Update on the tech giants; TikTok Is Sued by State of Indiana; The latest on Sam Bankman-Fried/FTX/Alameda Research; On my way to Fiji

1) In my November 8 e-mail, I wrote the following:

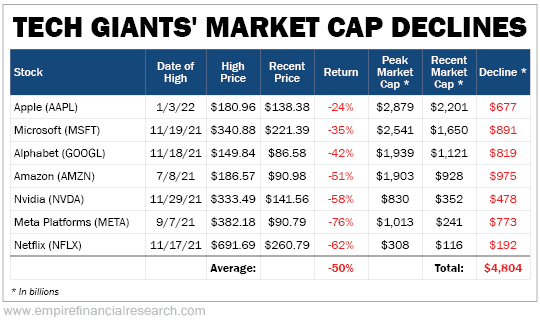

As you can see in this table, the stocks of seven tech giants have, on average, been cut in half and collectively lost nearly $5 trillion in market capitalization from their peaks, as this table shows (prices as of Friday's close):

These are seven of the greatest businesses of all time, which you can now buy for far less than investors were enthusiastically paying roughly a year ago. As a group, I think they will far outperform the S&P 500 going forward.

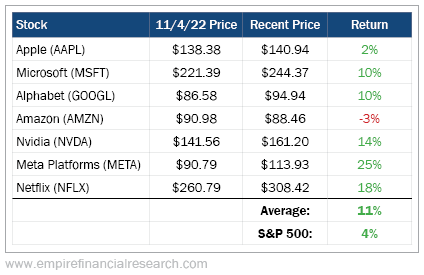

Now that exactly a month has passed, I wanted to share how these stocks have performed since then (through yesterday's close) – significant outperformance overall, led by the stock I was pounding the table on, Meta Platforms (META):

I continue to think that these tech giants will outperform...

2) I've written many times about how the federal government should immediately ban TikTok, so it's good to see that at least one state is taking action: TikTok Is Sued by State of Indiana, Accused of Targeting Young Teens With Adult Content. Excerpt:

Indiana filed a pair of lawsuits against TikTok Wednesday, alleging the platform is deceiving consumers about its content and data security, the latest in a growing number of moves by state officials to push back against the platform's influence on children and its connections to China.

The state said its lawsuits are the first of their kind against the popular app and its owner, Beijing-based ByteDance Ltd. In one of the complaints, Indiana alleged that TikTok's algorithm is designed to addict young users and promotes harmful content that isn't appropriate for them. The lawsuit cites studies and reports linking heavy use of the platform to mental disorders among teenagers, including eating disorders and depression.

"TikTok is actively exposing our children to drug use, alcohol abuse, profanity and sexually explicit material at a young age," Indiana Attorney General Todd Rokita, a Republican, said. "TikTok is deceiving Indiana parents."

The second lawsuit alleged that China has the ability to use TikTok's data to spy on, blackmail and coerce users to serve the country's national security and economic interests. Both lawsuits seek changes to TikTok's practices, as well as civil penalties for each alleged violation.

Also Wednesday, Texas Gov. Greg Abbott banned the use of TikTok on government-issued devices, citing concerns that the platform could assist China in the surveillance of Americans and other intelligence work. Other states have started making similar moves in recent weeks.

Incidentally, Meta would be a huge beneficiary if TikTok is banned or even reined in...

3) The latest on Sam Bankman-Fried ("SBF")/FTX/Alameda...

• The fact that SBF hasn't been arrested yet has led many to speculate that it's because he is being protected by the politicians (mostly Democrats) to whom he gave lots of money.

I think the real answer is more mundane, as this CNBC article notes: Sam Bankman-Fried could face years in prison over FTX's $32 billion meltdown – if the U.S. ever gets around to arresting him. Excerpt:

Whatever happens won't happen quickly.

In the most famous fraud case in recent years, Bernie Madoff was arrested within 24 hours of federal authorities learning of his multibillion-dollar Ponzi scheme. But Madoff was in New York and admitted to his crime on the spot.

The FTX founder is in the Bahamas and hasn't admitted wrongdoing. Short of a voluntary return, any efforts to apprehend him would require extradition.

With hundreds of subsidiaries and bank accounts, and thousands of creditors, it'll take prosecutors and regulators time to work through everything.

Similar cases "took years to put together," said Mariotti. At FTX, where record keeping was spotty at best, collecting enough data to prosecute could be much harder. Expenses were reportedly handled through messaging software, for example, making it difficult to pinpoint how and when money flowed out for legitimate expenses.

In Enron's bankruptcy, senior executives weren't charged until nearly three years after the company went under.

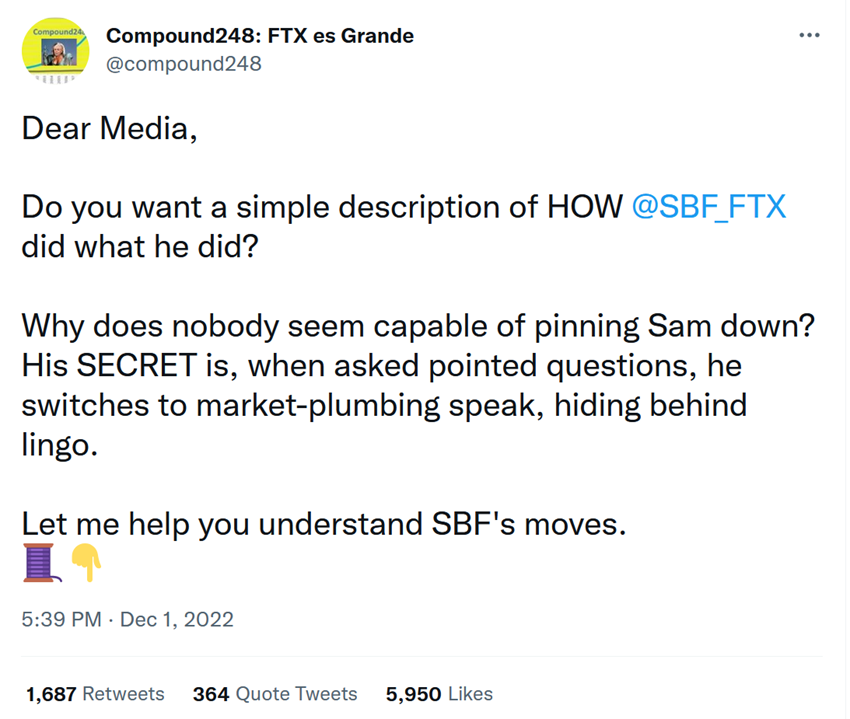

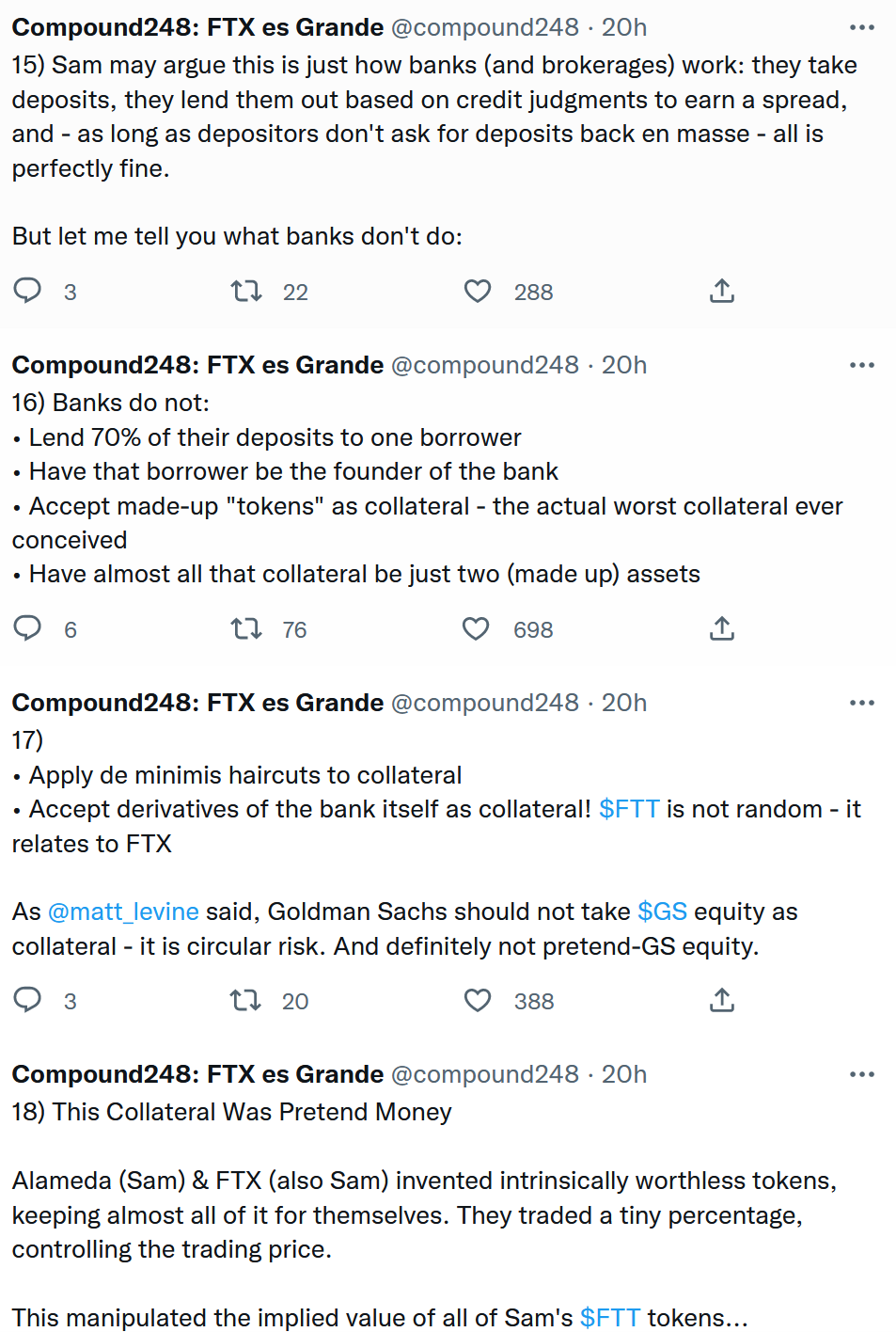

• This is the best thread I've read about what happened. Excerpt:

• Genevieve Roch-Decter interviewed crypto bulls Kevin O'Leary and Anthony Scaramucci about FTX:

• I'm not sure yet what to think of Caroline Ellison's role, but this guy is skeptical that her hands are clean:

Here's an excerpt from the Boston Globe article he links to:

Some question whether book smarts prepared Ellison to run a trading firm and manage billions of dollars in capital at such a young age.

Months before she was named co-CEO, she wrote on her blog that she didn't "have that much responsibility" at work. "What do CEOs of real companies do?" she wrote. In a podcast, Ellison claimed to only need "elementary school math" to do her job, a comment that raised eyebrows.

"Anyone that's in the trading industry that has seen those interviews, their jaw hits the floor," said Matt Walsh, founding partner of Cambridge-based Castle Island Ventures, which invests in blockchain startups...

While much remains to be pieced together, a quip Ellison made about the crypto industry on her blog earlier this year may have more of a ring of karma to it than she intended.

"Yeah, it's mostly scams and memes when you get down to it," she wrote.

• This two-minute collection of clips of CNBC hosts sucking up to SBF and showering him with accolades ("the J.P. Morgan of crypto") cracked me up (some good lessons here as well about the importance of tuning out the hype and thoroughly investigating something before investing in it):

4) As you read this, I'm on my way to Fiji for a week of scuba diving with a group of friends – I'll send pictures in a future e-mail.

This will be the 75th country that I'll have visited. Here's a map of all of them (from an app I use called Countries Been):

I'll be visiting Antarctica, my 76th "country" (and seventh and final continent) later this month...

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.