Berkshire Hathaway's fourth-quarter earnings report; Mohnish Pabrai's Q&A with London School of Economics; Price changes of various consumer goods and services from 2000 to 2022; Greetings from Park City, Utah

1) Berkshire Hathaway (BRK-B), which I continue to believe is the No. 1 retirement stock in America, reported its fourth-quarter earnings on Saturday, along with CEO Warren Buffett's much-anticipated annual letter, which I commented on in yesterday's e-mail. (Here are links to the news release and the annual report, which includes Buffett's shareholder letter as well as the 10-K.)

As I do every quarter, I asked my longtime friend and former partner Glenn Tongue, who is the axe on the company, to share his analysis of it. I shared some of Glenn's comments yesterday, and here's more from him:

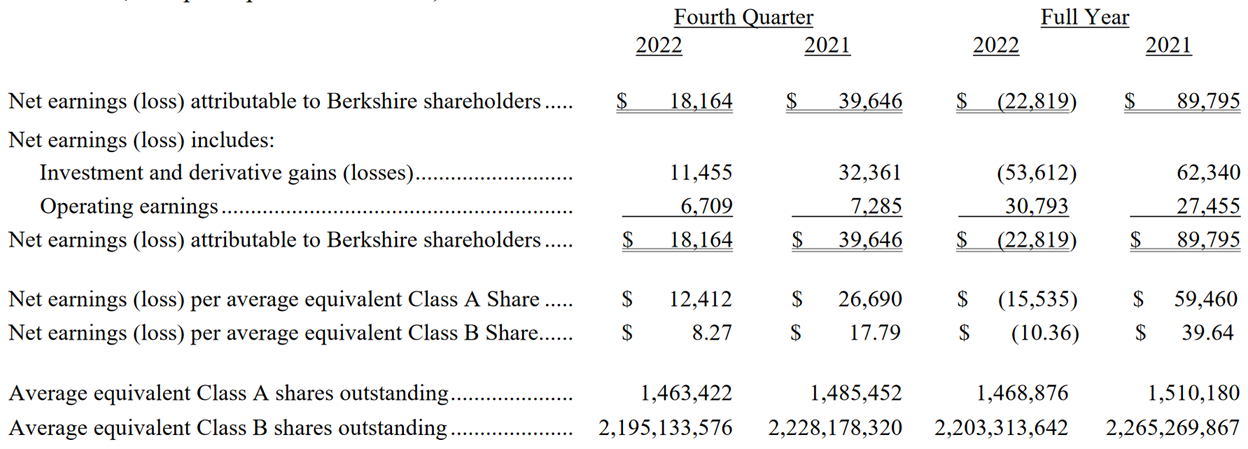

As usual, the company reported strong results. I focus on operating earnings, which are the most important metric (as opposed to capital gains and losses, which are an accounting artifact that fluctuate from quarter to quarter). Here are the two charts from Berkshire's news release:

As we have discussed many times, GAAP profits are meaningless because they include ups and downs among the stocks in Berkshire's massive $300-plus billion equity portfolio, so it's operating earnings that matter.

Operating earnings rose 6% in the fourth quarter (excluding foreign currency exchange losses) and 12% for the year, strong numbers for a company of Berkshire's scale. Cash ended the year at $128.6 billion and insurance float now stands at $164 billion.

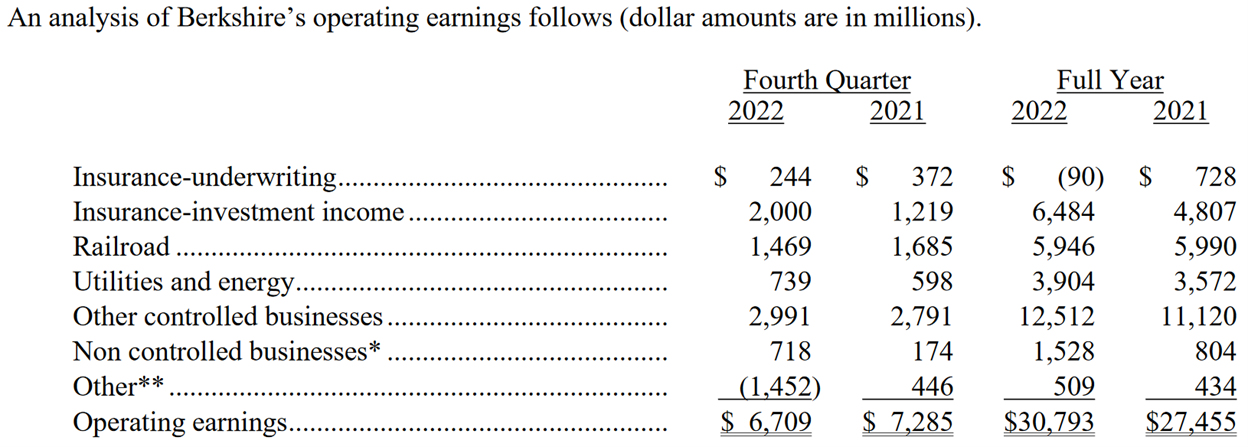

After a few years of large buybacks, the pace of repurchases slowed in 2022, presumably as there were other opportunities in a volatile market and as the spread between stock price and intrinsic value narrowed from 2021. Buybacks picked up somewhat in Q4 ($2.6 billion versus $1 billion in Q3) and continued into 2023.

In total, Berkshire repurchased $7.9 billion of its stock in 2022, reducing its share count by 1.2%. Recent buybacks have been done at $468,000 per class A share (equivalent to $310 per B-share).

Speaking of share repurchases, Buffett strongly rebuts the nonsense some are peddling in Washington that they're bad and should be heavily taxed. He writes:

A very minor gain in per-share intrinsic value took place in 2022 through Berkshire share repurchases as well as similar moves at Apple and American Express, both significant investees of ours. At Berkshire, we directly increased your interest in our unique collection of businesses by repurchasing 1.2% of the company's outstanding shares. At Apple and Amex, repurchases increased Berkshire's ownership a bit without any cost to us.

The math isn't complicated: When the share count goes down, your interest in our many businesses goes up. Every small bit helps if repurchases are made at value-accretive prices. Just as surely, when a company overpays for repurchases, the continuing shareholders lose. At such times, gains flow only to the selling shareholders and to the friendly, but expensive, investment banker who recommended the foolish purchases.

Gains from value-accretive repurchases, it should be emphasized, benefit all owners – in every respect. Imagine, if you will, three fully-informed shareholders of a local auto dealership, one of whom manages the business. Imagine, further, that one of the passive owners wishes to sell his interest back to the company at a price attractive to the two continuing shareholders. When completed, has this transaction harmed anyone? Is the manager somehow favored over the continuing passive owners? Has the public been hurt?

When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).

There was one large acquisition, Alleghany, a property-casualty insurer managed by Joe Brandon, a familiar name to Berkshire followers. This $11.5 billion acquisition represents a very good business at a good price managed by a high-grade manager.

It's important to note that capital expenditures for the year exceeded $15 billion, as compared to depreciation of approximately $10 billion. Berkshire is investing massively for the future, a dynamic that is often underappreciated.

Thank you, Glenn!

2) I enjoyed this talk my old friend Mohnish Pabrai did with students at the London School of Economics 10 days ago. Here's a summary of the topics he covered:

- 00:00:00 Intro

- 00:01:01 Durable Moats

- 00:04:27 Coca-Cola (KO)

- 00:07:57 Apple (AAPL)

- 00:08:52 Burlington Northern Railway

- 00:10:57 Patience is your most valuable asset

- 00:14:40 The Quest for 100 baggers

- 00:16:08 Charlie's greatest investing mistake: Belridge Oil

- 00:19:27 Reysas

- 00:25:30 Japan Company Handbook

- 00:30:09 Circle of competence

- 00:32:28 Margin of safety

- 00:32:51 Be unreasonable

- 00:34:12 Be an independent thinker

- 00:35:46 Cloning ideas

- 00:40:01 Thou shall never use Excel!

- 00:41:22 Charlie's mental models

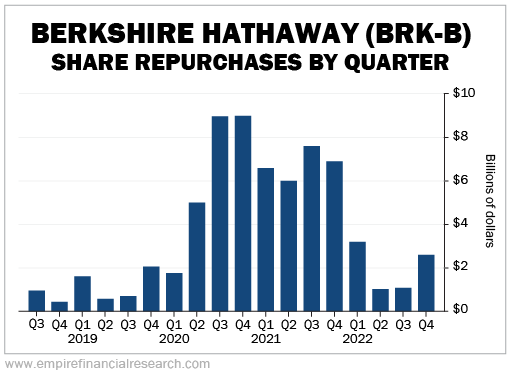

3) Some interesting data in this tweet on price changes of various consumer goods and services from 2000 to 2022. The top four are health and education related, while three of the bottom four are tech products:

4) Greetings from Park City, Utah!

When we were here last month (inadvertently during the Sundance Film Festival), Susan and I only used four of the seven days that our Ikon Passes give us at the Deer Valley ski area. So (since we clearly don't understand the concept of sunk costs), we booked a short trip back here this week to use up the last three days...

Unfortunately, it has been snowing heavily (there's a winter storm warning through 5 p.m. on Wednesday), so the visibility ranged from poor...

...to an absolute whiteout:

So we only skied a half-day yesterday and will probably take today off. Then we'll ski Wednesday and Thursday, flying home that night.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.