Activist short-sellers; Hindenburg report on Nikola; Nikola's lame response; I'm back in NYC; Manhattan's Office Buildings Are Empty. But for How Long?

1) As I've written many times before, I think short-sellers in general and activist short-sellers in particular are incredibly healthy for our markets – they uncover and expose fraud, hype, and overvaluation.

Their role is especially important today... With stocks soaring and easy-to-use trading platforms like Robinhood proliferating, more and more novice investors are being lured into risky stocks and types of investing, like trading options.

2) One of the best-known activist short-sellers is Nate Anderson of Hindenburg Research. I've met him and can attest that he does great work and has an excellent track record.

Yesterday, he published a lengthy and damning report on electric-truck maker Nikola (NKLA), Nikola: How to Parlay An Ocean of Lies Into a Partnership With the Largest Auto OEM in America. Here are the first five bullet points:

- Today, we reveal why we believe Nikola is an intricate fraud built on dozens of lies over the course of its Founder and Executive Chairman Trevor Milton's career.

- We have gathered extensive evidence – including recorded phone calls, text messages, private emails and behind-the-scenes photographs – detailing dozens of false statements by Nikola Founder Trevor Milton. We have never seen this level of deception at a public company, especially of this size.

- Trevor has managed to parlay these false statements made over the course of a decade into a ~$20 billion public company. He has inked partnerships with some of the top auto companies in the world, all desperate to catch up to Tesla (TSLA) and to harness the EV wave.

- We examine how Nikola got its early start and show how Trevor misled partners into signing agreements by falsely claiming to have extensive proprietary technology.

- We reveal how, in the face of growing skepticism over the functionality of its truck, Nikola staged a video called "Nikola One in Motion" which showed the semi-truck cruising on a road at a high rate of speed. Our investigation of the site and text messages from a former employee reveal that the video was an elaborate ruse – Nikola had the truck towed to the top of a hill on a remote stretch of road and simply filmed it rolling down the hill.

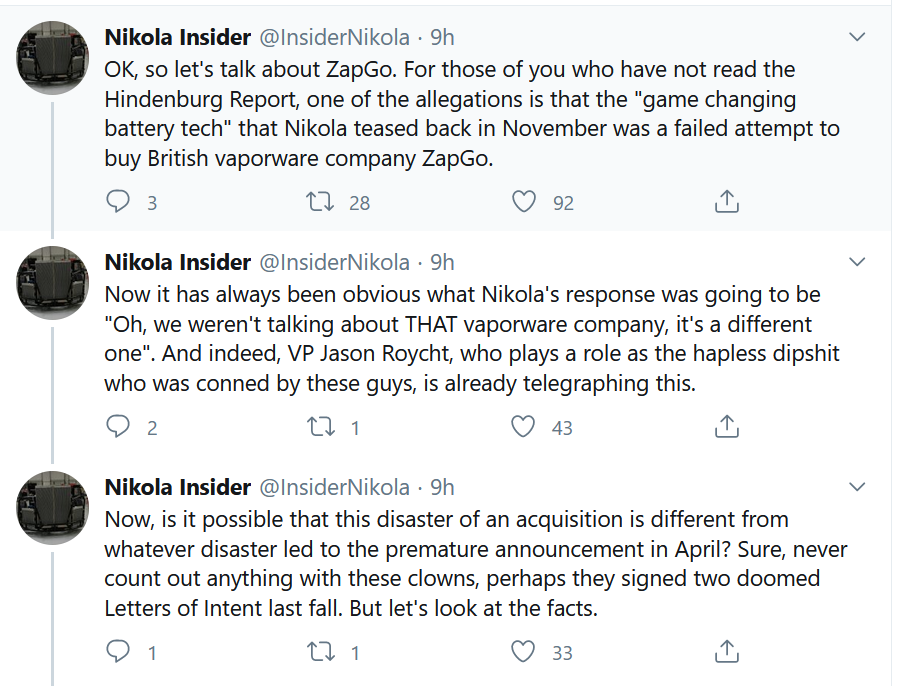

Adding to Hindenburg's research, someone who goes by "Nikola Insider" published this thread on Twitter this morning. It starts:

When reports like this come out, it's important to not only carefully and independently evaluate the facts and arguments in them, but also watch the company's response.

If the CEO calmly and factually responds to the short-seller – even calling him "a great investor and a wonderful human being" – as Netflix (NFLX) CEO Reed Hastings did shortly after I published an essay in December 2010 explaining "Why We're Short Netflix," then anyone short the stock should worry!

If, on the other hand, the company attacks the short-seller, threatens to sue, goes crying to the U.S. Securities and Exchange Commission ("SEC"), and promises a detailed response – but then fails to provide one – then anyone long the stock should worry!

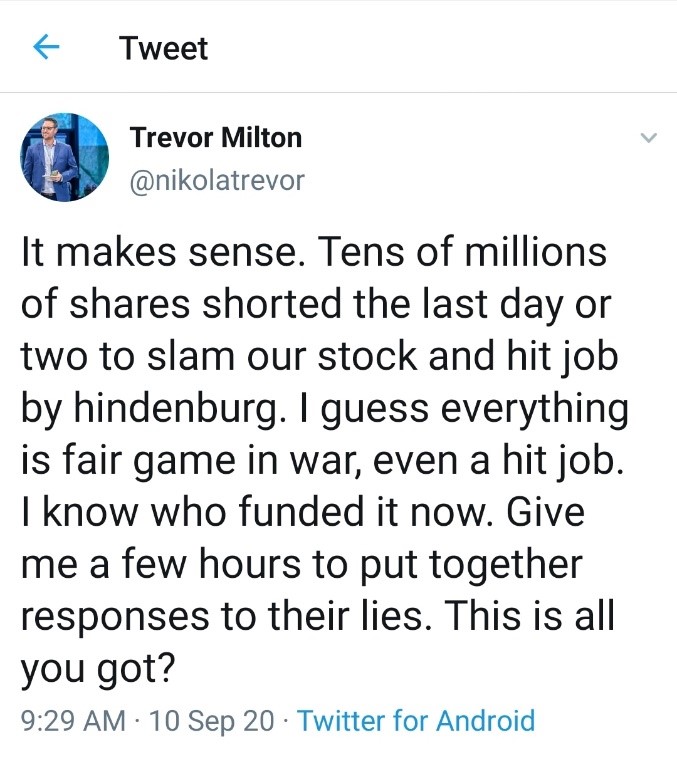

Guess which approach Nikola CEO Trevor Milton has taken... Shortly after the report was released, just before the market opened yesterday, he tweeted:

Investors waited all day for Milton's promised "response to their lies" – and when one wasn't forthcoming, the stock steadily sank, closing down 11%.

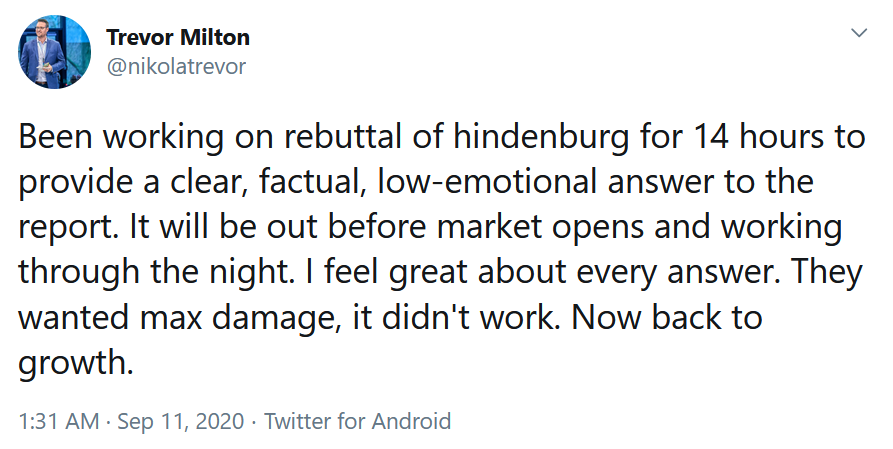

Then, at 1:31 a.m. this morning, he tweeted:

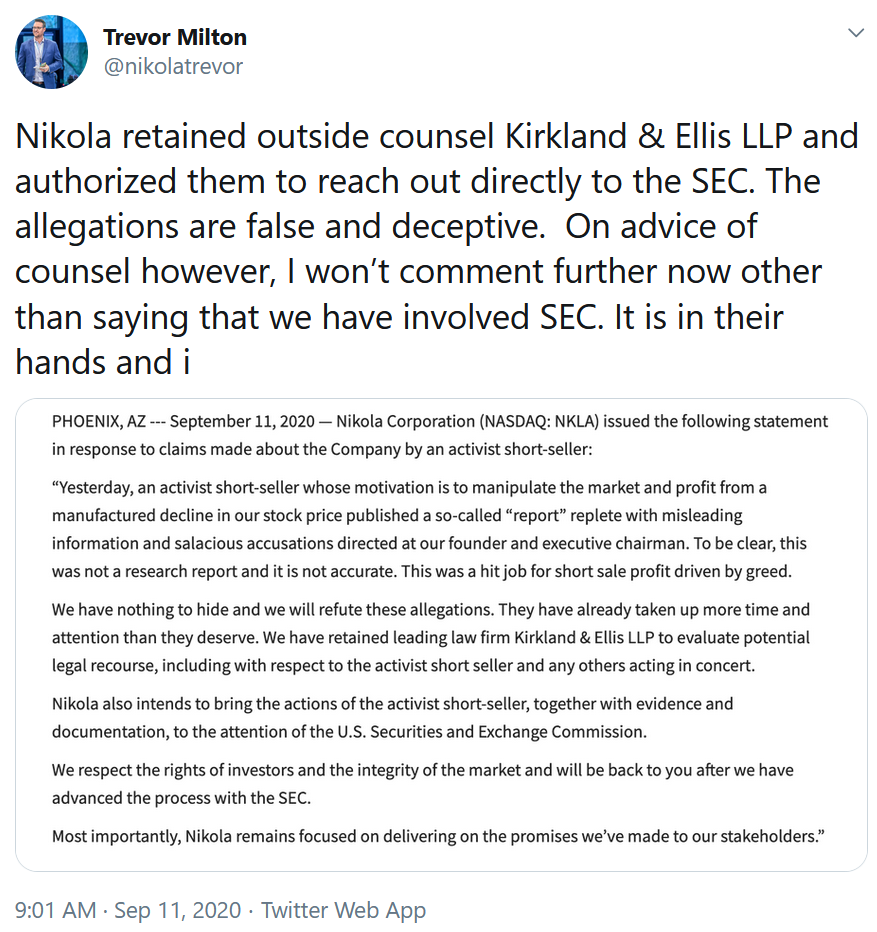

Then in a pair of tweets at 9:01 this morning, Milton backtracked, saying that "on advice of counsel however I won't comment further now" and the company won't have a response to the Hindenburg report until "the SEC finishes their work":

At the same time, Nikola issued a truly lame press release:

Yesterday, an activist short-seller whose motivation is to manipulate the market and profit from a manufactured decline in our stock price published a so-called "report" replete with misleading information and salacious accusations directed at our founder and executive chairman. To be clear, this was not a research report and it is not accurate. This was a hit job for short sale profit driven by greed.

We have nothing to hide and we will refute these allegations. They have already taken up more time and attention than they deserve. We have retained leading law firm Kirkland & Ellis LLP to evaluate potential legal recourse, including with respect to the activist short seller and any others acting in concert.

Nikola also intends to bring the actions of the activist short-seller, together with evidence and documentation, to the attention of the U.S. Securities and Exchange Commission.

We respect the rights of investors and the integrity of the market and will be back to you after we have advanced the process with the SEC.

Most importantly, Nikola remains focused on delivering on the promises we've made to our stakeholders.

No wonder the stock is down big again today...

My friend and activist short-seller Gabriel Grego just tweeted this:

And here's what one of my friends e-mailed me this morning:

Imagine the conversation inside Kirkland & Ellis right now: "How do we verify that Nikola's rebuttal will be accurate? Will we look like idiots if Trevor lies to us, and we have effectively underwritten his response? Will GM's lawyers laugh at us, or just sue us?"

They worked all night at a response. They said it was coming yesterday afternoon, then yesterday evening, then this morning. And then this response, which basically admits that their rebuttal is so weak that they need a law firm to underwrite it. Very weak sauce.

Prediction:

- Trevor gets fired. By Monday.

- Nikola as a company gets cut off from GM, in some way.

- Remaining Nikola assets get sold for a penny on the dollar, perhaps to GM, perhaps to someone else.

My take: I think Nate, Gabriel, and my other friend are right. Nikola is toast.

3) We just returned to New York City on Monday night after five and a half weeks in New Hampshire.

Things seem very busy – almost normal – on the Upper East Side and in Central Park. There's lots of traffic – in part because people continue to avoid public transportation.

But Midtown is still a ghost town, as this New York Times article highlights: Manhattan's Office Buildings Are Empty. But for How Long? Excerpt:

Even as the coronavirus pandemic appears to recede in New York, corporations have been reluctant to call their workers back to their skyscrapers and are showing even more hesitation about committing to the city long term.

Fewer than 10% of New York's office workers had returned as of last month and just a quarter of major employers expect to bring their people back by the end of the year, according to a new survey. Only 54% of these companies say they will return by July 2021.

Demand for office space has slumped. Lease signings in the first eight months of the year were about half of what they were a year earlier. That is putting the office market on track for a 20-year low for the full year. When companies do sign, many are opting for short-term contracts that most landlords would have rejected in February.

At stake is New York's financial health and its status as the world's corporate headquarters. There is more square feet of work space in the city than in London and San Francisco combined, according to Cushman & Wakefield (CWK), a real estate brokerage firm. Office work makes up the cornerstone of New York's economy and property taxes from office buildings account for nearly 10% of the city's total annual tax revenue.

What is most unnerving is that a recovery could unfold much more slowly than it did after the Sept. 11 attacks and the financial crisis of 2008. That's largely because the pandemic has prompted companies to fundamentally rethink their real estate needs.

Hopefully this announcement by JPMorgan Chase (JPM) will start a trend: JPMorgan Tells Trading-Floor Staff to Come Back to the Office.

To get a sense of how many professionals still haven't returned to the city, I heard that enrollment at the private preschool our daughters attended many years ago is down 40%!

4) I got a much-needed haircut earlier this week at Paul Mole on 74th Street and Lexington Ave. The barber told me its business is down 70% right now. Here are before and after pics of my cut...

Best regards,

Whitney