Amid a Busy Holiday Season, Avoid These Shipping Stocks

Editor's note: It's peak online-shopping season. That should be good news for just about all shipping companies... or so you might think. According to our colleague Vic Lederman from our corporate affiliate Chaikin Analytics, we need to look a little deeper.

In today's Weekend Edition, we're taking a break from our usual fare to share one of Vic's essays, adapted from a recent issue of the free Chaikin PowerFeed e-letter. In it, Vic reveals two stocks that are struggling this holiday season – and why this might be a good part of the market to avoid right now...

It's that time of year again...

We're less than two weeks away from Christmas.

And that means we're right in the thick of peak postal season.

In fact, the U.S. Postal Service ("USPS") says that it has already delivered 3 billion pieces of mail and packages this holiday season.

That sounds like a huge number. But in context, it's not as big as you might think...

Consider that during the 2019 holiday season, USPS delivered about 16 billion pieces of mail and packages. By 2022, that number had declined to less than 12 billion.

Now, you might be thinking that this should be good for private carriers. And in one sense, you'd be right. If people are still shipping packages but not through USPS, they would be using private carriers instead.

But when it comes down to these companies' stocks, it's a different story. One critical signal shows the big-name private carriers you know are in "bearish" territory. And that means there are better places to put your money today...

It's not just USPS that's suffering. The stocks of both FedEx (FDX) and United Parcel Service (UPS) are, too.

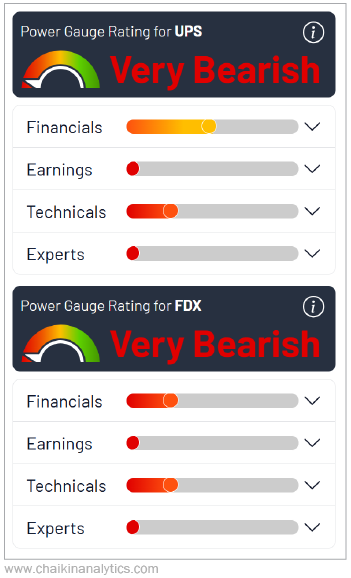

We can see this using the Power Gauge, a key tool we use at Chaikin Analytics. It gathers investment fundamentals and technicals into a simple rating of "bullish," "neutral," or "bearish."

In fact, United Parcel Service earns a "very bearish" rating from the Power Gauge right now. And so does FedEx. Take a look...

That might come as a surprise to you. After all, we're in the age of e-commerce. It's the holiday season. And it feels like just about everyone is buying everything online.

Yes, online sales have soared. But so has the carrier competition...

If you order regularly from Amazon (AMZN), you've likely noticed that packages from the mega-retailer come in company-branded trucks. But that's not all...

Amazon says it owns more than 110 aircraft as part of its fleet. Put simply, America's largest e-commerce company is squeezing out high-cost carriers like United Parcel Service and FedEx.

Add it all up, and demand for United Parcel Service and FedEx has fallen since the pandemic. And the competition has gotten fiercer.

That has led to serious declines. For example, in July, United Parcel Service reported that second-quarter profits had tumbled more than 30% compared with last year. And top-line revenue fell roughly 1%.

So, the company is struggling to make money. And its slice of the pie is getting smaller, too.

We've seen the overall struggles play out in the stocks of both United Parcel Service and FedEx this year. Take a look at the chart below...

As you can see, FedEx has been the stronger performer this year. Its stock is up about 12%.

Meanwhile, shares of UPS have collapsed nearly 15% in 2024.

Overall, both stocks have been terrible compared with the broad market. Remember, the S&P 500 Index has soared about 27% this year. That's a massive return.

Put simply, United Parcel Service and FedEx are serious underperformers.

The Power Gauge is clear, too. Both companies have "very bearish" ratings. That means our system says now isn't the time for dip buying.

The holiday season might bring you to your local post office or shipping center. And it will likely be busy in there. It's peak season, after all.

But the reality is that the American shipping landscape is more competitive than ever right now. And the legacy private carriers like United Parcel Service and FedEx are hurting.

For now, I would follow the Power Gauge's lead and avoid both stocks today.

Good investing,

Vic Lederman

Editor's note: Marc Chaikin's Power Gauge system helped his subscribers get out of stocks in 2020, before the COVID-19 crash... and then back in, before stocks soared 41%. Now, Marc is tracking a market signal that quietly flashed while the country was distracted by the election...

On December 17, he's sharing the one move you should make with your money right now... to avoid being blindsided by a dramatic stock market event that's likely to play out in early 2025. You may only have a few days to prepare... so don't miss Marc's announcement. Click here to secure your spot.