Berkshire Hathaway hits an all-time high; Invitation to my cocktail party in Omaha; Why pot stocks were up on Friday; A New COVID Wave May Be Coming. Most Americans Shouldn't Worry; Lift almost all restrictions and mandates

1) Berkshire Hathaway (BRK-B), which I've been pounding the table on for years as "America's #1 Retirement Stock," hit an all-time high on Friday, up 19.6% this year versus negative 4.7% for the S&P 500 Index and 54.7% since the beginning of 2021 versus 21.1% for the S&P.

This article by Barron's Andrew Bary captures many reasons why the stock is doing so well: Berkshire Hathaway's Warren Buffett Is Doing Deals. That's Good for the Stock. Excerpt:

Warren Buffett is getting his groove back, and investors are thrilled.

After several years on the sidelines, the CEO of Berkshire Hathaway is spending big again. In just a matter of weeks, he reached an $11.6 billion deal to buy insurer Alleghany (Y) for an attractive price and purchased a nearly 15% stake in Occidental Petroleum (OXY) worth $8 billion.

The rapid accumulation of Occidental shares has spurred speculation that Buffett wants to buy all of the company in a long-sought "elephant-sized acquisition" – his phrase – that could cost $70 billion. Such a transaction would excite the Berkshire faithful because it would put half of its nearly $150 billion of cash to work at a much higher return than the near-zero yield currently on its large holdings of Treasury bills.

My take: The stock has done exactly what I wanted and expected it to do – massively outperforming during times of turmoil, when growth stocks are getting whacked.

That said, it's now trading at almost exactly my estimate of its intrinsic value, which I calculated in two ways in my March 2 e-mail.

So while I think it's a solid long-term hold, I wouldn't be adding to it here.

2) Speaking of Berkshire, its famous annual meeting will be held in person for the first time in three years in Omaha, Nebraska, on Saturday, April 30, four weeks from Saturday.

I will, of course, be attending – my 25th in a row! – and will once again be hosting my annual cocktail party from 8 p.m. to midnight the evening before the meeting, Friday, April 29.

It's free and open to all: no agenda, no speeches, no dress code. Just come, enjoy the drinks and snacks, and meet other investors. And if we've never met, be sure to introduce yourself!

It will be in the St. Nicholas Room (2nd Floor) at the Hilton Omaha, right across the street from the CHI Health Center, where the meeting is held.

You can RSVP for it here.

3) If I wouldn't be adding to Berkshire, what would I be?

I still like pot stocks. While I was way too early in turning bullish on them and recommending the AdvisorShares Pure US Cannabis ETF (MSOS), I think we may have seen a bottom earlier this month. MSOS is up 17.7% from its all-time low on March 14, in part driven by the rally in beaten-down growth stocks, but there was also some good news on the fundamentals that drove gains in the sector on Friday, as my colleague Tom Carroll, who writes the Cannabis Capitalist newsletter, explains:

My apologies for being a cynic...

On Thursday, March 24, the Senate unanimously passed the Cannabidiol and Marihuana Research Expansion Act.

This act makes it a bit easier to research cannabis and its compounds. It also lets doctors talk to their patients about the benefits and pitfalls of cannabis use without fear of legal action. But that's about it.

This looks like a "check the box" moment for Republican Sen. Chuck Grassley and the Senate (this is the cynical part). The heat is on to prioritize cannabis legalization. This bill gives senators some cover to say they did do something regarding cannabis prior to the midterm election frenzy that's starting soon.

In terms of stocks, the regulatory move could benefit Clever Leaves (Nasdaq: CLVR), the Canadian operators, and Charlotte's Web (OTC: CWBHF).

There is language in the small print of the bill that allows researchers to import cannabis for research purposes. This ever-so-slightly opens the U.S. door to non-U.S. cannabis companies. And that's good for Clever Leaves.

Clever grows high-quality cannabis in Colombia, South America and exports to legal markets all over the world where it can. Its secret sauce is its underlying operating costs. Clever grows, processes, and packages at the lowest costs we've ever seen – about $100 per pound in 2021. The closest we've seen to this is Glass House Brands (OTC: GLASF) at $179 per pound.

The Canadian operators – which continue to show widening losses – could also benefit in a way. It opens the research door to them too. However, why would researchers buy from them at high prices when they could simply go to Clever? Either way, the market is pushing the Canadian stocks higher in the near term. Don't be fooled.

The bill helps out Charlotte's Web as well. It gives the U.S. Food and Drug Administration ("FDA") more flexibility in evaluating the beneficial effects of CBD. This is something Charlotte's Web has been waiting for. With an easier road to producing and marketing CBD products that have credible benefits, the stock could really take off. It is the best-known U.S. CBD company. Year to date, Charlotte's Web is up 13% – one of the top performers for 2022.

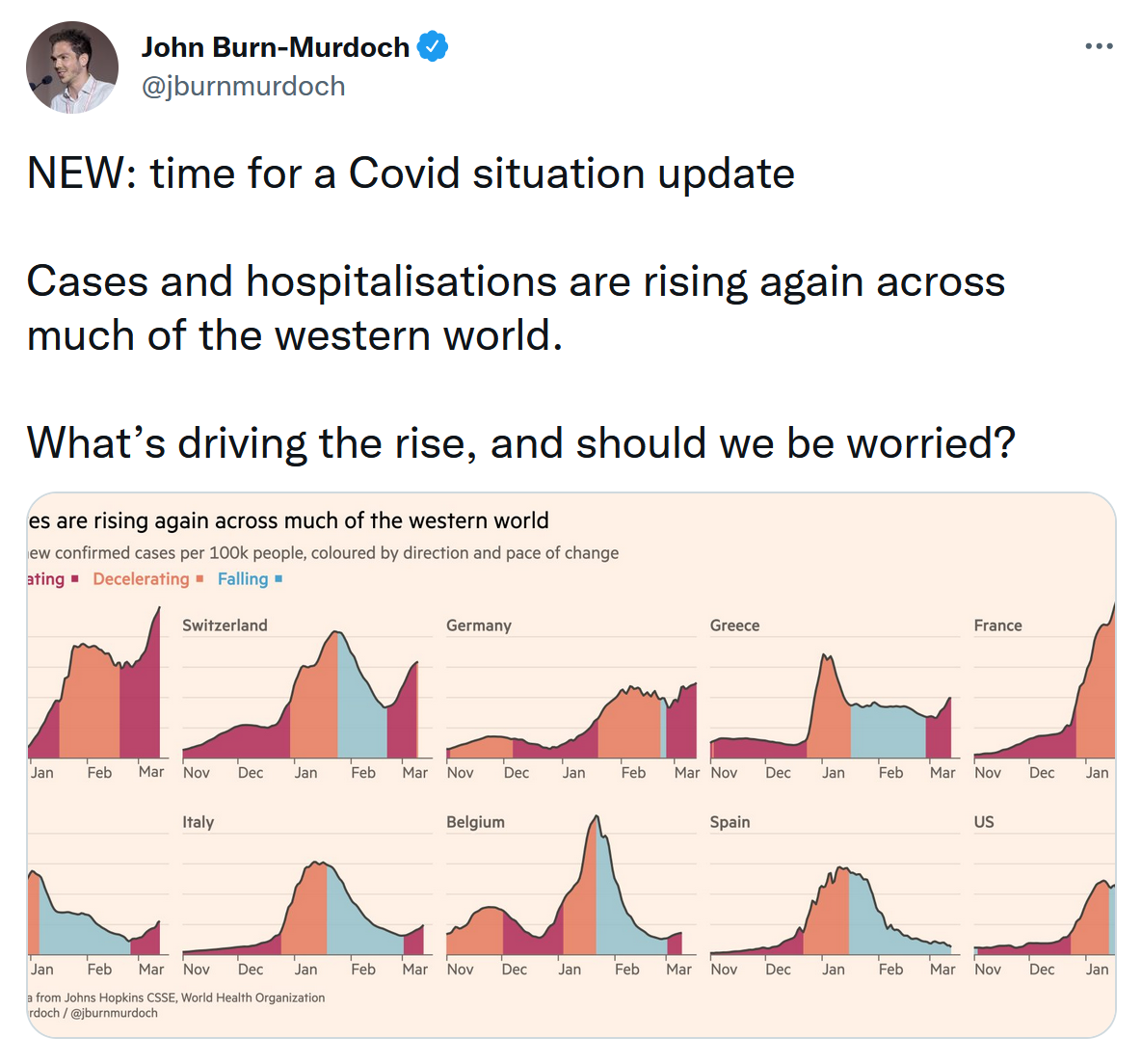

4) The COVID case, hospitalization, and death numbers for the U.S. continue to trend sharply downward (data here), which is great news, but we should prepare ourselves for the BA.2 wave, which is hitting us now (having already hit and mostly passed through Europe). It will likely lead to a decent-sized spike in cases and a modest increase in hospitalizations and deaths (as always, highly concentrated among those who haven't had COVID and aren't vaccinated), though I don't expect it to be anything like the first omicron wave, so don't be surprised or worried.

For more on this, see this insightful Twitter thread, which starts:

Here's a related article in the Washington Post: A new COVID wave may be coming. Most Americans shouldn't worry. Excerpt:

Two other factors provide reassurance despite BA.2's transmissibility. One is that it does not cause more severe disease as compared to the original omicron strain, known as BA.1, which is a milder variant than some previous strains such as delta. The other is that BA.2 is not so substantially different from BA.1 that it escapes immunity from vaccines or prior infection. A New England Journal of Medicine paper reported that people with booster doses produced equally effective antibodies against BA.1 as BA.2. And researchers from Britain and Qatar have found that vaccines provide excellent protection against severe illness due to both omicron subvariants.

Furthermore, people who were previously infected with omicron are unlikely to be reinfected with BA.2. A preprint study from Denmark found only 47 instances of BA.2 reinfection following infection of the original omicron strain, out of more than 1.8 million recent cases of Covid-19.

On a population level, the combination of recovery from omicron and vaccination means that the United States has high rates of immunity against BA.2. The influential Institute for Health Metrics and Evaluation has estimated that as many as 80% of Americans have some immunity that will protect them against a new omicron wave. This may be enough to successfully decouple infection from hospitalization such that a rise in cases does not overwhelm hospitals.

5) In light of this, I think it's ridiculous that New York City Mayor Adams lifted the vaccine mandate for entertainers/athletes like Nets star Kyrie Irving, which he should have done long ago but is leaving the mandates in place for municipal employees (how crazy was it that unvaccinated players on opposing teams could play in NYC, but not Irving, and that he could sit in the stands but not play on the court?).

At one time, I favored vaccine mandates because herd immunity (from vaccines and prior infection) was lower, and COVID was more dangerous. But higher herd immunity combined with a less severe variant (omicron) has improved the situation such that I believe mandates should be lifted on all but a small subset of people: Those who haven't had COVID (which is as good or better than a vaccine) and who are in close contact with at-risk people, such as those who work in nursing homes or with patients in hospitals.

As I've said before: Now that COVID isn't much more serious than the flu, we should treat it as such.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.