Why am I obsessed with FTX?; FTX's Balance Sheet Was Bad; FTX Founder Sam Bankman-Fried Attempts to Raise Fresh Cash Despite Bankruptcy; Why I do extreme sports

1) Regular readers may wonder why I've been writing so much about the implosion of FTX and its founder, Sam Bankman-Fried ("SBF")...

In addition to being highly entertaining for a markets junkie like me, it's also an important case study that every investor should study.

An economics professor I know e-mailed me this yesterday:

I plan to spend at least a day on this debacle in class next term. There are so many fantastic lessons in everything not to do. It's really, really important that we teach this stuff in college and to our own kids to make sure they are never involved in anything like this.

2) Bloomberg's Matt Levine yesterday published the most insightful analysis I've read about what happened (and might have happened) at FTX: FTX's Balance Sheet Was Bad. He looked at FTX's balance sheet that it was showing prospective investors as it desperately scrambled to raise money last week, and he couldn't believe what he found... Excerpt:

...the balance sheet that Sam Bankman-Fried's failed crypto exchange FTX.com sent to potential investors last week before filing for bankruptcy on Friday is very bad. It's an Excel file full of the howling of ghosts and the shrieking of tortured souls. If you look too long at that spreadsheet, you will go insane...

is less a balance sheet and more a list of some tickers interspersed with hasty apologies. If you blithely add up the "liquid," "less liquid," and "illiquid" assets, at their "deliverable" value as of Thursday, and subtract the liabilities, you do get a positive net equity of about $700 million. (Roughly $9.6 billion of assets versus $8.9 billion of liabilities.)

But then there is the "hidden, poorly internally labeled 'fiat@' account," with a balance of negative $8 billion. I don't actually think that you're supposed to subtract that number from net equity – though I do not know how this balance sheet is supposed to work! – but it doesn't matter.

If you try to calculate the equity of a balance sheet with an entry for HIDDEN POORLY INTERNALLY LABELED ACCOUNT, Microsoft Clippy will appear before you in the flesh, bloodshot and staggering, with a knife in his little paper-clip hand, saying "Just what do you think you're doing Dave?" You cannot apply ordinary arithmetic to numbers in a cell labeled "HIDDEN POORLY INTERNALLY LABELED ACCOUNT." The result of adding or subtracting those numbers with ordinary numbers is not a number; it is prison.

Levine then asks where the billions in missing cash went:

I tried, in the previous section, to capture the horrors of FTX's balance sheet as it spiraled into bankruptcy. But, as I said, there is something important missing in that account. What's missing is the money. What's missing is that FTX had at some point something like $16 billion of customer money, but most of its assets turned out to be tokens that it made up. It did not pay $16 billion for those tokens, or even $1 billion, probably. Money came in, but then when customers came to FTX and pried open the doors of the safe, all they found were cobwebs and Serum. Where did the money go?

I don't know, but the leading story appears to be that FTX gave the money to Alameda, and Alameda lost it. I am not sure about the order of operations here. The most sensible explanation is that Alameda lost the money first – during the crypto-market meltdown of this spring and summer, when markets were crazy and Alameda spent money propping up other failing crypto firms – and then FTX transferred customer money to prop up Alameda. And Alameda never made the money back, and eventually everyone noticed that it was gone.

Levine concludes by outlining six different ways FTX/Alameda could have lost so much money, with different levels of culpability for SBF, ranging from naïve fool to criminal mastermind (think Bernie Madoff).

I'm increasingly thinking the latter...

3) Here's breaking news this morning from the Wall Street Journal: FTX Founder Sam Bankman-Fried Attempts to Raise Fresh Cash Despite Bankruptcy. Excerpt:

FTX filed for bankruptcy last week, but the cryptocurrency exchange's founder still thinks that he can raise enough money to make users whole, according to people familiar with the matter.

Mr. Bankman-Fried, alongside a few remaining employees, spent the past weekend calling around in search of commitments from investors to plug a shortfall of up to $8 billion in the hopes of repaying FTX's customers, the people said.

The efforts to cover that shortfall have so far been unsuccessful. The Wall Street Journal couldn't determine what Mr. Bankman-Fried is offering in return for any potential cash infusion, or whether any investors have committed.

Some might view this as evidence that his heart is in the right place, but my view is the opposite. There's no way SBF is stupid enough to think anyone would invest a penny in the smoldering crater that is FTX today.

So why is he wasting his time trying to raise money now?

I think it's because he knows it's highly likely that he's going to be arrested, convicted of all sorts of fraud, and face somewhere between, I'd guess, five and 25 years in prison. So he's already planning his appeal to the sentencing judge (accompanied no doubt by lots of crocodile tears) along the lines of:

I never meant to hurt anyone or cause anyone to lose money. I was even trying to raise money to make everyone whole after FTX filed for bankruptcy.

What a load of crap! I think he gets 20 years...

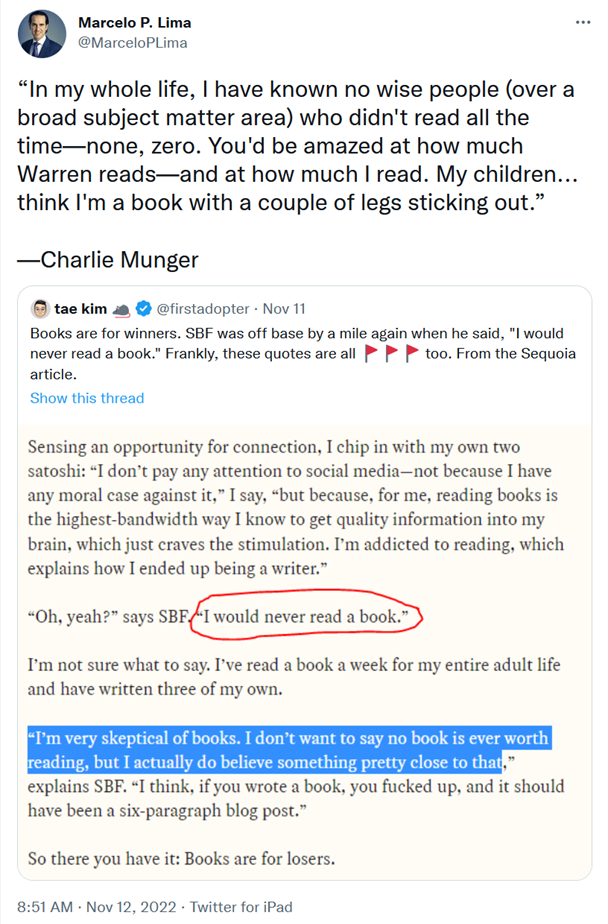

4) Another warning flag: SBF thought books were for losers, as my friend Marcelo Lima tweeted:

5) As I hobble around, nursing my aching muscles and horribly chafed legs after running 65 miles and doing 200-plus obstacles in the bitter cold at the 24-hour World's Toughest Mudder last weekend, you might be wondering why I do extreme sports like this.

There are several reasons...

I actively seek out new experiences, especially those that push me outside of my comfort zone. I find that they broaden my mind and bring incredible richness and joy into my life. Even amid quite a bit of pain and suffering, I experience incredible beauty and clarity. And at least I'm not stressing about the e-mails in my inbox for 24 hours!

At the end of each year, my outside-the-box adventures are always among the things I look back on most fondly.

Participating in events like this also motivates me to stay in great shape – which is especially important as I get older (I turned 56 two weeks ago). I want to lead a long, healthy life. A brutal race probably doesn't extend my life, but the months of training beforehand sure do.

Being super fit also makes me feel stronger and more confident.

Accomplishing something difficult also builds my resilience, both mentally and physically. I don't get nearly as upset as I used to when I encounter a setback.

Lastly, my adventures are an incredible bonding experience. Ask anyone who has served in combat which people they're closest to, and most of them will say the ones with whom they shared a foxhole.

We increasingly live in a "clicks and likes" world where our relationships are a mile wide and an inch deep...

But research shows that happiness actually comes from the opposite: the number of deep relationships you have.

What's a deep friendship?

I've always thought that this was a good test: Would they hide you? During the Holocaust, when the Nazis murdered more than 6 million Jews in Europe, some survived because their non-Jewish friends hid them – risking their own lives to do so. This is how Anne Frank and her family survived for more than two years in Amsterdam before they were betrayed.

How many people do you have in your life, outside of your immediate family, who would hide you?

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.