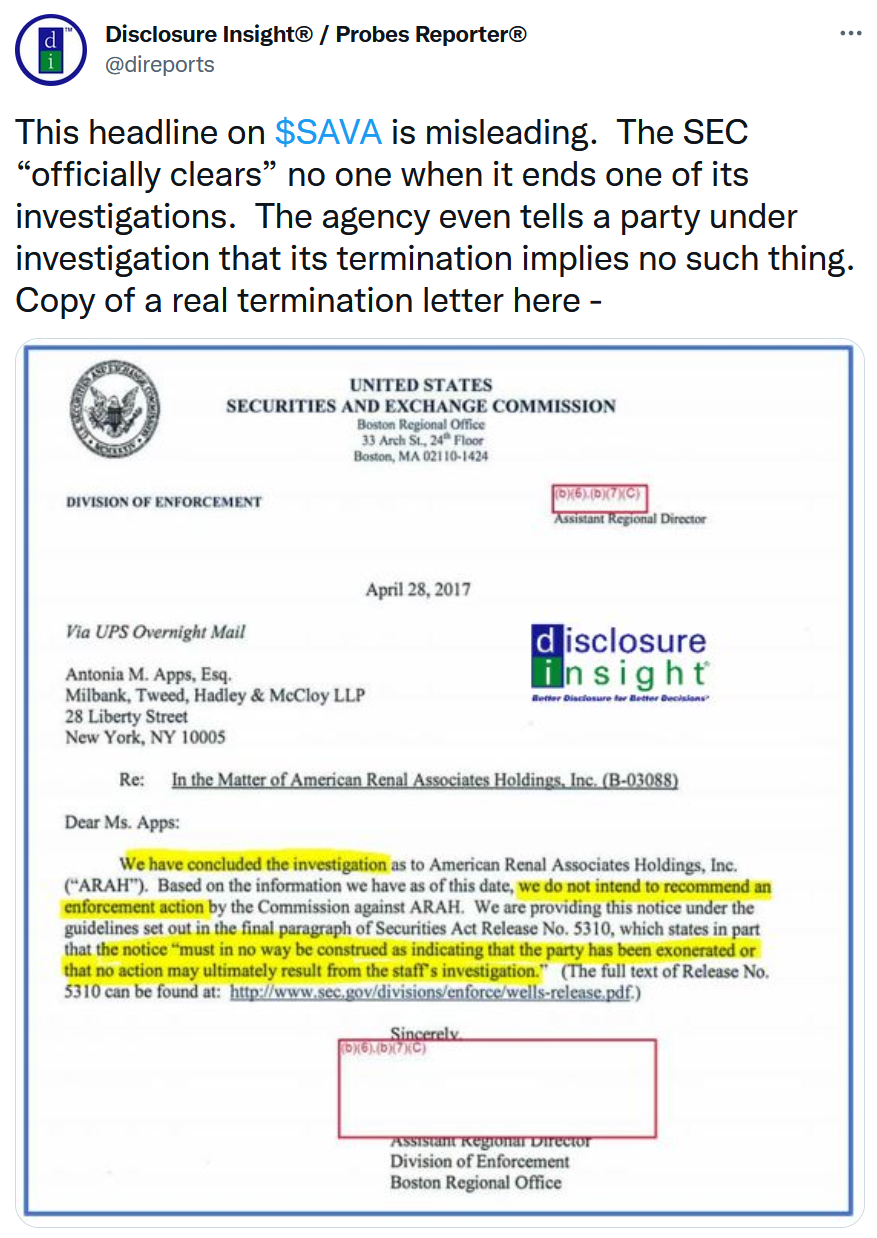

The stock has nearly doubled in recent days on this news: Cassava Rockets After SEC Reportedly Clears It of Tampering With Alzheimer's Data. Excerpt:

The Securities and Exchange Commission reportedly cleared an investigation into Cassava Sciences, leading SAVA stock to hit a seven-month high Thursday.

On today's stock market, SAVA stock rocketed 35.7% to $51.06.

Last November, the SEC launched an investigation into Cassava's Simufilam research. Scientists – who also held short positions in SAVA stock – claimed Cassava manipulated images used in testing of the experimental Alzheimer's treatment.

On Thursday, Seeking Alpha published a document showing the SEC reached a "five-page case-closing recommendation."

This smells fishy to me, so I asked Gabriel for his thoughts. He replied:

Seems like a misleading statement to me. The SEC did not clear anything to my knowledge. They just announced a completed investigation (and around the same time the DOJ leaked they are investigating as well). I am no expert here, but Occam's razor would suggest that the SEC might have transferred the probe to the DOJ once they concluded that criminal activity was likely. I believe the recent bullish press by the longs may be considered a dangerous distortion of the facts. This post by an expert seems to confirm my caution:

Thank you, Gabriel!

I'll say it again: Continue to avoid Cassava Sciences.

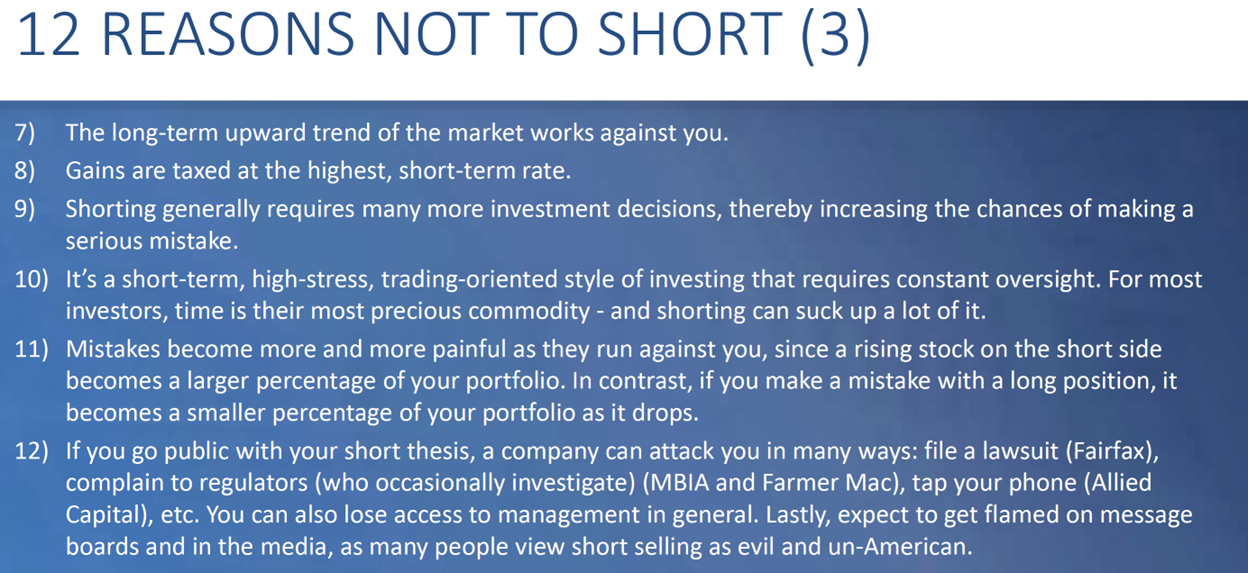

2) While I think Cassava Sciences will prove to be an excellent short from here, the wild swings in the stock price certainly underscore one of the many reasons why I think shorting is a terrible business and recommend that 99% of investors never engage in it.

Speaking of which, picking up where I left off on Wednesday, here are the next four slides from my presentation, "Lessons from 15 Years of Short Selling":

3) Greetings from the Laver Cup in London!

Susan and I flew here overnight and just watched a tight first match. The highlight will be Roger Federer's final match tonight, where he'll team up with Rafael Nadal to take on Americans Frances Tiafoe and Jack Sock.

By the way, I couldn't see any evidence of a recession last night and this morning. JFK and Heathrow airports were packed, as was our flight.

I specifically flew on Delta Air Lines (DAL) because my Platinum status almost always gets me an upgrade to at least Economy Plus, but I had no such luck last night. Susan and I were stuck in the back, so I only got four hours of pretty miserable sleep... I'm not a coffee drinker, so there will be lots of Diet Coke today!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.