Why the chaos in the U.K. won't happen here; Professor Aswath Damodaran on inflation and the market's valuation; Matt Levine humor; William Cohan on Musk and Wood; How I saved $2,000 with Verizon

1) In yesterday's e-mail, I discussed why I don't think there's any comparison between today and 2008 and therefore why we aren't going to have a financial crisis.

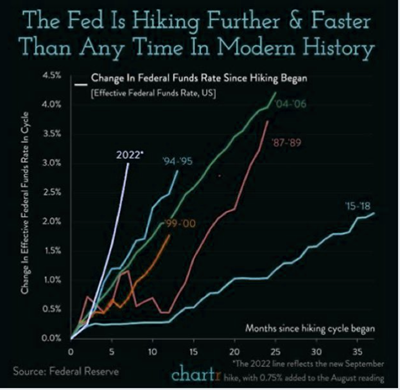

Those who disagree point to what happened in the U.K. last week, where the Bank of England had to step in to save numerous pension funds from collapse – what many are calling Britain's "Lehman moment." They argue that we're next, especially in light of the unprecedented speed and magnitude of the Fed's hikes, as this chart shows:

I disagree.

In the U.K., interest rates spiked suddenly after the new prime minister, Liz Truss, announced a poorly thought out and even more poorly communicated plan to cut taxes without any way to pay for it, which caused surprised investors to panic. The turmoil was so great that she was forced into a humiliating reversal, as this New York Times article explains: Truss, in Reversal, Drops Plan to Cut U.K. Tax Rate on High Earners.

But I don't see similar chaos happening here because the Fed has telegraphed its actions to raise interest rates, so nobody is surprised.

2) One of my favorite writers and thinkers, NYU professor Aswath Damodaran, just shared some of the smartest commentary I've come across about inflation and the market's current valuation. You can read his blog post here and watch his 30-minute video presenting it here. Excerpt:

In September 2022, there is no denying that inflation is back, and with a vengeance, though we can still debate how quickly it will fade, and to what level. The happy talk of 2021, where many policy makers and investors were dismissive of its emergence, attributing it almost entirely to the COVID recovery and supply chain problems, has largely faded and a grim acceptance has set in that we have an inflation problem, the solution to which may be perhaps as painful as the problem. One reason investors and businesses are struggling with this latest bout of inflation is that they have been spoiled by a decade of low and stable inflation, and as a consequence, have neither planned for high and unstable inflation in their business models, nor developed analytical tools to deal with that inflation...

Put simply, investors are expecting inflation to peak over the next year and subside in the long term, close to the levels that we saw in the last decade. That may be hopeful thinking, and the returns on stocks and bonds over the rest of the decade will be determined by the correctness of this assessment; if investors are underestimating expected inflation in the long term, as they did in the 1970s, we are in for an extended period of malaise in markets...

As investors, our assessments of how inflation and the economy will evolve in the coming years will determine how much we should pay for stocks and bonds today. Having chronicled how inflation has changed the level of interest rates and the price of risk, let us bring in the remaining questions on earnings, cash flows and growth that we need to address to evaluate whether the market has under or overreacted to inflation.

He concludes:

I think that market pricing today, and my expectations of expected earnings and cash flows, stocks are very mildly over valued on September 23, 2022. I trust my judgments enough that I will leave my existing equity holdings intact, but I am not quite ready to jump in and make bets on market direction now.

3) Another one of my favorite writers and thinkers is Bloomberg columnist Matt Levine. His commentary on the Elon Musk-Twitter (TWTR) drama has been especially insightful – and funny, as he showed in yesterday's missive: Everyone Wanted to Buy Twitter With Elon. Excerpt:

I have spent the last few years promoting the Elon Markets Hypothesis, which says that "the way finance works now is that things are valuable not based on their cash flows but on their proximity to Elon Musk." If you believe that, and I suppose I do, then any due diligence, beyond making sure that you have the correct phone number for Musk, is superfluous.

Anyway, Musk's tweets are great. The best analysis I have read of them is from Katie Notopolous, who tweeted that "Elon Musk's text messaging style is very efficient and also makes everyone who texts him look like an absolute dillweed." This is true, though I think it is largely a function of being the richest person in the world. If I were the richest person in the world, I assume a lot of people would send me a lot of long fawning texts and I'd send a lot of replies like "lol" or "tx" or just a thumbs-up tapback. I assume that would feel very cool, to me, though it is hard to untangle "sending tapback replies to fawning texts would feel cool" from "being the richest person in the world would feel cool." But it is reassuring to see that Elon Musk, who is the richest person in the world, seems to get pleasure from the same simple things that I imagine I would enjoy in his situation.

4) Lastly, another one of my favorite columnists is William Cohan, a former banker (like Levine), who writes for Puck. In his latest post, he also comments on Musk: Elon's Hollywood Ending. Excerpt:

There's no question anymore that Elon will lose and that the Chancery Court will throw the book at him because there's no other choice. It has to treat him harshly, not only because he deserves to be held seriously accountable but also because we'll be in another downward spiral if a (fairly) willing seller and a willing buyer can sign a legally binding, heavily negotiated merger agreement and then the buyer can just walk away. That just won't fly in America, even as so many other pillars of our society have been torn asunder in recent years. Elon needs a way out, preferably before the trial starts, because once it does, the Twitter board will be unable to settle. It will be beholden to Twitter's shareholders who are going to want that $54.20 in cash, or something that compensates them for the roughly $11 billion difference between where the stock is today and the $44 billion that Elon promised to pay.

A longtime Wall Street banker friend wrote to me the other day about Elon's predicament, "All the tea leaves are pointing to the judge coming down on him like a ton of bricks. He'll lose the bot argument. The only wild card is whether something really bad comes out through this whistleblower. I doubt that will happen, but it's about the only thing I see that could make a difference. If I'm right, the real question before the judge will be if/how she forces him to close or assesses some massive damages." If Elon ever needed Ari, his interstitial man, the time is now.

Cohen also (correctly) blasts ARK Invest's Cathie Wood's new venture-capital fund:

The spectacular rise and fall of ARK Invest has apparently done nothing to dampen the enthusiasm of the firm's founder and key meme-stock picker, Cathie Wood, who has just launched a new investment vehicle, ARK Venture Fund, allowing people with a few extra bucks in their pockets to join her bets on private technology companies, too. ARKK, after all, her flagship publicly traded fund targeting "paradigm shifting" stocks like Teladoc Health (down 91% from its peak), Zoom (down 87%), Roku (down 88%), and so on, has been one of the biggest losers of the post-Covid, post-stimulus, post-easy-money era. So of course, now that "disruptive" tech is "in deep value territory," as Cathie puts it, why not get in on the ground floor of fledgling private tech companies? This has "big mistake" written all over it. (This is not investing advice.)

Honestly, I just don't understand why anyone still listens to, let alone invests with Cathie Wood. And now she has the chutzpah to launch a venture-capital fund for individual investors? Between Chamath Palihapitiya (see last week's column) and Cathie, I am probably starting to repeat myself, but why any sane person would still invest with either of these charlatans at this point is absolutely beyond me. Wood's new venture-capital fund is – shockingly – open to any American willing to put up a minimum of $500. Again, this is not investment advice, but I can't reiterate emphatically enough how irresponsible this is for Wood for a whole host of reasons...

And let's be clear, this isn't a "small D, democratic" opportunity, either; this is just another way for Wood to make money. She is charging a fee of 2.75% on the $250 million or so she is raising for the fund. That's a cool nearly $7 million in fees a year for investing the money, plus another 1.47% in "distribution and other" fees, according to the Journal, or another $3.7 million. For those keeping score at home, Wood is going to grab $10 million in fees annually for this little gambit. And my favorite part of all this is that she will have no skin in the game once the investments are made because she's proudly proclaiming that she won't be taking carried interest in the fund.

Cathie is touting this as a benefit for investors but it's really not. It means she and Friedrich can make investments with impunity, and not really care how the investments perform. She'll get her $10 million a year no matter what. I'd rather she get the 20% carried interest and know that she really cared how the investments perform because her pocketbook would depend upon it. In this structure, it doesn't.

5) Susan, the girls, and I are on a massively expensive cellphone plan with Verizon (VZ), which costs $382 per month.

It rose $30 per month because in the past couple of weeks Susan and two of our daughters upgraded to the new iPhone 14 Pro (which they love) and, to get the $800 credit toward the new phone, they had to sign up for the $50-per-month wireless plan rather than the cheapest $40-per-month one.

Since I didn't upgrade, I called Verizon yesterday to downgrade my plan to the $40 one to save $10 per month – and ended up saving $167 per month ($2,004 per year)! Here's how...

Rather than downgrading my wireless plan to save $10 per month, the customer service rep offered to keep me on my current plan and knock $20 per month off my bill. Sounds good to me!

She also told me that if I signed up for electronic billing and autopay, Verizon would knock $50 per month off my bill. I said that I had already done so, but she said to get the discount, I had to switch my autopay from my credit card to a debit card or direct withdrawal from my checking account. That's easy!

I asked how much my new monthly bill was, and she said $272. When I asked how $20 plus $50-per-month savings added up to $110, she wasn't sure – I guess they were just overcharging me.

Lastly, when I logged into my account to update my autopay, I noticed that two of our five lines had Mobile Protect insurance for $17 per month and two had Total Equipment Coverage for $11.40 per month, so I canceled all of this to save another $57 per month.

So regardless of what cellphone provider you have, give them a call and ask if there are any ways you can save money. Who knows – maybe you'll get a huge, wonderful surprise just like I did!

By the way, if you want to really save money, one friend wrote:

I switched to Mint Mobile a year ago and, while I needed to provide my own phone, I pay only $15 a month for an amazing service!

And another friend warned:

Let me know next month if Verizon kept its word and you got that full discount, because I did this more than once trying to whittle down the bill and found that Verizon didn't deliver the savings they promised. You need to watch it like a hawk.

Will do!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.